Forex Analysis & Reviews: Tesla Benefits as Giants Slip, Shares Rise 12% After Quarterly Results

Wall Street Closes in the Red: Bond Yields Pressure Stocks On Wednesday, trading on Wall Street ended with a decline in the indices, amid rising Treasury bond yields, which negatively affected large-cap companies. Investors lost confidence in a rapid rate cut by the Federal Reserve, while corporate news added tension, hitting McDonald's and Coca-Cola stock prices. Bond Pressure and Fed Doubts The yield on 10-year U.S. Treasury bonds reached its highest point in three months. Investors are reconsidering their expectations for future Fed decisions, given steady economic indicators and the upcoming presidential elections. "The market is struggling to digest this latest rise in yields," noted Adam Turnquist, chief technical analyst at LPL Financial, emphasizing that higher rates are putting additional pressure on stocks. Mega Caps Under Fire Shares of large-cap companies sensitive to interest rate changes were in decline: Nvidia dropped 2.81%, Apple lost 2.16%, Meta Platforms (an organization banned in Russia) fell by 3.15%, and Amazon saw a decrease of 2.63%. These tech giants dragged down the tech-heavy Nasdaq index. Market Leaders and Laggards Among the 11 sectors in the S&P 500 index, only utilities and real estate showed positive momentum. All other sectors finished the day in negative territory.

News are provided by InstaForex.

Read more: https://ifxpr.com/3YEBGsg

Instaforex Analysis

Re: Instaforex Analysis

Forex Analysis & Reviews: Hot Forecast for EUR/USD on October 25, 2024

The excessive overbought condition of the dollar has indeed impacted the market, as the single European currency managed to show some growth despite the preliminary estimates of business activity indexes. The composite business activity index in the Eurozone rose from 49.6 to 49.7 points, although the forecast was for 50.1 points. This outcome was due to the services activity index, which fell from 51.4 to 51.2 points, whereas an increase to 51.7 points was expected. However, some support came from the manufacturing activity index, which increased from 45.0 to 45.9 points, exceeding the anticipated rise to 45.2 points. More notable is that the single currency demonstrated slight but consistent growth, even in the face of similar data from the United States, which exceeded forecasts. Specifically, the manufacturing activity index in the U.S. rose from 47.3 to 47.8 points instead of the expected increase of 47.6 points. The services activity index, expected to decline from 55.2 to 55.0 points, actually grew to 55.3 points. As a result, the composite activity index climbed from 54.0 to 54.3 points despite predictions that it would remain unchanged. Thus, market behavior indicates that the potential for dollar growth is exhausted, at least for now. The dollar's overbought condition has remained, so expecting a sustained rise in the euro seems reasonable.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3Un9Uho

The excessive overbought condition of the dollar has indeed impacted the market, as the single European currency managed to show some growth despite the preliminary estimates of business activity indexes. The composite business activity index in the Eurozone rose from 49.6 to 49.7 points, although the forecast was for 50.1 points. This outcome was due to the services activity index, which fell from 51.4 to 51.2 points, whereas an increase to 51.7 points was expected. However, some support came from the manufacturing activity index, which increased from 45.0 to 45.9 points, exceeding the anticipated rise to 45.2 points. More notable is that the single currency demonstrated slight but consistent growth, even in the face of similar data from the United States, which exceeded forecasts. Specifically, the manufacturing activity index in the U.S. rose from 47.3 to 47.8 points instead of the expected increase of 47.6 points. The services activity index, expected to decline from 55.2 to 55.0 points, actually grew to 55.3 points. As a result, the composite activity index climbed from 54.0 to 54.3 points despite predictions that it would remain unchanged. Thus, market behavior indicates that the potential for dollar growth is exhausted, at least for now. The dollar's overbought condition has remained, so expecting a sustained rise in the euro seems reasonable.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3Un9Uho

