LiteForex Market Analytics

Re: LiteForex Market Analytics

great stategy sir. i can add it to my analysis. i hope we can make better signal.

- vuanh

- Posts: 128

- Joined: Fri May 17, 2013 6:52 am

Re: LiteForex Market Analytics

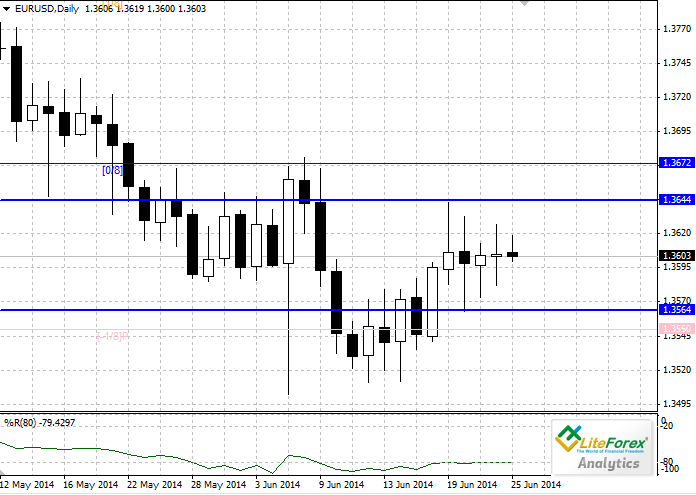

EUR/USD: The pair will continue to move in the downward channel

Current trend

Last week downward movement in the pair had slowed down; the price pushed off from the key support level of 1.3520 and started to go up slowly. Slight rise in demand for Euro and weak US macro-economic statistics boosted the rise in the pair to the level of 1.3650.

Note that negative statistics of Eurozone indicates slow rate of economic growth in Europe, which may force ECB to ease monetary policy. On Monday, the pair was under pressure from the negative data on business activity index in the manufacturing sectors of Germany, France and EU as a whole. Today, the price of the pair EUR/USD has slightly grown, due to the influence of the cross-pair EUR/GBP. The British Pound is losing positions due to the negative effect of the inflation report and the speech of the head of the Bank of England Mark Carney.

Investors will wait for the data on the US real estate market today.

Support and resistance

Although the pair has won back some of the losses, significant rise in the pair is not expected. The pair may go up to the resistance level of 1.3660, which is the key level, coinciding with the upper limit of the descending channel. After reaching this level the pair may continue to decline because of the negative fundamental news. It is unlikely that ECB will soon take other steps to ease monetary policy, as it will take time to assess the results of the measures, which have been already adopted. If the rate of economic growth in Europe continues to decline, ECB may consider introduction of the additional measure to stimulate economy. In the medium-term the price of the pair may fall to the target level of 1.3300.

Support levels: 1.3600, 1.3520, 1.3470, 1.3400, 1.3350 and 1.3300.

Resistance levels: 1.3660, 1.3720, 1.3770, 1.3810, 1.3900, 1.3960 and 1.4000.

Trading tips

In makes sense to place short and pending short orders from the level of 1.3660 with taking profit at the level of 1.3470 (1.3300).

Dmitry Likhachev

Analyst of LiteForex Investments Limited

Current trend

Last week downward movement in the pair had slowed down; the price pushed off from the key support level of 1.3520 and started to go up slowly. Slight rise in demand for Euro and weak US macro-economic statistics boosted the rise in the pair to the level of 1.3650.

Note that negative statistics of Eurozone indicates slow rate of economic growth in Europe, which may force ECB to ease monetary policy. On Monday, the pair was under pressure from the negative data on business activity index in the manufacturing sectors of Germany, France and EU as a whole. Today, the price of the pair EUR/USD has slightly grown, due to the influence of the cross-pair EUR/GBP. The British Pound is losing positions due to the negative effect of the inflation report and the speech of the head of the Bank of England Mark Carney.

Investors will wait for the data on the US real estate market today.

Support and resistance

Although the pair has won back some of the losses, significant rise in the pair is not expected. The pair may go up to the resistance level of 1.3660, which is the key level, coinciding with the upper limit of the descending channel. After reaching this level the pair may continue to decline because of the negative fundamental news. It is unlikely that ECB will soon take other steps to ease monetary policy, as it will take time to assess the results of the measures, which have been already adopted. If the rate of economic growth in Europe continues to decline, ECB may consider introduction of the additional measure to stimulate economy. In the medium-term the price of the pair may fall to the target level of 1.3300.

