Forex Analysis & Reviews: Hot Forecast for EUR/USD on October 2, 2024

The preliminary estimate of euro area inflation showed a slowdown in the growth of consumer prices from 2.2% to 1.8%. Although the data fully matched forecasts, this report marked the beginning of the dollar's strengthening. However, it was primarily driven by U.S. macroeconomic data, particularly the JOLTS report, which showed not only 8.0 million job openings (against a forecast of 7.7 million) but also 3.1 million layoffs, compared to an expected 3.3 million. In other words, the situation in the U.S. labor market is somewhat better than expected. Consequently, the Federal Reserve has no grounds for another 50 basis point rate cut. However, today's ADP report could introduce some adjustments and potentially weaken the dollar. According to forecasts, employment is expected to grow by only 90,000, which is more than twice as low as what is needed to maintain labor market stability at least. Employment data holds much more weight than job openings and layoffs. The dollar may retreat to the levels it held before the release of the preliminary inflation data from the Eurozone.

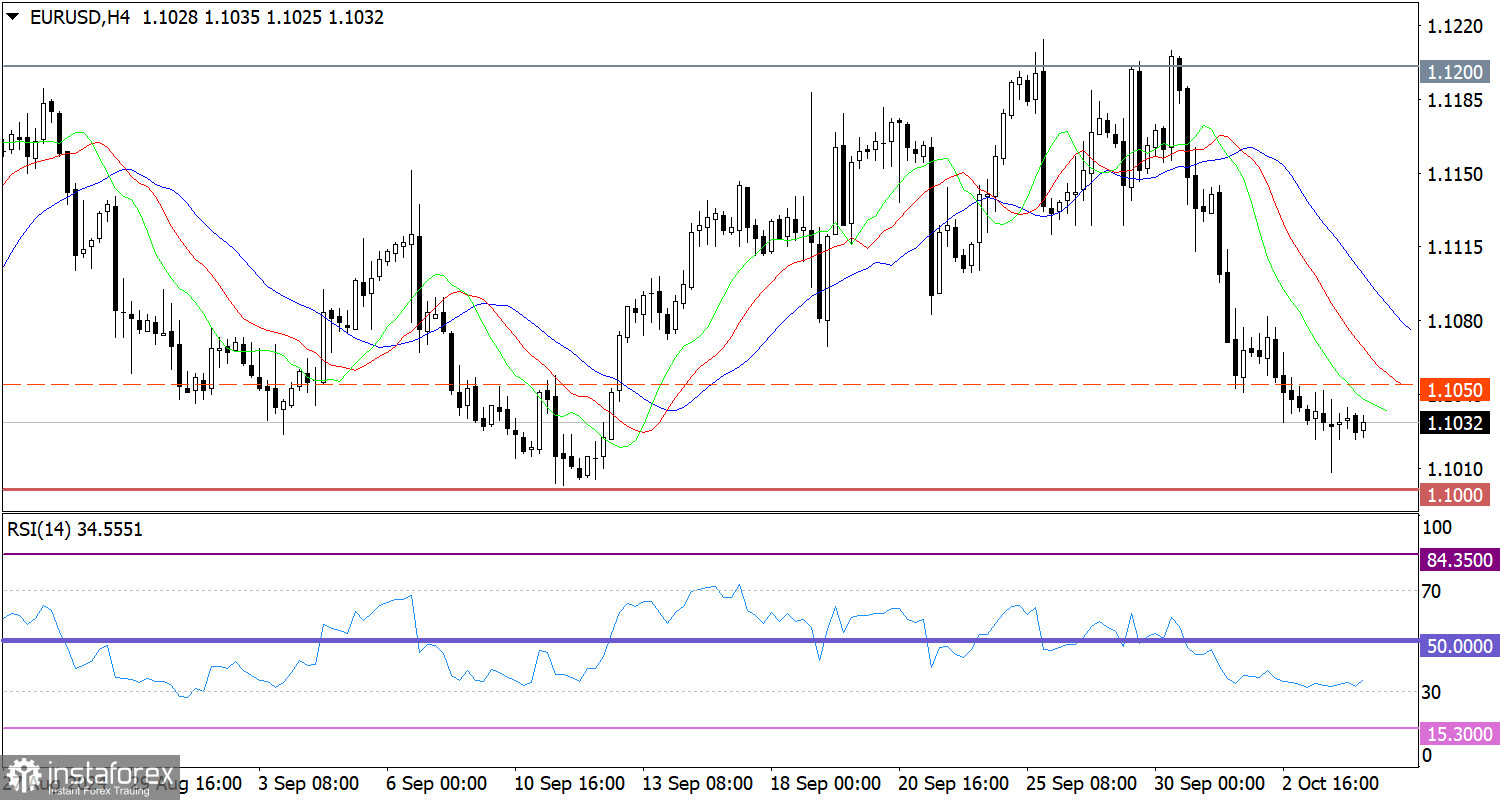

The stall at the peak of the upward trend ended with an active sell-off of euro positions, leading to the formation of a full-scale correction toward the upper zone of the psychological level of 1.1000/1.1050. In the four-hour chart, the RSI technical tool is moving in the lower 30/50 area of the indicator, indicating increased interest in short positions on the market. As for the Alligator indicator in the same time frame, the moving average lines (MA) are pointed downward, corresponding to the ongoing corrective cycle. Expectations and Prospects The speculative momentum favoring dollar positions still prevails in the financial markets. For this reason, a test of the 1.1000 level cannot be ruled out. Further development will depend on how the price behaves around this value. A partial recovery may occur if the volume of short positions on the euro decreases. However, if we see price stabilization below the 1.1000 level, a move toward the lower deviation of 1.0950 is possible.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3BtHJGM

