Forex Analysis & Reviews: EUR/USD. Analysis for March 6th. The dollar is on the verge of a new decline

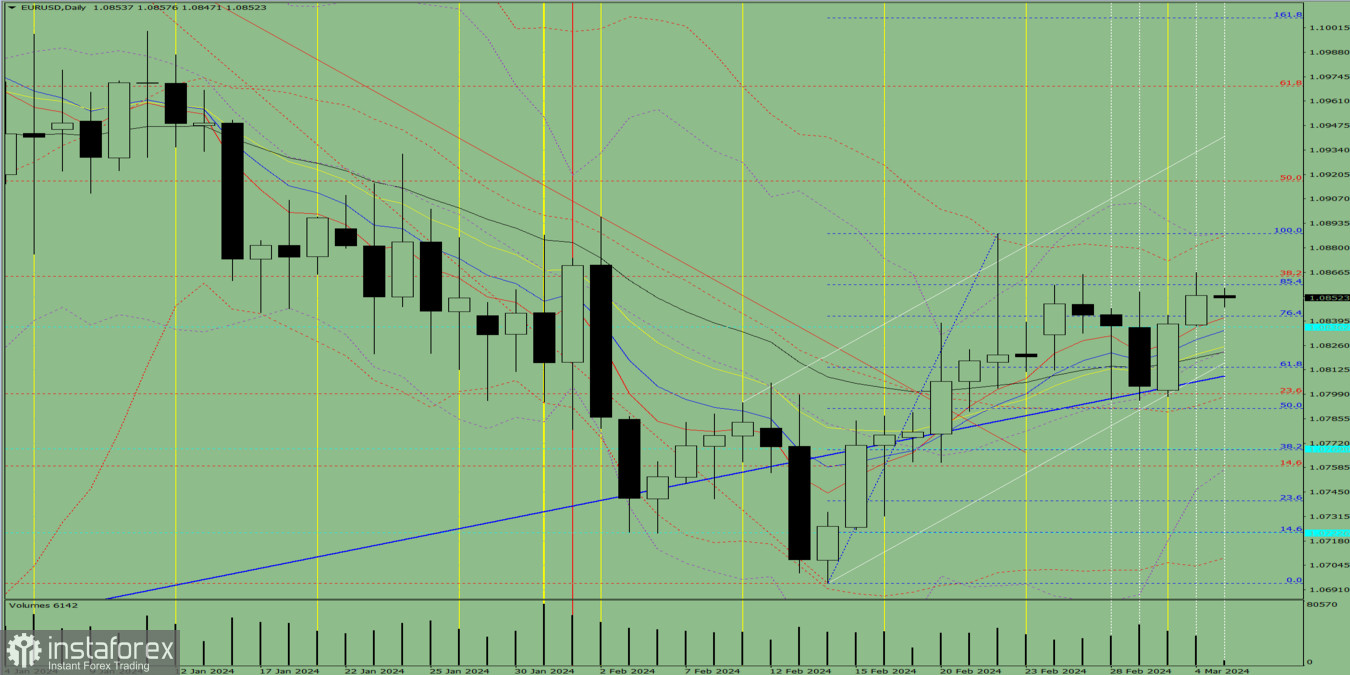

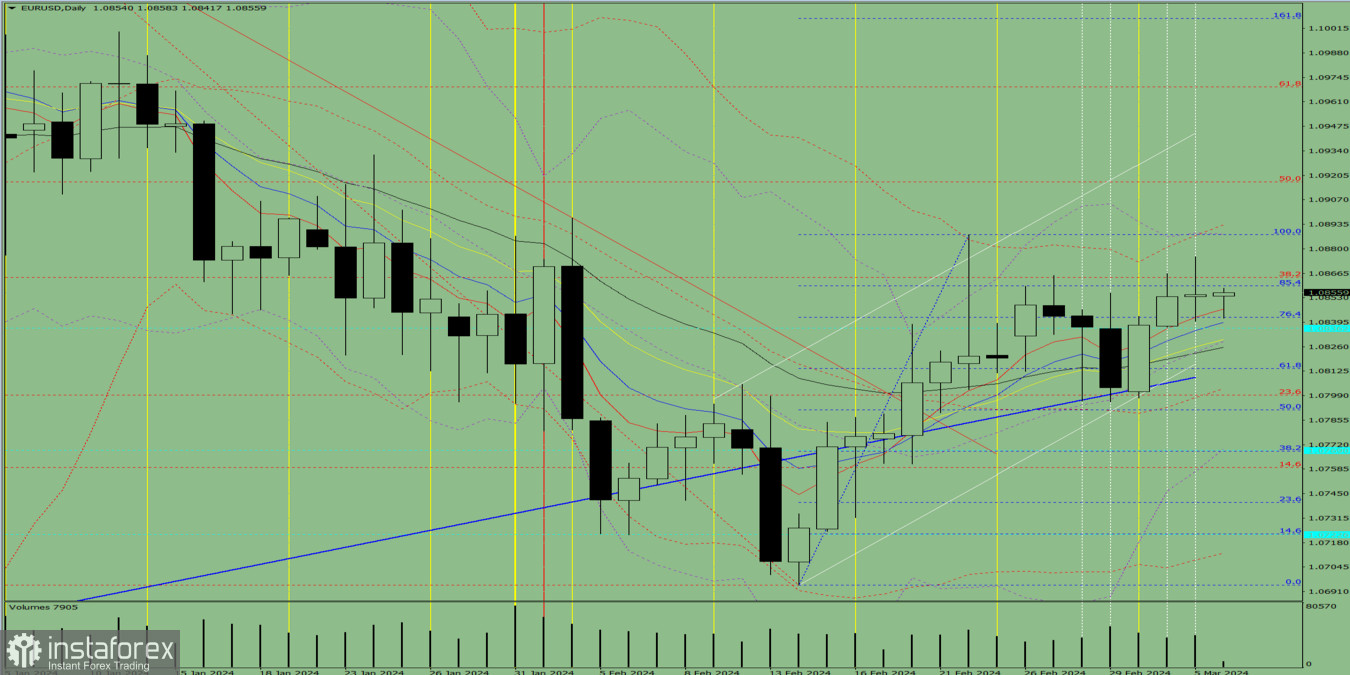

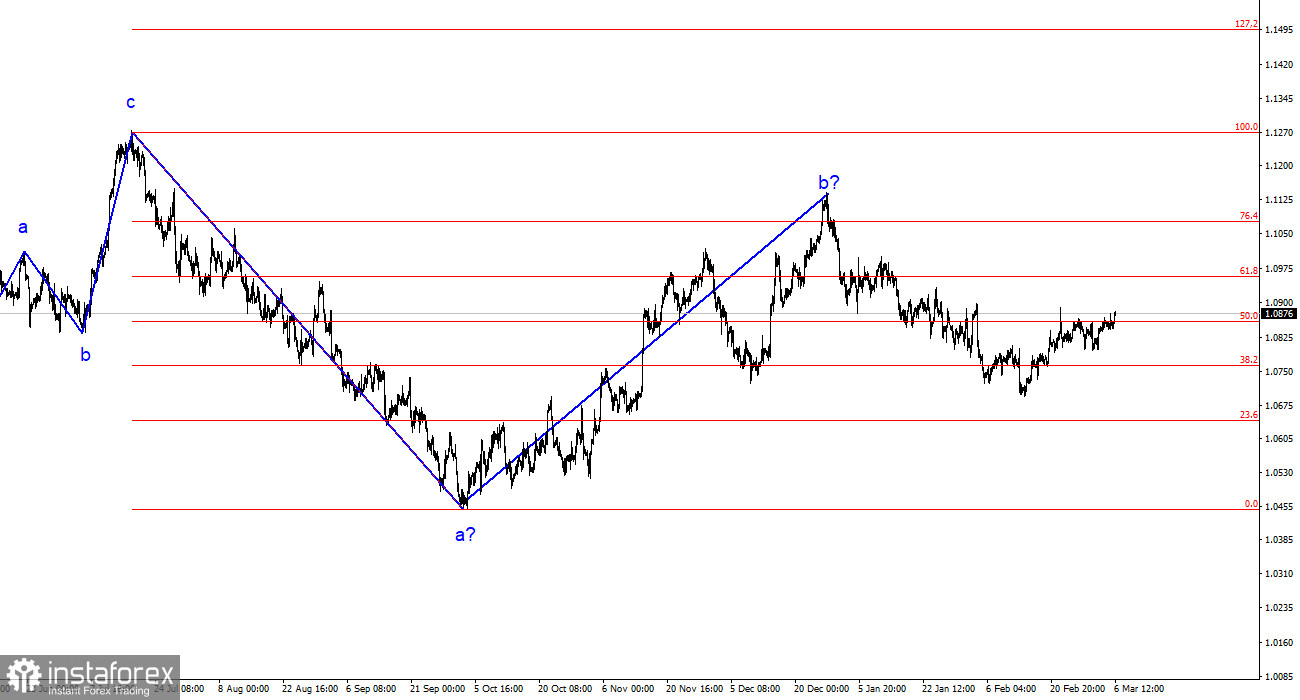

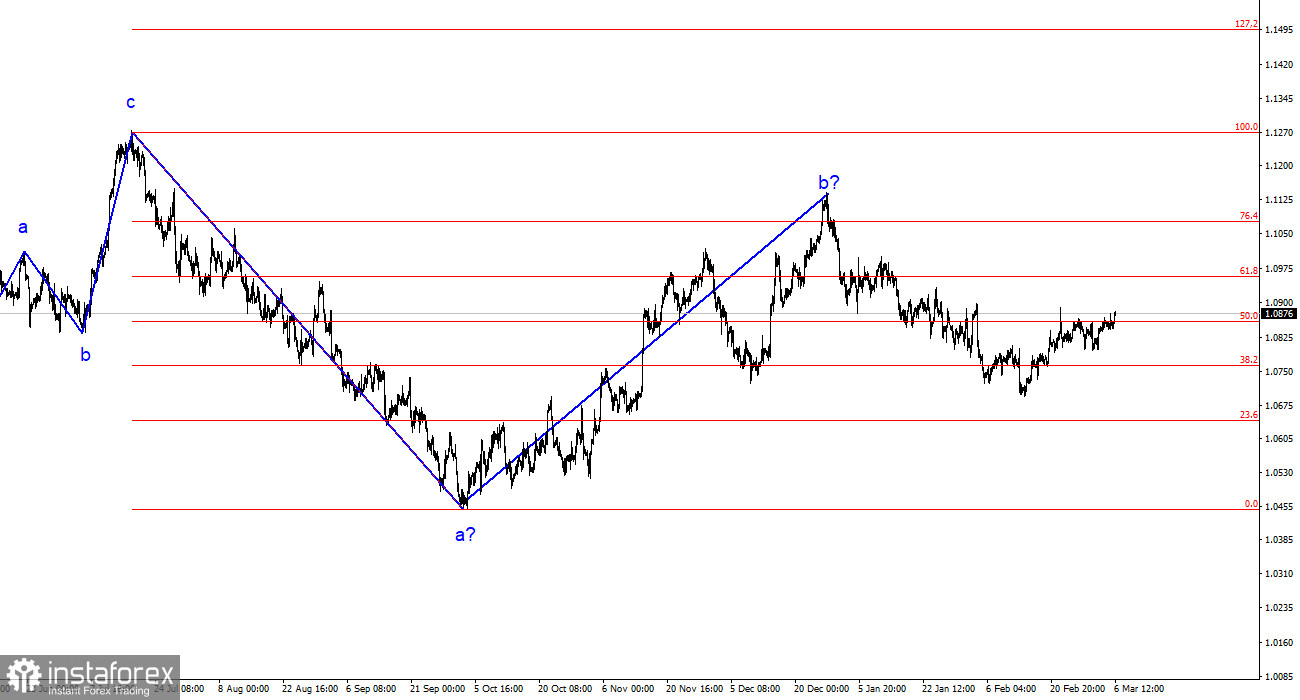

The wave analysis of the 4-hour chart for the EUR/USD pair remains unchanged. Over the past year, we have seen only three-wave structures of a larger scale that constantly alternate with each other. Currently, the construction of another three-wave structure is continuing - a downtrend that began on July 18 of last year. The presumed wave 1 is complete; wave 2 or b has become more complex three or four times but is now also complete as the decline of the pair has been ongoing for more than two months.

The upward trend section may still resume, but its internal structure will be absolutely unreadable in this case. I remind you that I try to highlight clear and unambiguous wave structures that do not tolerate dual interpretations. If the current wave analysis is correct, the market has