Support levels: 1.3600, 1.3520, 1.3470, 1.3400, 1.3350 and 1.3300.

Resistance levels: 1.3660, 1.3720, 1.3770, 1.3810, 1.3900, 1.3960 and 1.4000.

Trading tips

In makes sense to place short and pending short orders from the level of 1.3660 with taking profit at the level of 1.3470 (1.3300).

Dmitry Likhachev

Analyst of LiteForex Investments Limited

LiteForex Representative

- LiteForexTeam

- Posts: 1249

- Joined: Thu May 23, 2013 12:53 pm

Re: LiteForex Market Analytics

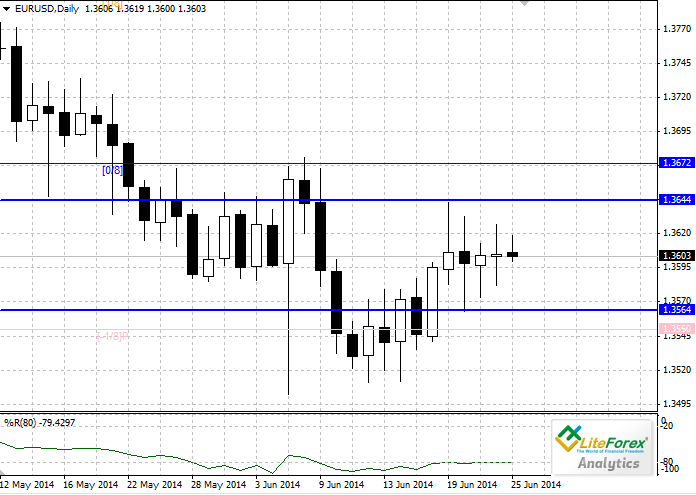

EUR/USD: General analysis

Current trend

European currency is traded in the narrow channel in the range of 100 points. Breakout of the upper limit of the channel at the level of 1.3644 will enable upward movement up to the level of 1.3794.

The latest economic statistics from France was below expectations of the experts, which had slight impact on the pair EUR/USD. Business confidence index fell to 92 points in June, which is the lowest value since August of last year. The economic growth in France is slowing down. Experts believe that governments plans to reduce budget expenses for 4 billion euro in order to lower total budget deficit to 3.8% of GDP in 2014, will only make the matters worse. Perhaps, if administration of President coordinates the plan to reduce taxes for business, it may revive the economy of the country.

Today a lot of US statistics will be released, including final data on GDP for Q1. It is expected that this index will decline to the level of 1.7%, which may have a serious impact on the USD and support Euro.

Support and resistance

The nearest resistance level is 1.3644.

Support level is 1.3564.

Trading tips

It is advisable to open long positions after breakdown of the level of 1.3644 with protective orders at 1.3624 and the target of 1.3780.

Dmitriy Agurbash

Analyst of LiteForex Investments Limited

Current trend

European currency is traded in the narrow channel in the range of 100 points. Breakout of the upper limit of the channel at the level of 1.3644 will enable upward movement up to the level of 1.3794.

The latest economic statistics from France was below expectations of the experts, which had slight impact on the pair EUR/USD. Business confidence index fell to 92 points in June, which is the lowest value since August of last year. The economic growth in France is slowing down. Experts believe that governments plans to reduce budget expenses for 4 billion euro in order to lower total budget deficit to 3.8% of GDP in 2014, will only make the matters worse. Perhaps, if administration of President coordinates the plan to reduce taxes for business, it may revive the economy of the country.

Today a lot of US statistics will be released, including final data on GDP for Q1. It is expected that this index will decline to the level of 1.7%, which may have a serious impact on the USD and support Euro.

Support and resistance

The nearest resistance level is 1.3644.

Support level is 1.3564.

Trading tips

It is advisable to open long positions after breakdown of the level of 1.3644 with protective orders at 1.3624 and the target of 1.3780.