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

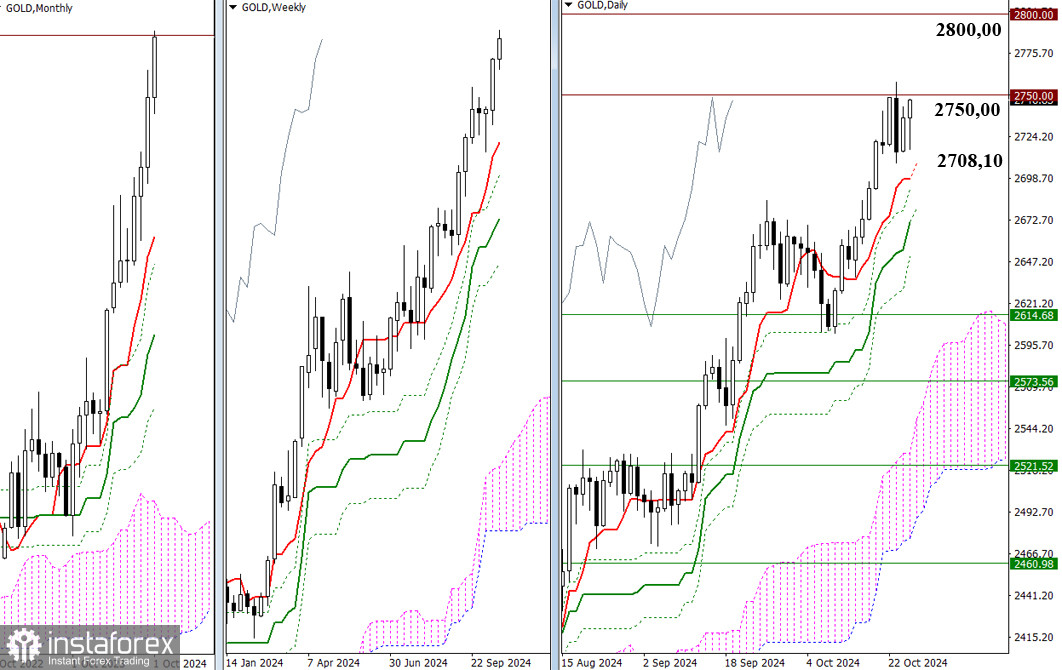

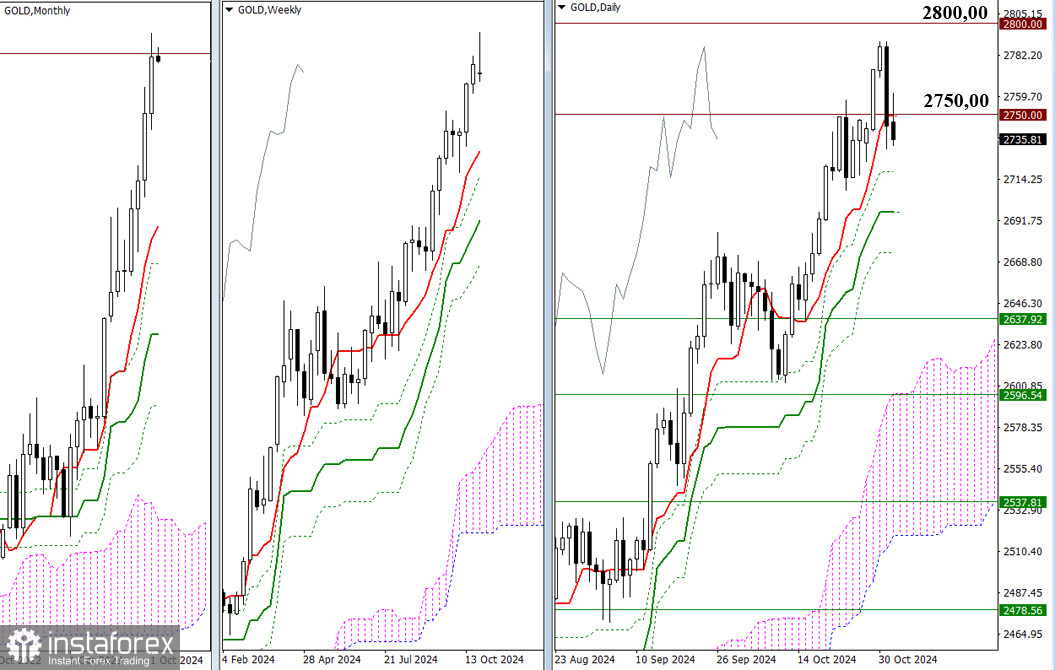

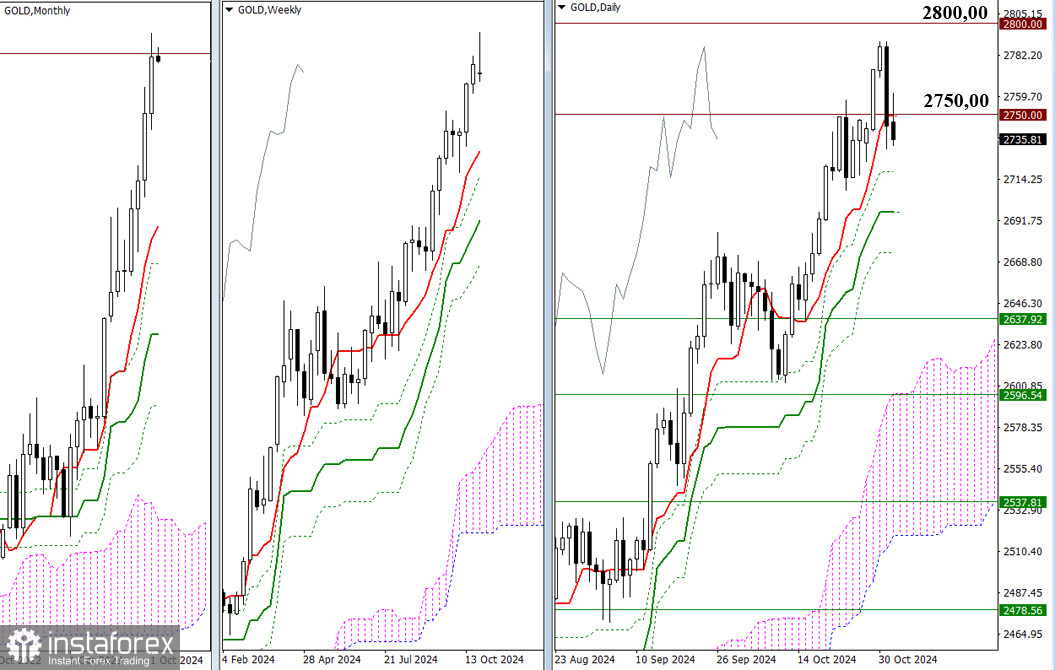

Forex Analysis & Reviews: GOLD – Technical Analysis

Last week, gold rose to challenge the psychological level of 2750.00. After stalling at this resistance, it continued to test this level throughout the week, setting a new all-time high at 2757.96. If the upward momentum continues, gold could reach new heights. All target levels indicated by the Ichimoku indicator have already been achieved, so the focus can now shift to psychological "round" levels, which historically have proven significant. The following levels are 2800.00, 2850.00, 2900.00, and so on. In a downward correction, the daily Ichimoku cross will receive initial support. On Monday, these support levels are at 2708.10 (Tenkan) and 2680.45 (Kijun). If bearish players actively push lower and quickly break the daily golden cross, their attention will likely shift to weekly Ichimoku support levels. The nearest level from the weekly cross is the short-term trend at 2614.68. If the downward correction is prolonged, the weekly levels will rise closer to the daily cross, providing additional support for bullish interests.

