Market Update – August 30 – Data bring Joy, for now?

Trading Leveraged Products is risky

Weaker than expected consumer confidence and JOLTS numbers helped diminish Fed rate hike risks which in turn underpinned strong gains in Treasuries, Wall Street & the Asian stock market today as the markets clawed back some of the hefty losses in August also on speculation that the Fed is nearing the end of the tightening cycle. The USDIndex slumped on the less hawkish Fed outlook. Short and intermediate Treasuries outperformed with yields dropping about 12 bps. The break of technical levels and another solid note auction added to the bullish momentum. The 2-year rate fell to a low of 4.865% but closed at 4.879%. The 5-year richened to 4.26%. The 10-year was at 4.10%. These are the lowest rates in about 2 weeks after recently hitting new cycle highs of 5.08%, 4.48%, and 4.34%, respectively, the cheapest in about 16-17 years. The curve bull disinverted to -76 bps from -84 bps Monday.

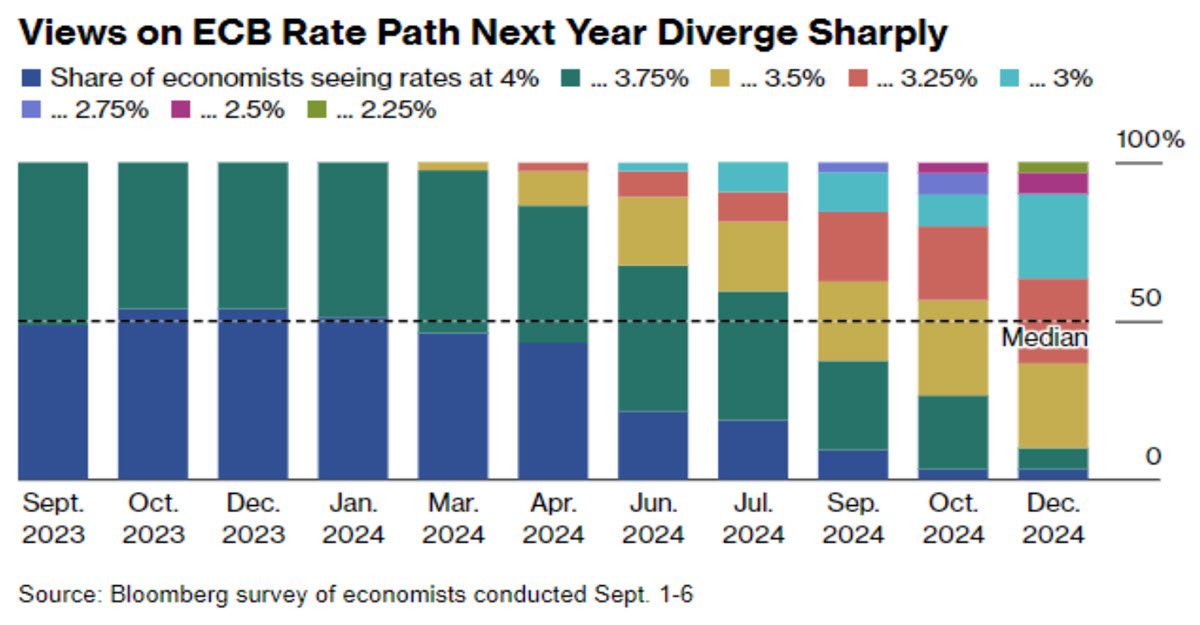

German import price inflation at the start of the session is also helping to bolster speculation of a pause from the ECB, especially after a round of dismal confidence readings.

*FX – USDIndex slumped to 103.28 on the less hawkish Fed outlook, currently at 103.48. This broke two straight days over the 104 mark for the first time since June 6-7. Central bank differentials will be important for the Greenback, and it could find some footing if JPY and CNY remain weak. EURUSD spiked to 1.0890 (above the 2-week channel), GBPUSD steady at 1.2640 and USDJPY retested 147.45 but turned quickly lower at 145.77.

