Date: 17th January 2024.Eurozone Economic Trends: Inflation, Growth, and Central Bank Outlook.

In the ever-evolving landscape of the Eurozone economy, key indicators suggest a complex scenario of lower inflation and weakened growth. While central bank officials express optimism about a potential soft landing, the ongoing improvement in German ZEW investor confidence supports this outlook. As we delve into the intricacies of economic data, it becomes evident that the European Central Bank (ECB) is contemplating rate cuts later this year, despite maintaining a cautious wait-and-see stance, while investors are onec again buying into hopes of early trade cuts.

Eurozone data so far was mixed, with German HICP ticking up at the end of 2023 and German ZEW investor confidence coming in stronger than anticipated. At the same time, consumer inflation expectations declined, according to the latest ECB survey. ECB officials meanwhile continued to signal that it is too early to talk about rate cuts, even if ECB’s Villeroy repeated that rates are set to decline this year.

German Inflation Landscape: German HICP inflation, confirmed at 3.8% y/y for December, reflects a nuanced picture. The rise in national CPI to 3.7% y/y is partly attributed to base effects from a one-off energy support payment in December 2022. Notably, food price inflation eased to 4.6% y/y, contributing to an overall inflation rate of 3.5% y/y when excluding energy and food. The challenge lies in the impact of these rising prices on disposable income, weighing on demand and overall growth.

Economic Contractions and Optimism: The German GDP contracted -0.3% last year, with adjusted figures showing a flash estimate of -0.1%, potentially indicating a technical recession in the latter half of 2023. Factors such as high inflation, increased debt financing costs, and weakened domestic and external demand have posed challenges to the recovery from the pandemic. Despite these setbacks, German ZEW investor expectations unexpectedly improved, suggesting a cautious optimism driven by hopes of major central bank rate cuts.

Eurozone Industrial Production and Trade Dynamics: Eurozone industrial production contracted -0.3% m/m in November, aligning with expectations and signaling a potential decline in GDP for the last quarter of 2023. Concurrently, the Eurozone seasonally adjusted trade surplus widened to EUR 14.8 billion in November, driven by a rise in exports and a decline in imports. However, the subdued improvement in real terms indicates that the widening surplus may not necessarily signify an overall economic upturn.

Central Bank Insights and Currency MovementsECB officials remain vigilant, emphasizing that it is premature to declare victory over inflation. Despite differing opinions within the central bank, the latest ECB survey shows a drop in consumer inflation expectations. Geopolitical risks further complicate the outlook, with potential impacts on inflation. Austrian central bank head Holzmann cautions against expecting a rate cut in 2024 amid increasing geopolitical threats.

In the current WEF Annual Meeting, ECB’s Lagarde flagged rate cuts in the summer. When asked about a possible rate cut in the summer the central bank head told Bloomberg she suggested that there is likely to be a majority in favor of such a move by then, but cautioned that the ECB has to be “data dependent”. Lagarde stressed “that there is still a level of uncertainty and some indicators that are not anchored at the level where we would like to see them”. Meanwhile, ECB’s Knot stated it’s unlikely that rates will go up again, but he warned that the ECB needs to see a turnaround in wages before making a decision and that any easing, if it happens, will be very gradual. Knot also stressed that the more easing markets are pricing in, the less likely it is that the ECB will indeed cut rates. More push back against excessive rate cut expectations has put bonds under pressure this morning, amid the large number of central bankers stressing that rate cuts are not on the agenda for now.

US30 – Global Sentiment Towards Stocks Declines. Eyes on Goldman Sachs Earnings!EURO: Central Bank and Growth Outlooks Influence Exchange Rates

US30 – Global Sentiment Towards Stocks Declines. Eyes on Goldman Sachs Earnings!EURO: Central Bank and Growth Outlooks Influence Exchange RatesIn the currency markets, EURUSD has undergone correction in response to central bank and growth outlook uncertainties. With the USDIndex surpassing the 103 mark and Treasury yields fluctuating, EURUSD corrected to 1.0883, reflecting the dynamic interplay of market forces.