Instaforex Analysis

Re: Instaforex Analysis

Forex Analysis & Reviews: Forecast for EUR/USD on October 3, 2024

Yesterday, the single European currency declined by 22 pips, while the stock market (S&P 500) rose by 0.01%. Overall, stock indices closed mixed, but the VIX index fell by 1.87%, and it still needs to increase by 25.7% to reach its September peak of 23.76. There's no sign of a flight from risk. Even oil prices fell yesterday, and investors were not keen on holding U.S. government bonds in their portfolios.

On the weekly EUR/USD chart, the price has reached strong support — the point where the Kijun-sen line intersects with the 138.2% Fibonacci retracement level. The channels on the Marlin oscillator also create a strong potential reversal point at the intersection of the lower boundaries of both the descending and ascending channels. The divergence formed during the downward movement may reverse. We also see that the price has not yet tested the 200.0% and 238.2% Fibonacci reaction levels at 1.1230 and 1.1350. There are good prospects for the price to correct this oversight. If the price can overcome the 138.2% retracement level (1.1033 – yesterday's low) and consolidate, the downward trend will continue to strengthen.

On the daily chart, the price is close to consolidating below the Kijun-sen line, which requires today's close to be below this line. Marlin is slightly turning upward in the downtrend territory. Considering the situation on the weekly chart, the main events will likely unfold next week.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/47Qdp5o

Yesterday, the single European currency declined by 22 pips, while the stock market (S&P 500) rose by 0.01%. Overall, stock indices closed mixed, but the VIX index fell by 1.87%, and it still needs to increase by 25.7% to reach its September peak of 23.76. There's no sign of a flight from risk. Even oil prices fell yesterday, and investors were not keen on holding U.S. government bonds in their portfolios.

