Forex Analysis & Reviews: What Do Falling Bonds, Rising Indexes, and Macy's Trouble Have in Common?

Wall Street Ends Higher, Russell 2000 Hits Record U.S. stock markets closed higher on Monday, with the Russell 2000 small-cap index hitting an all-time high. The optimism was boosted by the nomination of Scott Bessent to be U.S. Treasury Secretary, which helped push Treasury yields lower. Geopolitics and Oil: Unexpected Calm Oil prices have fallen amid ceasefire talks between Israel and Lebanon. This has had a negative impact on the energy sector, with the Energy Index (.SPNY) falling 2%. Market participants have reacted to the potential easing of tensions in the Middle East, which has increased pressure on the quotes of "black gold". Trump names a name, markets react President-elect Donald Trump on Friday evening finally named his nominee for Treasury Secretary, ending weeks of anticipation. The appointment of Scott Bessent has caused a stir in the markets, as some analysts believe he can limit the growth of the national debt, even while delivering on Trump's promises in the field of fiscal and trade policy. Fiscal fears recede Experts note that Bessent's appointment has reduced investor anxiety about the possible introduction of new tariffs, which previously caused jumps in bond yields. "The focus is now on trade policy. "The nomination of Scott Bessent has significantly eased key fiscal concerns," said James Reilly, chief market economist at Capital Economics. Markets continue to closely monitor the appointments and statements of the new administration, awaiting further signals on the course of economic policy.

News are provided by InstaForex

Read more: https://ifxpr.com/3AWHGDB

Instaforex Analysis

Re: Instaforex Analysis

Forex Analysis & Reviews: Forecast for GBP/USD on November 28, 2024

The pound sustained its correction potential and yesterday approached the target level of 1.2708. The Marlin oscillator broke out of the descending channel upward but remains in negative territory for now.

A move above the nearest target level will also signal a shift into positive territory for the Marlin oscillator. A simultaneous breakout of the price and the oscillator would boost the pound's momentum for further growth. The next targets are 1.2773; the subsequent one is 1.2859. On the four-hour chart, the price has risen above both indicator lines.

The price may consolidate to solidify its breakout above the nearest resistance, potentially reaching the target level of 1.2773. The Marlin oscillator is slightly declining this morning, which could set the stage for renewed growth from a lower base. If the price falls below the MACD moving average at 1.2568, the trend will shift back to a medium-term decline.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4f7bTOp

The pound sustained its correction potential and yesterday approached the target level of 1.2708. The Marlin oscillator broke out of the descending channel upward but remains in negative territory for now.

A move above the nearest target level will also signal a shift into positive territory for the Marlin oscillator. A simultaneous breakout of the price and the oscillator would boost the pound's momentum for further growth. The next targets are 1.2773; the subsequent one is 1.2859. On the four-hour chart, the price has risen above both indicator lines.

The price may consolidate to solidify its breakout above the nearest resistance, potentially reaching the target level of 1.2773. The Marlin oscillator is slightly declining this morning, which could set the stage for renewed growth from a lower base. If the price falls below the MACD moving average at 1.2568, the trend will shift back to a medium-term decline.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4f7bTOp

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Forecast for EUR/USD on December 2, 2024

On Friday, the euro reached its target resistance at 1.0590. However, during the Asian session, it erased Friday's gains and dropped to Thursday's low. The Marlin oscillator's signal line turned downward from the neutral zero line. This indicates that the correction from 1.0350 is likely complete, and the price is now heading towards the target range of 1.0449/83. A breakout below this range would open the path to the next target at 1.0350.

Additionally, today's data on business activity in the Eurozone and the US supports dollar strengthening. The Eurozone Manufacturing PMI for November is expected to weaken from 46.0 to 45.2, while the US Manufacturing PMI is forecasted to rise from 48.5 to 48.8. The ISM Manufacturing Index is also expected to improve from 46.5 to 47.7.

On the H4 chart, the price and oscillator have formed a divergence. Marlin is already in bearish territory, signaling downward momentum. The 1.0449/83 range coincides with the MACD line, making this zone strategically significant. A break below it would pave the way for new targets below 1.0350, with 1.0250 as the next key level.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3OGWKYZ

On Friday, the euro reached its target resistance at 1.0590. However, during the Asian session, it erased Friday's gains and dropped to Thursday's low. The Marlin oscillator's signal line turned downward from the neutral zero line. This indicates that the correction from 1.0350 is likely complete, and the price is now heading towards the target range of 1.0449/83. A breakout below this range would open the path to the next target at 1.0350.

