Market Update – December 15 – FED: Inflation Remains Public Enemy No. 1.

Trading Leveraged Products is risky

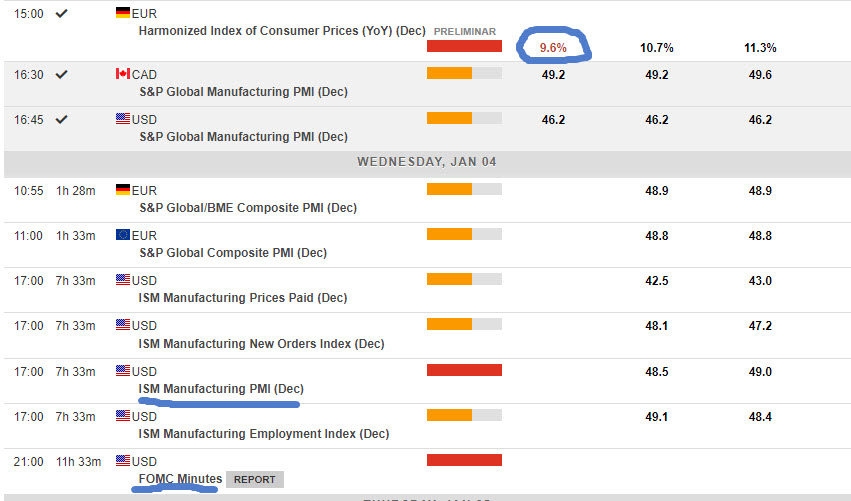

The FED, as expected, announced a 50 bp increase in the federal funds rate to place it in a target range of 4.25%-4.50% (the highest level in 15 years – since 2007). Powell pointed out that “We have more work to do” and that “there is a long way to go” expecting “continued increases”. The first is expected to be 25bp in February, which “will depend on incoming data” and from there the pace will be set taking into account “the cumulative tightening of monetary policy”. 17 of 19 members expect the terminal rate to be over 5.1% during 2023, and “there are no rate cuts in the projections for 2023” and that there will not be until the Fed “has full confidence that inflation is continually falling to the target” , for which it will have to“maintain restrictive rates for a sustained period of time”.

The higher for longer mantra continues – its not the rate of increase but how long it remains elevated. Sounded Hawkish but markets not convinced.

*The USD Index gyrated on the FED announcement moving north of 104.00 but dipped to new 6-mth lows at 103.33 before recovering to 103.85 now. US Stocks rallied on open again but fell post FED and by close were lower (-0.42-0.76%). Yields held at lows too as Treasuries held on to Tuesday’s gains, 10yr closed at 3.503%. Commodities were mixed (Gold under $1800 but USOil holds over $76.50, from $77.50). Asian stocks are mostly lower in the aftermath of the FOMC and disappointing Chinese activity data.

*EUR – rotates 50 bps higher over 1.0600 at 1.0650 now, ahead of ECB later today.