On the weekly EUR/USD chart, the price has reached strong support — the point where the Kijun-sen line intersects with the 138.2% Fibonacci retracement level. The channels on the Marlin oscillator also create a strong potential reversal point at the intersection of the lower boundaries of both the descending and ascending channels. The divergence formed during the downward movement may reverse. We also see that the price has not yet tested the 200.0% and 238.2% Fibonacci reaction levels at 1.1230 and 1.1350. There are good prospects for the price to correct this oversight. If the price can overcome the 138.2% retracement level (1.1033 – yesterday's low) and consolidate, the downward trend will continue to strengthen.

On the daily chart, the price is close to consolidating below the Kijun-sen line, which requires today's close to be below this line. Marlin is slightly turning upward in the downtrend territory. Considering the situation on the weekly chart, the main events will likely unfold next week.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/47Qdp5o

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Middle East conflict steals the show as Tesla and Nike reports leave investors cold

S&P 500 remains flat amid Middle East tensions and job data concerns The U.S. stock index S&P 500 ended Wednesday's trading session nearly unchanged as tech stocks managed to gain, but investors remained cautious due to geopolitical risks in the Middle East and anticipation of critical U.S. employment data expected later this week. Nvidia's gains offset by Tesla's drop A rise in Nvidia shares by 1.6% provided support to the S&P 500's tech sector. However, Tesla shares declined by 3.5% after the electric vehicle manufacturer reported quarterly vehicle deliveries that fell short of market expectations. Market eyes on the Middle East Investors closely monitored developments in the Middle East after Israel vowed to retaliate for Iran's missile attack on Tuesday. U.S. President Joe Biden stated on Wednesday that he would not back an Israeli strike on Iran's nuclear facilities in response to the attack and urged Israel to act "proportionately." Labor market remains resilient Early Wednesday, data showed that U.S. private sector jobs increased more than expected in September, suggesting continued strength in the labor market. Still, traders remain focused on the upcoming non-farm payrolls report due Friday, as well as Thursday's jobless claims data, which could further influence market expectations.

News are provided by InstaForex.

Read more: https://ifxpr.com/4eOyW0p

S&P 500 remains flat amid Middle East tensions and job data concerns The U.S. stock index S&P 500 ended Wednesday's trading session nearly unchanged as tech stocks managed to gain, but investors remained cautious due to geopolitical risks in the Middle East and anticipation of critical U.S. employment data expected later this week. Nvidia's gains offset by Tesla's drop A rise in Nvidia shares by 1.6% provided support to the S&P 500's tech sector. However, Tesla shares declined by 3.5% after the electric vehicle manufacturer reported quarterly vehicle deliveries that fell short of market expectations. Market eyes on the Middle East Investors closely monitored developments in the Middle East after Israel vowed to retaliate for Iran's missile attack on Tuesday. U.S. President Joe Biden stated on Wednesday that he would not back an Israeli strike on Iran's nuclear facilities in response to the attack and urged Israel to act "proportionately." Labor market remains resilient Early Wednesday, data showed that U.S. private sector jobs increased more than expected in September, suggesting continued strength in the labor market. Still, traders remain focused on the upcoming non-farm payrolls report due Friday, as well as Thursday's jobless claims data, which could further influence market expectations.

News are provided by InstaForex.

Read more: https://ifxpr.com/4eOyW0p

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Hot Forecast for EUR/USD on October 4, 2024

The dollar is on hold in anticipation of the release of the U.S. Department of Labor report. Moreover, there is increasing speculation that the report's content may be slightly better than forecasts. In particular, based on recent labor market data, there are doubts that the unemployment rate will rise from 4.2% to 4.3%. It is more likely to remain at its current level. Furthermore, it appears that 140,000 new jobs will be created outside of agriculture, rather than the previously predicted 130,000. While this number isn't huge, given the population size and growth rate in the U.S., it is still slightly more than initially expected. This could lead to further strengthening of the U.S. dollar. However, everything will depend on the content of the U.S. Department of Labor report.