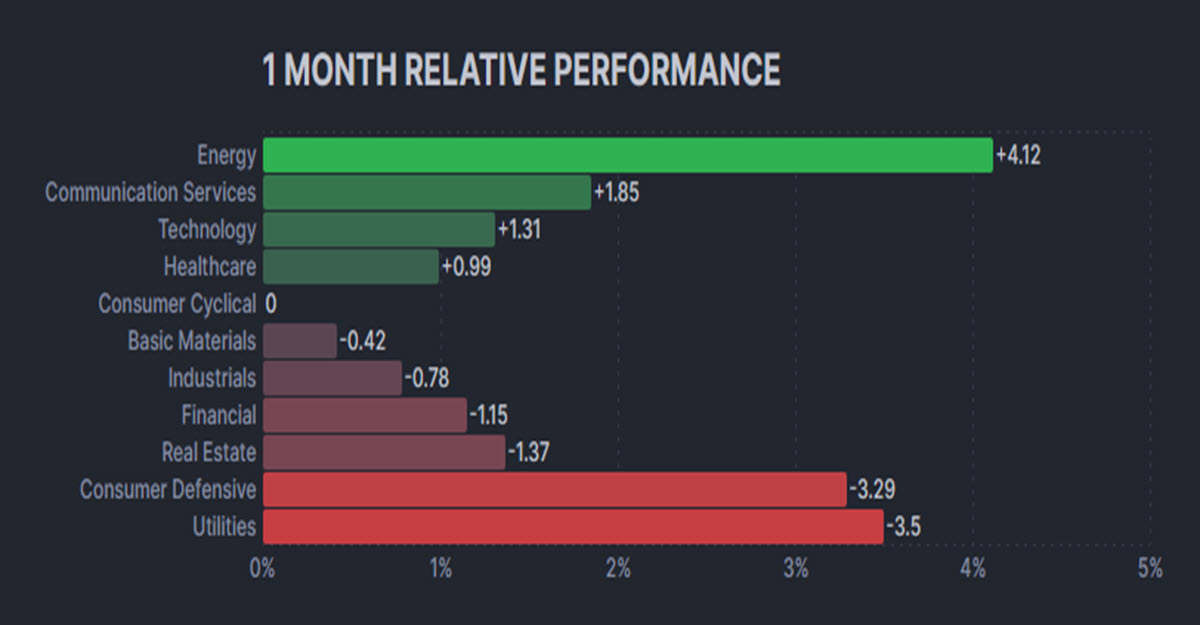

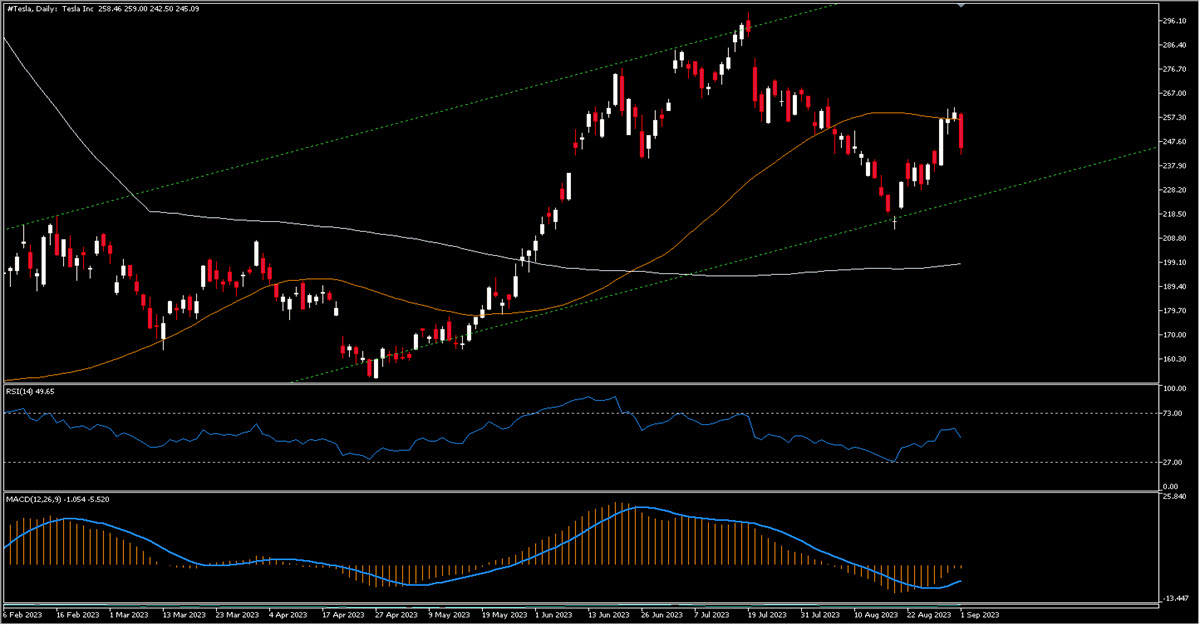

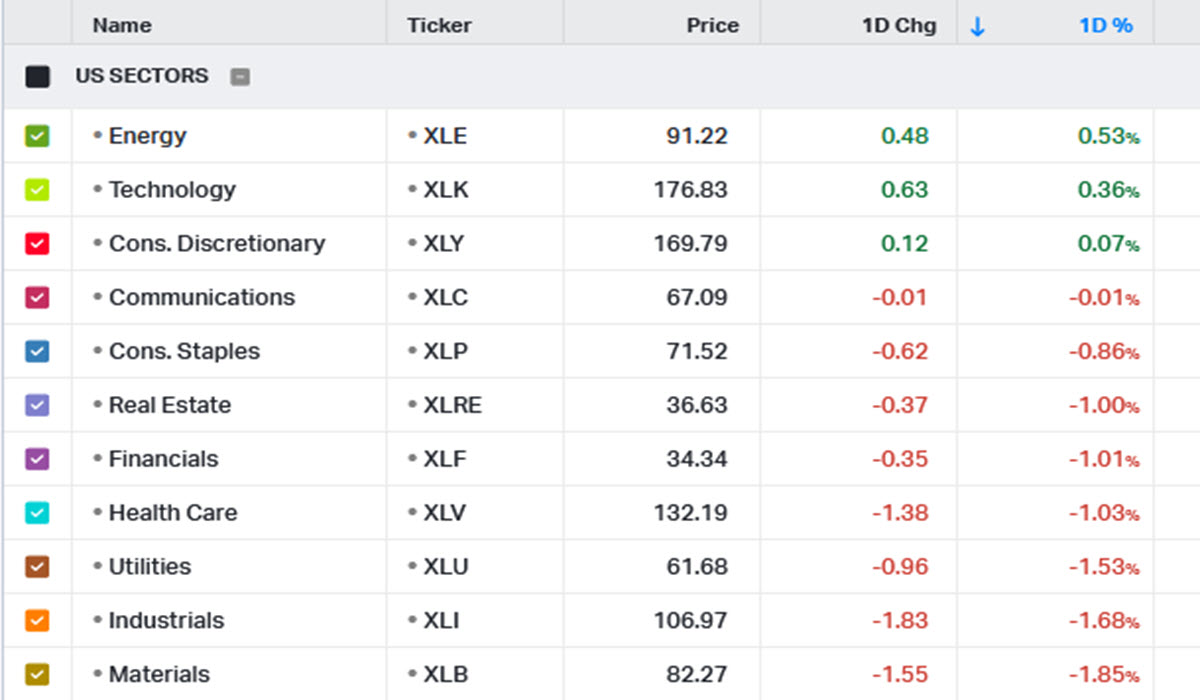

*Stocks – Mega-caps climbed after a tough August. The US100 surged 1.74%, while the US500 advanced 1.45%, with the US30 up 0.85%. Gains were broadbased but paced by communication services, consumer discretionary, and IT. The US500 rose for a third straight session, the first time since the end of July. And it broke resistance at 4440 to extend the move to 4495.

