The EUR/USD currency pair traded quietly, mostly sideways, on Monday. However, there is little doubt that this is just a pause before the next storm, and the new storm will likely not favor the US dollar. Just as sentiments regarding Greenland began to settle, Donald Trump initiated a new saga entitled "US vs. Canada." It seems that Trump has grievances against all nations on the planet; they are all living incorrectly and only exist due to America. This time, the controversial US president is unhappy with a possible trade deal between China and Canada. According to Trump, Canada wants to become a "buffer" between China and the US, accepting goods from China for further trafficking into America. Thus, we again see Trump trying to establish a world order that suits him. Furthermore, it's no longer just about relationships between America and other countries. Even Uganda might face US tariffs for trading with Zimbabwe. Everything will depend on Trump's opinion and mood. It seems that Trump wants every country to ask Washington for permission before taking any steps on the international stage. It sounds absurd, but, by his actions, this is precisely what the American president is striving for. Trump has stated that Canada exists only due to the US, while Canadian Prime Minister Mark Carney has called on the world to oppose autocracy. The Republican president took offense and did not invite Canada to the "Council of Peace," of which Trump must be the lifelong chair. If we weren't sure that this is reality, we might think it is some sort of fantastic novel. It should also be noted that Trump has encroached on Canadian sovereignty and independence since the day he became president of the United States for the second time. His initial attacks included offering Canada to become the 51st state of America. Now, Trump wants to impose 100% tariffs on goods from Canada if it reaches a free trade agreement with China. Overall, we are not surprised at