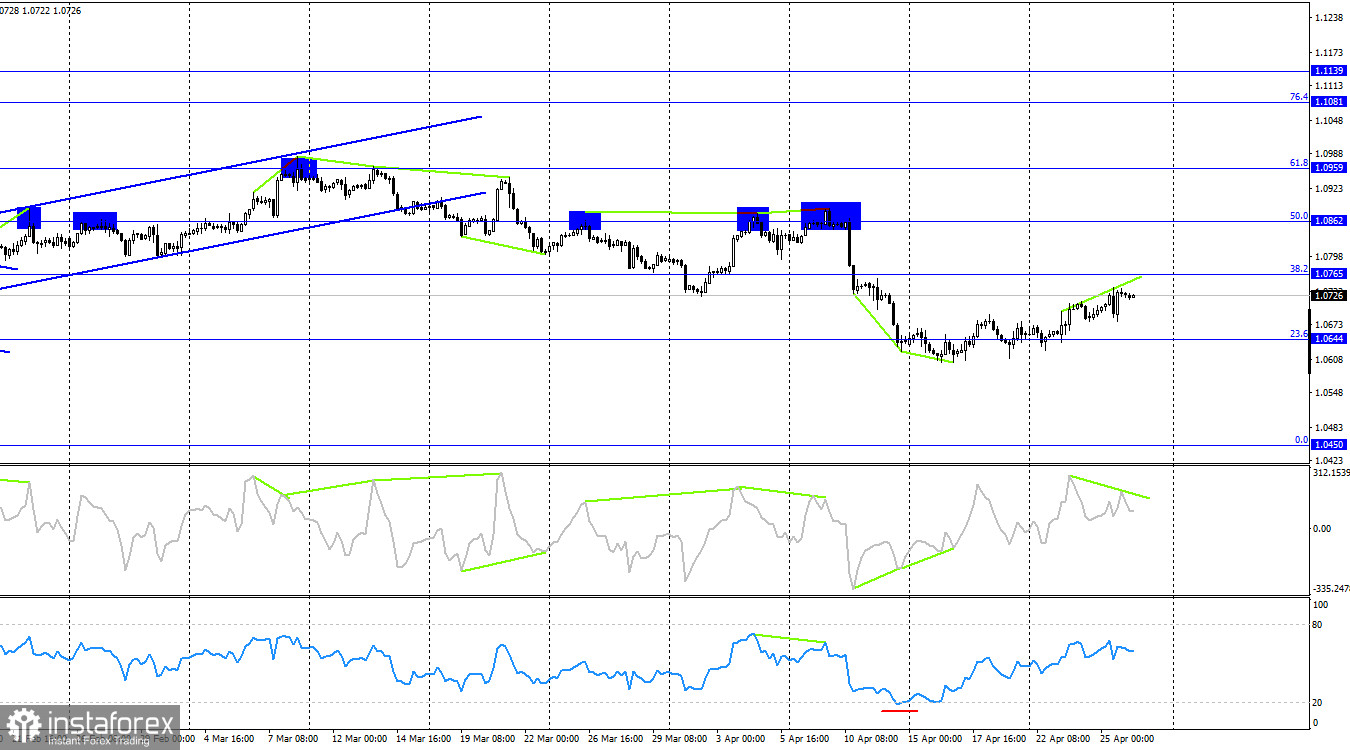

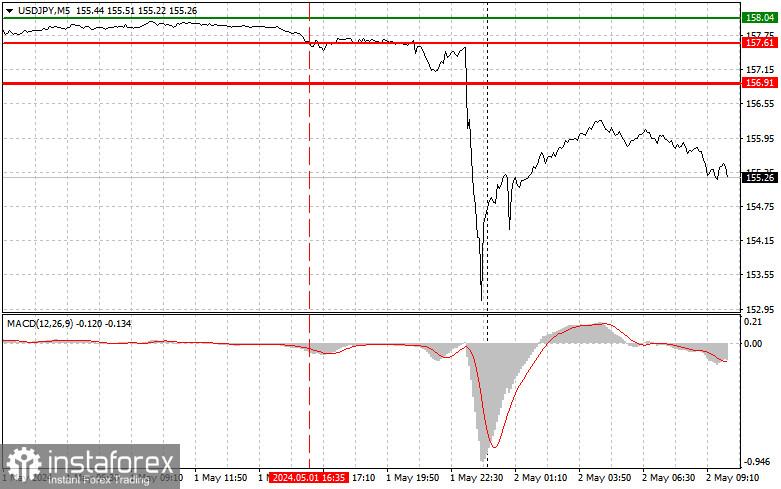

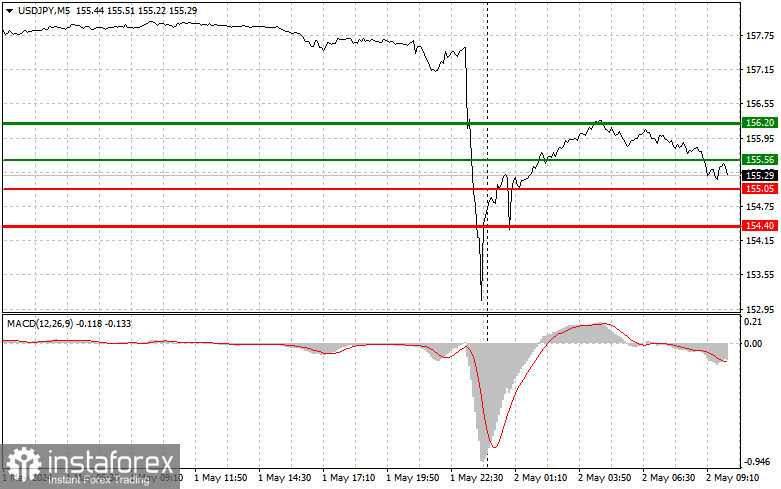

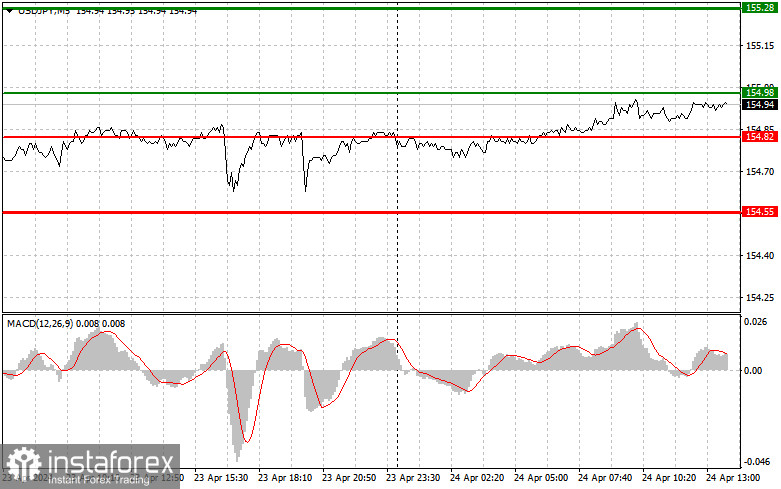

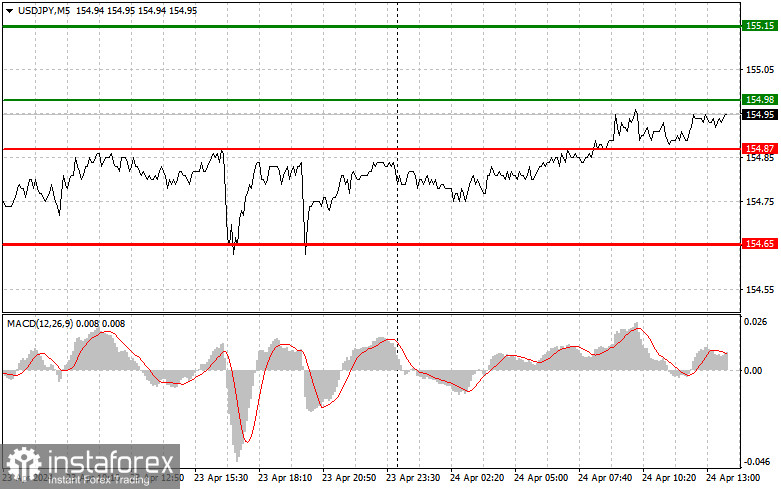

Trade analysis and advice on trading the Japanese yen In line with our usual trading approach, there were no tests of the levels I indicated in the first half of the day near the annual maximum, which prevented entry into the market. Traders betting on the rise of the dollar are increasingly adhering to a strategy of buying on declines from good and solid levels, as only some believe in breaking the annual maximum and significant growth after that. I advise you to do the same, especially since there are no forthcoming statistics capable of leading to breakthroughs in maximums. Data on changes in US durable goods orders is expected, and that's about it. So, trading within the channel and buying on downward slips will be the most relevant option. As for the intraday strategy, I will rely more on scenario #2.