Additionally, today's data on business activity in the Eurozone and the US supports dollar strengthening. The Eurozone Manufacturing PMI for November is expected to weaken from 46.0 to 45.2, while the US Manufacturing PMI is forecasted to rise from 48.5 to 48.8. The ISM Manufacturing Index is also expected to improve from 46.5 to 47.7.

On the H4 chart, the price and oscillator have formed a divergence. Marlin is already in bearish territory, signaling downward momentum. The 1.0449/83 range coincides with the MACD line, making this zone strategically significant. A break below it would pave the way for new targets below 1.0350, with 1.0250 as the next key level.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3OGWKYZ

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Nvidia Stock Soars, Indexes Strengthen, FDA Puts a Stop to Applied Therapeutics Plans

Market Record Highs: How the S&P 500 and Dow Jones Rewrote History on Black Friday The S&P 500 and Dow Jones Industrial Average once again pleased investors on Black Friday, closing at record highs. The main drivers of growth were tech giants like Nvidia and Tesla, as well as a rebound in retail trading caused by the start of the holiday shopping season. Tech Sector as a Driver The information technology sector was a key driver of growth for the S&P 500 and Dow Jones. Leading companies showed impressive results: Nvidia shares added 2%, and Tesla rose 3.7%. These successes helped the benchmark S&P 500 index and the blue chips of the Dow confidently end the shortened trading session. In addition, the industrial sector made a significant contribution to the growth of the indices, confirming the stability and diversification of the American economy. E-commerce breaks records The holiday shopping season started with records. According to Adobe Analytics, consumers set a new high, spending $ 10.8 billion on online shopping. This is 9.9% more than on Black Friday last year. The retail sector also responded to the shopping activity with rising shares. Thus, Target shares added 1.7%, and Macy's rose by 1.8%. This underscores investors' optimism regarding demand for holiday goods. Indices update historical maximums The key indices' indicators speak for themselves: The S&P 500 rose by 0.56%, ending the day at 6032.44 points, which exceeded the previous intraday record of 6025.42 points; The Dow Jones Industrial Average rose by 0.42%, reaching 44910.65 points; The Nasdaq added 0.83%, closing at 19218.17 points; The Russell 2000, an index of small companies, rose 1.48%, reaching a new record high at the beginning of the week. Semiconductors regain ground After a brief decline the day before, shares of chip makers have confidently recovered. The Philadelphia SE semiconductor index rose by 1.5%, which became another positive signal for the market. Black Friday not only boosted consumer activity, but also demonstrated once again the power of the tech and industrial sectors to drive sustainable economic growth. The holiday season has just begun, and the market faces new challenges and possibly new records. Small-cap gains as bond yields fall The Russell 2000 small-cap index rose 0.4%, helped by Treasury yields falling from multi-month highs earlier this year. That bolstered small-cap stocks that are sensitive to changes in economic policy and market liquidity.