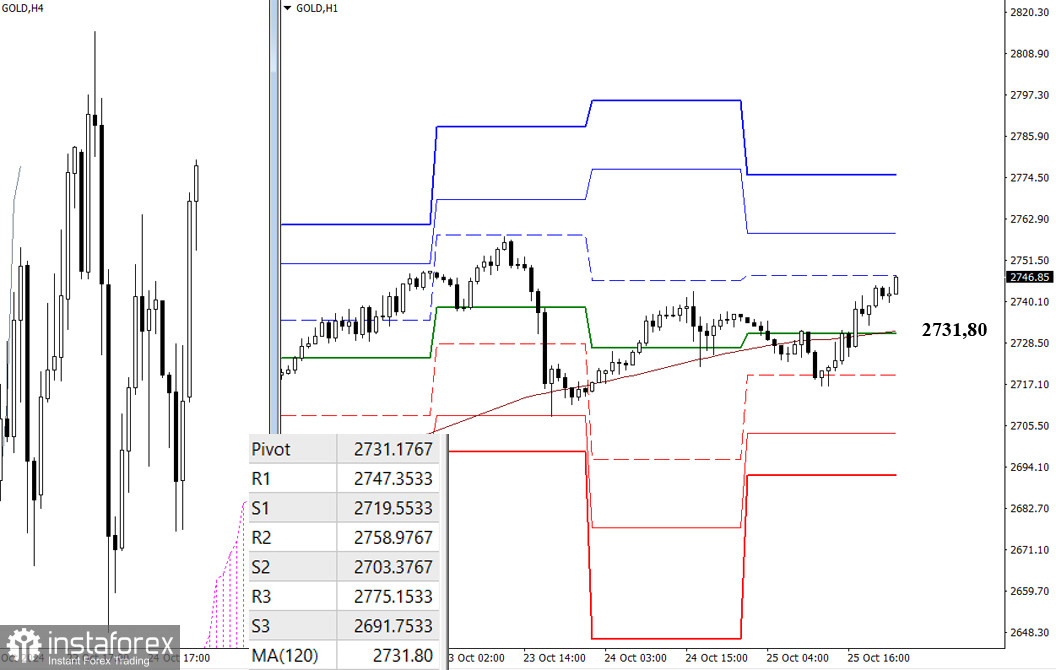

H4 – H1 In lower time frames, the uncertainty seen in higher time frames has led to a lack of clear, decisive movement. However, the advantage still leans towards bullish players. Currently, gold is trading above the weekly long-term trend at 2731.80. Any further rise will need to overcome the resistance of the classic Pivot Points, which provide good intraday guidance. Losing support from the weekly long-term trend at 2731.80 would shift the balance of power, drawing market attention to bearish targets at the support levels of the classic Pivot Points. It's essential to note that the values of these Pivot Points will update upon market opening.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3YkP5nH

Last week, gold rose to challenge the psychological level of 2750.00. After stalling at this resistance, it continued to test this level throughout the week, setting a new all-time high at 2757.96. If the upward momentum continues, gold could reach new heights. All target levels indicated by the Ichimoku indicator have already been achieved, so the focus can now shift to psychological "round" levels, which historically have proven significant. The following levels are 2800.00, 2850.00, 2900.00, and so on. In a downward correction, the daily Ichimoku cross will receive initial support. On Monday, these support levels are at 2708.10 (Tenkan) and 2680.45 (Kijun). If bearish players actively push lower and quickly break the daily golden cross, their attention will likely shift to weekly Ichimoku support levels. The nearest level from the weekly cross is the short-term trend at 2614.68. If the downward correction is prolonged, the weekly levels will rise closer to the daily cross, providing additional support for bullish interests.

H4 – H1 In lower time frames, the uncertainty seen in higher time frames has led to a lack of clear, decisive movement. However, the advantage still leans towards bullish players. Currently, gold is trading above the weekly long-term trend at 2731.80. Any further rise will need to overcome the resistance of the classic Pivot Points, which provide good intraday guidance. Losing support from the weekly long-term trend at 2731.80 would shift the balance of power, drawing market attention to bearish targets at the support levels of the classic Pivot Points. It's essential to note that the values of these Pivot Points will update upon market opening.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3YkP5nH

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Hot Forecast for EUR/USD on 29.10.2024

Recently, the euro has fluctuated upward, often without any specific reason. It's clearly largely oscillating around the 1.08 mark, with movements merely representing minor deviations from this level. Given that this week is sparse on macroeconomic data, this situation will likely continue until Friday. Additionally, with the U.S. presidential elections set for next Tuesday, the uncertainty intensifies, as the outcome remains highly unpredictable and the media portray the two candidates as complete opposites. In other words, the atmosphere is tense, and few are willing to take risks in such a setting. Therefore, this stagnation may well extend into the middle of next week.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3AiCd9F

Recently, the euro has fluctuated upward, often without any specific reason. It's clearly largely oscillating around the 1.08 mark, with movements merely representing minor deviations from this level. Given that this week is sparse on macroeconomic data, this situation will likely continue until Friday. Additionally, with the U.S. presidential elections set for next Tuesday, the uncertainty intensifies, as the outcome remains highly unpredictable and the media portray the two candidates as complete opposites. In other words, the atmosphere is tense, and few are willing to take risks in such a setting. Therefore, this stagnation may well extend into the middle of next week.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3AiCd9F

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Boeing Falls, Russell 2000 Gains: How Wall Street Reacts to Weekly News

Wall Street Up at Start of Busy Earnings Week The U.S. stock market ended the day in the green on Monday amid growing optimism ahead of a flurry of earnings from major corporations and the final push before the November 5 presidential election. Investor confidence was boosted by the fact that energy supplies remain stable despite the escalation in the Middle East, which has not affected critical infrastructure. Israel's Response: Focus on Defense Facilities Israel's response to the Iranian attack earlier this month focused on military plants and strategic sites near Tehran, leaving refineries and nuclear facilities out of the strike zone. That caution has reduced the risk to global oil supplies and provided reassurance to investors worried about the impact of geopolitical tensions on the energy sector. Earnings Week: Markets Await the Magnificent Seven This week's key event will be the release of quarterly earnings reports from 169 companies in the S&P 500, including many of the tech leaders. Investors are particularly focused on the so-called "Magnificent Seven" — the tech giants that have driven the market to record highs. Alphabet, Meta, and Apple are set to report results in the coming days, fueling speculation about further gains. The major indexes gained steadily on Monday, with the S&P 500 up 15.4 points (+0.27%) to 5,823.52; the Nasdaq Composite up 48.58 points (+0.26%) to 18,567.19; and the Dow Jones up 273.17 points (+0.65%) to close at 42,387.57. Nvidia Overtakes Apple, AI Remains in Focus Last week was a big one, with Nvidia overtaking Apple in market value to become the world's most valuable company. Investors are now eagerly awaiting data on AI spending, which could play a key role in the tech sector's performance given the huge expectations for AI in the coming years. Corporate Earnings: A Look Ahead "Earnings reports will be key to understanding what capital expenditures companies can afford to make next year," said Paul Christopher, head of global investment strategy at Wells Fargo Investment Institute. Corporate executives will be disclosing their plans for the future, which will be an important guide for investors. Microsoft and Amazon, in particular, will be in the spotlight this week when they report results.

News are provided by InstaForex.

Read more: https://ifxpr.com/4edPfU4

Wall Street Up at Start of Busy Earnings Week The U.S. stock market ended the day in the green on Monday amid growing optimism ahead of a flurry of earnings from major corporations and the final push before the November 5 presidential election. Investor confidence was boosted by the fact that energy supplies remain stable despite the escalation in the Middle East, which has not affected critical infrastructure. Israel's Response: Focus on Defense Facilities Israel's response to the Iranian attack earlier this month focused on military plants and strategic sites near Tehran, leaving refineries and nuclear facilities out of the strike zone. That caution has reduced the risk to global oil supplies and provided reassurance to investors worried about the impact of geopolitical tensions on the energy sector. Earnings Week: Markets Await the Magnificent Seven This week's key event will be the release of quarterly earnings reports from 169 companies in the S&P 500, including many of the tech leaders. Investors are particularly focused on the so-called "Magnificent Seven" — the tech giants that have driven the market to record highs. Alphabet, Meta, and Apple are set to report results in the coming days, fueling speculation about further gains. The major indexes gained steadily on Monday, with the S&P 500 up 15.4 points (+0.27%) to 5,823.52; the Nasdaq Composite up 48.58 points (+0.26%) to 18,567.19; and the Dow Jones up 273.17 points (+0.65%) to close at 42,387.57. Nvidia Overtakes Apple, AI Remains in Focus Last week was a big one, with Nvidia overtaking Apple in market value to become the world's most valuable company. Investors are now eagerly awaiting data on AI spending, which could play a key role in the tech sector's performance given the huge expectations for AI in the coming years. Corporate Earnings: A Look Ahead "Earnings reports will be key to understanding what capital expenditures companies can afford to make next year," said Paul Christopher, head of global investment strategy at Wells Fargo Investment Institute. Corporate executives will be disclosing their plans for the future, which will be an important guide for investors. Microsoft and Amazon, in particular, will be in the spotlight this week when they report results.

