Forex Analysis & Reviews: Forecast for EUR/USD on December 10, 2024

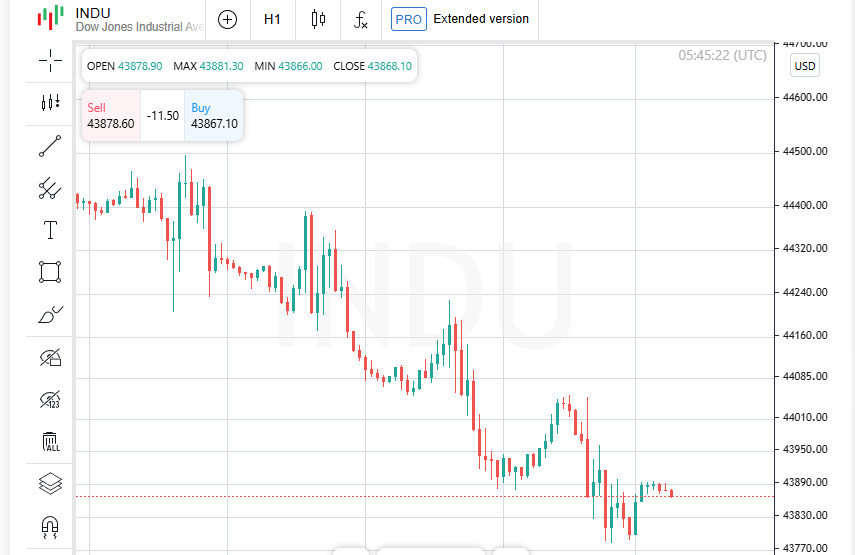

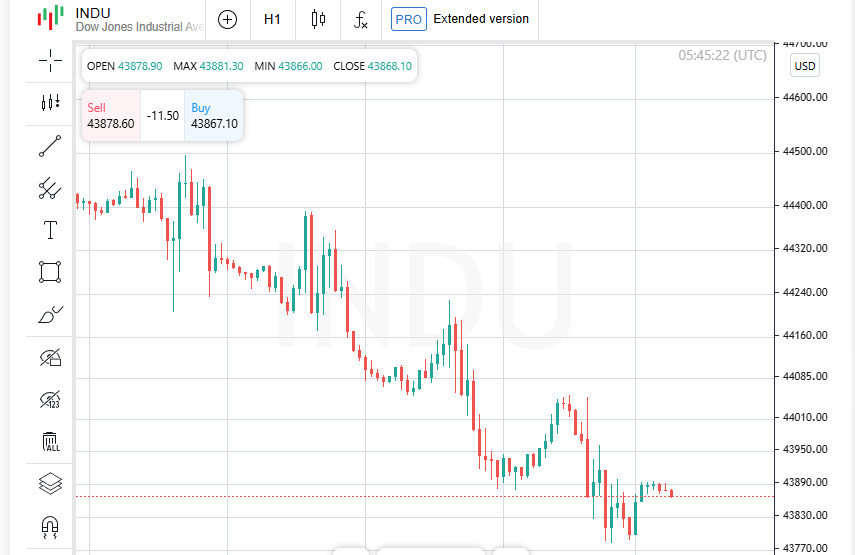

The main event influencing the currency market on Monday was the decline in the U.S. stock market. The S&P 500 index fell by 0.61% after hitting a historic high on Friday. The reversal occurred at strong technical resistance, supported by other signs of a trend shift. It is possible that the "Trump Rally" has ended, with investors moving away from risk. This is further evidenced by an 11.12% increase in the S&P 500 Volatility Index (VIX). If the stock market decline continues, it may substantially impact the euro more than the nearly priced-in European Central Bank rate cut. Even if the ECB decides not to lower rates, the euro may lack the strength for significant growth. For more details, see the article "The U.S. Stock Market Ends the "Trump Rally."'

Currently, the euro is retreating from the upper boundary of the expected range, 1.0461–1.0598. The euro's weakness is already evident, as the price refrained from attempting to breach 1.0598 yesterday. The Marlin oscillator aligns near the neutral line, positioning itself to react to any ECB scenario when the decision is announced. The bears are gradually gaining the upper hand.