News are provided by InstaForex

Read more: https://ifxpr.com/3CRcPJ7

Market Record Highs: How the S&P 500 and Dow Jones Rewrote History on Black Friday The S&P 500 and Dow Jones Industrial Average once again pleased investors on Black Friday, closing at record highs. The main drivers of growth were tech giants like Nvidia and Tesla, as well as a rebound in retail trading caused by the start of the holiday shopping season. Tech Sector as a Driver The information technology sector was a key driver of growth for the S&P 500 and Dow Jones. Leading companies showed impressive results: Nvidia shares added 2%, and Tesla rose 3.7%. These successes helped the benchmark S&P 500 index and the blue chips of the Dow confidently end the shortened trading session. In addition, the industrial sector made a significant contribution to the growth of the indices, confirming the stability and diversification of the American economy. E-commerce breaks records The holiday shopping season started with records. According to Adobe Analytics, consumers set a new high, spending $ 10.8 billion on online shopping. This is 9.9% more than on Black Friday last year. The retail sector also responded to the shopping activity with rising shares. Thus, Target shares added 1.7%, and Macy's rose by 1.8%. This underscores investors' optimism regarding demand for holiday goods. Indices update historical maximums The key indices' indicators speak for themselves: The S&P 500 rose by 0.56%, ending the day at 6032.44 points, which exceeded the previous intraday record of 6025.42 points; The Dow Jones Industrial Average rose by 0.42%, reaching 44910.65 points; The Nasdaq added 0.83%, closing at 19218.17 points; The Russell 2000, an index of small companies, rose 1.48%, reaching a new record high at the beginning of the week. Semiconductors regain ground After a brief decline the day before, shares of chip makers have confidently recovered. The Philadelphia SE semiconductor index rose by 1.5%, which became another positive signal for the market. Black Friday not only boosted consumer activity, but also demonstrated once again the power of the tech and industrial sectors to drive sustainable economic growth. The holiday season has just begun, and the market faces new challenges and possibly new records. Small-cap gains as bond yields fall The Russell 2000 small-cap index rose 0.4%, helped by Treasury yields falling from multi-month highs earlier this year. That bolstered small-cap stocks that are sensitive to changes in economic policy and market liquidity.

News are provided by InstaForex

Read more: https://ifxpr.com/3CRcPJ7

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: How to Trade the GBP/USD Pair on December 3? Simple Tips and Trade Analysis for Beginners

On Monday, the GBP/USD pair also traded downward from the market opening. There were no clear reasons for the British currency to fall overnight, leading us to believe that the market has shown the direction it intends to take this week. Later, the U.S. released the ISM Manufacturing PMI, which showed stronger growth than expected. The accompanying S&P Business Activity Index also surpassed market expectations. As a result, during the U.S. trading session, the dollar had solid grounds for growth. Considering the overall technical and fundamental picture, it becomes evident that the pound sterling is likely to continue its decline in nearly any scenario. The only question is how long the corrective phase will last. As is well known, corrections can be quite prolonged, but this does not imply a significant rise in the pair.

Three good trading signals were formed on the 5-minute TF on Monday. First, the price bounced from the area of 1.2680-1.2685, then overcame this area, and finally bounced (with a small error) from the level of 1.2613. The first signal can be false, but the price moved 20 pips in the desired direction, allowing the trade to close at breakeven with a Stop Loss. The second and third signals yielded profits for novice traders. Trading Strategy for Tuesday: The GBP/USD pair continues to show a downward bias on the hourly timeframe. We fully support the pound's decline in the medium term as we believe this is the only logical outcome. The pound sterling remains in a corrective phase, which could take some time. However, it's important to remember that the current rise in the British currency is driven purely by technical factors. On Tuesday, novice traders can anticipate a new decline in the British pound, given that the 1.2680–1.2685 area has already been broken. On the 5-minute TF, you can now trade at 1.2387, 1.2445, 1.2502-1.2508, 1.2547, 1.2633, 1.2680-1.2685, 1.2754, 1.2791-1.2798, 1.2848-1.2860, 1.2913, 1.2980-1.2993. The only significant event on Tuesday is the JOLTs report on job openings in the U.S. However, this report is only moderately important, as it is published with a two-month lag.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4gk5bpf

On Monday, the GBP/USD pair also traded downward from the market opening. There were no clear reasons for the British currency to fall overnight, leading us to believe that the market has shown the direction it intends to take this week. Later, the U.S. released the ISM Manufacturing PMI, which showed stronger growth than expected. The accompanying S&P Business Activity Index also surpassed market expectations. As a result, during the U.S. trading session, the dollar had solid grounds for growth. Considering the overall technical and fundamental picture, it becomes evident that the pound sterling is likely to continue its decline in nearly any scenario. The only question is how long the corrective phase will last. As is well known, corrections can be quite prolonged, but this does not imply a significant rise in the pair.