News are provided by InstaForex.

Read more: https://ifxpr.com/4edPfU4

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Hot Forecast for EUR/USD on 30.10.2024

The euro has been treading water for an entire week. However, today, it might be able to strengthen its position against the dollar and potentially reduce its current oversold state. This potential boost could come from the preliminary Eurozone GDP data for Q3, precisely the initial estimate, which tends to have the most impact. According to forecasts, Eurozone economic growth is expected to accelerate from 0.6% to 1.0%. This is a fairly positive outcome, given the significant concerns about the prospects of the European economy. As a result, the euro could gain a considerable boost in optimism and strengthen its position noticeably. Moreover, according to forecasts, similar data from the United States is expected to show stable growth rates. Although growth rates in Europe are lower, the mere improvement in dynamics is a positive factor.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4fm213E

The euro has been treading water for an entire week. However, today, it might be able to strengthen its position against the dollar and potentially reduce its current oversold state. This potential boost could come from the preliminary Eurozone GDP data for Q3, precisely the initial estimate, which tends to have the most impact. According to forecasts, Eurozone economic growth is expected to accelerate from 0.6% to 1.0%. This is a fairly positive outcome, given the significant concerns about the prospects of the European economy. As a result, the euro could gain a considerable boost in optimism and strengthen its position noticeably. Moreover, according to forecasts, similar data from the United States is expected to show stable growth rates. Although growth rates in Europe are lower, the mere improvement in dynamics is a positive factor.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4fm213E

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Alphabet Soars as Nasdaq Hits New High: How Tech Giant Breathed Life into Market

Tech Boom and Big Expectations The Nasdaq stock index hit a new record close on Tuesday, while the S&P 500 showed positive dynamics. However, the Dow remained in the red, while investors kept a close eye on financial reports. The main event of the evening was the results of Google's parent company, Alphabet (GOOGL.O), which were released after the end of the trading day. Alphabet, one of the so-called "Magnificent Seven" tech giants, reported earnings that beat market expectations, adding to investor confidence. Earnings Week: Focus on the Magnificent Seven This week has been one of the busiest this quarter for the S&P 500, with five of the "Magnificent Seven" reporting their quarterly results. The reports could help determine whether Wall Street continues to embrace the tech and AI bullishness that has driven stock indexes to new highs this year. Yield Distortion: Focus on the Magnificent "One of the key things the market is thinking about right now is whether there's a potential plateau in earnings growth between the Magnificent Seven, which are heavily weighted in the market, and the rest of the pack," explains Bill Mertz, head of capital markets research at U.S. Asset Management. Bank. Market Summary: Facts and Figures The Nasdaq Composite (.IXIC) rose 145.56 points, or 0.78%, to close at 18,712.75, surpassing its previous record close in July. The S&P 500 (.SPX) added 9.45 points, or 0.16%, to close at 5,832.97. Meanwhile, the Dow Jones Industrial Average (.DJI) fell 154.52 points, or 0.36%, to close at 42,233.05.

News are provided by InstaForex.

Read more: https://ifxpr.com/3YJrBKz

Tech Boom and Big Expectations The Nasdaq stock index hit a new record close on Tuesday, while the S&P 500 showed positive dynamics. However, the Dow remained in the red, while investors kept a close eye on financial reports. The main event of the evening was the results of Google's parent company, Alphabet (GOOGL.O), which were released after the end of the trading day. Alphabet, one of the so-called "Magnificent Seven" tech giants, reported earnings that beat market expectations, adding to investor confidence. Earnings Week: Focus on the Magnificent Seven This week has been one of the busiest this quarter for the S&P 500, with five of the "Magnificent Seven" reporting their quarterly results. The reports could help determine whether Wall Street continues to embrace the tech and AI bullishness that has driven stock indexes to new highs this year. Yield Distortion: Focus on the Magnificent "One of the key things the market is thinking about right now is whether there's a potential plateau in earnings growth between the Magnificent Seven, which are heavily weighted in the market, and the rest of the pack," explains Bill Mertz, head of capital markets research at U.S. Asset Management. Bank. Market Summary: Facts and Figures The Nasdaq Composite (.IXIC) rose 145.56 points, or 0.78%, to close at 18,712.75, surpassing its previous record close in July. The S&P 500 (.SPX) added 9.45 points, or 0.16%, to close at 5,832.97. Meanwhile, the Dow Jones Industrial Average (.DJI) fell 154.52 points, or 0.36%, to close at 42,233.05.

News are provided by InstaForex.

Read more: https://ifxpr.com/3YJrBKz

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: EUR/USD and GBP/USD Technical Analysis for October 31

