Market Update – July 24 – It is all about central banks!

Trading Leveraged Products is risky

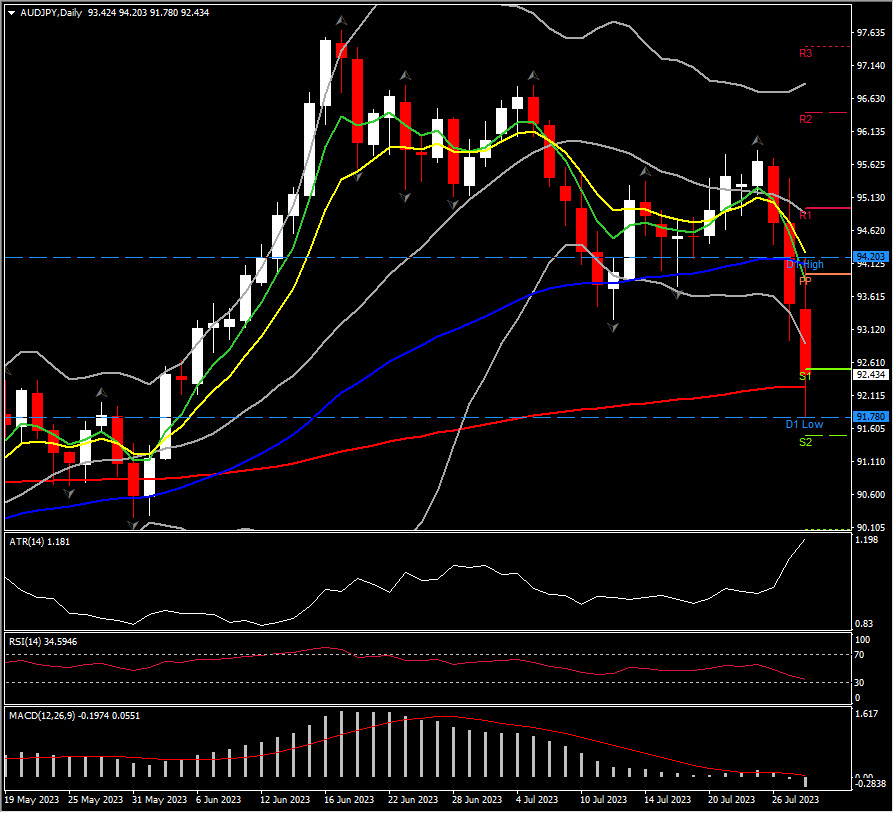

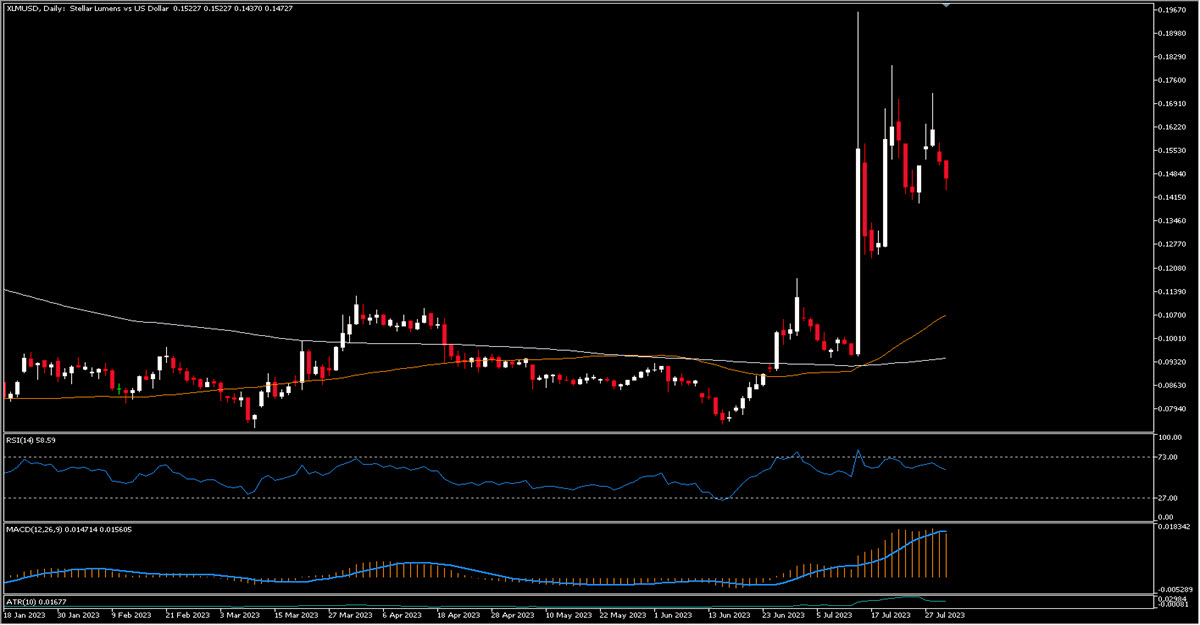

It is all about central bank decisions this week with three major banks on the calendar including the FOMC, ECB, and BoJ, with the markets positioning ahead of these releases. Trading was quiet heading into the weekend while Treasuries have gone through several gyrations in recent weeks amid on-again, off-again expectations regarding the future policy path. Dollar steadied at 100.73 as bearish US Dollar bets prevail. Today, stock markets traded mixed and Japan bourses rallied, as comments and reports suggest the bank sees little need to tweak policy or address the side effects of YCC.