Three good trading signals were formed on the 5-minute TF on Monday. First, the price bounced from the area of 1.2680-1.2685, then overcame this area, and finally bounced (with a small error) from the level of 1.2613. The first signal can be false, but the price moved 20 pips in the desired direction, allowing the trade to close at breakeven with a Stop Loss. The second and third signals yielded profits for novice traders. Trading Strategy for Tuesday: The GBP/USD pair continues to show a downward bias on the hourly timeframe. We fully support the pound's decline in the medium term as we believe this is the only logical outcome. The pound sterling remains in a corrective phase, which could take some time. However, it's important to remember that the current rise in the British currency is driven purely by technical factors. On Tuesday, novice traders can anticipate a new decline in the British pound, given that the 1.2680–1.2685 area has already been broken. On the 5-minute TF, you can now trade at 1.2387, 1.2445, 1.2502-1.2508, 1.2547, 1.2633, 1.2680-1.2685, 1.2754, 1.2791-1.2798, 1.2848-1.2860, 1.2913, 1.2980-1.2993. The only significant event on Tuesday is the JOLTs report on job openings in the U.S. However, this report is only moderately important, as it is published with a two-month lag.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4gk5bpf

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Forecast for EUR/USD on December 4, 2024

Yesterday's corrective growth was minimal, with the white candlestick amounting to 12 pips. The overall downward trend, driven by the reversal of both the price and the oscillator from their resistance levels, looks more solid. The current task for the bears is to consolidate within the 1.0449/83 range, which would pave the way for a move toward the 1.0350 target.

Economic data from Europe and the U.S. will influence this scenario. The Eurozone Services PMI for November is expected to decline from 51.6 to 49.2, while the U.S. PMI is forecasted to rise from 55.0 to 57.0. However, the ISM Non-Manufacturing Index may edge down slightly from 56.0 to 55.5, but this is offset by an anticipated 0.3% growth in industrial orders.

Yesterday, the price returned below the balance line on the four-hour chart, coinciding with the Marlin oscillator's signal line turning downward from the zero line. The intent to move into the 1.0449/83 range is clear, but the MACD line within this range could hinder further bearish progress.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/49CrPXP

Yesterday's corrective growth was minimal, with the white candlestick amounting to 12 pips. The overall downward trend, driven by the reversal of both the price and the oscillator from their resistance levels, looks more solid. The current task for the bears is to consolidate within the 1.0449/83 range, which would pave the way for a move toward the 1.0350 target.

Economic data from Europe and the U.S. will influence this scenario. The Eurozone Services PMI for November is expected to decline from 51.6 to 49.2, while the U.S. PMI is forecasted to rise from 55.0 to 57.0. However, the ISM Non-Manufacturing Index may edge down slightly from 56.0 to 55.5, but this is offset by an anticipated 0.3% growth in industrial orders.

Yesterday, the price returned below the balance line on the four-hour chart, coinciding with the Marlin oscillator's signal line turning downward from the zero line. The intent to move into the 1.0449/83 range is clear, but the MACD line within this range could hinder further bearish progress.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/49CrPXP

