Forex Analysis & Reviews: Trading Signal for Gold (XAU/USD) On September 28-29, 2022: buy above $1,625 or in case of rebound at $1,600 (0/8 Murray - oversold)

Since the beginning of August, gold (XAU/USD) has been trading inside a downtrend channel. It is likely to find support around 0/8 Murray (1,625).

Gold reached the low of April 05, 2020, at 1,621.01. It is currently trading near these levels and is showing levels of consolidation.

Some members of the FED are supporting further increases in interest rates, even at the risk of slowing economic growth. On Friday, the president of the Federal Reserve Bank of Philadelphia said that he believed that the US central bank could reduce inflation without causing a deep recession and high unemployment.

Yesterday, in the American session, gold made a brief recovery and reached 1,642.33. As it failed to consolidate gains, it changed course and now is facing a decision to break the critical support of 1,625.

In the event of a drop below 1,624, it will head towards the next level of 1,610 and could even drop towards the psychological level of 1,600.

Conversely, a sharp break above the 21 SMA could accelerate the upside momentum and the price could reach the top of the downtrend channel around 1,656-1,662.

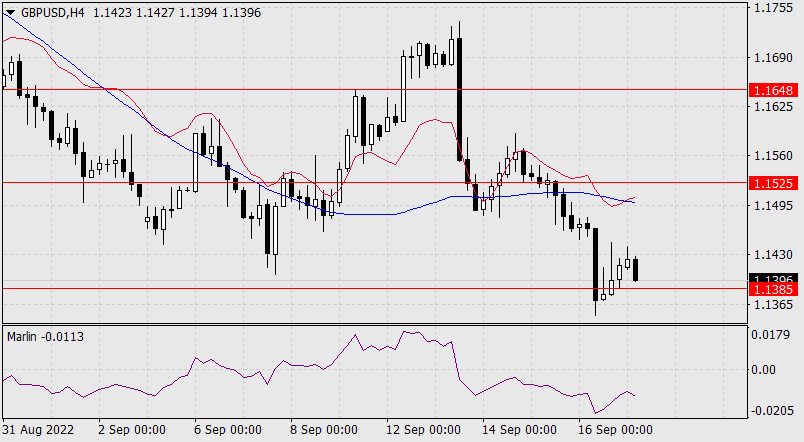

According to the 4-hour chart, the outlook remains negative for gold. In case of extending the bounce, the resistances could be located at 1,641, followed by 1,656. A drop below 1,625 in the short term would expose the area of recent lows and the next support at 1,600.

Our trading plan for the next few hours is to buy XAU/USD only if it trades above 0/8 Murray (1,625) or if there is a technical bounce off the bottom of the downtrend channel around 1,600. With targets at 1,625,1,645 and 1,656.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex.https://ifxpr.com/3DZmVGl