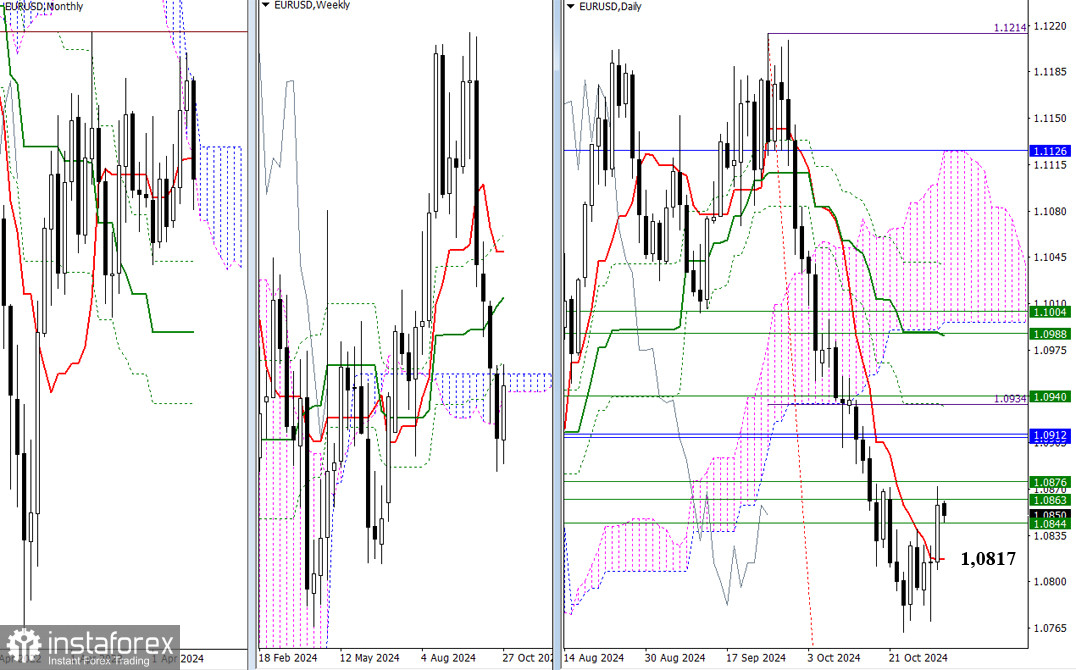

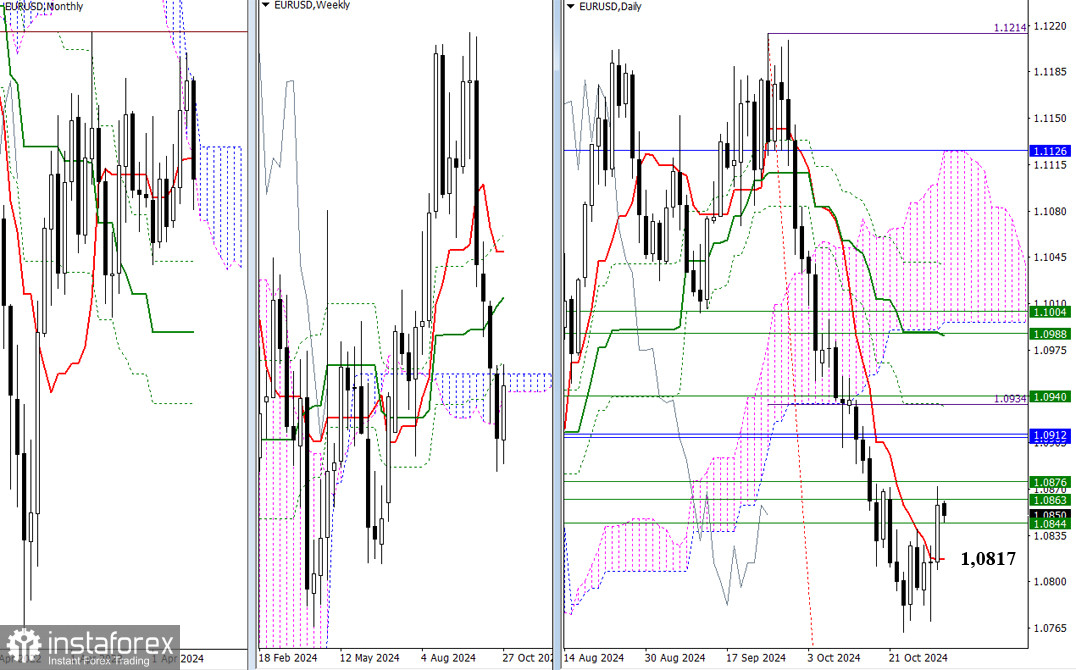

EUR/USD

Higher Time Frames Yesterday, the bulls climbed above the daily short-term trend (1.0817) but couldn't break through the weekly resistances (1.0844 – 1.0863 – 1.0876) on the first attempt, leaving this task still relevant. Today marks the end of the month. October has been dominated by bearish sentiment, and the focus now is on the length of the lower shadow of the monthly candle and whether the bears can close the month as optimistically as possible.