Sunday: Spain was plunged into political uncertainty on Sunday night as both the right and left failed to secure a clear path to forming a government, even though the opposition People’s Party won the most seats in parliament.

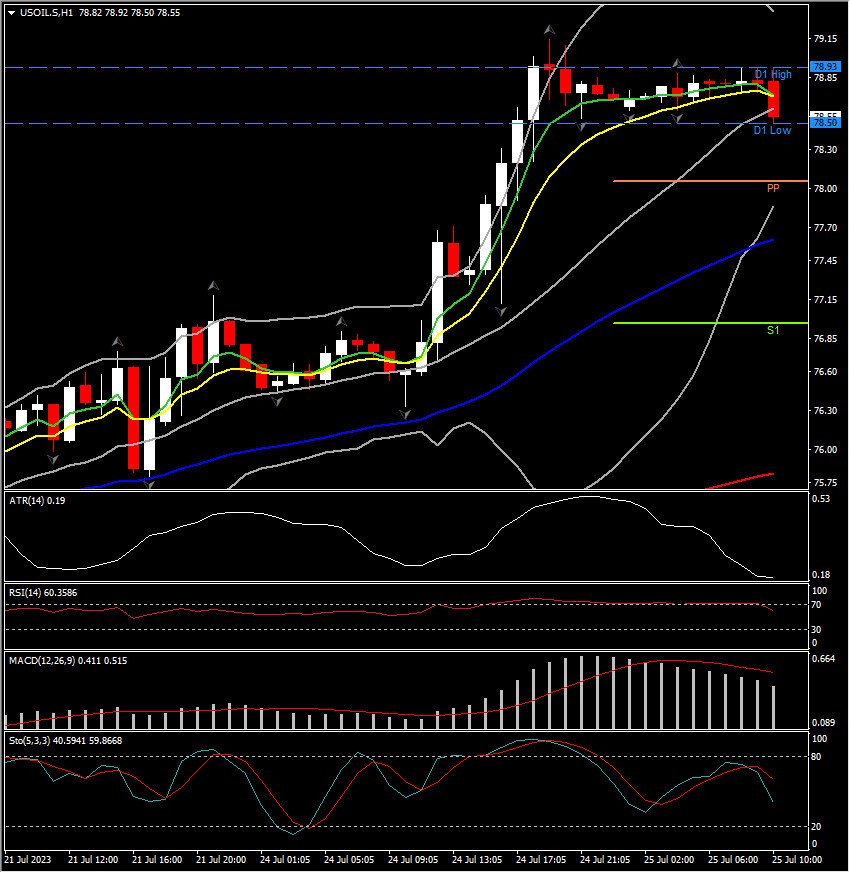

OIL is still headed north, USOil regained $76, UKOil is trading above $80. You have probably heard about the rally in agriculturals and it’s good to keep an eye on the commodities prices input for future inflation developments. Anyway, Wheat price is still well below where it has been for the vast majority of time since the beginning of 2022.