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

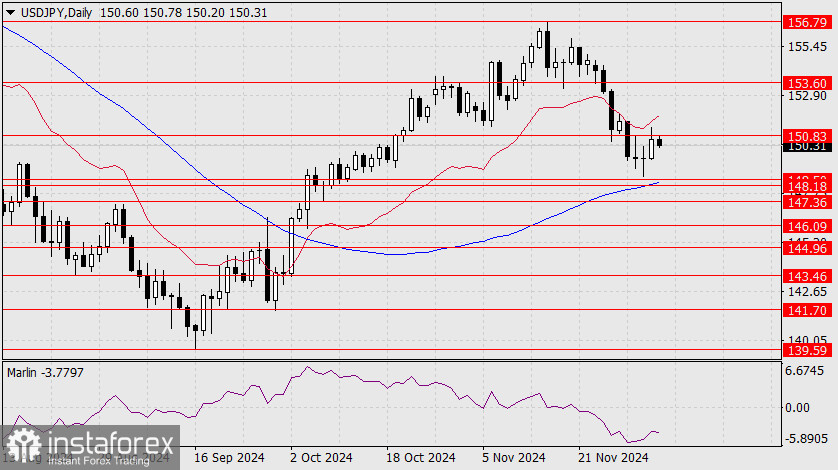

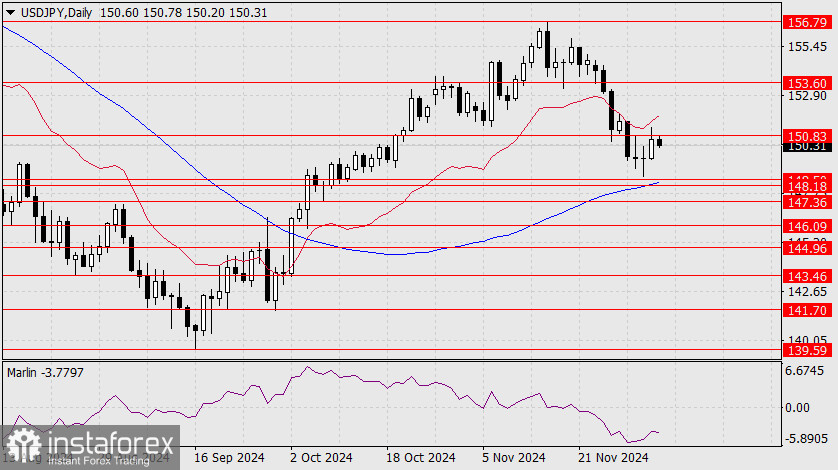

Forex Analysis & Reviews: Forecast for USD/JPY on December 5, 2024

Bank of Japan representatives are increasingly expressing concerns about a rate hike ahead of their December 19 meeting (Nakamura), traditionally citing a "broader range of data."

Given the Bank of Japan's caution about sudden market changes and its intention to provide prior notice to investors regarding its actions, the rate may remain unchanged at this meeting. If the price consolidates above the 150.83 level, further growth to 153.60 becomes likely, with the pair potentially reaching this level before the Federal Reserve meeting on December 18.

On the 4-hour chart, growth has only begun following a double divergence with the Marlin oscillator when the price approached the target range of 148.18/50. The initial impulse has been achieved, but the price needs to consolidate above the MACD line at the 151.24 mark, corresponding to yesterday's high.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4geWcGh

Bank of Japan representatives are increasingly expressing concerns about a rate hike ahead of their December 19 meeting (Nakamura), traditionally citing a "broader range of data."

Given the Bank of Japan's caution about sudden market changes and its intention to provide prior notice to investors regarding its actions, the rate may remain unchanged at this meeting. If the price consolidates above the 150.83 level, further growth to 153.60 becomes likely, with the pair potentially reaching this level before the Federal Reserve meeting on December 18.

On the 4-hour chart, growth has only begun following a double divergence with the Marlin oscillator when the price approached the target range of 148.18/50. The initial impulse has been achieved, but the price needs to consolidate above the MACD line at the 151.24 mark, corresponding to yesterday's high.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4geWcGh

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Forecast for EUR/USD on December 6, 2024

On Thursday, the euro gained 77 pips, driven by U.S. data from Challenger showing a rise in job cuts from 55,597 in October to 57,727 in November. Adding to the pessimism, initial jobless claims released an hour later rose to 224k from 215k the previous week. What does this fundamental-technical pattern suggest? Major players may be preparing to buy the euro, even in response to neutral U.S. labor data released today. Today's forecasts offer room for interpretation. November nonfarm Payrolls (NFP) are expected to show an increase of 202k, but unemployment is also projected to rise from 4.1% to 4.2%. Even minor deviations could be framed as "weak."

The technical outlook suggests the price aims to break above the 1.0598 resistance level, supported by the leading Marlin oscillator, which holds firmly in bullish territory. The first target for growth is the resistance at 1.0667, where the price will face the balance line. Success here could allow the euro to continue its ascent into the 1.0762/77 target range, a support zone from October 23–29. (Target levels have been slightly adjusted since the last review).

A bearish scenario would materialize only if the price falls below 1.0461, negating the bullish plan. The price consolidates between the balance line and the 1.0598 target level. The Marlin oscillator is extending its growth in positive territory. The next move will largely depend on today's U.S. labor market data.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4gh9RvK

On Thursday, the euro gained 77 pips, driven by U.S. data from Challenger showing a rise in job cuts from 55,597 in October to 57,727 in November. Adding to the pessimism, initial jobless claims released an hour later rose to 224k from 215k the previous week. What does this fundamental-technical pattern suggest? Major players may be preparing to buy the euro, even in response to neutral U.S. labor data released today. Today's forecasts offer room for interpretation. November nonfarm Payrolls (NFP) are expected to show an increase of 202k, but unemployment is also projected to rise from 4.1% to 4.2%. Even minor deviations could be framed as "weak."