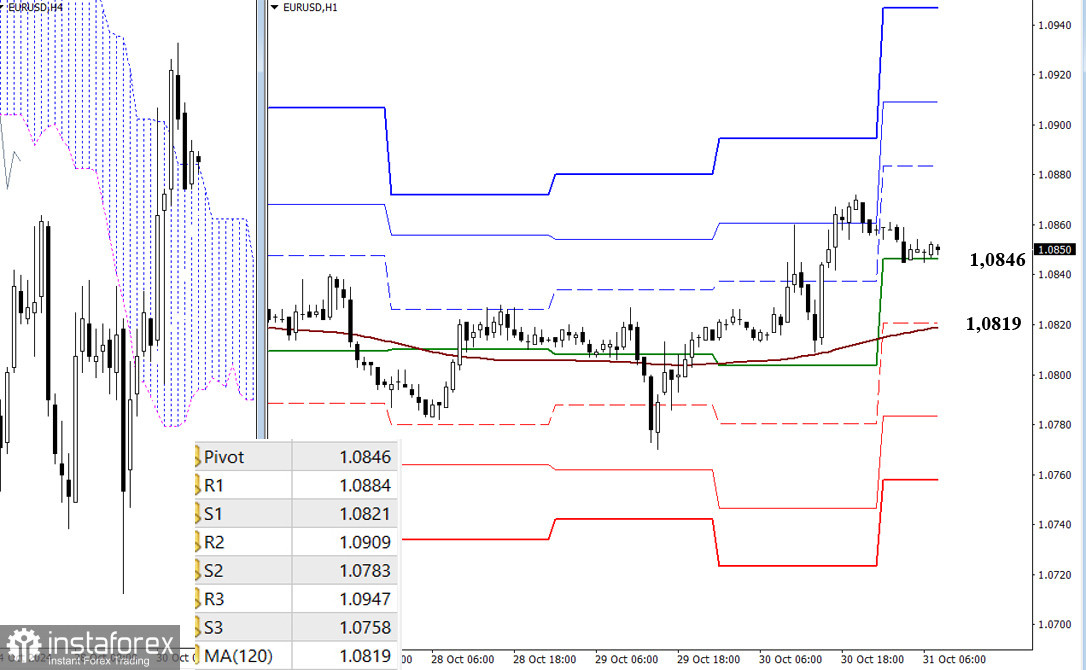

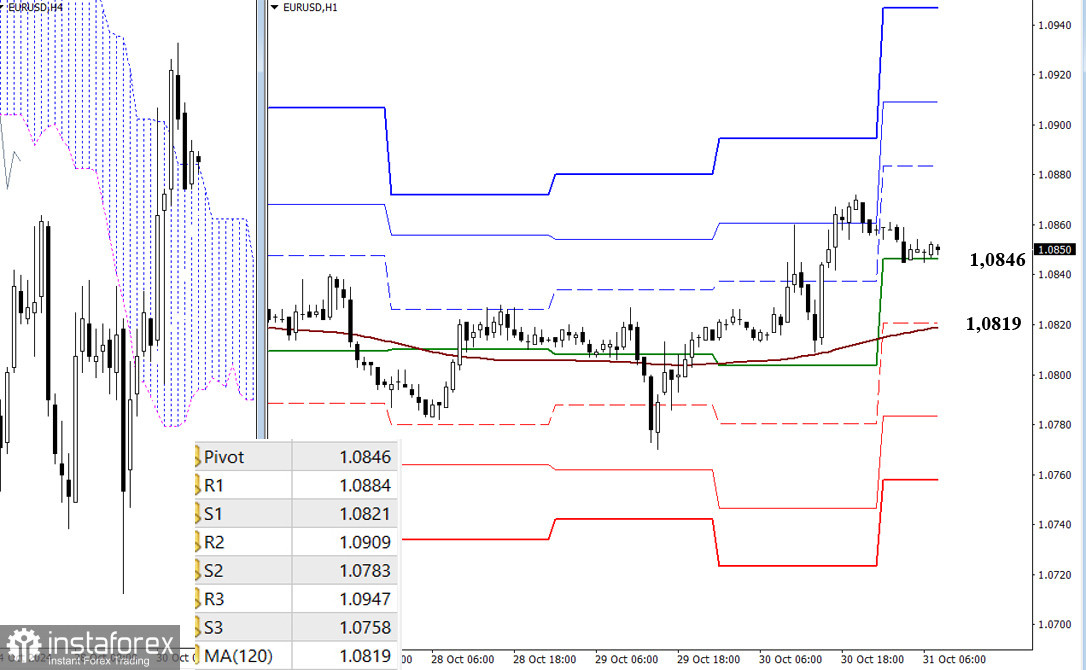

H4 – H1 In the lower time frames, the bulls currently hold the advantage. They may soon leave the H4 cloud and form an upward target for breaking through it. As a result, additional targets in the form of classic Pivot levels (1.0884 – 1.0909 – 1.0947) will be added to the H4 targets during the day. If the bears gain control, the most crucial target for corrective decline would be the weekly long-term trend (1.0819). A breakthrough and reversal of this trend could shift the current balance of power. The following downside targets during the day will be the support levels of classic Pivots levels (1.0783 – 1.0758). GBP/USD

H4 – H1 On the lower time frames, the market has recently been hovering around the key levels of 1.2980 – 1.2975 (central Pivot point of the day + weekly long-term trend), which are currently horizontal, supporting uncertainty. Breaking out of this zone and strengthening the direction of either side will lead to a decisive movement. For the bulls, targets would be the classic Pivot resistance levels (1.3023 – 1.3086 – 1.3129), while for the bears, they would be the support levels (1.2917 – 1.2874 – 1.2811).

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3C2Nj3k

EUR/USD

Higher Time Frames Yesterday, the bulls climbed above the daily short-term trend (1.0817) but couldn't break through the weekly resistances (1.0844 – 1.0863 – 1.0876) on the first attempt, leaving this task still relevant. Today marks the end of the month. October has been dominated by bearish sentiment, and the focus now is on the length of the lower shadow of the monthly candle and whether the bears can close the month as optimistically as possible.

H4 – H1 In the lower time frames, the bulls currently hold the advantage. They may soon leave the H4 cloud and form an upward target for breaking through it. As a result, additional targets in the form of classic Pivot levels (1.0884 – 1.0909 – 1.0947) will be added to the H4 targets during the day. If the bears gain control, the most crucial target for corrective decline would be the weekly long-term trend (1.0819). A breakthrough and reversal of this trend could shift the current balance of power. The following downside targets during the day will be the support levels of classic Pivots levels (1.0783 – 1.0758). GBP/USD

H4 – H1 On the lower time frames, the market has recently been hovering around the key levels of 1.2980 – 1.2975 (central Pivot point of the day + weekly long-term trend), which are currently horizontal, supporting uncertainty. Breaking out of this zone and strengthening the direction of either side will lead to a decisive movement. For the bulls, targets would be the classic Pivot resistance levels (1.3023 – 1.3086 – 1.3129), while for the bears, they would be the support levels (1.2917 – 1.2874 – 1.2811).

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3C2Nj3k

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: AI Breaks and Breaks: Amazon Spends, Microsoft Gains, Nasdaq Slips

U.S. Indexes Close Lower: 'Chip' Fever and Earnings Expectations The American stock market ended Wednesday with a decline, as chipmakers slipped and investors paused, awaiting corporate earnings. Microsoft: Beating the Estimates After the market closed, Microsoft and Meta Platforms (banned in Russia) reported earnings that exceeded revenue forecasts. These positive results drew attention to upcoming reports from other tech giants, reinforcing confidence in the "heavyweights" of the tech market. Alphabet: 'Magnificent Seven' Reports Offer a Bright Spot Among the largest players in the top "Magnificent Seven," Alphabet also showed impressive results. Its 2.8% growth on Tuesday after beating third-quarter revenue and earnings expectations gave the market a small boost, helping to offset the negative impact from the decline in chipmaker stocks. Chipmakers Under Pressure: AMD and Qorvo Slump Shares of Advanced Micro Devices (AMD) and Qorvo faced significant pressure. Grim forecasts triggered drops of 10.6% and 27.3% in their stock prices, respectively. Heavy Losses for Super Micro and Nvidia Super Micro Computer dropped 32.6% after Ernst & Young stepped down as the company's auditor. Nvidia also ended in the red, with a 1.4% drop. Tech Sector Hit Hard The information technology sector saw the biggest drop among S&P 500 sectors, down 1.34%, while the communication services sector showed slight growth due to Alphabet's success. Market Optimism Fades According to Michael James, managing director of equity trading at Wedbush Securities, the volatility in Qorvo, Advanced Micro, and Super Micro stocks is raising questions and "dulling the rosy picture" set by Alphabet's impressive report.

News are provided by InstaForex.