Dmitriy Agurbash

Analyst of LiteForex Investments Limited

LiteForex Representative

- LiteForexTeam

- Posts: 1249

- Joined: Thu May 23, 2013 12:53 pm

Re: LiteForex Market Analytics

GBP/USD: General analysis

Current trend

Yesterday the price of the pair GBP/USD had reached weekly lows at the level of 1.6951. Nevertheless, during European trading session, the Pound tried to win back lost positions and consolidate above the level of 1.7000. The price of the British currency started to fall after the statement by Mark Carney, the head of the Bank of England who had changed his position towards interest rates. Mark Carney said that British economy has not yet regained and the decision on the raise of the interest rates can be made when unemployment rate falls to 6%.

Support and resistance

The nearest resistance levels: 1.7004 (Wednesday’s highs), 1.7064 (highs of 19 June), 1.7100 (important psychological level).

Support levels: 1.6951 (Wednesday’s lows), 1.6923 (lows of 18 June), 1.6880 (moving average with the period of 21 days), 1.6845 (moving average with the period of 50 days), 1.6698 (lows of 4 June).

Trading tips

It is recommended to open long positions after breakdown of the level of 1.7005 with protective orders at 1.6990 and the target of 1.7060.

Short positions can be opened from the level of 1.6950 with the target of 1.6880 and stop-loss at 1.6970.

Vadim Smarzh

Analyst of LiteForex Investments Limited

Current trend

Yesterday the price of the pair GBP/USD had reached weekly lows at the level of 1.6951. Nevertheless, during European trading session, the Pound tried to win back lost positions and consolidate above the level of 1.7000. The price of the British currency started to fall after the statement by Mark Carney, the head of the Bank of England who had changed his position towards interest rates. Mark Carney said that British economy has not yet regained and the decision on the raise of the interest rates can be made when unemployment rate falls to 6%.

Support and resistance

The nearest resistance levels: 1.7004 (Wednesday’s highs), 1.7064 (highs of 19 June), 1.7100 (important psychological level).

Support levels: 1.6951 (Wednesday’s lows), 1.6923 (lows of 18 June), 1.6880 (moving average with the period of 21 days), 1.6845 (moving average with the period of 50 days), 1.6698 (lows of 4 June).

Trading tips

It is recommended to open long positions after breakdown of the level of 1.7005 with protective orders at 1.6990 and the target of 1.7060.

Short positions can be opened from the level of 1.6950 with the target of 1.6880 and stop-loss at 1.6970.

Vadim Smarzh

Analyst of LiteForex Investments Limited

LiteForex Representative

- LiteForexTeam

- Posts: 1249

- Joined: Thu May 23, 2013 12:53 pm

Re: LiteForex Market Analytics

USD/JPY: Review and forecast

Current trend

On Wednesday the currency pair USD/JPY reached two-week lows at the level of 101.61. The decline was caused by poor data on the US GDP for Q1. The index fell by 2.9% against expectation of the decline of 1.7%. This news led to the sharp decline of the price in the pair USD/JPY; however soon after that the pair won back part of the losses.

At the moment the price is moving in the narrow sideways channel of 30 points. Investors do not want to take risk awaiting a block of important economic statistics from Japan, including national index of consumer price in May, household expenses and retail sales.

Support and resistance

In the near future it is likely that the price will move in the sideways in the range of 101.86-101.67. If fundamental data released on Friday will be positive, the price may slowly fall to the level of 101.48.

Technical indicators confirm downtrend. MACD histogram is in the negative zone; its volumes are increasing. Stochastic lines are directed downwards.

Trading tips

In the current situation it makes sense to place short positions from the level of 101.67 with taking profit at the level of 101.48.

Dmitriy Zolotov

Analyst of LiteForex Investments Limited

Current trend

On Wednesday the currency pair USD/JPY reached two-week lows at the level of 101.61. The decline was caused by poor data on the US GDP for Q1. The index fell by 2.9% against expectation of the decline of 1.7%. This news led to the sharp decline of the price in the pair USD/JPY; however soon after that the pair won back part of the losses.

At the moment the price is moving in the narrow sideways channel of 30 points. Investors do not want to take risk awaiting a block of important economic statistics from Japan, including national index of consumer price in May, household expenses and retail sales.

Support and resistance

In the near future it is likely that the price will move in the sideways in the range of 101.86-101.67. If fundamental data released on Friday will be positive, the price may slowly fall to the level of 101.48.