The four-hour chart shows that the price is pressing below the balance line for support. The Marlin oscillator has shifted into bearish territory. The MACD line supports the price at 1.0514, a neutral point within the overall range of 1.0461–1.0598. A drop below this level would enable the price to approach the ECB announcement near the support at 1.0461 preemptively and more aggressively.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3OPUT4c

Instaforex Analysis

Re: Instaforex Analysis

Forex Analysis & Reviews: Forecast for GBP/USD on December 12, 2024

After yesterday's moderate decline (an attempt to test the 1.2708 support), the pound sterling is again pressing against the resistance levels of the balance indicator line and the MA34. The Marlin oscillator is moving sideways but trending upward. The price signals its intent to target the 1.2906 level, where it may encounter the MACD line on the daily chart.

If the euro fails to exhibit strong movement following today's European Central Bank meeting, the pound will likely break above current resistance levels and enter the 1.2816/47 range. However, if this plan does not materialize, a move below 1.2708 could lead the pair to test the 1.2616 level, marking the December 2 low.

On the 4-hour chart, yesterday's brief move of the Marlin oscillator into negative territory appears to have been a false signal, as it has since returned to the growth zone this morning. The balance line firmly supports the price, while the stronger MACD line (blue) lies just below. The trend remains upward, with the key question being whether the price can break through the daily resistance levels. A break below 1.2708 on the H4 chart would indicate that the pound has chosen a downward trajectory.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3ZxrJvJ

After yesterday's moderate decline (an attempt to test the 1.2708 support), the pound sterling is again pressing against the resistance levels of the balance indicator line and the MA34. The Marlin oscillator is moving sideways but trending upward. The price signals its intent to target the 1.2906 level, where it may encounter the MACD line on the daily chart.

If the euro fails to exhibit strong movement following today's European Central Bank meeting, the pound will likely break above current resistance levels and enter the 1.2816/47 range. However, if this plan does not materialize, a move below 1.2708 could lead the pair to test the 1.2616 level, marking the December 2 low.

On the 4-hour chart, yesterday's brief move of the Marlin oscillator into negative territory appears to have been a false signal, as it has since returned to the growth zone this morning. The balance line firmly supports the price, while the stronger MACD line (blue) lies just below. The trend remains upward, with the key question being whether the price can break through the daily resistance levels. A break below 1.2708 on the H4 chart would indicate that the pound has chosen a downward trajectory.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3ZxrJvJ

- IFX Bella

- Posts: 443

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Nasdaq Index Above 20,000! Tesla Fortunes, Healthcare Struggles

Yuan Gains Ground The offshore yuan gained 0.2%, trading at 7.2670 per dollar. This reflects growing investor confidence in the Chinese currency despite broader discussions around China's monetary policy. Gold Soars to Monthly Peak Gold reached a more-than-one-month high amid promises of lower bond yields as the Federal Reserve and other central banks move toward easing policies. The precious metal hit $2,725.79, its highest level since November 6, before settling back to $2,710.45. Oil Prices Hover Near Multi-Week Highs Oil prices steadied near their two-week highs, driven by concerns over potential new sanctions that could limit Russian oil production. U.S. West Texas Intermediate (WTI) crude futures slipped by 9 cents to $70.20 per barrel, after hitting $70.53 on Wednesday, their highest since November 25. Brent crude futures fell by 3 cents to $73.49 per barrel. Uncertainty Ahead Investors remain focused on the actions of major central banks, currency movements, and developments in commodity markets. Particular attention is directed at potential sanctions that may impact global oil supply and Federal Reserve policies shaping key asset trajectories.