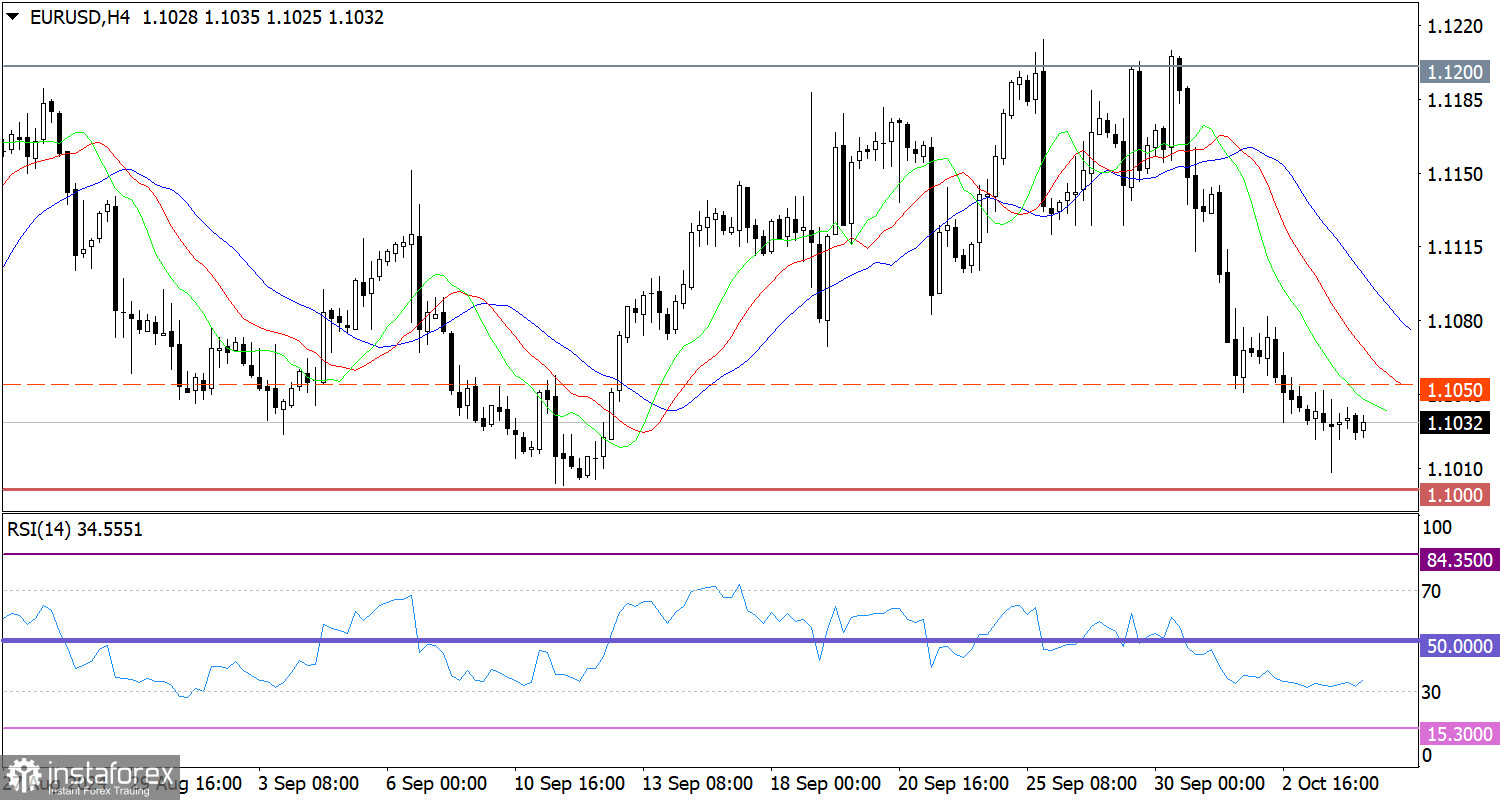

The EUR/USD currency pair is in a corrective phase from the resistance level 1.1200. As a result, the price has reached the support level of 1.1000. In the four-hour chart, the RSI technical tool is moving in the sellers' zone of 30/50, indicating the appeal of short positions on the euro. However, oversold conditions are already being observed in shorter-term periods. As for the Alligator indicator in the same time frame, the moving average (MA) lines are directed downward, in line with the ongoing corrective cycle. Expectations and Prospects Based on the theory of support around the 1.1000 level, the volume of short positions could decline, potentially leading to a price rebound. If the price stabilizes above 1.1050, a clearer signal for increased long positions on the euro may emerge. However, if the price stabilizes below the 1.1000 level, further declines toward the 1.0900/1.0950 area are possible. The complex indicator analysis for the short-term period points to a price rebound from the 1.1000 level. For the intraday period, the indicators continue to show a bearish sentiment.

Analysis are provided by InstaForex.

Read more:https://ifxpr.com/3Nbat9S

The dollar is on hold in anticipation of the release of the U.S. Department of Labor report. Moreover, there is increasing speculation that the report's content may be slightly better than forecasts. In particular, based on recent labor market data, there are doubts that the unemployment rate will rise from 4.2% to 4.3%. It is more likely to remain at its current level. Furthermore, it appears that 140,000 new jobs will be created outside of agriculture, rather than the previously predicted 130,000. While this number isn't huge, given the population size and growth rate in the U.S., it is still slightly more than initially expected. This could lead to further strengthening of the U.S. dollar. However, everything will depend on the content of the U.S. Department of Labor report.

The EUR/USD currency pair is in a corrective phase from the resistance level 1.1200. As a result, the price has reached the support level of 1.1000. In the four-hour chart, the RSI technical tool is moving in the sellers' zone of 30/50, indicating the appeal of short positions on the euro. However, oversold conditions are already being observed in shorter-term periods. As for the Alligator indicator in the same time frame, the