Technical indicators confirm downtrend. MACD histogram is in the negative zone; its volumes are increasing. Stochastic lines are directed downwards.

Trading tips

In the current situation it makes sense to place short positions from the level of 101.67 with taking profit at the level of 101.48.

Dmitriy Zolotov

Analyst of LiteForex Investments Limited

LiteForex Representative

- LiteForexTeam

- Posts: 1249

- Joined: Thu May 23, 2013 12:53 pm

Re: LiteForex Market Analytics

EUR/USD: Further movement in the pair will depend on the decision of ECB

Current trend

By yesterday afternoon the pair EUR/USD dropped to the level of 1.3570. However it did not take long for European currency to regain and win back losses. Some experts express opinion that ECB does not wish to introduce additional measures of monetary policy easing, preferring instead to reduce interest rates once again. Today the quotes began to grow and reached the level of 1.3630.

Among important fundamental news will be German preliminary consumer price index for June and US consumer confidence index, as per Reuters/Michigan.

Support and resistance

Further strengthening in European currency is not expected. Strong data on German indices were not able to provide support, which would be strong enough to break down key resistance level of 1.3660, coinciding with the upper limit of the downward channel. In the medium-term the pair is likely to go down to the local lows. Breakdown of support level of 1.3520 is also possible. The target, which is still at the level of 1.3300, can be reached in the mid-July.

Support levels: 1.3600, 1.3520, 1.3470, 1.3400, 1.3350 and 1.3300.

Resistance levels: 1.3660, 1.3720, 1.3770, 1.3810, 1.3900, 1.3960 and 1.4000.

Trading tips

In the current situation it is advisable to open short and pending short positions from the level of 1.3660 with taking profit at the level of 1.3470 (1.3300).

Dmitry Likhachev

Analyst of LiteForex Investments Limited

Current trend

By yesterday afternoon the pair EUR/USD dropped to the level of 1.3570. However it did not take long for European currency to regain and win back losses. Some experts express opinion that ECB does not wish to introduce additional measures of monetary policy easing, preferring instead to reduce interest rates once again. Today the quotes began to grow and reached the level of 1.3630.

Among important fundamental news will be German preliminary consumer price index for June and US consumer confidence index, as per Reuters/Michigan.

Support and resistance

Further strengthening in European currency is not expected. Strong data on German indices were not able to provide support, which would be strong enough to break down key resistance level of 1.3660, coinciding with the upper limit of the downward channel. In the medium-term the pair is likely to go down to the local lows. Breakdown of support level of 1.3520 is also possible. The target, which is still at the level of 1.3300, can be reached in the mid-July.

Support levels: 1.3600, 1.3520, 1.3470, 1.3400, 1.3350 and 1.3300.

Resistance levels: 1.3660, 1.3720, 1.3770, 1.3810, 1.3900, 1.3960 and 1.4000.

Trading tips

In the current situation it is advisable to open short and pending short positions from the level of 1.3660 with taking profit at the level of 1.3470 (1.3300).

Dmitry Likhachev

Analyst of LiteForex Investments Limited

LiteForex Representative

- LiteForexTeam

- Posts: 1249

- Joined: Thu May 23, 2013 12:53 pm

Re: LiteForex Market Analytics

GBP/USD: When will the Bank of England decide to tighten monetary policy?

Current trend

Last week the pair had traded in the sideways channel; however at the end of last week the pair went up winning back some of the losses. Although the demand for the Pound continues to grow, fundamental support is still required in order to break down key resistance level. Investors are waiting for the monetary policy tightening and the increase of the key interest rate by the Bank of England.

Today UK data on the approved mortgage loans and the volume of the net loans to the individuals became known. Both indices were below expectations and the pair GBP/USD fell to the level of 1.7020.

Support and resistance

In the near future the pair may undergo short correction with the target of 1.6920 (1.7000), after which the pair may continue ascending movement. American macro-economic statistics continues to be disappointing, so the rise in the pair is not expected this week.

Support levels: 1.7000, 1.6920, 1.6850, 1.6810, 1.6780 and 1.6700.

Resistance levels: 1.7060, 1.7100, 1.7150 and 1.7300.

