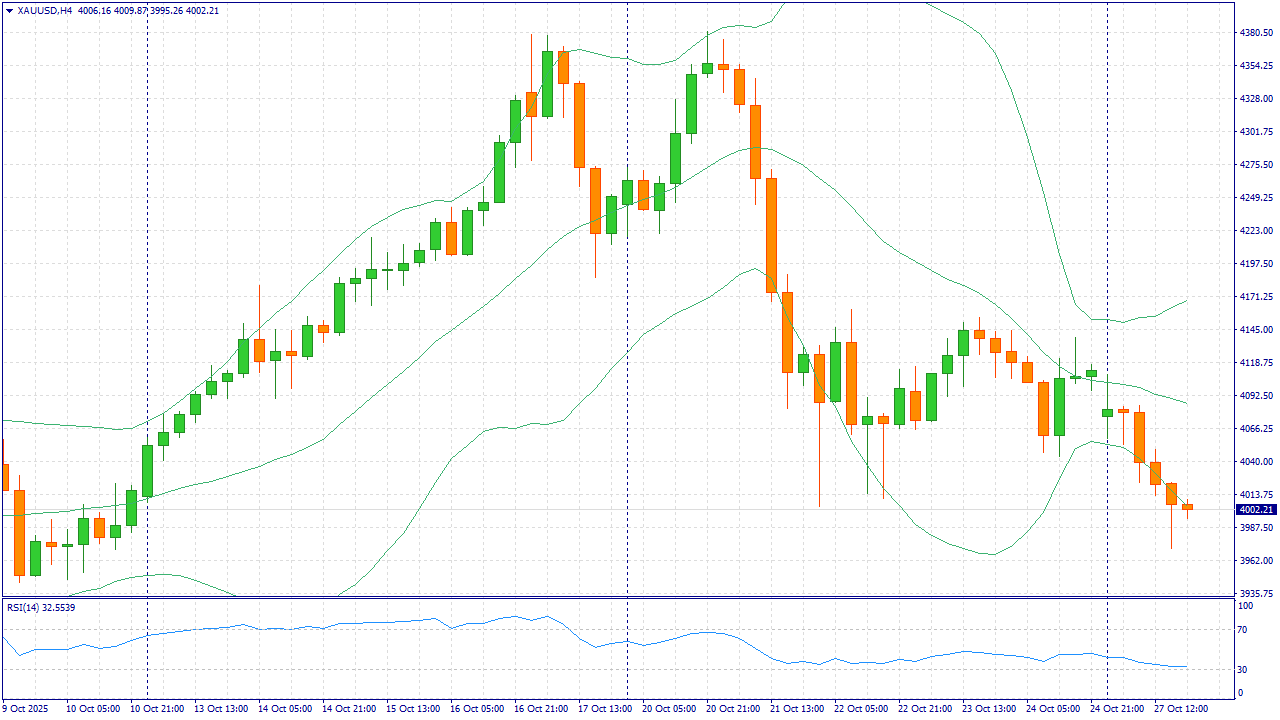

Weekly Outlook: XAUUSD, #SP500, #BRENT for 3-7 November 2025XAUUSD: BUY 4012.50, SL 3920.00, TP 4200.00For our readers only—202% bonus on deposits from $202; mention promo code TOPUP25 in support and trade with TRIPLED capital; details via the link.

Gold starts the week near 4,012 per ounce as interest in safe-haven assets is supported by the recent Fed rate cut and the softer trend in U.S. Treasury yields. Investment demand remains firm: inflows into gold funds rose in Q3, and central banks maintained active purchases, helping the price hold above round levels. This week the market’s focus is on U.S. business activity indices and Friday’s labor report, which will set the tone for the dollar and real yields.

The fundamental balance for gold over the week is moderately positive: cheaper financing conditions in the U.S. and ongoing official-sector buying help offset potential volatility spikes. Risks to the upside scenario include unexpectedly strong U.S. labor data and a sharp dollar rebound, which could temporarily cool demand for metals. Supportive factors remain structural central-bank purchases, solid ETF holdings, and elevated geopolitical uncertainty.

Trading recommendation: BUY 4012.50, SL 3920.00, TP 4200.00#SP500: BUY 6860, SL 6740, TP 7120

U.S. equities open the week on a positive note: futures are firmer after a strong October and a second rate cut this year by the Fed, easing financial conditions and keeping 10-year Treasury yields near 4%. Demand for equities is supported by earnings expectations at major companies and steady investor interest in rate-sensitive segments and spending on digital infrastructure.

Key drivers this week are the ISM reports for manufacturing and services, the job-openings report, and Friday’s employment data. If the figures confirm easing labor-market pressures without signs of overheating, the backdrop for the index should remain constructive. Risks include weak corporate guidance, unexpectedly “hot” jobs data, and renewed tariff uncertainty, any of which could lift volatility and temporarily narrow risk appetite.

Trading recommendation: BUY 6860, SL 6740, TP 7120#BRENT: BUY 65.20, SL 62.60, TP 73.00

Brent crude stabilizes around 65 per barrel after OPEC+ decided to pause the planned output increase in Q1 2026. Headlines also include reports of damage to Russian energy infrastructure and record U.S. production—a mix that keeps prices range-bound: a supply-risk premium limits declines while surplus concerns cap rallies. Another near-term catalyst is the U.S. EIA weekly stocks report on Wednesday, which quickly reflects shifts in supply-demand balance.

Structurally, the oil market remains sensitive to signals on future OPEC+ volumes and the trajectory of global demand. The IEA points to supply growth outpacing demand, raising the risk of inventory builds into year-end. In the short run, news on flows and dollar moves can provide support. Risks to long positions include confirmation of faster-than-expected non-OPEC+ supply growth, soft macro data from key consumers, and deeper outlines of a surplus.

Trading recommendation: BUY 65.20, SL 62.60, TP 73.00FreshForex offers a wonderful

300% bonus on every deposit of $100 or more, giving you the opportunity to increase your trading volumes!

You can find more analytical information on our website.