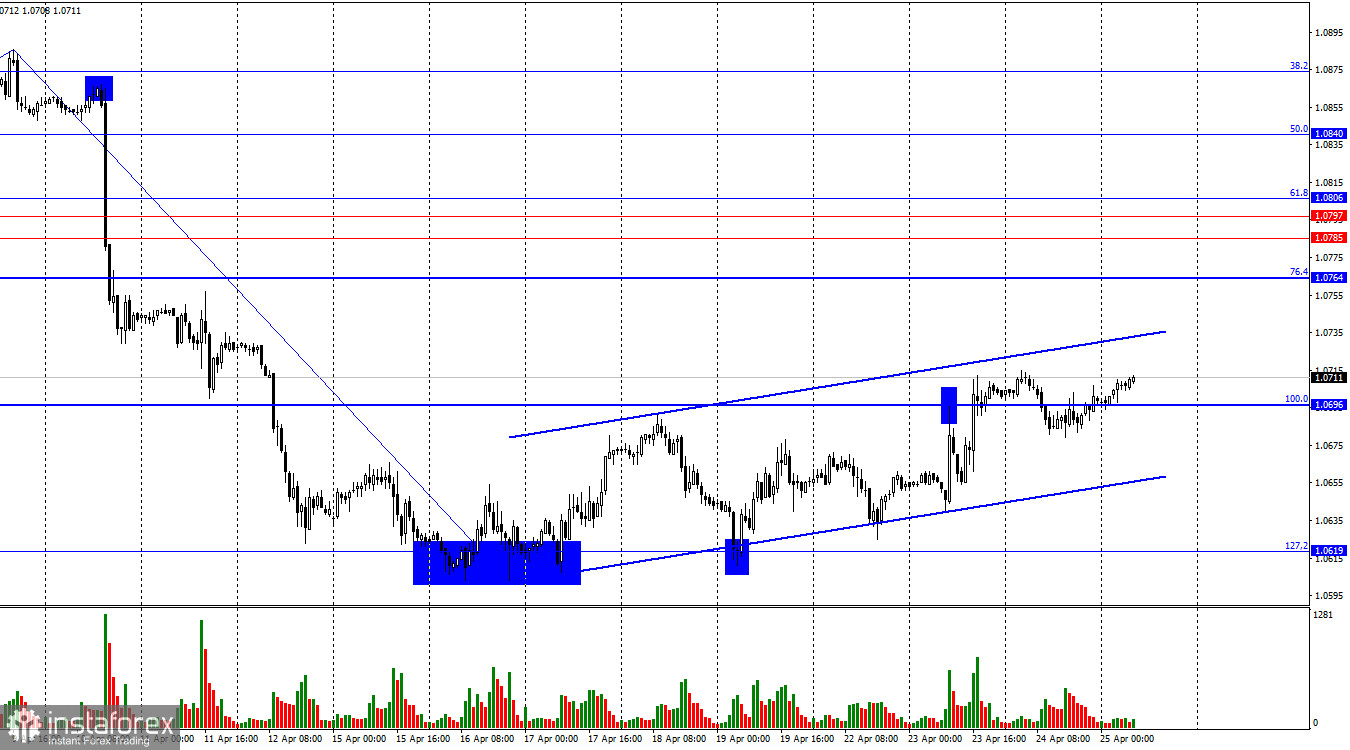

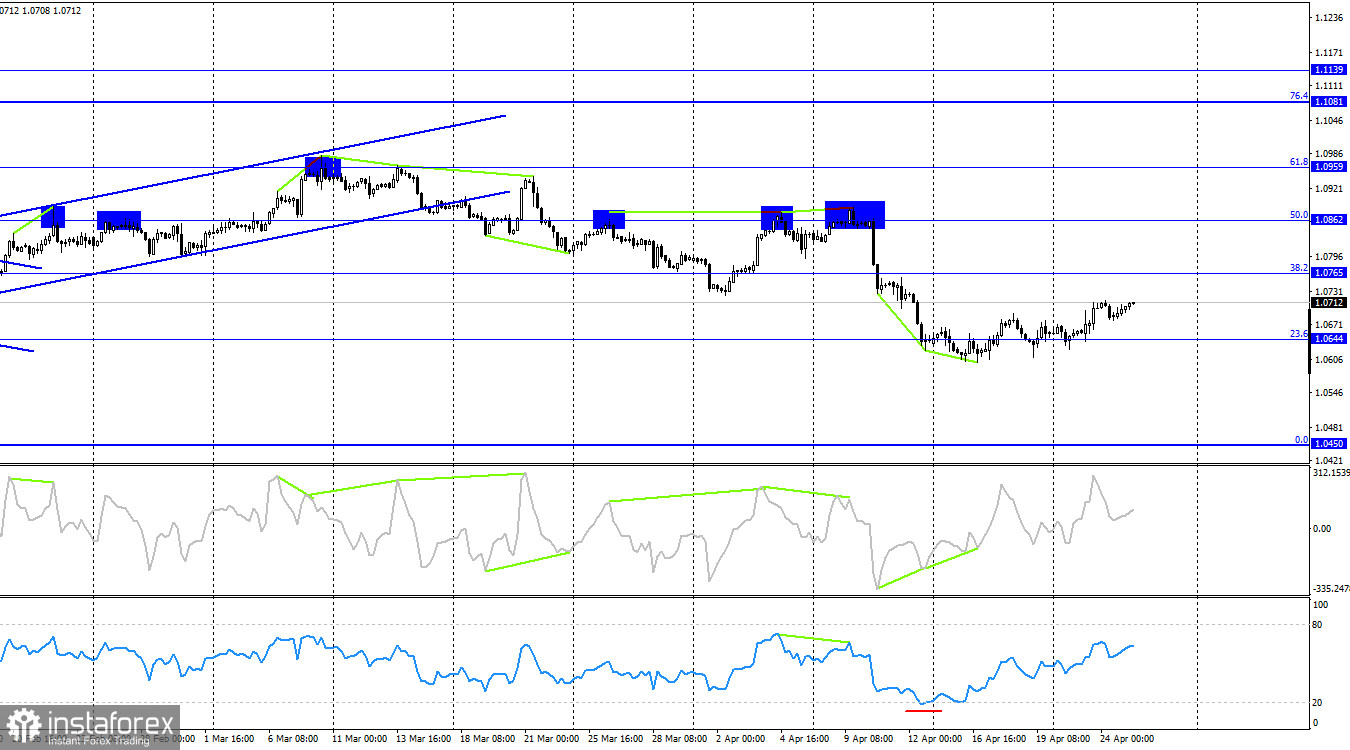

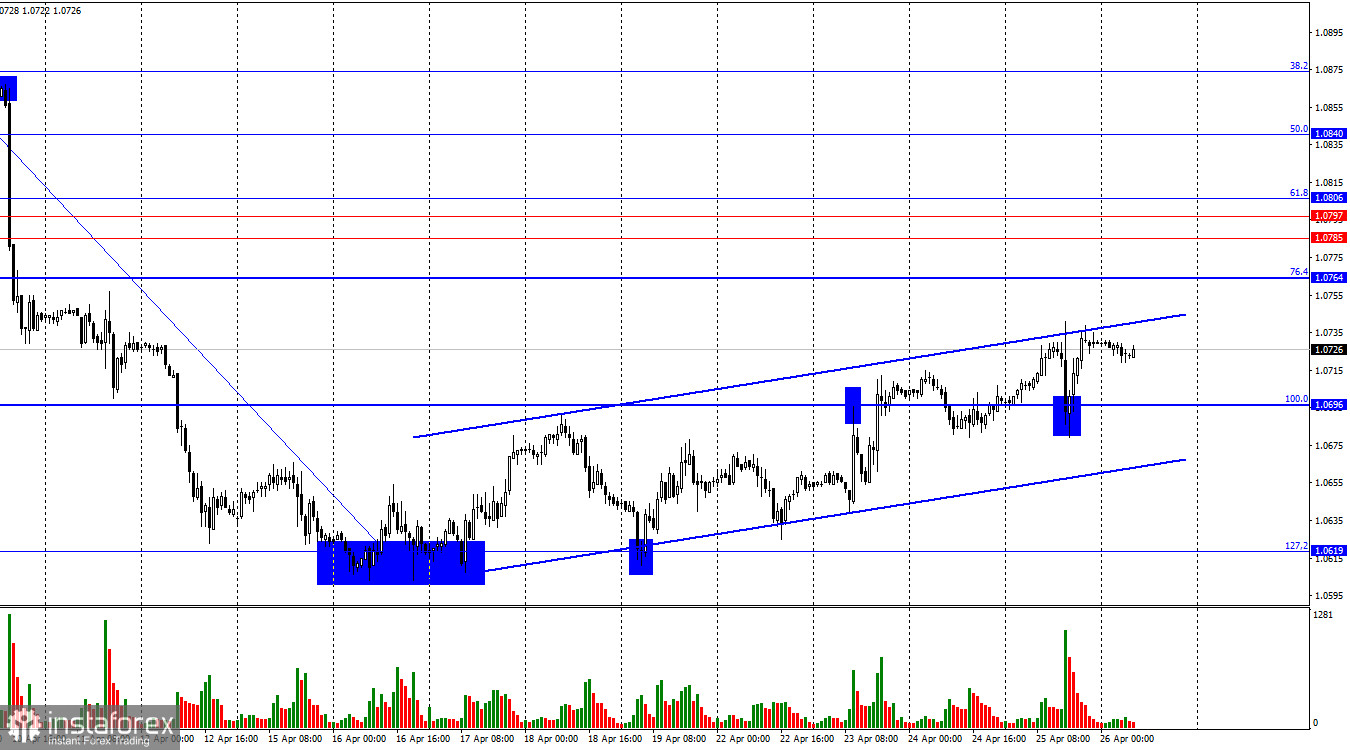

Buy Signal Scenario #1: Today, I plan to buy USD/JPY when the entry point reaches around 154.98 (green line on the chart), with the target of rising to the level of 155.15 (thicker green line on the chart). At around 155.15, I will exit purchases and open sales in the opposite direction (aiming for a movement of 30-35 pips in the opposite direction from the level). Counting on the pair's rise today will only work after very strong US statistics. Important! Before buying, make sure that the MACD indicator is above the zero mark and is just starting to rise from it. Scenario #2: I also plan to buy USD/JPY today in case of two consecutive tests of the price at 154.87 when the MACD indicator is in the oversold zone. This will limit the downward potential of the pair and lead to a reversal of the market upwards. Expect a rise to the opposite levels of 154.98 and 155.15. Sell Signal Scenario #1: I plan to sell USD/JPY today after updating the level of 154.87 (red line on the chart), which will lead to a rapid decline in the pair. The key target for sellers will be the level of 154.65, where I will exit sales and also immediately open purchases in the opposite direction (aiming for a movement of 20-25 points in the opposite direction from the level). Pressure on the pair will return in case of an unsuccessful breakout of the daily maximum. Important! Before selling, make sure that the MACD indicator is below the zero mark and is just starting to decrease from it. Scenario #2: I also plan to sell USD/JPY today in case of two consecutive tests of the price at 154.98 when the MACD indicator is in the overbought zone. This will limit the upward potential of the pair and lead to a reversal of the market downwards. Expect a decline to the opposite levels of 154.87 and 154.65.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/49Stirt