Trading tips

In the current situation it makes sense to open long positions from the level of 1.6920 with taking profit at the level of 1.7300.

Dmitry Likhachev

Analyst of LiteForex Investments Limited

Current trend

Last week the pair had traded in the sideways channel; however at the end of last week the pair went up winning back some of the losses. Although the demand for the Pound continues to grow, fundamental support is still required in order to break down key resistance level. Investors are waiting for the monetary policy tightening and the increase of the key interest rate by the Bank of England.

Today UK data on the approved mortgage loans and the volume of the net loans to the individuals became known. Both indices were below expectations and the pair GBP/USD fell to the level of 1.7020.

Support and resistance

In the near future the pair may undergo short correction with the target of 1.6920 (1.7000), after which the pair may continue ascending movement. American macro-economic statistics continues to be disappointing, so the rise in the pair is not expected this week.

Support levels: 1.7000, 1.6920, 1.6850, 1.6810, 1.6780 and 1.6700.

Resistance levels: 1.7060, 1.7100, 1.7150 and 1.7300.

Trading tips

In the current situation it makes sense to open long positions from the level of 1.6920 with taking profit at the level of 1.7300.

Dmitry Likhachev

Analyst of LiteForex Investments Limited

LiteForex Representative

- LiteForexTeam

- Posts: 1249

- Joined: Thu May 23, 2013 12:53 pm

Re: LiteForex Market Analytics

Forex: Ichimoku Clouds. Review of NZD/USD

NZD/USD, H4

On the four-hour chart Tenkan-sen line is above Kijun-sen, and the price is stuck between them. Chinkou Span line is above the price chart, current cloud is ascending. After an abrupt rise the pair has been corrected under Tenkan-sen line, which becomes a resistance level (0.8759). The closest support level is Kijun-sen line (0.8727).

NZD/USD, D1

Let’s look at the daily chart. Tenkan-sen line is above Kijun-sen, the red line is directed upwards, while the blue one remains horizontal. Chinkou Span line is above the price chart; current cloud is ascending. The pair is being corrected. However, the correction hasn’t reached Tenkan-sen line, which is stil a support level (0.8722). One of the previous maximums of Chinkou Span line is expected to be a resistance level at 0.8791.

Key levels

Support levels: 0.8722, 0.8727.

Resistance levels: 0.8759, 0.8791.

Trading tips

On the both charts we can see a correction of an upward movement; however, Bullish trend is still strong. Is a good opportunity to open new long trades with targets 0.8759, 0.8791.

Anastasiya Glushkova

Analyst of LiteForex Investments Limited

NZD/USD, H4

On the four-hour chart Tenkan-sen line is above Kijun-sen, and the price is stuck between them. Chinkou Span line is above the price chart, current cloud is ascending. After an abrupt rise the pair has been corrected under Tenkan-sen line, which becomes a resistance level (0.8759). The closest support level is Kijun-sen line (0.8727).

NZD/USD, D1

Let’s look at the daily chart. Tenkan-sen line is above Kijun-sen, the red line is directed upwards, while the blue one remains horizontal. Chinkou Span line is above the price chart; current cloud is ascending. The pair is being corrected. However, the correction hasn’t reached Tenkan-sen line, which is stil a support level (0.8722). One of the previous maximums of Chinkou Span line is expected to be a resistance level at 0.8791.

Key levels

Support levels: 0.8722, 0.8727.

Resistance levels: 0.8759, 0.8791.

Trading tips

On the both charts we can see a correction of an upward movement; however, Bullish trend is still strong. Is a good opportunity to open new long trades with targets 0.8759, 0.8791.

Anastasiya Glushkova

Analyst of LiteForex Investments Limited

LiteForex Representative

- LiteForexTeam

- Posts: 1249

- Joined: Thu May 23, 2013 12:53 pm

Re: LiteForex Market Analytics

EUR/USD: the pair will return to the descending channel

Current trend

At the beginning of the week European currency was growing despite negative macro-economic statistics of Eurozone. AS investors did not fear the possibility of further monetary policy easing and reduction of the interest rates, the demand for the risky assets continued to grow. Today the pair is traded at the level of 1.3690. Market participants are waiting for the business activity index in the US manufacturing sector and the speech of the US Minister of Treasury, Mr. Jacob Lew. Tomorrow GDP of EU will become known, which may affect the movement in the pair.