News are provided by InstaForex

Read more: https://ifxpr.com/3ZyBcmx

Yuan Gains Ground The offshore yuan gained 0.2%, trading at 7.2670 per dollar. This reflects growing investor confidence in the Chinese currency despite broader discussions around China's monetary policy. Gold Soars to Monthly Peak Gold reached a more-than-one-month high amid promises of lower bond yields as the Federal Reserve and other central banks move toward easing policies. The precious metal hit $2,725.79, its highest level since November 6, before settling back to $2,710.45. Oil Prices Hover Near Multi-Week Highs Oil prices steadied near their two-week highs, driven by concerns over potential new sanctions that could limit Russian oil production. U.S. West Texas Intermediate (WTI) crude futures slipped by 9 cents to $70.20 per barrel, after hitting $70.53 on Wednesday, their highest since November 25. Brent crude futures fell by 3 cents to $73.49 per barrel. Uncertainty Ahead Investors remain focused on the actions of major central banks, currency movements, and developments in commodity markets. Particular attention is directed at potential sanctions that may impact global oil supply and Federal Reserve policies shaping key asset trajectories.

News are provided by InstaForex

Read more: https://ifxpr.com/3ZyBcmx

- IFX Bella

- Posts: 443

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

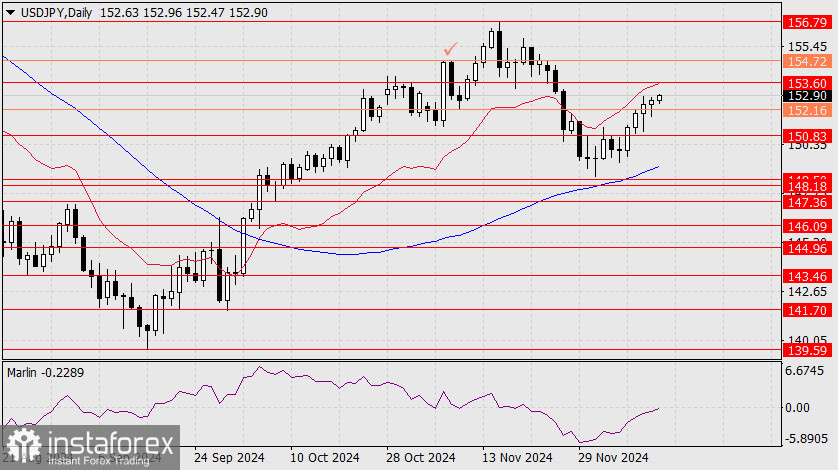

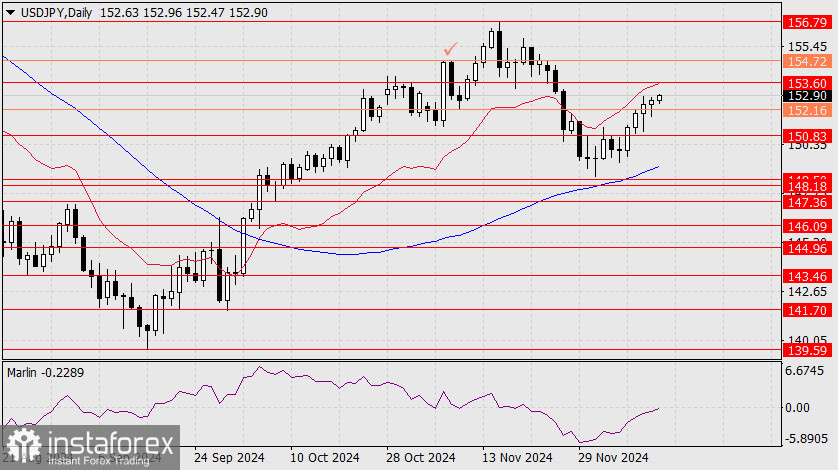

Forex Analysis & Reviews: Forecast for USD/JPY on December 13, 2024

The dollar successfully resists all attempts to push it below key technical levels (150.83, 152.16) in its battle against the yen. This resilience is partly due to the dollar's overall strengthening in the market and the time remaining before the Bank of Japan's monetary policy meeting on December 19.

However, caution is warranted regarding the pair's current growth trajectory. After the price surpasses the intermediate resistance level of 152.16, the first target is 153.60. This level gains additional support from the balance line. At the same time, the Marlin oscillator could reach the boundary of its growth zone as the price approaches this level, potentially reversing from there. If the price manages to break through 153.60, the next intermediate level at 154.72 (the November 7 peak) comes into play. A reversal could occur from this point, forming a false breakout above 153.60. This move may coincide with the Bank of Japan meeting.