Read more: https://ifxpr.com/4fqrusy

U.S. Indexes Close Lower: 'Chip' Fever and Earnings Expectations The American stock market ended Wednesday with a decline, as chipmakers slipped and investors paused, awaiting corporate earnings. Microsoft: Beating the Estimates After the market closed, Microsoft and Meta Platforms (banned in Russia) reported earnings that exceeded revenue forecasts. These positive results drew attention to upcoming reports from other tech giants, reinforcing confidence in the "heavyweights" of the tech market. Alphabet: 'Magnificent Seven' Reports Offer a Bright Spot Among the largest players in the top "Magnificent Seven," Alphabet also showed impressive results. Its 2.8% growth on Tuesday after beating third-quarter revenue and earnings expectations gave the market a small boost, helping to offset the negative impact from the decline in chipmaker stocks. Chipmakers Under Pressure: AMD and Qorvo Slump Shares of Advanced Micro Devices (AMD) and Qorvo faced significant pressure. Grim forecasts triggered drops of 10.6% and 27.3% in their stock prices, respectively. Heavy Losses for Super Micro and Nvidia Super Micro Computer dropped 32.6% after Ernst & Young stepped down as the company's auditor. Nvidia also ended in the red, with a 1.4% drop. Tech Sector Hit Hard The information technology sector saw the biggest drop among S&P 500 sectors, down 1.34%, while the communication services sector showed slight growth due to Alphabet's success. Market Optimism Fades According to Michael James, managing director of equity trading at Wedbush Securities, the volatility in Qorvo, Advanced Micro, and Super Micro stocks is raising questions and "dulling the rosy picture" set by Alphabet's impressive report.

News are provided by InstaForex.

