Technical Templates

Re: Technical Templates

On EURJPY I was looking for buyers to jump in at around 140.500 and managed to catch a long from 140.700 to 140.882 at which point a very tight trailing stop took me out. In light of recent market movements, I'm taking a much shorter term view to trades. Overall was happy with the setup and outcome but disappointed that I didn't keep an eye on the time and the German IFO news. Thankfully the news went with me.

- grantyboy

- Posts: 38

- Joined: Mon Jun 03, 2013 9:11 am

- Location: Melbourne

Re: Technical Templates

If EURCAD can hold above yesterday's NY Open around 1.5320 then I'd be looking for a pullback entry long. However, I don't think I'll be at the screen if it happens so would probably have to wait for a break and retrace @ 1.5350. Any moves below 1.526 and I'll be on the sidelines.

- grantyboy

- Posts: 38

- Joined: Mon Jun 03, 2013 9:11 am

- Location: Melbourne

Re: Technical Templates

Most of the trending pairs are moving in the opposite direction today grantyboy so you're going to have to be patient & re-assess when everything closes out later.

If the initial or established trending action is still intact you'll get the nod soon enough at the usual reaction points.

Your identification levels certainly make sense from where I'm looking anyway, so just drop down (or up) to the next area that is likely to attract attention & see if you get a reaction sufficiently strong enough to engage.

I hate testing & probing for entries when price moves further than I expected it to, but it's the same for everybody who adopts this type of activity. There's a good chunk of the week to go at yet so no rush.

Good luck with your trades.

If the initial or established trending action is still intact you'll get the nod soon enough at the usual reaction points.

Your identification levels certainly make sense from where I'm looking anyway, so just drop down (or up) to the next area that is likely to attract attention & see if you get a reaction sufficiently strong enough to engage.

I hate testing & probing for entries when price moves further than I expected it to, but it's the same for everybody who adopts this type of activity. There's a good chunk of the week to go at yet so no rush.

Good luck with your trades.

- zilly

- Posts: 53

- Joined: Fri Jul 22, 2011 11:25 am

Re: Technical Templates

Yeah this week has been quite uneventful for me as well...only 3 trades thus far and maybe 2 missed opportunities but generally speaking, market sentiment hasn't been as evident.

Only yesterday we saw some decisive eur stops getting fired off and some selling this morning (which was one of my missed) and aussie selling (my other missed trade) which are clear cut moves as per my background work.

It has been a "technical" week with no real drivers...and i've learned to keep my hands under my bottom when this happens. Hope your week went better than mine

Only yesterday we saw some decisive eur stops getting fired off and some selling this morning (which was one of my missed) and aussie selling (my other missed trade) which are clear cut moves as per my background work.

It has been a "technical" week with no real drivers...and i've learned to keep my hands under my bottom when this happens. Hope your week went better than mine

..Be the miracle...

-

jcpfx - Posts: 393

- Joined: Mon Oct 29, 2012 10:02 am

- Location: Italy

Re: Technical Templates

The opportunities certainly aren't breaking my front door down lately that's for sure.

The only 2 pairs I've shown any degree of interest in this month have been GBPAUD & GBPCAD, principally because of their established bullish trends.

I'm still just seeking out the easier background structures & waiting until they offer a reasonable entry trigger. There isn't an abundance of opportunities, but they're still out there if you're patient enough.

I've had a couple of false starts over the past 2 or 3 weeks, but that's only to be expected when momentum & volatility are subdued.

I imagine it won't be too long before the market receives it's next shot in the arm & everything will begin jumping around again.

The only 2 pairs I've shown any degree of interest in this month have been GBPAUD & GBPCAD, principally because of their established bullish trends.

I'm still just seeking out the easier background structures & waiting until they offer a reasonable entry trigger. There isn't an abundance of opportunities, but they're still out there if you're patient enough.

I've had a couple of false starts over the past 2 or 3 weeks, but that's only to be expected when momentum & volatility are subdued.

I imagine it won't be too long before the market receives it's next shot in the arm & everything will begin jumping around again.