On the H4 chart, the signal line of the Marlin oscillator has turned upward from the lower boundary of its extended consolidation range. Indicator lines also point towards growth, and the price has consolidated above the 152.16 level. The target at 153.60 is now open.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3VCRqtw

The dollar successfully resists all attempts to push it below key technical levels (150.83, 152.16) in its battle against the yen. This resilience is partly due to the dollar's overall strengthening in the market and the time remaining before the Bank of Japan's monetary policy meeting on December 19.

However, caution is warranted regarding the pair's current growth trajectory. After the price surpasses the intermediate resistance level of 152.16, the first target is 153.60. This level gains additional support from the balance line. At the same time, the Marlin oscillator could reach the boundary of its growth zone as the price approaches this level, potentially reversing from there. If the price manages to break through 153.60, the next intermediate level at 154.72 (the November 7 peak) comes into play. A reversal could occur from this point, forming a false breakout above 153.60. This move may coincide with the Bank of Japan meeting.

On the H4 chart, the signal line of the Marlin oscillator has turned upward from the lower boundary of its extended consolidation range. Indicator lines also point towards growth, and the price has consolidated above the 152.16 level. The target at 153.60 is now open.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3VCRqtw

- IFX Bella

- Posts: 443

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Forecast for EUR/USD on December 16, 2024

On Friday, the euro rebounded from the technical support level at 1.0461, closing the day with a 37-pip gain. During today's Pacific session, the pair continues its upward movement..

The Marlin oscillator has returned to the growth zone, which could indicate that the previous downward move (highlighted by the gray rectangle) was a false dip. Even if a breakout above doesn't occur (target at 1.0667), the bullish target of 1.0598 has been established. The euro will likely remain within the 1.0461–1.0598 range until the Federal Reserve meeting on Wednesday.

On the H4 chart, the Marlin oscillator has also shifted into the growing trend zone. If the price breaks above the MACD line resistance at 1.0538, the 1.0598 level will become the active target.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3VI0qO6

On Friday, the euro rebounded from the technical support level at 1.0461, closing the day with a 37-pip gain. During today's Pacific session, the pair continues its upward movement..

The Marlin oscillator has returned to the growth zone, which could indicate that the previous downward move (highlighted by the gray rectangle) was a false dip. Even if a breakout above doesn't occur (target at 1.0667), the bullish target of 1.0598 has been established. The euro will likely remain within the 1.0461–1.0598 range until the Federal Reserve meeting on Wednesday.

On the H4 chart, the Marlin oscillator has also shifted into the growing trend zone. If the price breaks above the MACD line resistance at 1.0538, the 1.0598 level will become the active target.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3VI0qO6

- IFX Bella

- Posts: 443

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: EUR/USD Forecast for December 17, 2024

The euro continues its slow technical upward movement within the trading range of 1.0461–1.0598, awaiting the Federal Reserve's rate decision. The Marlin oscillator has firmly entered positive territory, suggesting that the single currency's upward movement may continue today.

However, if the price reverses following the Fed meeting, it does not necessarily have to reach the 1.0598 resistance level, as the overall trend remains bearish. The balance line (red moving average) may act as an insurmountable obstacle, similar to what occurred on December 6 (as indicated by the arrow).

On the 4-hour chart, the price is rising below the MACD line (1.0543). Consolidation above 1.0543 will increase the probability of testing 1.0598. The price appears to be narrowing its consolidation range, approximately 1.0461–1.0543.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3OXjwfs

The euro continues its slow technical upward movement within the trading range of 1.0461–1.0598, awaiting the Federal Reserve's rate decision. The Marlin oscillator has firmly entered positive territory, suggesting that the single currency's upward movement may continue today.

However, if the price reverses following the Fed meeting, it does not necessarily have to reach the 1.0598 resistance level, as the overall trend remains bearish. The balance line (red moving average) may act as an insurmountable obstacle, similar to what occurred on December 6 (as indicated by the arrow).

