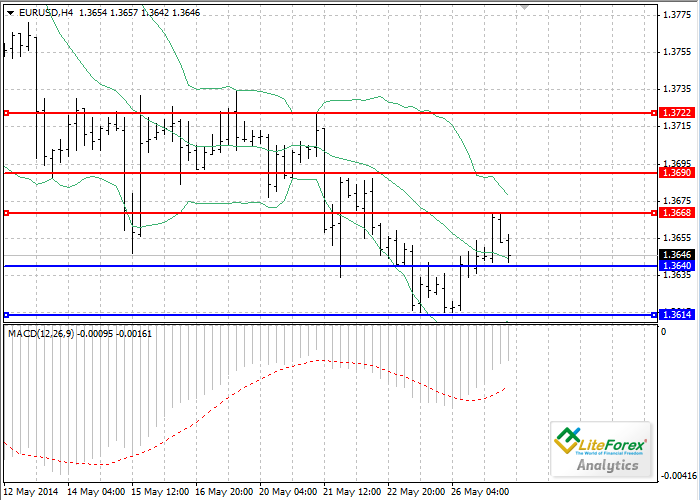

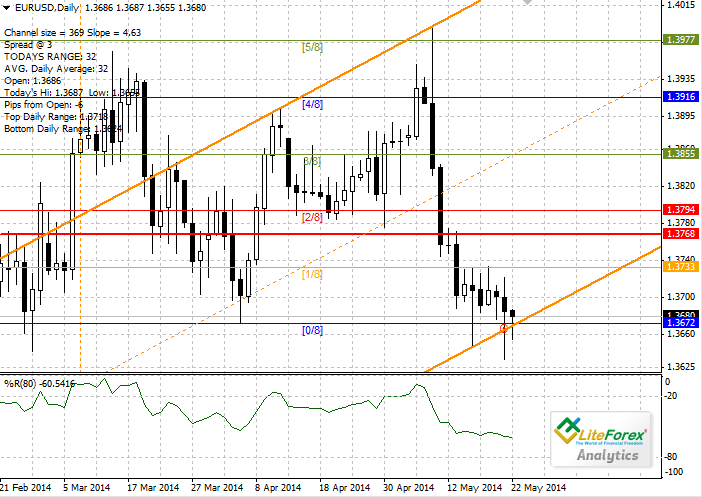

Current trend

European currency continues to trade in the downtrend. Yesterday Euro has broken down important support level of 0/8 Murray (1.3672) on the daily chart but failed to maintain at this level. At the moment the pair is trading at the level of 1.3683. Technical correction is possible, which may be followed by the rollback to the level of 1.3733.

Euro is under pressure from the data on surplus of current account balance in Eurozone, which fell to 18.8 billion euro against the previous value of 21.8 billion. The decrease in inflation may force ECB to launch incentive programs, which will have a negative impact on the rate of EUR/USD. The rate on deposit may be lowered by 10 basis points at the next meeting in June, as monetary authorities might want to increase lending and use liquidity for improving situation in economy. However, experience in other countries showed that such practice may have a negative effect, as the banks may refuse to provide loans to the clients at the reduced rates, which will lead to the reduction of profitability.

Support and resistance

The nearest resistance level is 1.3733 (1/8 Murray level). Support level is 0/8 Murray level (1.3672).

Trading tips

It is recommended to open short positions after breakdown of the level of 1.3672 with stop-loss at 1.3700 and the target of 1.3620.

Dmitriy Agurbash

Analyst of LiteForex Investments Limited