-

strobe - Posts: 61

- Joined: Wed Jan 04, 2012 3:58 pm

Re: Technical Templates

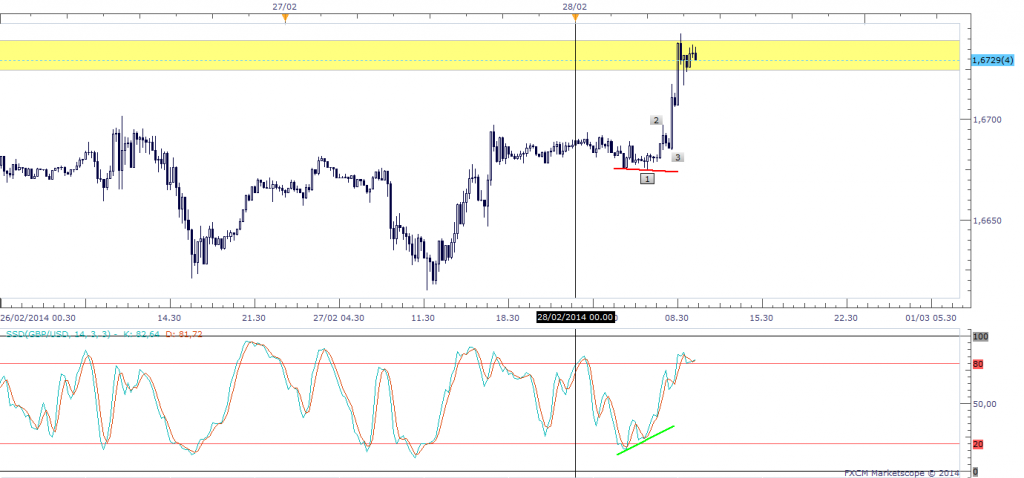

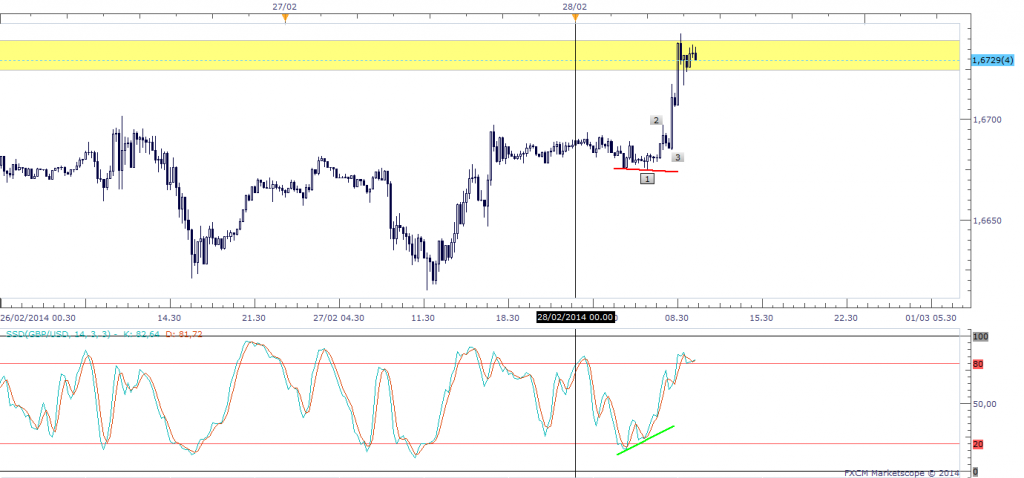

Cable has given a good little burst this morning. We had typical entry signals as well, starting with the early morning (pre-london) divergence, and then a higher low after price vibrated the o/n high. With the shallow consolidation overnight, this made me confident we were heading higher. Stop loss below the o/n low and target in the prior highs. I encashed completely on 6729 after the lower high was confirmed.

..Be the miracle...

-

jcpfx - Posts: 393

- Joined: Mon Oct 29, 2012 10:02 am

- Location: Italy

Re: Technical Templates

Hold onto your trousers...risk is in the pipeline with the whole Russia-Ukraine dispute... i'm not too familiar with these moments so i'll be sticking to the usual setups and trying to stay away from the most volatile instruments during risk on/off sessions lik Crude, Gold, Chf, Jpy...

For any of the guys in here that have traded during the Lehman collapse (biggest risk off in a decade) and the european debt crisis in 2010/11, do you have any particular thoughts/considerations to share?