On the 4-hour chart, the price is rising below the MACD line (1.0543). Consolidation above 1.0543 will increase the probability of testing 1.0598. The price appears to be narrowing its consolidation range, approximately 1.0461–1.0543.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3OXjwfs

- IFX Bella

- Posts: 443

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Stocks stagnate, oil surges: investors on edge ahead of regulators' decision

Financial markets at a crossroads: investors await cues from the US Federal Reserve MSCI's global stock index fell on Friday, while bond yields rose. Investors held their breath ahead of next week's Federal Reserve meeting, where key signals on the future trajectory of interest rates are expected. Bonds: New three-week high The yield on the US 10-year Treasury note hit a three-week high, rising for the fifth straight session. Market participants speculate that the Fed, led by Jerome Powell, may pause further easing after an expected 25 basis point rate cut. Such a move reflects the regulator's cautious approach in the face of high inflation. Inflation: A persistent challenge for the Fed Despite the central bank's efforts, US inflation remains above the 2% target. The latest data released on Thursday showed higher-than-expected producer price readings for November. However, fresh data on Friday showed almost flat import prices, helped by a strong dollar. However, some categories such as food and fuel continued to show gains. Experts weigh in "The market is pricing in a rate cut next week, followed by a pause. This seems reasonable given the contradictions between inflation data and the labor market situation," said Matt Rowe, head of portfolio management and asset strategies at Nomura Capital Management.

News are provided by InstaForex

Read more: https://ifxpr.com/4iDm686

Financial markets at a crossroads: investors await cues from the US Federal Reserve MSCI's global stock index fell on Friday, while bond yields rose. Investors held their breath ahead of next week's Federal Reserve meeting, where key signals on the future trajectory of interest rates are expected. Bonds: New three-week high The yield on the US 10-year Treasury note hit a three-week high, rising for the fifth straight session. Market participants speculate that the Fed, led by Jerome Powell, may pause further easing after an expected 25 basis point rate cut. Such a move reflects the regulator's cautious approach in the face of high inflation. Inflation: A persistent challenge for the Fed Despite the central bank's efforts, US inflation remains above the 2% target. The latest data released on Thursday showed higher-than-expected producer price readings for November. However, fresh data on Friday showed almost flat import prices, helped by a strong dollar. However, some categories such as food and fuel continued to show gains. Experts weigh in "The market is pricing in a rate cut next week, followed by a pause. This seems reasonable given the contradictions between inflation data and the labor market situation," said Matt Rowe, head of portfolio management and asset strategies at Nomura Capital Management.

News are provided by InstaForex

Read more: https://ifxpr.com/4iDm686

- IFX Bella

- Posts: 443

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: GBP/USD Forecast for December 18, 2024

On Tuesday, the British pound rose by 27 pips, closing the day below the 1.2708 resistance level after briefly breaching it during the session. Today, the pound starts slightly weakening as the balance line reinforces the reached level. Today's focus will be on the Federal Reserve's decision to lower rates by 0.25%, with consideration for the Bank of England's expected decision to maintain rates tomorrow.

From a purely technical standpoint, the pound has all the conditions for a potential move into the 1.2816/47 range, even as a false breakout against the market trend, with a subsequent return below the 1.2616 level if the market adopts a downward direction. However, the current sentiment for the pound appears slightly bearish, as the Marlin oscillator hints at a reversal.

On the H4 chart, the price did not manage to break above the balance line resistance. There was no consolidation above the 1.2708 level. Marlin is moving in tandem with the price. Without breaking the reversal setup, the price may test the MACD line resistance at 1.2750. A break above the MACD line would open the target range of 1.2816/47.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3BzpBM2

On Tuesday, the British pound rose by 27 pips, closing the day below the 1.2708 resistance level after briefly breaching it during the session. Today, the pound starts slightly weakening as the balance line reinforces the reached level. Today's focus will be on the Federal Reserve's decision to lower rates by 0.25%, with consideration for the Bank of England's expected decision to maintain rates tomorrow.

From a purely technical standpoint, the pound has all the conditions for a potential move into the 1.2816/47 range, even as a false breakout against the market trend, with a subsequent return below the 1.2616 level if the market adopts a downward direction. However, the current sentiment for the pound appears slightly bearish, as the Marlin oscillator hints at a reversal.