*Nvidia jumps by 4.16% as Google AI Alliance expands. Disney at 9-year lows.

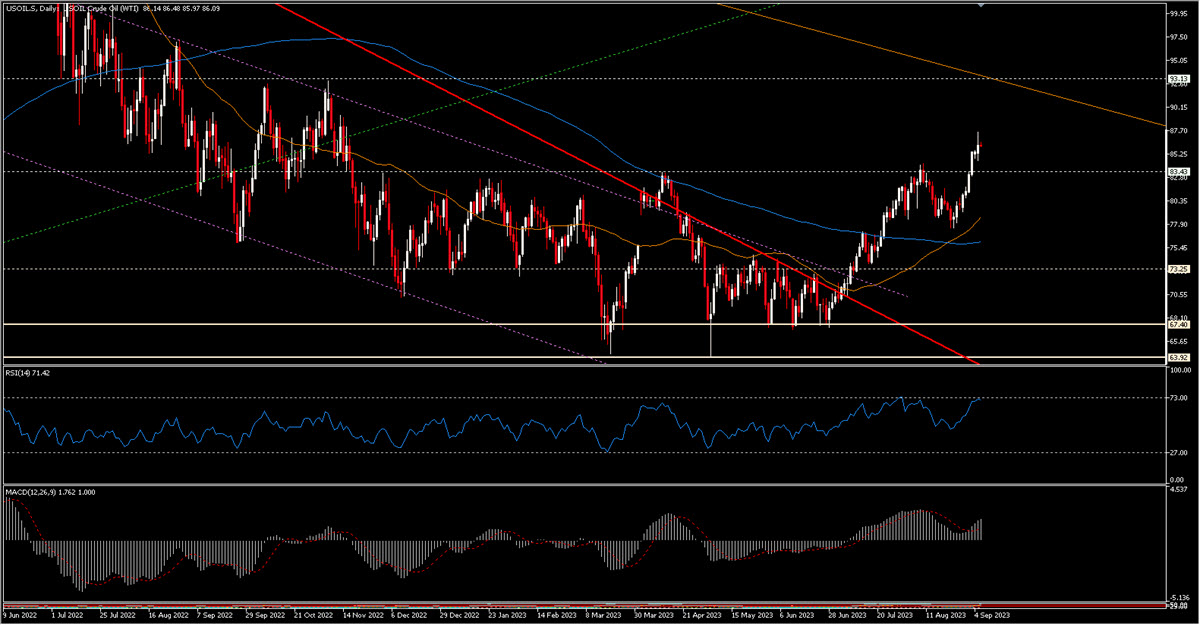

*Commodities – USOil higher through the session, rallying 1.3% to $81.33, the highest in over a week, on a combination of factors:

1. Overnight reports of a fresh round of stimulus from China helped support the demand outlook.

2. The advance has been boosted by the advent of Hurricane Idalia which is threatening supply as shipping is halted and some terminals are closed.

3. DOE reported Cushing stockpiles declined -1.9 mln barrels, near January lows.

4. The drop in Treasury yields & the USD are also underpinning.

5. On the other side of the coin, China’s biggest refiner Sinopec said product demand growth is expected to slow in 2H.

*Gold – spiked to $1,938. Gold is likely to remain resilient, with any dip likely to attract buyers. Lisa Shalett, chief investment officer at Morgan Stanley Wealth Management, said in a note yesterday that “regarding the intermediate outlook, we are buyers of gold on weakness or declines in rates”, and others are likely to take a similar stance.

*BTCUSD rose 5.32% and is currently settled at 27,354.

Today: US ADP and Preliminary GDP Price Index in focus.

Key Mover: USOIL (+0.54%) extended more than 50% of August downleg, with next key restistance levels at 81.60 and 82.30.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.