moving average (MA) lines are directed downward, in line with the ongoing corrective cycle. Expectations and Prospects Based on the theory of support around the 1.1000 level, the volume of short positions could decline, potentially leading to a price rebound. If the price stabilizes above 1.1050, a clearer signal for increased long positions on the euro may emerge. However, if the price stabilizes below the 1.1000 level, further declines toward the 1.0900/1.0950 area are possible. The complex indicator analysis for the short-term period points to a price rebound from the 1.1000 level. For the intraday period, the indicators continue to show a bearish sentiment.

Analysis are provided by InstaForex.

Read more:https://ifxpr.com/3Nbat9S

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Technical Analysis of Daily Price Movement of EUR/USD Main Currency Pairs, Monday October 07, 2024.

With the appearance of deviations between the price movements of the main currency pair EUR/USD which formed a Higher-High (Double Top) while inversely proportional to the Stochastic Oscillator indicator which actually formed a Higher Low, it gives an indication that in the next few days seller pressure will begin to occur even though a strengthening correction could occur but as long as it does not break above the level of 1.1145, EUR/USD will still remain under pressure and will try to test the level of 1.0943 if this level is successfully broken down, Fiber will try to test the next two targets, namely 1.0829 and 1.0679.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4eU6U3C

With the appearance of deviations between the price movements of the main currency pair EUR/USD which formed a Higher-High (Double Top) while inversely proportional to the Stochastic Oscillator indicator which actually formed a Higher Low, it gives an indication that in the next few days seller pressure will begin to occur even though a strengthening correction could occur but as long as it does not break above the level of 1.1145, EUR/USD will still remain under pressure and will try to test the level of 1.0943 if this level is successfully broken down, Fiber will try to test the next two targets, namely 1.0829 and 1.0679.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4eU6U3C

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Spirit Airlines Bankruptcy, Oil Rising: How the U.S. Balances Labor Market Gains and Geopolitics