*FX – The USDIndex firmer at 100.73. USDJPY at Friday’s highs at 141.55 as gains against JPY were pronounced after indications from BoJ Ueda that the Bank is not looking to tweak YCC any time soon. GBP hovering around 20-DMA, at 1.2870, while EUR holds above 1.11 for now.

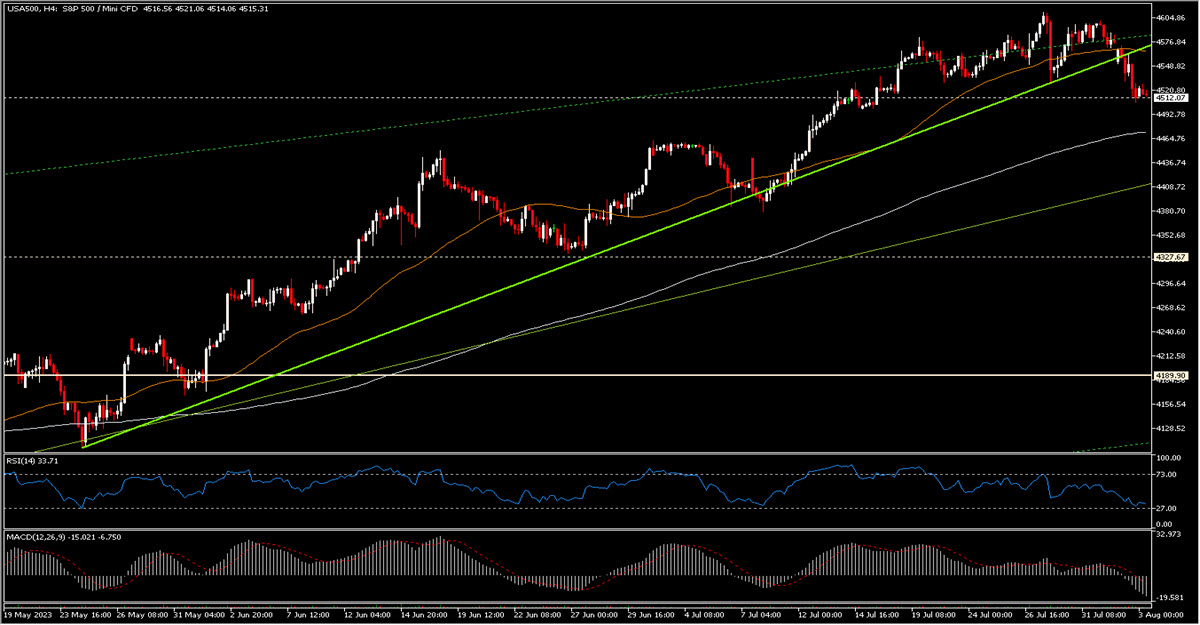

*Stocks – The JPN225 closed up 1.23% at 32,700.7 amid the automakers rally including Mitsubishi (+5.55%). GER40 and UK100 are down -0.4% and US futures are narrowly mixed, with the US100 outperforming slightly. Hong Kong’s Hang Seng index was a bit of an outlier on the downside with a drop of 1.5%, dragged lower by Chinese property developers which tumbled more than 5%. #Nvidia -2.66%, #META -2.73%, Chevron +1.46% (strong oil earnings) & #Tesla -1.10%.

*Commodities – USOil remains supported as supply restrictions start to bite, at $76.60.

*Gold – failed to break 20-DMA and currently settled at $1962.80.

Today – Data on Consumer Confidence, Q2 GDP and US inflation. Microsoft, GM, Verizon, Alphabet, Exxon Mobil, Meta and more stocks to watch this week.

Biggest FX Mover @ (06:30 GMT) EURUSD (-0.54%) return below 1.1100 post German manufacturing PMI.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.