moved on to form wave 3 or c. Currently, presumably, wave 2 in 3 or c is being built. If this is indeed the case, an unsuccessful attempt to break the 61.8% Fibonacci level may indicate the completion of this wave. At the same time, this wave can take on a distinctly three-wave form. In any case, this decline in the quotes of the pair should not be completed.

Alternatively, wave analysis may become significantly more complicated. The exchange rate of the EUR/USD pair rose by 15 basis points on Wednesday. Every day I say the same thing: market activity is currently so low that all price changes can be ignored. In addition to low market activity, the pair has been in a horizontal movement between Fibonacci levels 76.4% and 61.8% for over two weeks. Wave 2 in 3 or c may take on a three-wave form, implying a breakthrough of the 1.0881 mark. If this happens, the American currency may depreciate even more. However, there is no need to worry about this. Correctional waves often take on a three-wave form, so it can be said that everything is going according to plan.

Today, as well as Thursday and Friday, will be crucial for the American currency. In a couple of hours in America, reports on job vacancies and the number of new employees in the non-agricultural sector will be released, and Jerome Powell will speak in the US Congress. Tomorrow is another Powell speech, and the day after tomorrow is the nonfarm payrolls and unemployment reports. And this is not counting the ECB meetings and Christine Lagarde's speeches. Everything indicates that the last three working days of the week should be fiery.

For the current wave analysis to be preserved, at least not all of these events should increase demand for the euro. If at least half of the reports favor the dollar, and Lagarde and Powell do not change their previously voiced rhetoric, the dollar may depreciate within the wave plan. And then move on to building wave 3 in 3 or c. If this wave starts today or tomorrow, I'm fine with that too. I continue to consider only selling the pair.

Analysis are provided byInstaForex.Read more:

https://ifxpr.com/3TpIhE0