The technical outlook suggests the price aims to break above the 1.0598 resistance level, supported by the leading Marlin oscillator, which holds firmly in bullish territory. The first target for growth is the resistance at 1.0667, where the price will face the balance line. Success here could allow the euro to continue its ascent into the 1.0762/77 target range, a support zone from October 23–29. (Target levels have been slightly adjusted since the last review).

A bearish scenario would materialize only if the price falls below 1.0461, negating the bullish plan. The price consolidates between the balance line and the 1.0598 target level. The Marlin oscillator is extending its growth in positive territory. The next move will largely depend on today's U.S. labor market data.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4gh9RvK

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Forecast for EUR/USD on December 9, 2024

Friday's U.S. employment data delivered mixed results, leading to dollar weakness. This weakness aligned with gains in the stock market (as previously anticipated). However, by the end of the day, investors decided to lock in short-term profits due to increased uncertainty surrounding the upcoming meetings of the Federal Reserve and the European Central Bank. Mary Daly, President of the San Francisco Fed, unexpectedly stated that if inflation does not continue to decline, the Fed might raise rates. We interpret this as a signal of a potential rate hold on December 18 or a 0.25% rate cut accompanied by a pause announcement for January and March. Either outcome could favor the dollar. Market sentiment regarding the ECB's monetary policy remains more pessimistic. Europe faces challenges like a potential trade war with Trump, deepening economic contraction, and internal political issues, including debt crises in Italy, Spain, and Greece. Consequently, even if the ECB cuts rates on December 12, the market response may be muted.

The euro remains within a range of uncertainty between 1.0461 and 1.0598. The upper boundary could extend to 1.0667, as the price needs to break above the daily balance line, which is capping upward movement. The Marlin Oscillator has established itself in the growth zone. However, given Friday's profit-taking, the market may need time to accumulate positions before breaking above the 1.0598 resistance. Moving above this level would pave the way toward 1.0667 and reach the strategic target of 1.0762–1.0777. Despite significant resistance at 1.0598, the euro retains its upward potential. A bearish shift would require a breakdown below the 1.0461 support level.

On the H4 chart, the Marlin Oscillator's signal line has reached zero-line support, suggesting a potential minor reversal and subsequent sideways movement under the 1.0598 resistance. If the price attempts to breach 1.0461, the MACD at 1.0505 will get in its way, potentially leading to a false breakout. In conclusion, the euro continues to drift freely within the 1.0461–1.0598 range, awaiting a decisive move.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/49rIq0i

Friday's U.S. employment data delivered mixed results, leading to dollar weakness. This weakness aligned with gains in the stock market (as previously anticipated). However, by the end of the day, investors decided to lock in short-term profits due to increased uncertainty surrounding the upcoming meetings of the Federal Reserve and the European Central Bank. Mary Daly, President of the San Francisco Fed, unexpectedly stated that if inflation does not continue to decline, the Fed might raise rates. We interpret this as a signal of a potential rate hold on December 18 or a 0.25% rate cut accompanied by a pause announcement for January and March. Either outcome could favor the dollar. Market sentiment regarding the ECB's monetary policy remains more pessimistic. Europe faces challenges like a potential trade war with Trump, deepening economic contraction, and internal political issues, including debt crises in Italy, Spain, and Greece. Consequently, even if the ECB cuts rates on December 12, the market response may be muted.

The euro remains within a range of uncertainty between 1.0461 and 1.0598. The upper boundary could extend to 1.0667, as the price needs to break above the daily balance line, which is capping upward movement. The Marlin Oscillator has established itself in the growth zone. However, given Friday's profit-taking, the market may need time to accumulate positions before breaking above the 1.0598 resistance. Moving above this level would pave the way toward 1.0667 and reach the strategic target of 1.0762–1.0777. Despite significant resistance at 1.0598, the euro retains its upward potential. A bearish shift would require a breakdown below the 1.0461 support level.