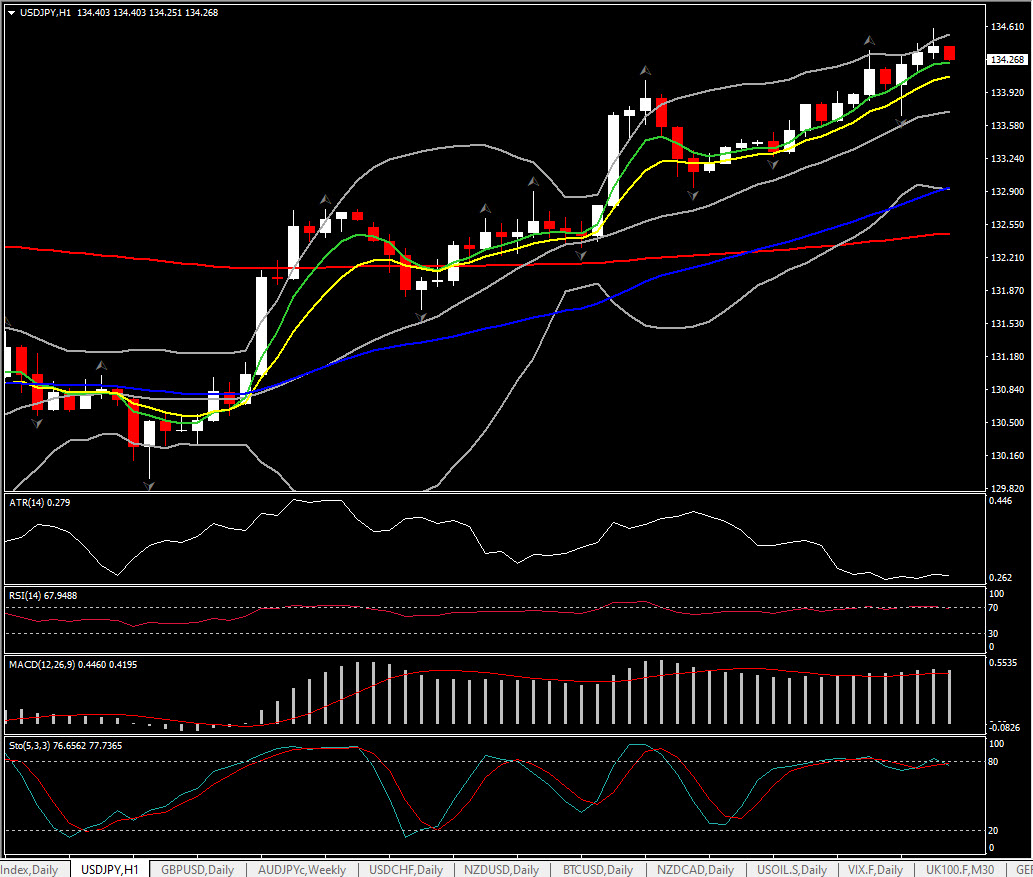

*JPY – sank to 134.50 lows, ahead of the FED, spiked to 136.00 then dipped to 134.80 as Powell spoke and is back to 135.80 now. – Weak JPY (Trade) & Chinese (Ind. Production & Retail Sales) data and strong AUD jobs numbers.

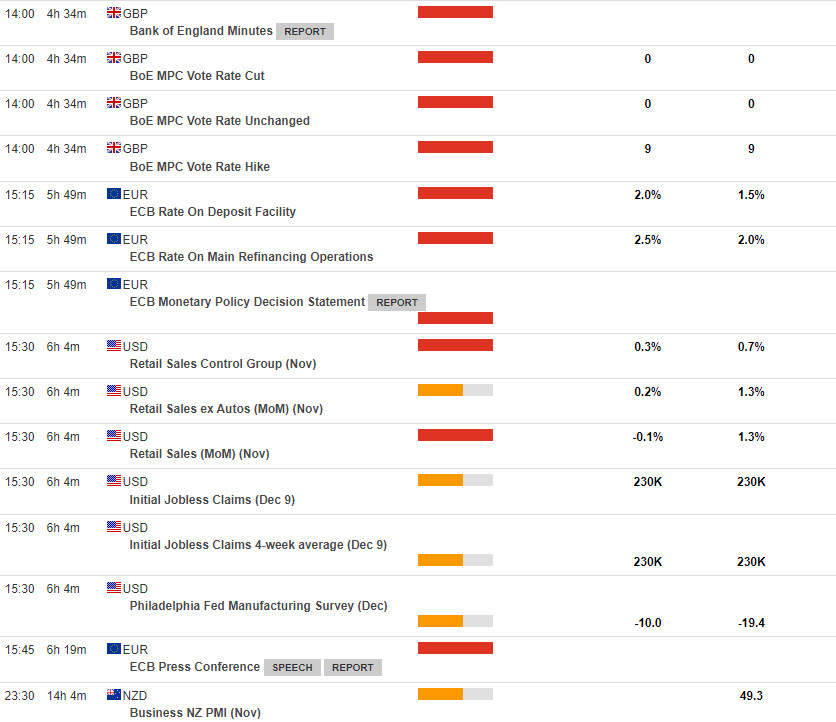

*GBP – Sterling rotated a whole big number from 1.2445 to 1.2345 and trades at 1.2388 ahead of an expected 50 bp rate hike from the BoE today.

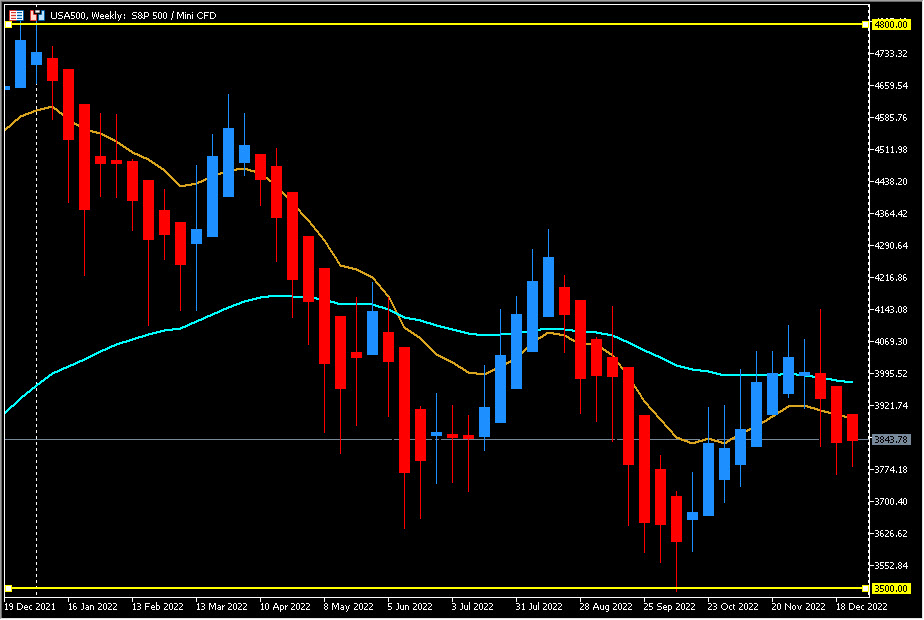

*Stocks – Wall Street rallied but then closed lower – US500 -24.33 (-0.61%) 3995, and slips below 4000 again. Big movers included TSLA -2.58%, COIN -3.88%, AMD -3.80%. FUTS trades at 4012 now.

