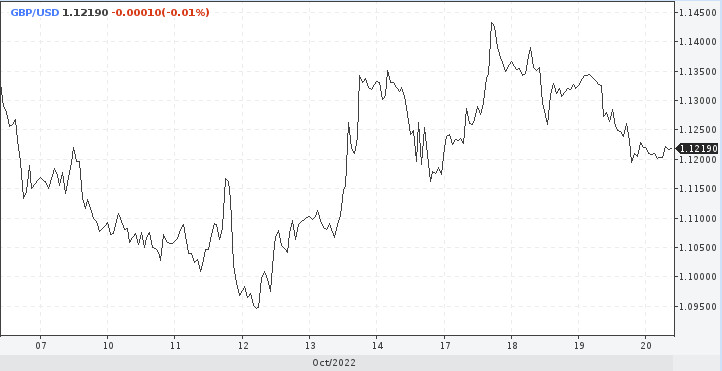

Yesterday, the foreign exchange market experienced a strong storm. At first, the dollar took off like a rocket in all directions, and then it also sharply sprung back. But it still looks good against the yen.

The bouncing dollar

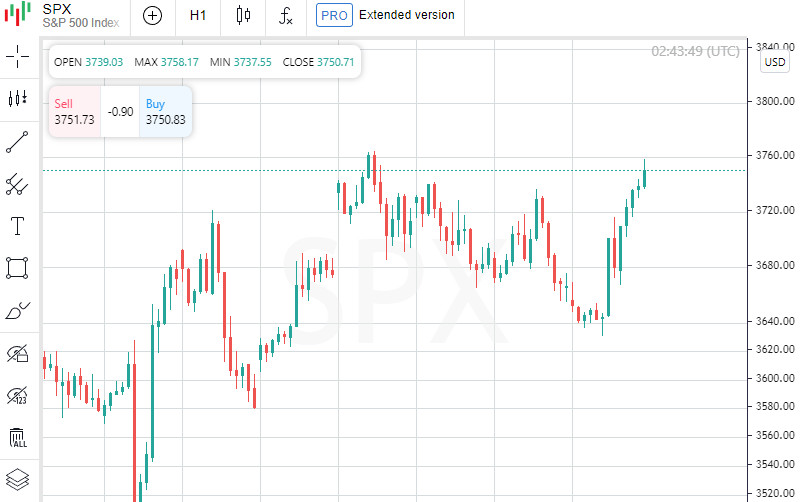

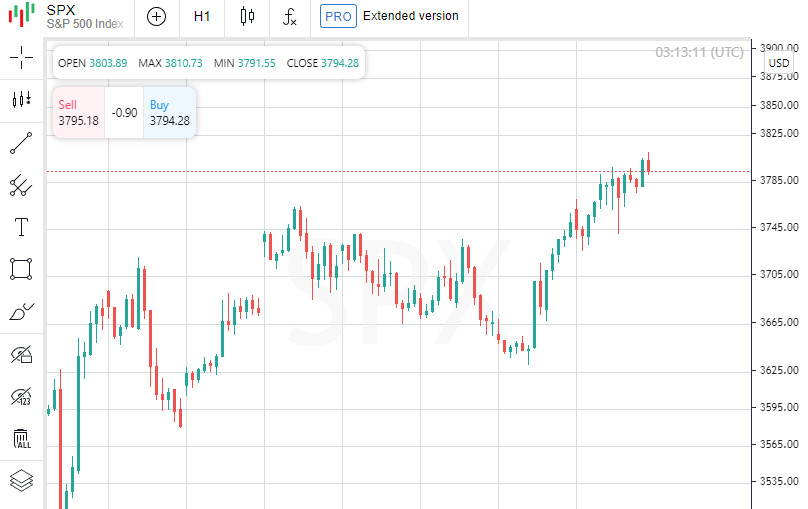

On Wednesday, the US currency showed another parabolic growth against all its major competitors. The springboard for the greenback was the shocking data on inflation in the United States.

Statistics for September showed that consumer prices in America rose more than expected. On a monthly basis, the indicator rose by 0.4% against the forecast of 0.2%.

As for the annual dynamics, inflation also exceeded the preliminary estimate of economists and amounted to 8.2%. This is only 0.1% lower than the value recorded in August.

The market saw that the growth of consumer prices in the United States is still stable, despite the aggressive anti-inflationary campaign launched by the Federal Reserve this year.

This significantly increased traders' expectations about the continuation of the hawkish course in America and the next increase in the interest rate by 75 bps.

Moreover, the hot inflation data again provoked a wave of speculation about a possible rise in the indicator in November by a full percentage point. The probability of such a scenario has increased to 13.4%.

Optimism about a more aggressive tightening served as an excellent springboard for the dollar. Literally overnight, the DXY index jumped by more than 0.5%.

One of the most productive majors was the USD/JPY pair. The quote soared by 0.7% and set another record at 147.665.

The last time the dollar traded against the yen at this level was in 1990. However, the USD/JPY pair did not stay at the 32-year high for long.

Shortly after the release of the consumer price index, the large-scale triumph of the greenback was replaced by an epic failure of the same power.

Analysts explain this by the fact that the market has already fully embedded in the value of the dollar expectations about sustained inflation and its impact on the future course of the Fed. Now a new trigger is needed for the USD to grow steadily, and we will get it soon. Now everyone's focus is switching to the Fed's monetary policy meeting next month.

As we approach the moment X, the dollar will grow on strong US economic data.

The yen is an obvious loser

Despite its recent rebound, the USD/JPY pair still maintains a strong upward mood. This morning, the asset is staying near the 32-year peak reached a day earlier.

Even the growing risk of currency intervention cannot weaken the grip of dollar bulls. At the start of Friday, the Japanese government again threatened to intervene in the market if there is a rapid fall in the yen.

Recall that last month, for the first time since 1998, Japan intervened in support of its national currency, when it fell against the dollar below the level of 145.90.

Given the recent statements of Japanese officials regarding the intervention, it can be assumed that now they will not protect any specific levels.

The other day, the Japanese Finance Minister and the head of the Bank of Japan stressed that at this stage the focus is shifted to the rate of change in the exchange rate.

According to analysts, this approach can keep dollar bulls only from sudden movements, but in general USD/JPY will remain in a bullish trend.

In the future, the asset will move to new price highs quietly for several weeks. Perhaps at some point it will get bogged down in consolidation again, but the upcoming rate hike in the US will not allow it to go into suspended animation for a long time.

The monetary divergence of America and Japan, which has already collapsed the yen against the dollar by almost 28% since the beginning of the year, will continue to intensify and put pressure on the JPY.

This week, BOJ Governor Haruhiko Kuroda once again reaffirmed his commitment to a dovish monetary exchange rate.

He again stressed that he does not consider the current inflation a reason to raise rates, especially since the Japanese economy has not yet recovered from the COVID-19 pandemic and still needs incentives.

Kuroda's comment further aggravated the divergence in the policy of the BOJ and the Fed, especially amid the fact that the market is now expecting further tightening in America.

This suggests that the yen's downward trend against the dollar will not change in the near future, even if the threat of further interventions will contribute to slowing the growth of the USD/JPY pair.

News are provided by

InstaForex.

Read More https://ifxpr.com/3T7qP4H