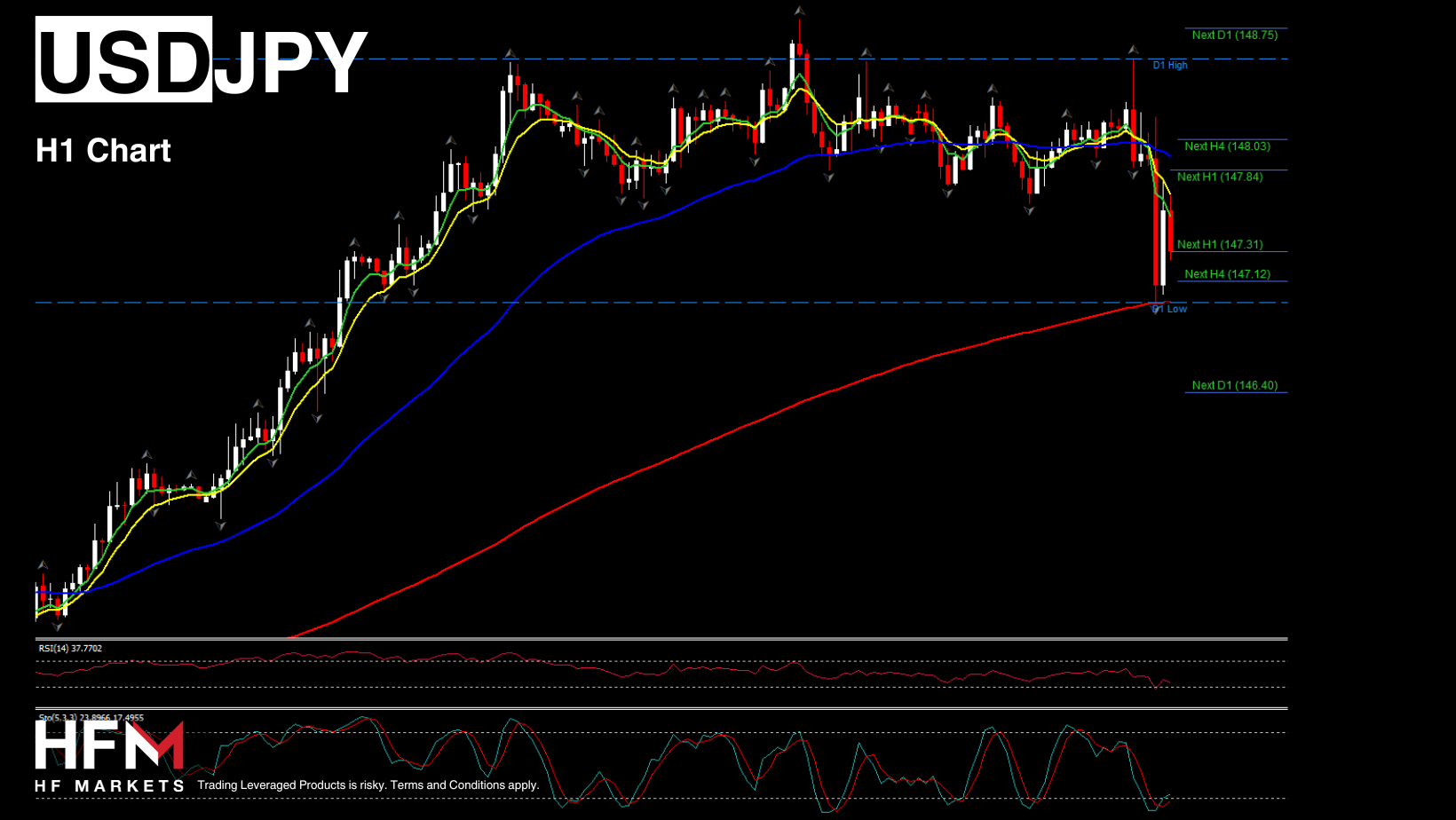

EURJPY has been oscillating within the 158.50-160.00 range after experiencing a robust rebound to a one-month peak of 160.17 last week.

From a technical perspective, the short-term range is delineated by the 50% and 61.8% Fibonacci retracement levels from the previous decline. Notably, the sequence of higher highs and higher lows, initiated from December’s low point, remains encouraging.

Furthermore, the Relative Strength Index (RSI) is still hovering above its neutral mark of 50, and the Moving Average Convergence Divergence (MACD) is showing marginal strengthening, positioned slightly above its zero and signal lines. This maintains a positive bias in the market sentiment.

Practically, for the bullish momentum to persist, a decisive close above the 160.00-160.50 zone is essential. This breakthrough could pave the way for an advance towards the 78.6% Fibonacci level at 162.00 and the previously breached ascending trendline from March 2023, located at 162.70. Further upward movement may retest the ceiling observed in November at 163.70-164.28.

Conversely, if the price dips below the 158.50 support, a period of consolidation might occur around the 38.2% Fibonacci level at 157.40 before sellers target the lower boundary of the bullish channel at 156.45. A bearish breakout from this point could extend towards the 200-day Exponential Moving Average (EMA) positioned at 155.20.

In summary, while EURJPY retains bullish momentum, a sustained breach above the 160.00-160.50 region is crucial for a more significant upside potential.Always trade with strict risk management. Your capital is the single most important aspect of your trading business.Please note that times displayed based on local time zone and are from time of writing this report.Click

HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click

HERE to register for FREE!

Click HERE to READ more Market news.

Michalis Efthymiou

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

HotForex is an award winning, fully regulated and licensed online forex and commodities broker. Offers various accounts, trading software and trading tools to trade Forex and Commodities for individuals, fund managers and institutional customers.