Thanks & Good Luck!

For any of the guys in here that have traded during the Lehman collapse (biggest risk off in a decade) and the european debt crisis in 2010/11, do you have any particular thoughts/considerations to share?

Thanks & Good Luck!

..Be the miracle...

-

jcpfx - Posts: 393

- Joined: Mon Oct 29, 2012 10:02 am

- Location: Italy

a model for all seasons

jcpfx wrote:risk is in the pipeline with the whole Russia-Ukraine dispute... i'm not too familiar with these moments so i'll be sticking to the usual setups and trying to stay away from the most volatile instruments during risk on/off sessions...

For any of the guys in here that have traded during the Lehman collapse (biggest risk off in a decade) and the european debt crisis in 2010/11, do you have any particular thoughts/considerations to share?

The approach & the way the set ups are configured are designed to operate across all timeframes & volatility conditions. If you scroll back to the periods you mentioned Justin you'll see how the comments & charts at the time reflected those (& other high volatility) conditions.

It’s also designed to accommodate different risk profiles, therefore rather than actively avoid something maybe adjust the way you trade it until the market stabilizes.

Providing you're not over leveraging,instigating excessive risks & using your common sense, you shouldn't really get into too much trouble.

As always, if you can't get a read on your usual set up/trigger combinations on your favourite pairings based on a specific approach (intraday for instance) then either stand aside, consider playing them from a longer time duration or look elsewhere.

There will always be opportunities out there regardless the conditions; it's just whether it suits your particular risk profile at the time.

- kyle morgan

- Posts: 43

- Joined: Fri Dec 09, 2011 4:50 pm

Re: a model for all seasons

If you revisit most of the answers to your questions jcp you'll notice how they consistently attract much the same kind of comment.

In other words, every decision you make in the market during either low or high volatility trading conditions is generated on the back of your preferred risk appetite for that deal.

That's why the constant in all this is always adhering to the correct background & foreground criteria first. That's your default mechanism or trip switch.

If that stacks up your only other decisions are to determine if enough of the daily or weekly range is available for your objective & marry it up with the appropriate risk. If any of that default criteria fails to line up then you have to decide if the bet is off or not.

Don't lose sight of the rigid structure.

It doesn't matter what conditions are present, only whether they offer you the right odds to play them.

Most of the time they will (in one form or other), & some of the time they won't.

In other words, every decision you make in the market during either low or high volatility trading conditions is generated on the back of your preferred risk appetite for that deal.

That's why the constant in all this is always adhering to the correct background & foreground criteria first. That's your default mechanism or trip switch.

If that stacks up your only other decisions are to determine if enough of the daily or weekly range is available for your objective & marry it up with the appropriate risk. If any of that default criteria fails to line up then you have to decide if the bet is off or not.

Don't lose sight of the rigid structure.

It doesn't matter what conditions are present, only whether they offer you the right odds to play them.

Most of the time they will (in one form or other), & some of the time they won't.

-

shona123 - Posts: 64

- Joined: Tue Nov 10, 2009 3:54 pm

Re: Technical Templates

Thanks Kyle & Shona,

i appreciate the continuous reinforcement of what's been taught.

I actually took a long stab at the Bund yesterday afternoon when it gave the only hook of the day, and it went well.

This morning Intrerfax is reporting that russian troops have been ordered to "cease their surprize drills" and the market is feeling a little more relaxed.

If anyone feels nostalgic, i'd recommend watching "13 Days"...great film on the Cuban missle crisis and some analogies with what's been happening recently.

Cheers!

i appreciate the continuous reinforcement of what's been taught.

I actually took a long stab at the Bund yesterday afternoon when it gave the only hook of the day, and it went well.

This morning Intrerfax is reporting that russian troops have been ordered to "cease their surprize drills" and the market is feeling a little more relaxed.

If anyone feels nostalgic, i'd recommend watching "13 Days"...great film on the Cuban missle crisis and some analogies with what's been happening recently.

Cheers!

..Be the miracle...

-

jcpfx - Posts: 393

- Joined: Mon Oct 29, 2012 10:02 am

- Location: Italy

Return to Forex trading strategies and systems