*USOil – Rallied to $77.54, post FED having touched $75.50 following huge inventory gains of 10.2 million barrels, trades at the key $76.50 now.

*Gold – Spiked down to $1795, rallied to $1815 and trades at $1788 now, unable to hold the $1800 handle.

*BTC – Sentiment woes continue from Binance & SBF but the weaker USD saw a peak over $18.3k, before a crash to $17.7k now. – FTX bankruptcy lawyers say they -“do not trust” – Bahamas government.

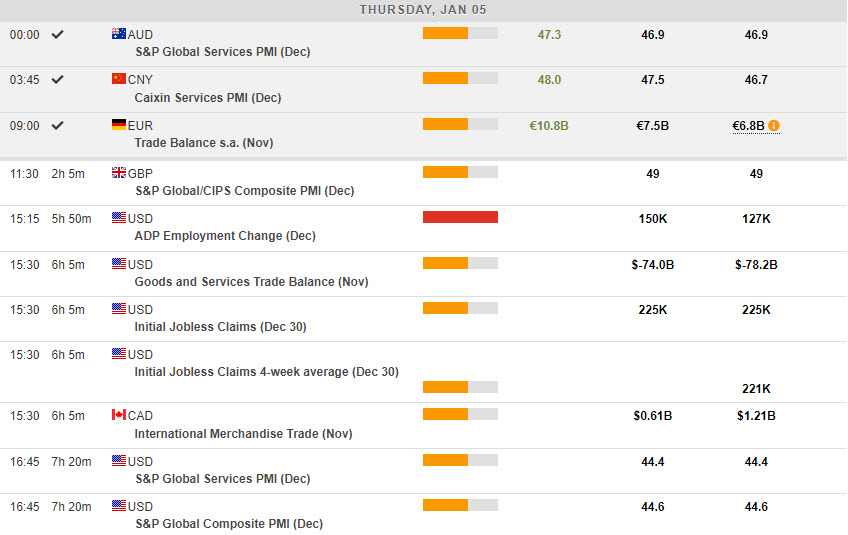

Today – US Weekly Claims, Retail Sales & Industrial Production, BoE, ECB, Norges Bank, SNB & Banxico Policy Announcements, European Council Meeting, Press Conferences with ECB’s Lagarde, Norges Bank’s Bache & SNB’s Jordan.

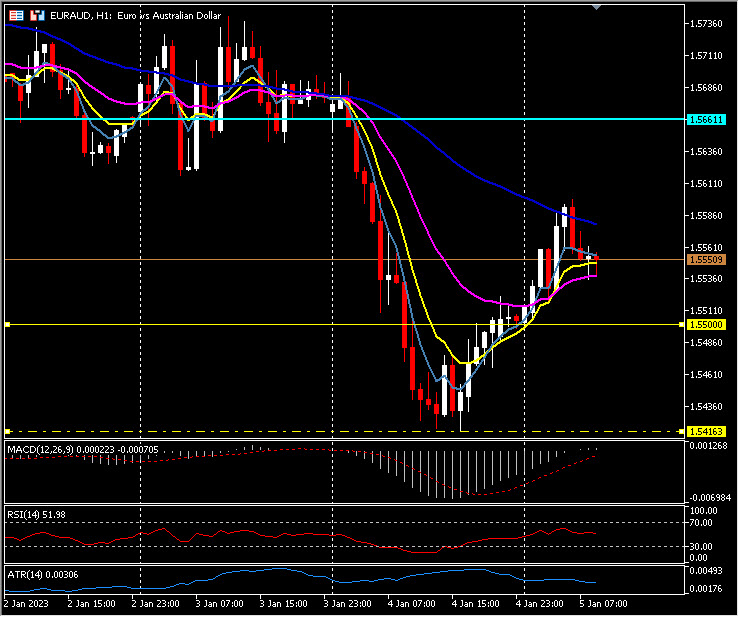

Biggest FX Mover@ (07:30 GMT) AUDUSD (-0.59%) fell from highs over 0.6885 yesterday to test 0.6825 today. MAs aligned lower, MACD histogram & signal line negative and falling. RSI 39.22 & falling, H1 ATR 0.00183, Daily ATR 0.00935.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Stuart Cowell

Head Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.