The yellow metal continues to decline, plunging investors into gloom and prompting them to reassess their trading strategies. However, some analysts are confident that the precious metal will rebound in the near future, viewing its decline as a natural step before another rally. The optimism of experts bolsters investors, although some market players remain skeptical about the near-term prospects of gold. On Monday, April 22, the precious metal sharply fell amid reduced geopolitical risks and decreased demand for safe-haven assets. As a result, gold lost more than 2.7%. According to estimates, gold's decline at the end of the day was the most significant since June 2022. The metal depreciated amid easing tensions in the Middle East. Such a development reduced the risk premium in the market. At the moment, gold continues to trade downwards after the sharpest decline in two years. The catalyst for the current downtrend in the precious metal was the de-escalation of the conflict between Israel and Iran. Against this backdrop, many experts are pessimistic about the near-term prospects of gold. They believe that investors will turn to other sources of capital preservation. According to some specialists, prices for the precious metal may break below the $2,300 per ounce level and then plummet to $2,200 per ounce. Analysts recommend preparing for a significant decline in the yellow metal amid extremely overbought conditions, as indicated by the RSI on the daily chart.

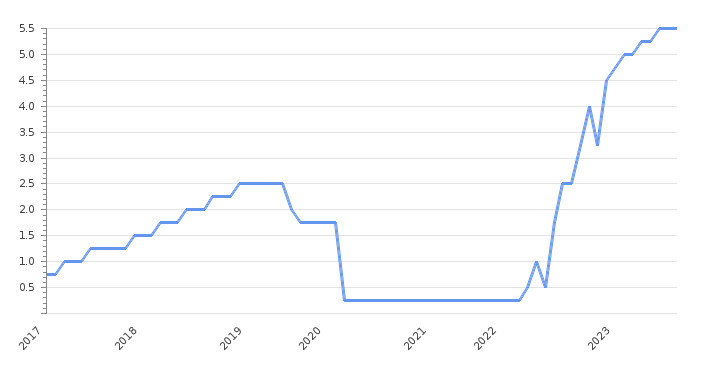

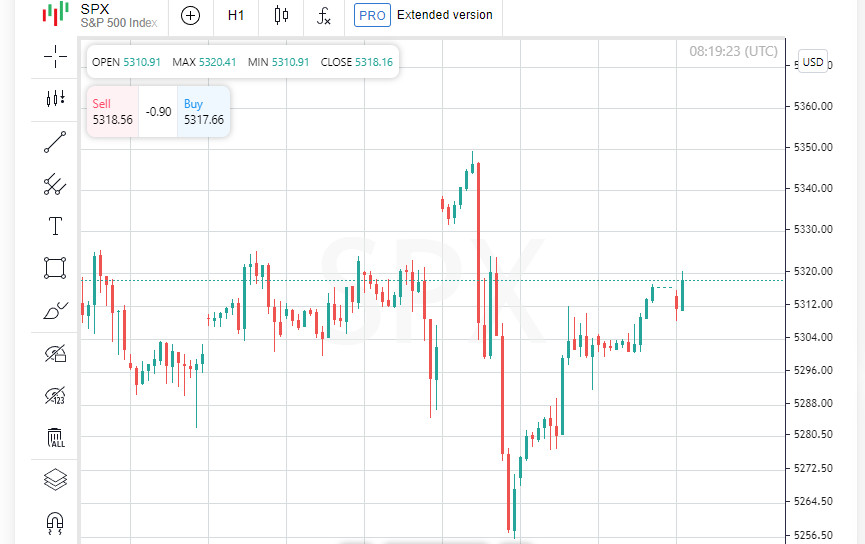

The precious metal was also weighed down by the high likelihood that the Federal Reserve would maintain a tight monetary policy much longer than expected in early 2024. The focus of market attention is on the publication of the key inflation indicator in the United States - the Core Personal Consumption Expenditures Price Index, which the regulator pays special attention to when assessing risks. The release of this report is scheduled for Friday, April 26. According to preliminary forecasts, the indicator decreased to 2.6% year-on-year in March. Recall that its February value was 2.8% year-on-year. Many investors are counting on some easing of geopolitical tensions. At the same time, market participants are switching to riskier assets such as stocks. According to CFTC data, the volume of major market players' long positions in gold futures and options is at a four-year high. The reason for profit-taking was the fairly rapid decline in the value of the precious metal. In addition, in recent months, gold has appreciated despite a steep rally in the greenback. In the current situation, the risks of a deep correction in the precious metal are increasing. However, according to some analysts, there are favorable factors contributing to further gans in gold. Tailwinds for the yellow metal will be the US Federal Reserve's rate cuts, global instability, and the growing US government debt. Against this backdrop, even economists at Bank of America, who are skeptical about the prospects of the precious metal, expect its price to rise to $3,000 by 2025. Analysts at Citi Bank are also bullish on gold, expecting it to gain in the next 6–18 months. Many investors adhere to this position, asserting that the likely record of $3,000 per ounce will be surpassed in a couple of years. Improvement in forecasts for gold prices in 2024 boosts investor optimism. It is worth noting that these forecasts anticipate an increase in the value of the metal in the near future. Confidence in such a scenario allows market players to weather the current market woes and prepare for an upcoming rise in gold.

Read more: https://www.instaforex.eu/forex_analysis/375065

News are provided by InstaForex.

Read more: https://ifxpr.com/3Ju0pXN