Dow Ends Week at Record High, Nasdaq Shows Solid Gains The Dow hit record highs on Friday, while the Nasdaq posted an impressive gain of more than 1%, driven by an unexpectedly strong increase in U.S. employment, which somewhat allayed investors' fears about possible economic weakness. Record Job Growth September was the month with the most significant job growth in the past six months. According to the published data, the unemployment rate fell to 4.1%. Experts took this report as a signal that the economy remains resilient and does not lose momentum. "The data confirms that we can expect stable economic activity in the fourth quarter," commented Peter Cardillo, chief economist at Spartan Capital Securities. Impact on Interest Rates The improving economic situation, however, may slow down the interest rate cuts that were previously expected. Cardillo noted that positive news from the labor market will most likely slow the process of further rate cuts. Traders also adjusted their expectations for the upcoming Federal Reserve meeting, scheduled for November 6-7. The chance of a 50 basis point rate cut fell to 8% from 31% earlier in the day, according to CME Group's FedWatch data. Small Caps, Financials Rise Amid the broader market rally, small caps and financials stood out. The Russell 2000 Index rose 1.5%, while the S&P 500 Index rose 1.6%. The trading session's results showed that despite the uncertainty surrounding the Fed's future actions, investors remain optimistic about the resilience of the U.S. economy.

News are provided by InstaForex.

Read more: https://ifxpr.com/3TYhaQh

Dow Ends Week at Record High, Nasdaq Shows Solid Gains The Dow hit record highs on Friday, while the Nasdaq posted an impressive gain of more than 1%, driven by an unexpectedly strong increase in U.S. employment, which somewhat allayed investors' fears about possible economic weakness. Record Job Growth September was the month with the most significant job growth in the past six months. According to the published data, the unemployment rate fell to 4.1%. Experts took this report as a signal that the economy remains resilient and does not lose momentum. "The data confirms that we can expect stable economic activity in the fourth quarter," commented Peter Cardillo, chief economist at Spartan Capital Securities. Impact on Interest Rates The improving economic situation, however, may slow down the interest rate cuts that were previously expected. Cardillo noted that positive news from the labor market will most likely slow the process of further rate cuts. Traders also adjusted their expectations for the upcoming Federal Reserve meeting, scheduled for November 6-7. The chance of a 50 basis point rate cut fell to 8% from 31% earlier in the day, according to CME Group's FedWatch data. Small Caps, Financials Rise Amid the broader market rally, small caps and financials stood out. The Russell 2000 Index rose 1.5%, while the S&P 500 Index rose 1.6%. The trading session's results showed that despite the uncertainty surrounding the Fed's future actions, investors remain optimistic about the resilience of the U.S. economy.

News are provided by InstaForex.

Read more: https://ifxpr.com/3TYhaQh

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Hot Forecast for EUR/USD on October 8, 2024

Retail sales in the Eurozone grew by 0.8%, which was only slightly below the forecast of 0.9%. Nevertheless, this is an excellent result after a decline of -0.1%. However, judging by the market's reaction, investors are focused on further strengthening the dollar. Despite the dollar being overbought, no local rebound has occurred, and the market remained stagnant. The formal reason for this was the Eurozone data, which turned out to be slightly worse than expected. But after all, we are talking about sales growth, not a decline. Considering that today's macroeconomic calendar is empty, we will likely see not so much a continuation of the stagnation but rather a slow weakening of the euro.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4eQmq0q

Retail sales in the Eurozone grew by 0.8%, which was only slightly below the forecast of 0.9%. Nevertheless, this is an excellent result after a decline of -0.1%. However, judging by the market's reaction, investors are focused on further strengthening the dollar. Despite the dollar being overbought, no local rebound has occurred, and the market remained stagnant. The formal reason for this was the Eurozone data, which turned out to be slightly worse than expected. But after all, we are talking about sales growth, not a decline. Considering that today's macroeconomic calendar is empty, we will likely see not so much a continuation of the stagnation but rather a slow weakening of the euro.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4eQmq0q