Read more: https://ifxpr.com/4fqrusy

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

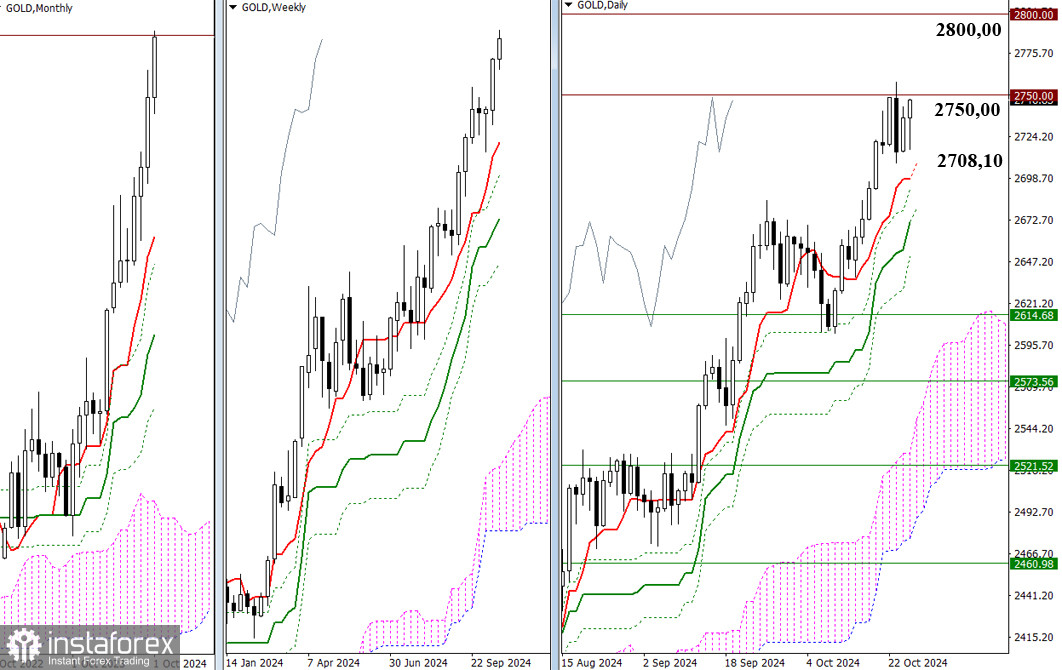

Forex Analysis & Reviews: GOLD – Technical Analysis

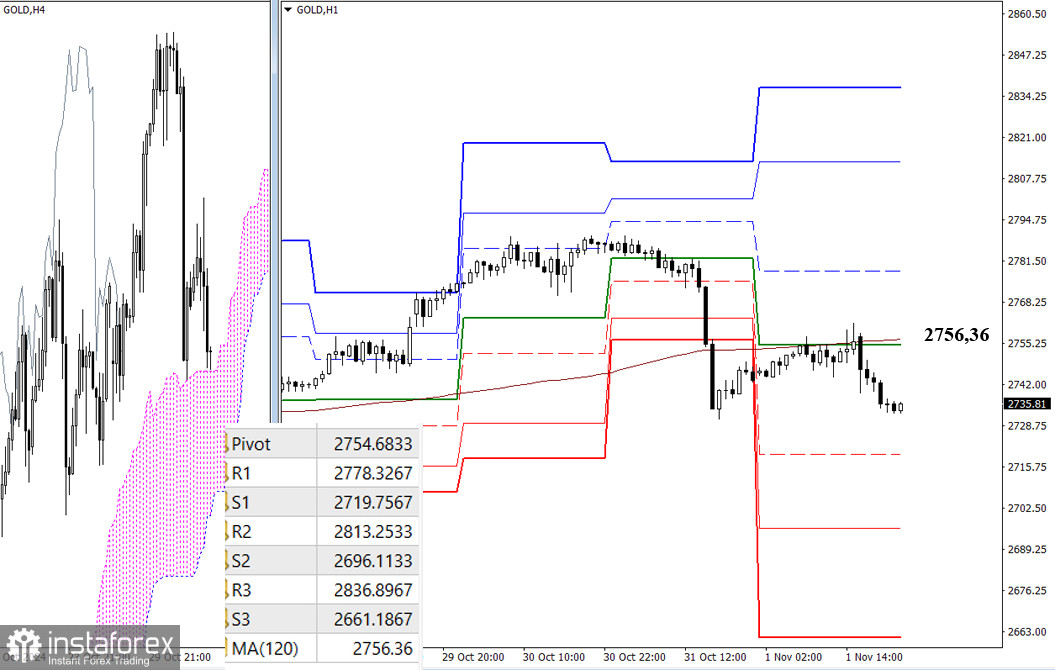

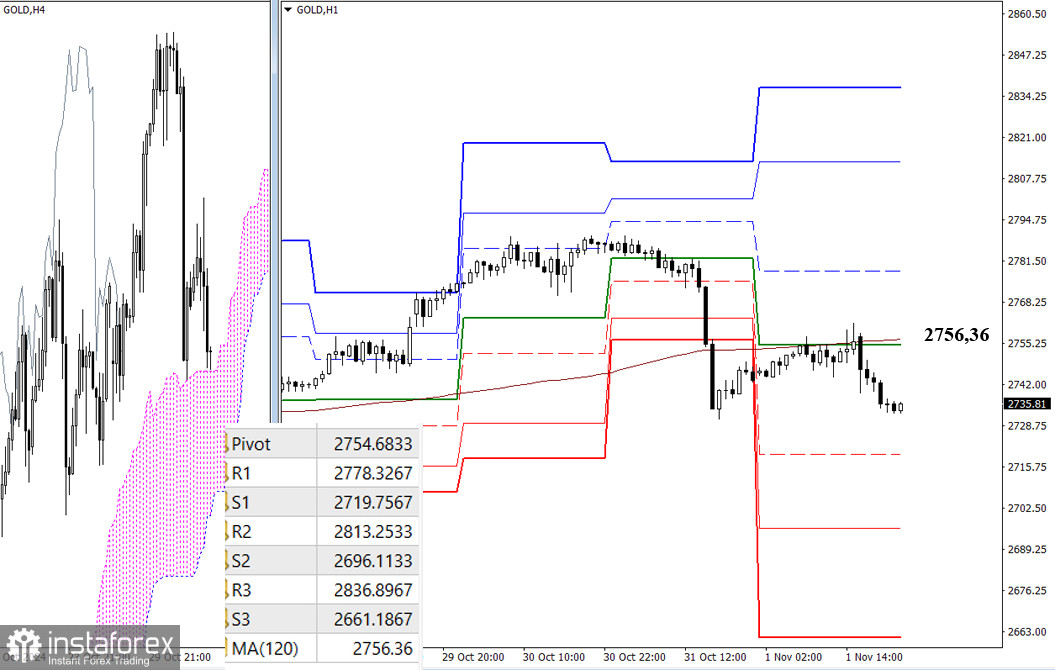

On Friday, the weekly result was marked by an uncertainty candle with an extended upper shadow. It is possible that the bears found a good spot for a corrective decline, as the bulls failed to reach 2800.00 and closed October below the psychological level of 2750.00, which had been actively tested throughout the second half of the month. It should be noted that the bears secured support from the daily short-term trend (2748.92), which is now defending their interests. If a decline develops, the primary task for the bears at this section of the chart will be to test, break, and eliminate the daily golden cross, which currently can be marked at levels 2718.28 – 2696.24 – 2674.21. For the bulls, the nearest prospects maintain their relevance and position. New bullish opportunities may arise only after the 2750.00 level is broken and the resistance zone 2800.00 is tested and overcome.

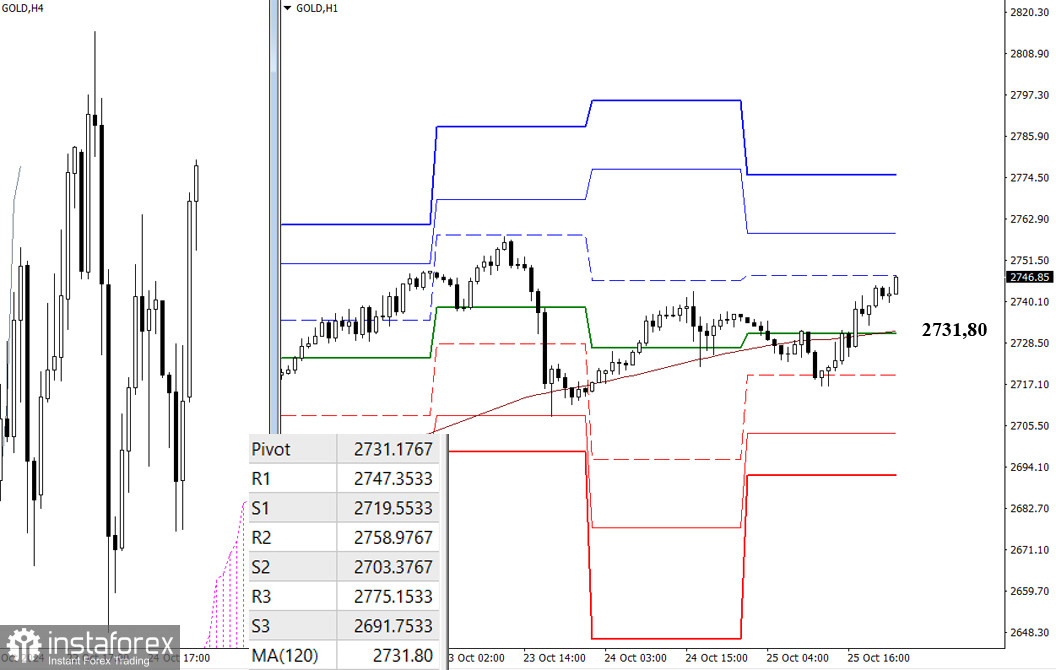

H4 – H1 On the lower time frames, the pair tested the weekly long-term trend (2756.36) from below on Friday, with the bears managing to defend their advantage and remain below the trend. Soon, it will be necessary for the bears to break through the H4 cloud, exit, and secure a position in the bearish zone relative to the cloud. If the cloud break is realized, additional downward targets on the lower timeframes, including the supports of the classic Pivot levels, will be added with the newly formed target for the H4 cloud breakout. If the bulls use the cloud's support and push off from it, simultaneously gaining the weekly long-term trend, then the intraday market focus will shift to the resistances of the classic Pivot levels. On the higher time frames, bulls will again aim to conquer 2750.00 and reach 2800.00. Updated classic Pivot level values for guidance will appear when trading opens at the start of the new workweek.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4huJlAH

On Friday, the weekly result was marked by an uncertainty candle with an extended upper shadow. It is possible that the bears found a good spot for a corrective decline, as the bulls failed to reach 2800.00 and closed October below the psychological level of 2750.00, which had been actively tested throughout the second half of the month. It should be noted that the bears secured support from the daily short-term trend (2748.92), which is now defending their interests. If a decline develops, the primary task for the bears at this section of the chart will be to test, break, and eliminate the daily golden cross, which currently can be marked at levels 2718.28 – 2696.24 – 2674.21. For the bulls, the nearest prospects maintain their relevance and position. New bullish opportunities may arise only after the 2750.00 level is broken and the resistance zone 2800.00 is tested and overcome.

H4 – H1 On the lower time frames, the pair tested the weekly long-term trend (2756.36) from below on Friday, with the bears managing to defend their advantage and remain below the trend. Soon, it will be necessary for the bears to break through the H4 cloud, exit, and secure a position in the bearish zone relative to the cloud. If the cloud break is realized, additional downward targets on the lower timeframes, including the supports of the classic Pivot levels, will be added with the newly formed target for the H4 cloud breakout. If the bulls use the cloud's support and push off from it, simultaneously gaining the weekly long-term trend, then the intraday market focus will shift to the resistances of the classic Pivot levels. On the higher time frames, bulls will again aim to conquer 2750.00 and reach 2800.00. Updated classic Pivot level values for guidance will appear when trading opens at the start of the new workweek.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4huJlAH

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am