On the H4 chart, the price did not manage to break above the balance line resistance. There was no consolidation above the 1.2708 level. Marlin is moving in tandem with the price. Without breaking the reversal setup, the price may test the MACD line resistance at 1.2750. A break above the MACD line would open the target range of 1.2816/47.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3BzpBM2

- IFX Bella

- Posts: 443

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: EUR/USD Forecast for December 19, 2024

At yesterday's FOMC meeting, the Federal Reserve cut the rate by the anticipated 0.25%. However, the FOMC projected only two rate cuts for the upcoming year, compared to the market's expectation of three. This led the euro to fall by 139 pips. Yet, the most notable event of the day was the 2.95% drop in the S&P 500. The index erased three weeks of gains in a single day. The technical picture indicates a crisis scenario, as we mentioned last week in the analysis titled "The U.S. Stock Market Ends the 'Trump Rally' on December 10", suggesting further developments in this direction.

On the daily chart, the euro has reached the 1.0350 target level. As of Thursday morning, the price is undergoing a slight correction. After this correction, we expect the price to move below this level and continue its decline toward the next target at 1.0250. If a divergence forms at this level, a deeper correction could follow. If not, further decline toward 1.0135 is possible.

On the H4 chart, the Marlin oscillator begins easing out of the oversold zone, signaling a minor recovery. Once the market stabilizes, we anticipate another attempt to break the 1.0350 support, followed by a move toward 1.0250.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4gj3A3a

At yesterday's FOMC meeting, the Federal Reserve cut the rate by the anticipated 0.25%. However, the FOMC projected only two rate cuts for the upcoming year, compared to the market's expectation of three. This led the euro to fall by 139 pips. Yet, the most notable event of the day was the 2.95% drop in the S&P 500. The index erased three weeks of gains in a single day. The technical picture indicates a crisis scenario, as we mentioned last week in the analysis titled "The U.S. Stock Market Ends the 'Trump Rally' on December 10", suggesting further developments in this direction.

On the daily chart, the euro has reached the 1.0350 target level. As of Thursday morning, the price is undergoing a slight correction. After this correction, we expect the price to move below this level and continue its decline toward the next target at 1.0250. If a divergence forms at this level, a deeper correction could follow. If not, further decline toward 1.0135 is possible.

On the H4 chart, the Marlin oscillator begins easing out of the oversold zone, signaling a minor recovery. Once the market stabilizes, we anticipate another attempt to break the 1.0350 support, followed by a move toward 1.0250.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4gj3A3a

- IFX Bella

- Posts: 443

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: EUR/USD Forecast for December 23, 2024

On Friday, the euro completed its correction from the December 17-18 price decline. Assuming that the correction is incomplete, a move above 1.0461 would invalidate investors' plans regarding the Federal Reserve's monetary policy.

The Marlin oscillator also signals the end of the correction, as it begins to turn downward without reaching the growth territory boundary. A gradual decline to the support level at 1.0250 appears logical. Considering the thinning market ahead of the Catholic holidays, strong orders may already be absent at the 1.0350 level.

The four-hour chart shows the price's growth from the 1.0350 support occurred below the balance line (red moving average). The Marlin oscillator moved above the zero line, but this could be a false move, confirming a reversal toward a new low at 1.0250.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3VT6ZxH

On Friday, the euro completed its correction from the December 17-18 price decline. Assuming that the correction is incomplete, a move above 1.0461 would invalidate investors' plans regarding the Federal Reserve's monetary policy.

The Marlin oscillator also signals the end of the correction, as it begins to turn downward without reaching the growth territory boundary. A gradual decline to the support level at 1.0250 appears logical. Considering the thinning market ahead of the Catholic holidays, strong orders may already be absent at the 1.0350 level.

The four-hour chart shows the price's growth from the 1.0350 support occurred below the balance line (red moving average). The Marlin oscillator moved above the zero line, but this could be a false move, confirming a reversal toward a new low at 1.0250.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3VT6ZxH

- IFX Bella

- Posts: 443

- Joined: Sat Dec 08, 2012 12:39 am