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Who Will Hold Wall Street Back? Amazon and Alphabet Under Attack, Pfizer Takes the Lead

Wall Street Closes in the Red as Investors Brace for New Challenges US stock markets closed Monday with the major indexes down about 1% as Treasury yields rose, driven by traders' revised forecasts for the Federal Reserve's future policy and concerns about the impact of instability in the Middle East on global oil prices. Escalation and anticipation of new data Market participants continue to analyze economic indicators and prepare for the start of the earnings season for major companies. Additional concerns are caused by the approaching Hurricane Milton, which is expected to reach the United States in the coming days. Recall that Hurricane Helene, which recently swept across the country, claimed more than 200 lives and affected six states, leaving significant damage and requiring large-scale restoration work. Corporate news: a blow to the giants Investor sentiment worsened after a US court decision against Alphabet, which will have to reconsider its approach to mobile applications. This is due to the need to expand the capabilities for Android users, which may affect the company's profitability. In turn, analysts' forecasts caused a decline in the shares of such tech giants as Amazon and Apple. Rising bond yields: Fed rate revision Friday's employment report turned out to be more optimistic than expected, which prompted market participants to revise their expectations regarding future Fed decisions. Traders have now virtually ruled out the possibility of a 50 basis point rate cut in November, with an 86% chance of a 25 basis point rate cut. Moreover, there is a 14% chance that the Federal Reserve will leave rates unchanged, according to the CME FedWatch tool.

News are provided by InstaForex.

Read more: https://ifxpr.com/3ZWcHl5

Wall Street Closes in the Red as Investors Brace for New Challenges US stock markets closed Monday with the major indexes down about 1% as Treasury yields rose, driven by traders' revised forecasts for the Federal Reserve's future policy and concerns about the impact of instability in the Middle East on global oil prices. Escalation and anticipation of new data Market participants continue to analyze economic indicators and prepare for the start of the earnings season for major companies. Additional concerns are caused by the approaching Hurricane Milton, which is expected to reach the United States in the coming days. Recall that Hurricane Helene, which recently swept across the country, claimed more than 200 lives and affected six states, leaving significant damage and requiring large-scale restoration work. Corporate news: a blow to the giants Investor sentiment worsened after a US court decision against Alphabet, which will have to reconsider its approach to mobile applications. This is due to the need to expand the capabilities for Android users, which may affect the company's profitability. In turn, analysts' forecasts caused a decline in the shares of such tech giants as Amazon and Apple. Rising bond yields: Fed rate revision Friday's employment report turned out to be more optimistic than expected, which prompted market participants to revise their expectations regarding future Fed decisions. Traders have now virtually ruled out the possibility of a 50 basis point rate cut in November, with an 86% chance of a 25 basis point rate cut. Moreover, there is a 14% chance that the Federal Reserve will leave rates unchanged, according to the CME FedWatch tool.

News are provided by InstaForex.

Read more: https://ifxpr.com/3ZWcHl5

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Hot Forecast for EUR/USD on 09.10.2024

The market seems to be at a standstill, not so much because of the absence of any macroeconomic data but rather due to the anticipation of tomorrow's inflation data release in the United States. Some data has been released, such as crude oil inventory data from the American Petroleum Institute, which surprised significantly with an increase of 10.9 million barrels. However, these figures rarely substantially impact the market, as they precede the more influential report from the U.S. Department of Energy. Nevertheless, this sharp increase has already led to adjustments in forecasts for today's figures, with investors now expecting a 1.9 million barrel rise in inventories. However, the dollar will wait for the release of inflation data due tomorrow. According to forecasts, the growth rate of consumer prices is likely to slow from 2.5% to 2.3%. Given the dollar's clear overbought status, a slowdown in inflation could be an excellent trigger for a significant correction. However, no one is willing to take risks prematurely, as U.S. data have been full of surprises lately.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3BE7nsz