On the H4 chart, the Marlin Oscillator's signal line has reached zero-line support, suggesting a potential minor reversal and subsequent sideways movement under the 1.0598 resistance. If the price attempts to breach 1.0461, the MACD at 1.0505 will get in its way, potentially leading to a false breakout. In conclusion, the euro continues to drift freely within the 1.0461–1.0598 range, awaiting a decisive move.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/49rIq0i

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Bitcoin Above $100K Again, Nasdaq Rises: Positive Signals in the Market

Market Optimism The Nasdaq and S&P 500 hit new all-time highs on Friday, fueled by upbeat forecasts from companies like Lululemon Athletica. An additional driver was the U.S. employment report, which increased expectations that the Federal Reserve will decide to cut interest rates as early as this month. However, the Dow declined, helped by a 5.1% drop in UnitedHealth Group (UNH.N). Consumer Staples Sectors Are Strong Among the S&P 500 (.SPLRCD) sectors, the consumer staples tier was the best performer, gaining 2.4% to reach an all-time high, led by Lululemon. Lululemon Athletica and Ulta Beauty Lead the Way Sportswear maker Lululemon Athletica (LULU.O) surged 15.9% after the company raised its full-year revenue forecast. The positive sentiment was also supported by the retail segment, with shares of cosmetics chain Ulta Beauty (ULTA.O) rising 9% after an upward revision to its full-year profit forecast. US Labor Market Situation The US Labor Department report showed a strong job gain in November. However, the unemployment rate rising to 4.2% signals some signs of weakening in the labor market. A Rate Cut Nearer? "These data support the possibility of continued rate cuts at the December Fed meeting and into the first quarter of next year," said Bill Northey, senior investment officer at U.S. Bank Wealth Management. These factors have combined to fuel investor optimism and confidence in the economic recovery. Records Amid Mixed Dynamics The Dow Jones Industrial Average (.DJI) fell 123.19 points, or 0.28%, to 44,642.52 on Friday. Meanwhile, the S&P 500 (.SPX) rose 15.16 points, or 0.25%, to 6,090.27, and the Nasdaq Composite (.IXIC) added 159.05 points, or 0.81%, to 19,859.77. The day marked the 57th all-time closing high for the S&P 500 in 2024 and the 36th all-time high for the Nasdaq Composite in the same period. Nasdaq has had a great week On a weekly basis, the Nasdaq is up 3.3%, the S&P 500 is up about 1%, and the Dow is down 0.6%. These numbers reflect investor appetite for tech and fast-growing companies as traditional sectors slump.

News are provided by InstaForex

Read more: https://www.instaforex.eu/forex_analysis/370527

Market Optimism The Nasdaq and S&P 500 hit new all-time highs on Friday, fueled by upbeat forecasts from companies like Lululemon Athletica. An additional driver was the U.S. employment report, which increased expectations that the Federal Reserve will decide to cut interest rates as early as this month. However, the Dow declined, helped by a 5.1% drop in UnitedHealth Group (UNH.N). Consumer Staples Sectors Are Strong Among the S&P 500 (.SPLRCD) sectors, the consumer staples tier was the best performer, gaining 2.4% to reach an all-time high, led by Lululemon. Lululemon Athletica and Ulta Beauty Lead the Way Sportswear maker Lululemon Athletica (LULU.O) surged 15.9% after the company raised its full-year revenue forecast. The positive sentiment was also supported by the retail segment, with shares of cosmetics chain Ulta Beauty (ULTA.O) rising 9% after an upward revision to its full-year profit forecast. US Labor Market Situation The US Labor Department report showed a strong job gain in November. However, the unemployment rate rising to 4.2% signals some signs of weakening in the labor market. A Rate Cut Nearer? "These data support the possibility of continued rate cuts at the December Fed meeting and into the first quarter of next year," said Bill Northey, senior investment officer at U.S. Bank Wealth Management. These factors have combined to fuel investor optimism and confidence in the economic recovery. Records Amid Mixed Dynamics The Dow Jones Industrial Average (.DJI) fell 123.19 points, or 0.28%, to 44,642.52 on Friday. Meanwhile, the S&P 500 (.SPX) rose 15.16 points, or 0.25%, to 6,090.27, and the Nasdaq Composite (.IXIC) added 159.05 points, or 0.81%, to 19,859.77. The day marked the 57th all-time closing high for the S&P 500 in 2024 and the 36th all-time high for the Nasdaq Composite in the same period. Nasdaq has had a great week On a weekly basis, the Nasdaq is up 3.3%, the S&P 500 is up about 1%, and the Dow is down 0.6%. These numbers reflect investor appetite for tech and fast-growing companies as traditional sectors slump.

News are provided by InstaForex

Read more: https://www.instaforex.eu/forex_analysis/370527

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am