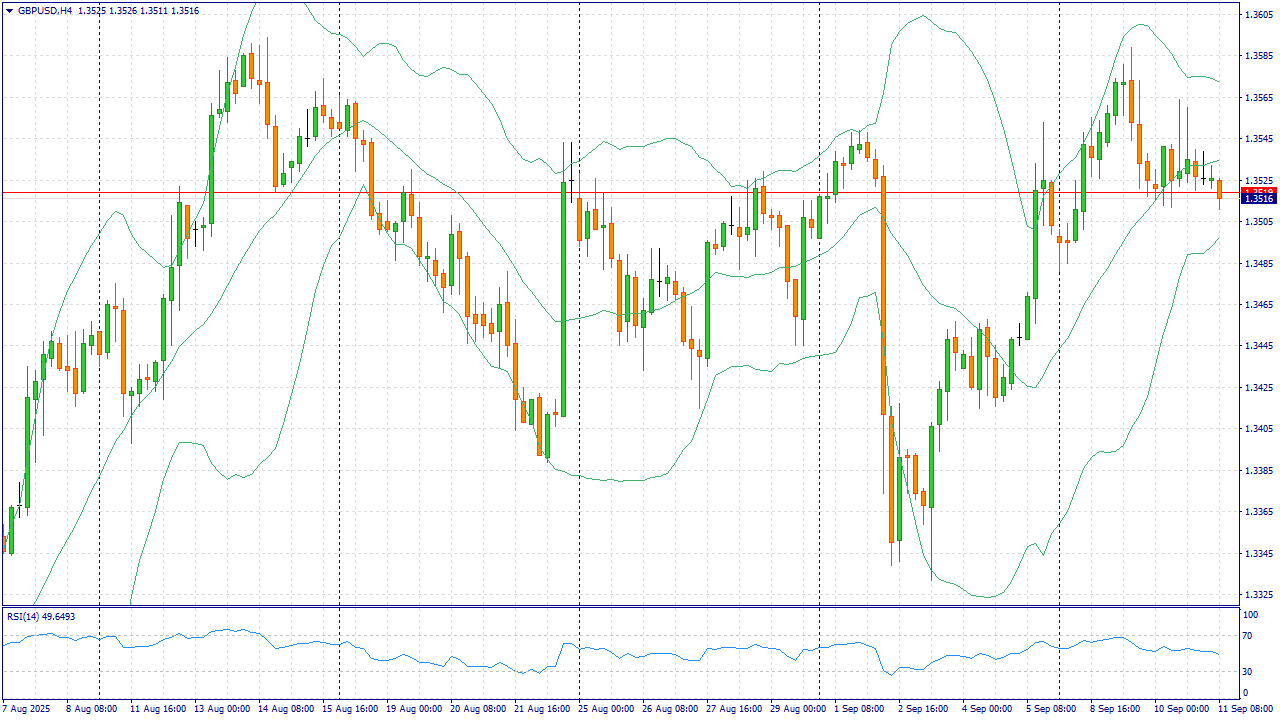

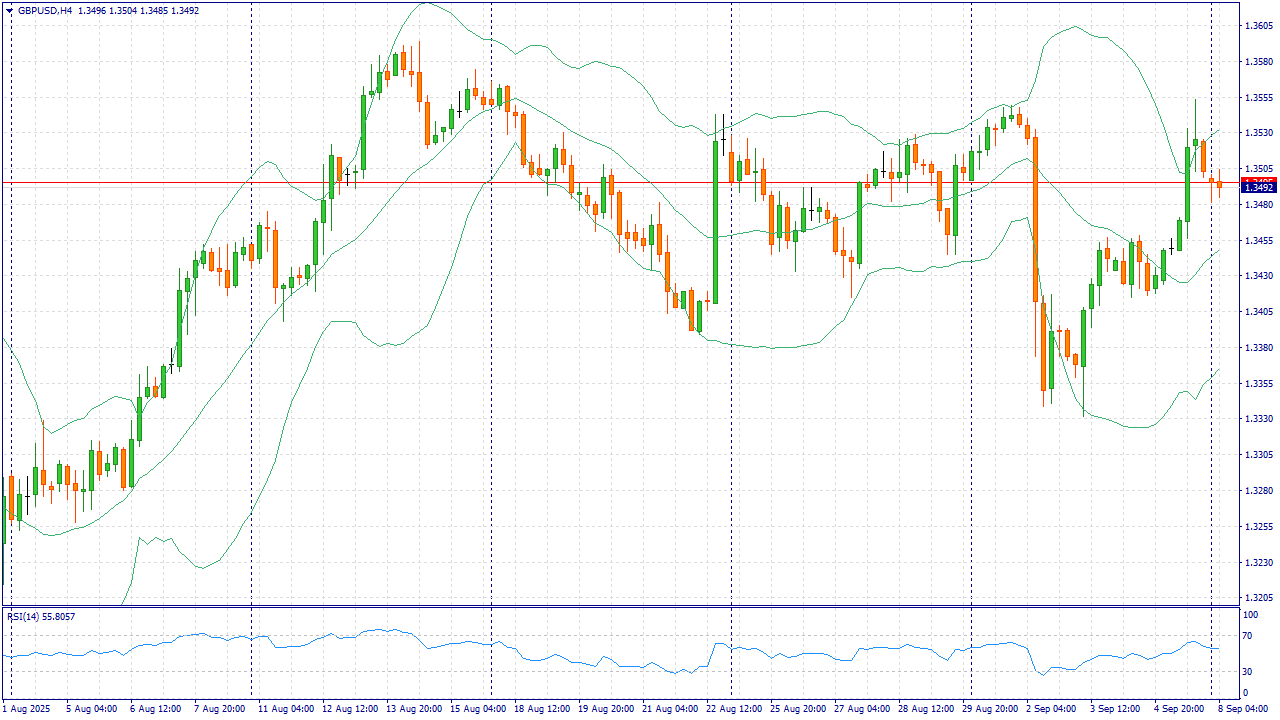

GBPUSD:

Only for our readers - a 202% bonus on deposits from $202, mention promo code INDEX202 in support and trade with TRIPLED capital, details of the promotion at the link.