The market seems to be at a standstill, not so much because of the absence of any macroeconomic data but rather due to the anticipation of tomorrow's inflation data release in the United States. Some data has been released, such as crude oil inventory data from the American Petroleum Institute, which surprised significantly with an increase of 10.9 million barrels. However, these figures rarely substantially impact the market, as they precede the more influential report from the U.S. Department of Energy. Nevertheless, this sharp increase has already led to adjustments in forecasts for today's figures, with investors now expecting a 1.9 million barrel rise in inventories. However, the dollar will wait for the release of inflation data due tomorrow. According to forecasts, the growth rate of consumer prices is likely to slow from 2.5% to 2.3%. Given the dollar's clear overbought status, a slowdown in inflation could be an excellent trigger for a significant correction. However, no one is willing to take risks prematurely, as U.S. data have been full of surprises lately.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3BE7nsz

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: PepsiCo Leads Gains, Tech Boosts Nasdaq as Investors Brace for Inflation Surprises

Tech Returns: Wall Street Ends Day on a Positive Note U.S. stock indexes rose on Tuesday, partially recouping losses from the previous session. Investors turned their attention back to the tech sector as attention shifts to upcoming inflation data and the start of the third-quarter earnings season. Recovering from the Crash: How Did Wall Street Overcome Monday's Slump? The major indexes fell sharply earlier in the week amid rising Treasury yields, heightened geopolitical risks in the Middle East, and a reassessment of U.S. interest rate expectations. Each of the three major indexes lost about 1%. However, falling bond yields sent the market into a buying frenzy on Tuesday, with attention once again focused on high-growth stocks that benefit from lower borrowing costs. As a result, investors increasingly bought shares of tech giants, which are traditionally sensitive to changes in the cost of capital. Tech on the Rise: Palantir and Palo Alto Lead The information technology sector led the S&P 500's gains, adding 2.1%. The biggest contributors were Palantir Technologies, which jumped 6.6%, and Palo Alto Networks, which gained 5.1%. The Magnificent Seven Are Back: Nvidia Sets the Tone Among the "magnificent seven" tech titans, Nvidia has attracted particular attention. Its shares soared by 4.1%, recording the largest daily gain in the last month. Other tech giants such as Apple, Tesla and Meta Platforms (banned in Russia) were also in the green, adding between 1.4% and 1.8%.

News are provided by InstaForex.

Read more: https://ifxpr.com/3U12joo

Tech Returns: Wall Street Ends Day on a Positive Note U.S. stock indexes rose on Tuesday, partially recouping losses from the previous session. Investors turned their attention back to the tech sector as attention shifts to upcoming inflation data and the start of the third-quarter earnings season. Recovering from the Crash: How Did Wall Street Overcome Monday's Slump? The major indexes fell sharply earlier in the week amid rising Treasury yields, heightened geopolitical risks in the Middle East, and a reassessment of U.S. interest rate expectations. Each of the three major indexes lost about 1%. However, falling bond yields sent the market into a buying frenzy on Tuesday, with attention once again focused on high-growth stocks that benefit from lower borrowing costs. As a result, investors increasingly bought shares of tech giants, which are traditionally sensitive to changes in the cost of capital. Tech on the Rise: Palantir and Palo Alto Lead The information technology sector led the S&P 500's gains, adding 2.1%. The biggest contributors were Palantir Technologies, which jumped 6.6%, and Palo Alto Networks, which gained 5.1%. The Magnificent Seven Are Back: Nvidia Sets the Tone Among the "magnificent seven" tech titans, Nvidia has attracted particular attention. Its shares soared by 4.1%, recording the largest daily gain in the last month. Other tech giants such as Apple, Tesla and Meta Platforms (banned in Russia) were also in the green, adding between 1.4% and 1.8%.

News are provided by InstaForex.

Read more: https://ifxpr.com/3U12joo

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am