Support and resistance

It is likely that following significant growth the pair will undergo the downward correction to the level of 1.3600. After that the pair will start to go down to the local lows and key support levels of 1.3520 and 1.3470. In the medium-term the pair may fall to the level of 1.3300.

Support levels: 1.3660, 1.3600, 1.3520, 1.3470, 1.3400 and 1.3300.

Resistance levels: 1.3720, 1.3770, 1.3810, 1.3900, 1.3960 and 1.4000.

Trading tips

In the current situation it makes sense to open short positions and pending short positions from the levels of 1.3720 and 1.3770 and take profit at the level of 1.3520 (1.3300).

Dmitry Likhachev

Analyst of LiteForex Investments Limited

Current trend

At the beginning of the week European currency was growing despite negative macro-economic statistics of Eurozone. AS investors did not fear the possibility of further monetary policy easing and reduction of the interest rates, the demand for the risky assets continued to grow. Today the pair is traded at the level of 1.3690. Market participants are waiting for the business activity index in the US manufacturing sector and the speech of the US Minister of Treasury, Mr. Jacob Lew. Tomorrow GDP of EU will become known, which may affect the movement in the pair.

Support and resistance

It is likely that following significant growth the pair will undergo the downward correction to the level of 1.3600. After that the pair will start to go down to the local lows and key support levels of 1.3520 and 1.3470. In the medium-term the pair may fall to the level of 1.3300.

Support levels: 1.3660, 1.3600, 1.3520, 1.3470, 1.3400 and 1.3300.

Resistance levels: 1.3720, 1.3770, 1.3810, 1.3900, 1.3960 and 1.4000.

Trading tips

In the current situation it makes sense to open short positions and pending short positions from the levels of 1.3720 and 1.3770 and take profit at the level of 1.3520 (1.3300).

Dmitry Likhachev

Analyst of LiteForex Investments Limited

LiteForex Representative

- LiteForexTeam

- Posts: 1249

- Joined: Thu May 23, 2013 12:53 pm

Re: LiteForex Market Analytics

Forex: Ichimoku Clouds. Review of Brent

Brent, H4

On the four-hour chart Tenkan-sen line is below Kijun-sen, and they are both almost horizontal. Chinkou Span line is below the price chart; current cloud is descending. Regardless numerous corrections, crude oil Brent continue to fall. Tenkan-sen line is the closest resistance level (112.30). One of the previous minimums of Chinkou Span line is expected to be a support level at 109.77.

Brent, D1

On the daily chart Tenkan-sen line is above Kijun-sen, and the price is stuck between them. Chinkou Span line is above the price chart; current cloud is still ascending. Horizontal Kijun-sen line is a strong support level (111.70). Tenkan-sen line is a resistance level (1.6805).

Key levels

Support levels: 111.70, 109.77.

Resistance levels: 112.30, 113.70.

Trading tips

On the four-hour chart we can see a downward trend, on the daily chart — the beginning of trend reversal. Sell positions can be opened below 111.70 with targets at 109.77.

Anastasiya Glushkova

Analyst of LiteForex Investments Limited

Brent, H4

On the four-hour chart Tenkan-sen line is below Kijun-sen, and they are both almost horizontal. Chinkou Span line is below the price chart; current cloud is descending. Regardless numerous corrections, crude oil Brent continue to fall. Tenkan-sen line is the closest resistance level (112.30). One of the previous minimums of Chinkou Span line is expected to be a support level at 109.77.

Brent, D1

On the daily chart Tenkan-sen line is above Kijun-sen, and the price is stuck between them. Chinkou Span line is above the price chart; current cloud is still ascending. Horizontal Kijun-sen line is a strong support level (111.70). Tenkan-sen line is a resistance level (1.6805).

Key levels

Support levels: 111.70, 109.77.

Resistance levels: 112.30, 113.70.

Trading tips

On the four-hour chart we can see a downward trend, on the daily chart — the beginning of trend reversal. Sell positions can be opened below 111.70 with targets at 109.77.

Anastasiya Glushkova

Analyst of LiteForex Investments Limited

LiteForex Representative

- LiteForexTeam

- Posts: 1249

- Joined: Thu May 23, 2013 12:53 pm