The GBP/USD pair is starting the new week on a softer note, dropping below the 1.3500 psychological mark during the Asian session. However, the decline does not look convincing, which calls for caution from bearish traders and positioning for a continuation of Friday's pullback from the 1.3555 area, or a nearly three-week high.

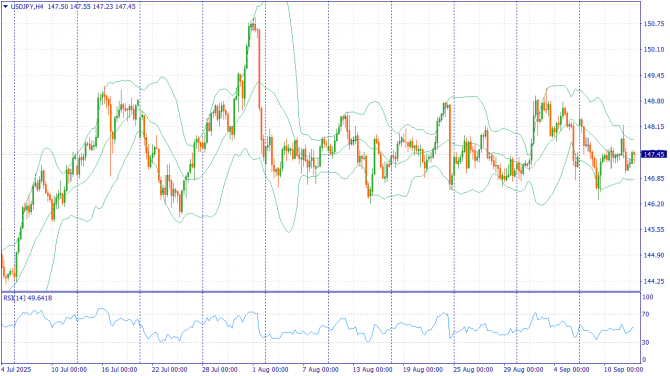

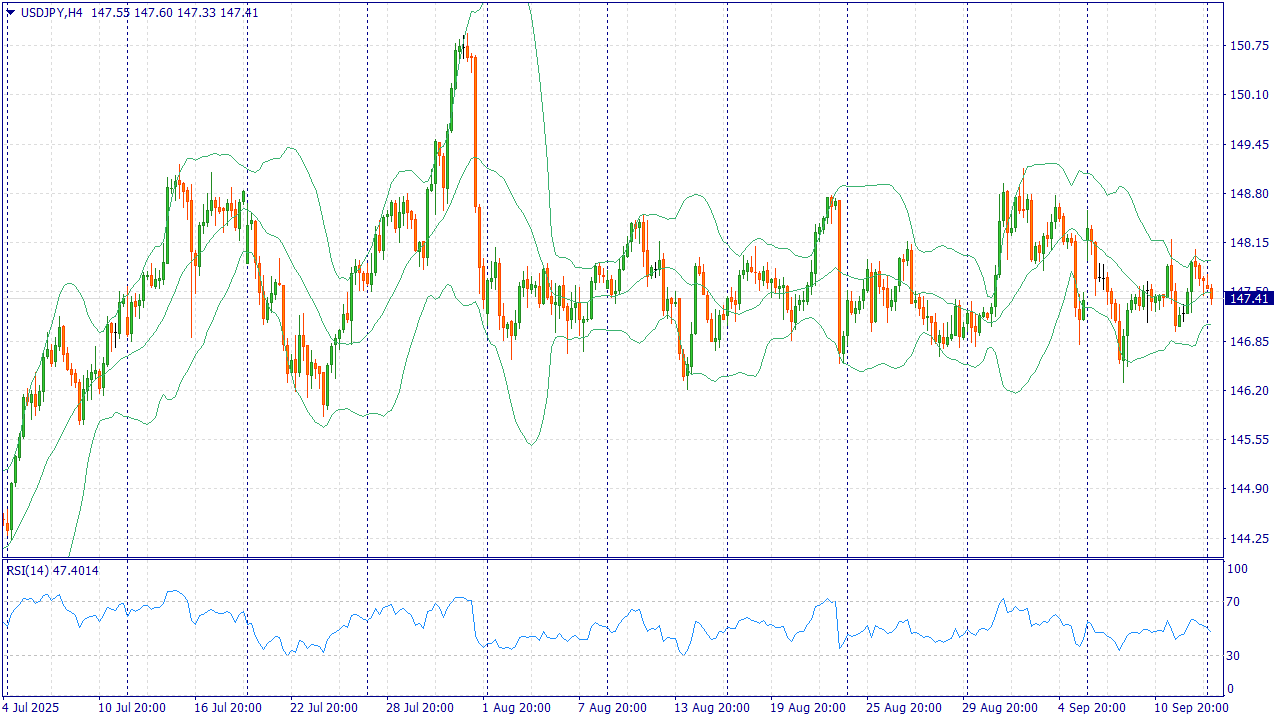

The US Dollar (USD) is gaining positive momentum and pulling away from its low since July 28, reached on Friday in response to disappointing US employment data, which in turn is putting pressure on the GBP/USD pair. The rise in the USD can be attributed to the fall of the Japanese Yen (JPY) amid domestic political turmoil and risks fizzling out rather quickly amid growing bets on a Federal Reserve (Fed) rate cut.

The U.S. Nonfarm Payrolls (NFP) report showed that the economy added only 22,000 jobs in August, significantly below consensus forecasts. In addition, revisions to previous data showed that the economy lost 13,000 jobs in June, the first monthly decline since December 2020, indicating a weakening U.S. labor market. This has fueled speculation of a more aggressive Fed interest rate cut and should limit the USD's rise.

The British Pound (GBP), however, may struggle to attract significant buyers amid financial uncertainty ahead of the autumn budget in November.

Trading recommendation: BUY 1.3495, SL 1.3475, TP 1.3595

Connect Drawdown bonus 101% and trade with double your deposit! Bonus funds will help you increase your profits or withstand a sudden drawdown!

You can find more analytical information on our website.