What are the chances of another Bank of England rate hike in November?In order to understand how the Bank of England is going to act at the remaining two meetings in 2023, we need to consider its potential for raising interest rates. The first and most crucial indicator that the central bank (and the markets) has been relying on for some time is inflation. However, as of September, inflation remains extremely high, well above the target level. One might assume that the BoE will continue to hike rates, but in September, it took a pause. A pause can only mean two things: either the BoE is preparing to end the tightening process, or it has already completed it.

BoE Governor Andrew Bailey and some other members of the BoE's Monetary Policy Committee have mentioned that they expect inflation to drop to 5% by the end of the year. A 5% inflation rate is still very high, 2.5 times above the target. If the BoE is already prepared to conclude its tightening, it may not achieve the target. Furthermore, there's no guarantee that inflation won't start accelerating again. For instance, US inflation has been rising for the past two months. All I want to convey with these arguments is that it's still too early to assume that inflation can return to 2% at the current interest rate level.

Based on that, I believe that the BoE has exhausted its potential for rate hikes, and this is the main reason for the pause in September. Now, the central bank will only raise rates if inflation starts to accelerate significantly. And in that case, the 2% target may be forgotten for several years even with a peak rate, but we could still see 1-2 more emergency rate hikes.

I also want to note that the BoE (like the European Central Bank) is counting on holding rates at the peak level for an extended period to bring inflation back to 2%. This was mentioned after last week's meeting. The Monetary Policy Committee expects inflation to slow down further, but Bailey says cutting rates would be "very premature". Four out of nine committee members voted for a rate hike at the previous meeting. In addition, the Monetary Policy Committee said its balance sheet of government debt will shrink by £100 billion.

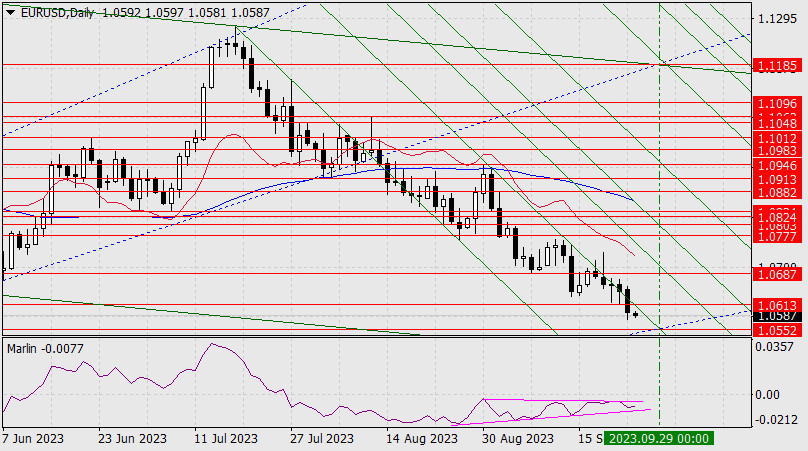

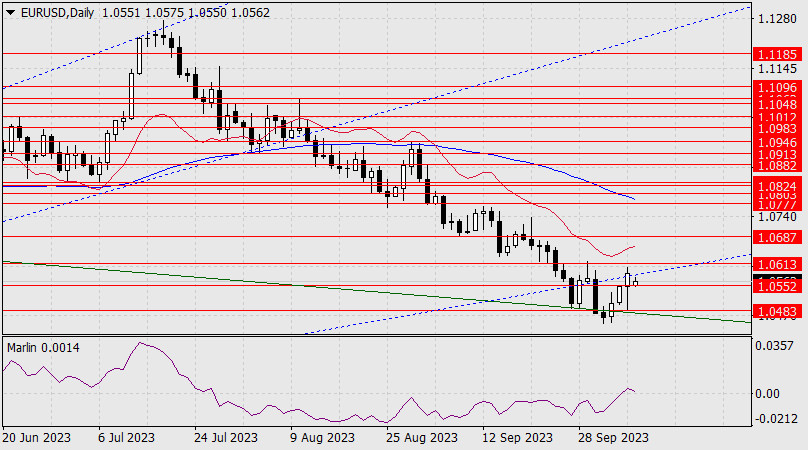

Based on the analysis conducted, I came to the conclusion that a downward wave pattern is being formed. I still believe that targets in the 1.0500-1.0600 range for the downtrend are quite feasible, especially since they are quite near. Therefore, I will continue to sell the instrument. Since the downward wave did not end near the 1.0637 level, we can expect the pair to fall to the 1.05 level and slightly below. However, the second corrective wave will start sooner or later.

The wave pattern of the GBP/USD instrument suggests a decline within the downtrend. At most, the British pound can expect the formation of wave 2 or b in the near future. However, even with a corrective wave, there are still significant challenges. At this time, I would remain cautious about selling, as there may be a corrective upward wave forming in the near future, but for now we have not seen any signals for this wave yet.

Analysis are provided by InstaForex.Read More

https://ifxpr.com/48ry937