all. Throughout the last year, we constantly stated that Trump considers China his main enemy. Therefore, grievances against China are continually raised. Other countries cannot trade with China. Additionally, Trump is attempting to claim what is easily accessible, such as Greenland or Venezuelan oil. The key is to arrange everything so that the world has no serious complaints against Washington. And Trump's plan is working, if not 100%, then at least 80%. Almost all countries, except for Canada, Russia, Iran, and China, prefer not to spoil relations with the controversial Republican, and as a consequence, yield to his threats to varying degrees. Understanding that his tactics are effective, Trump continues to make further demands for resources, money, and territories. This is an endless game.

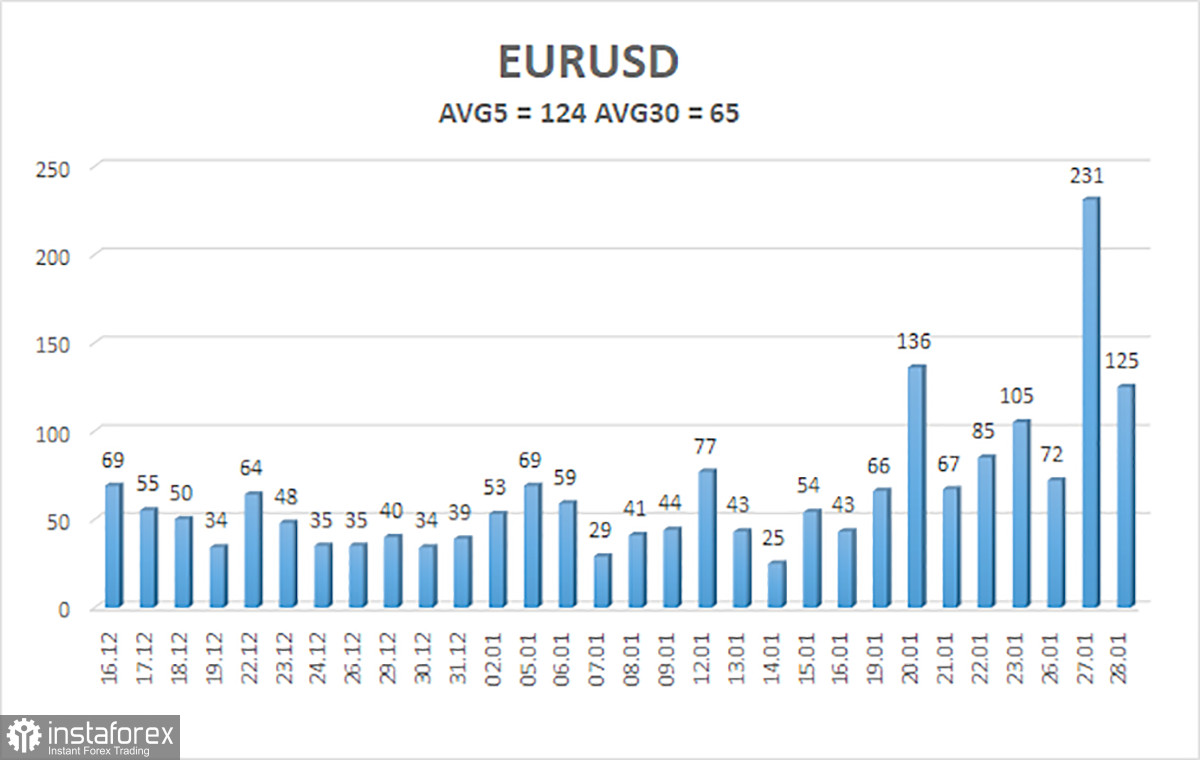

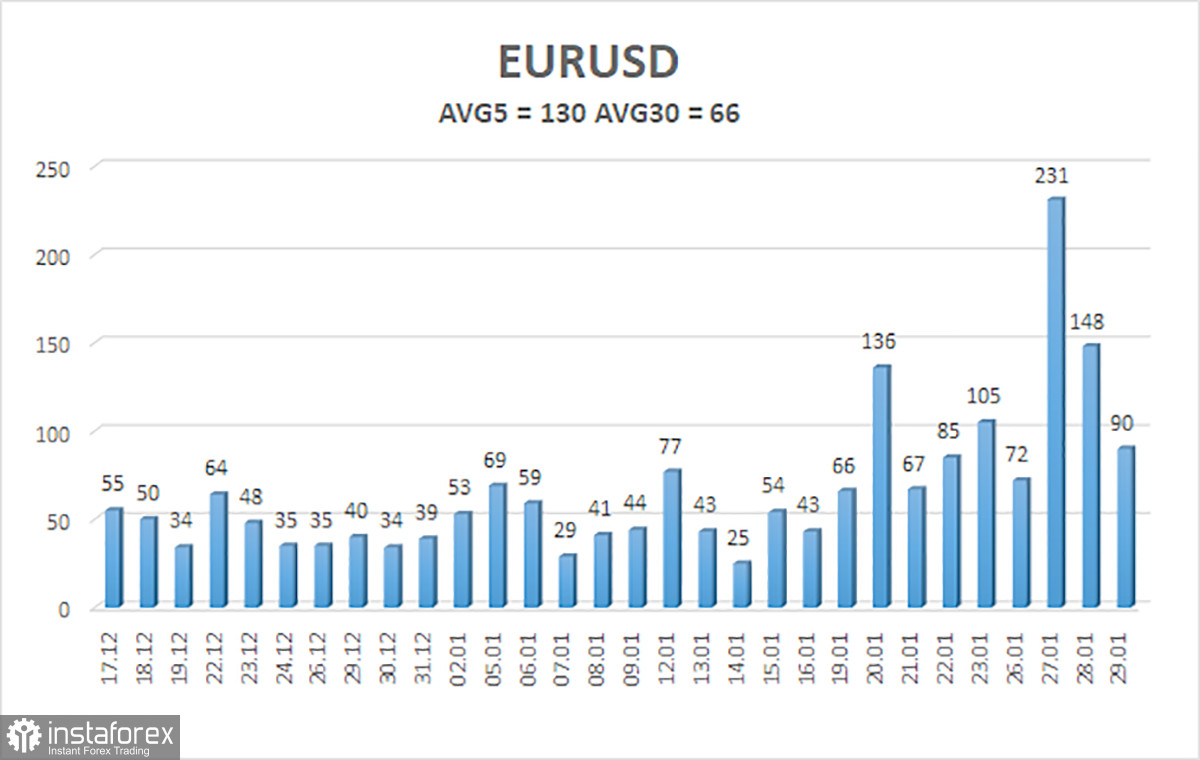

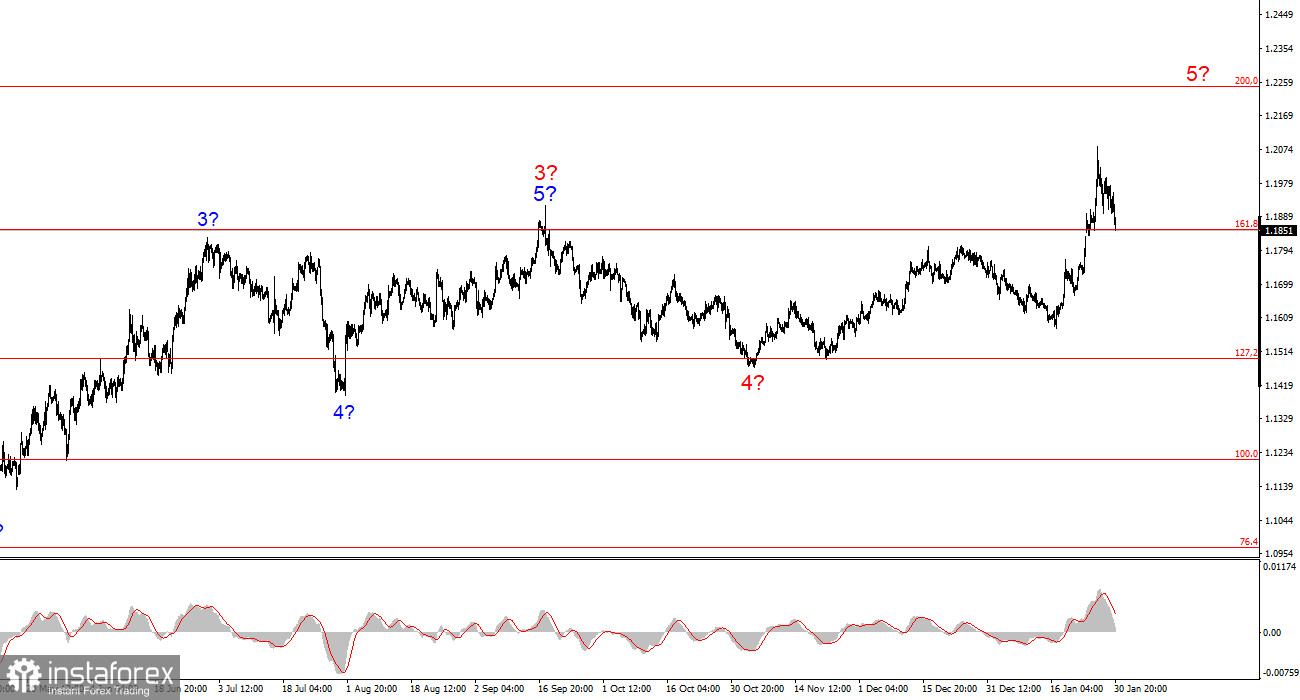

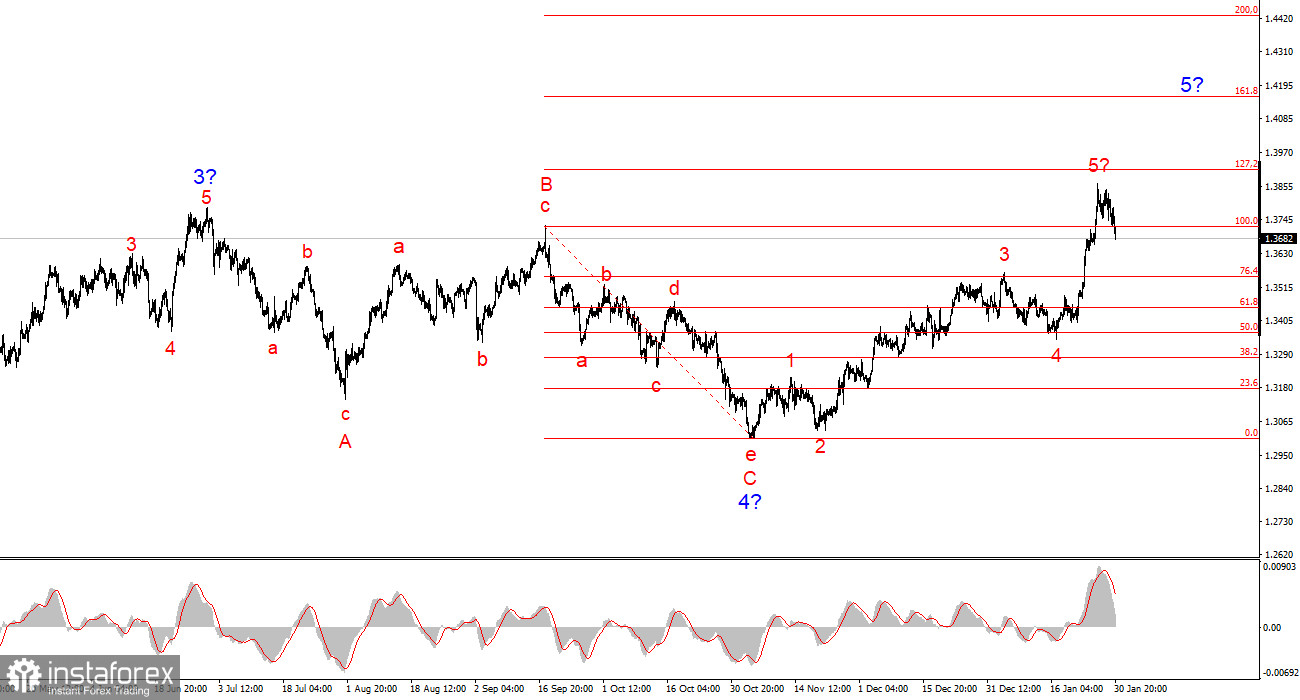

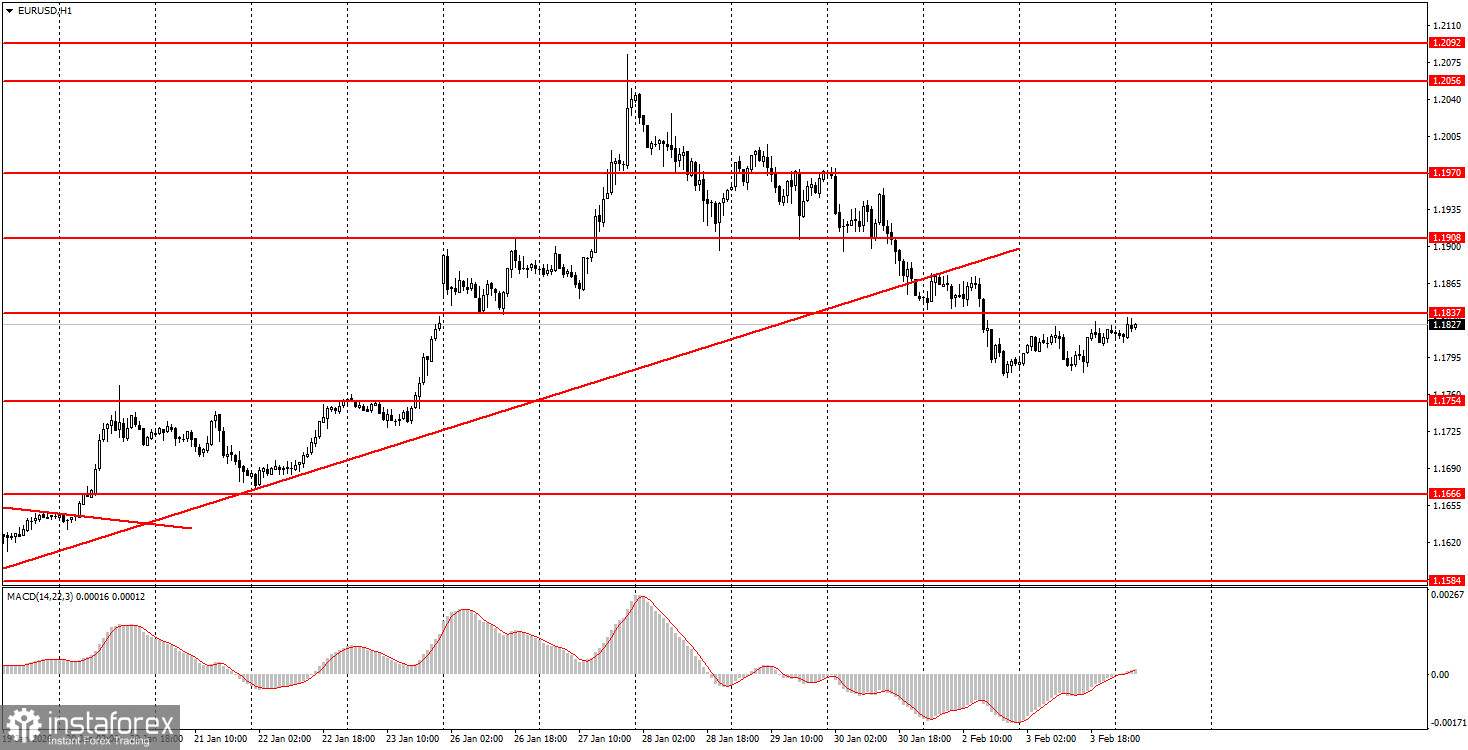

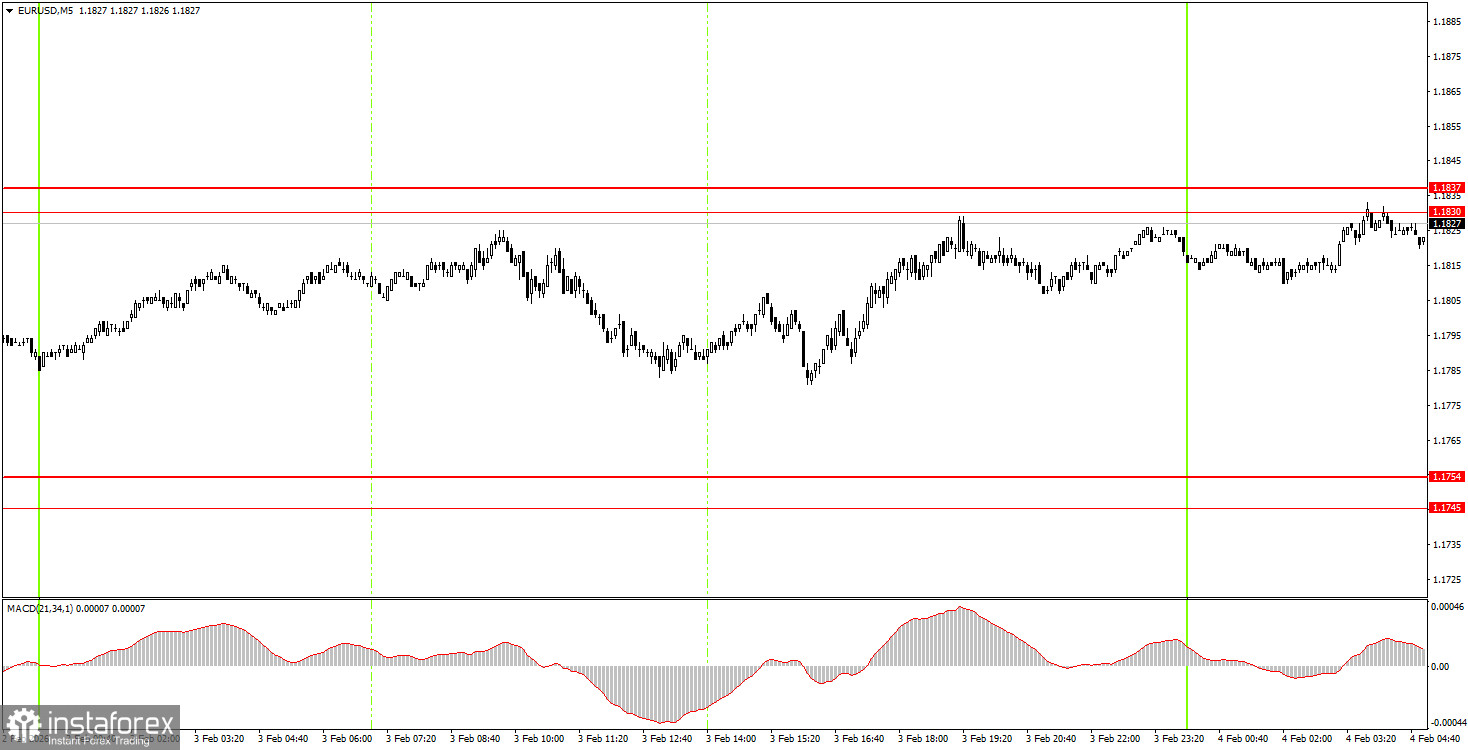

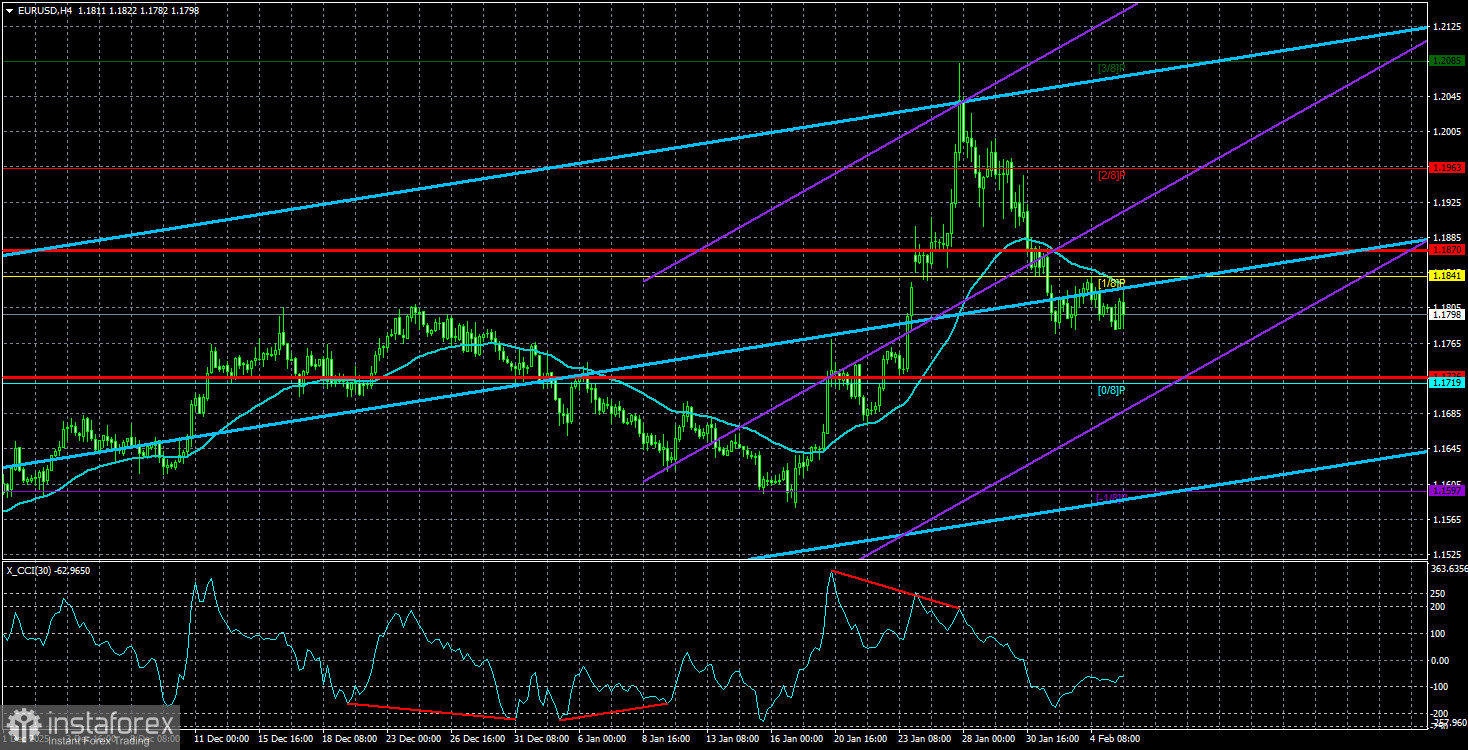

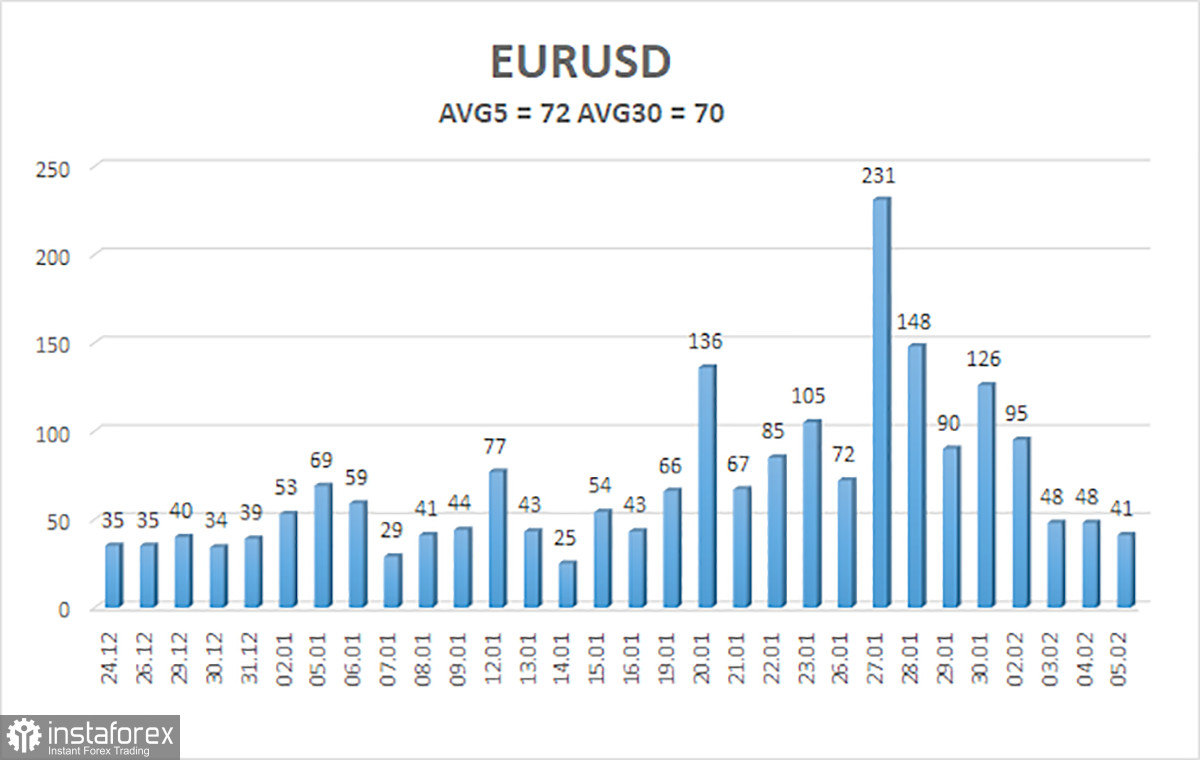

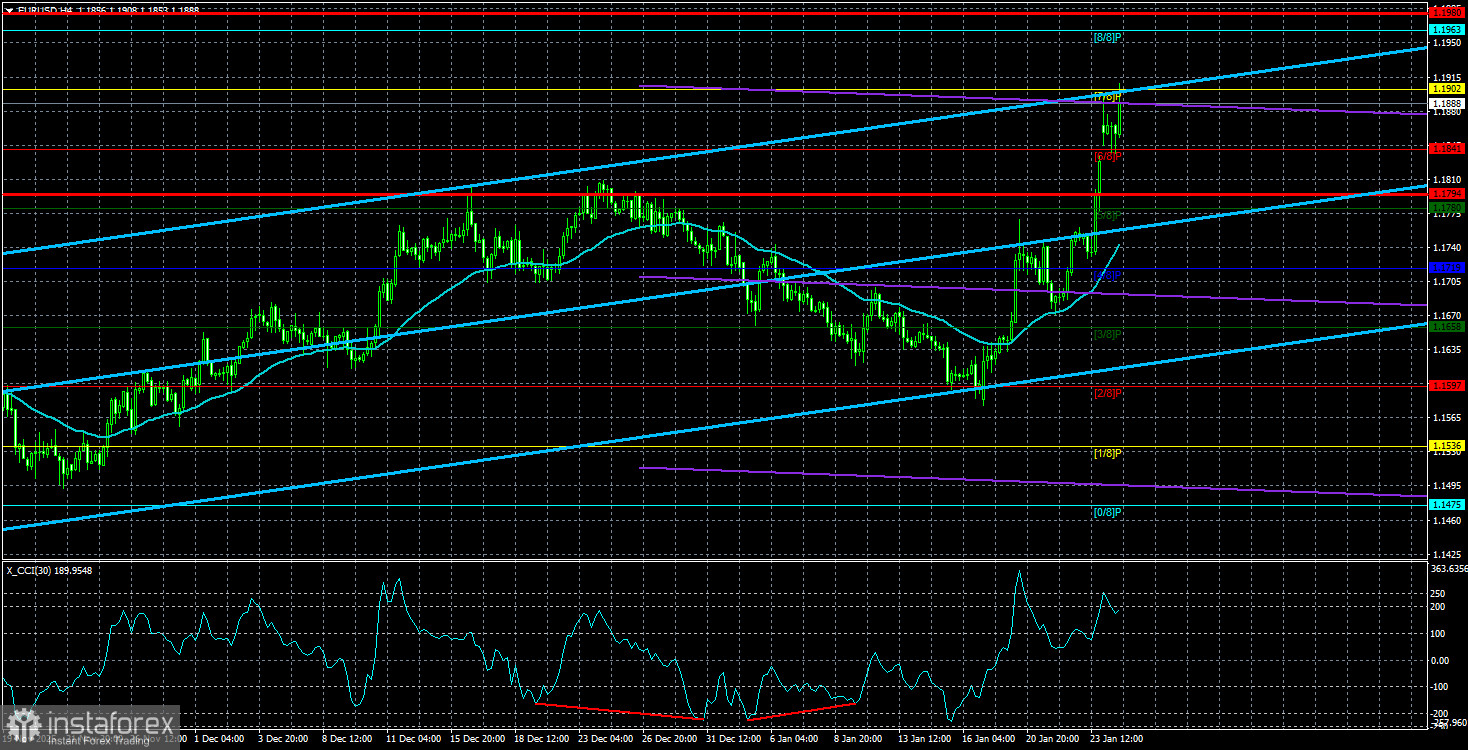

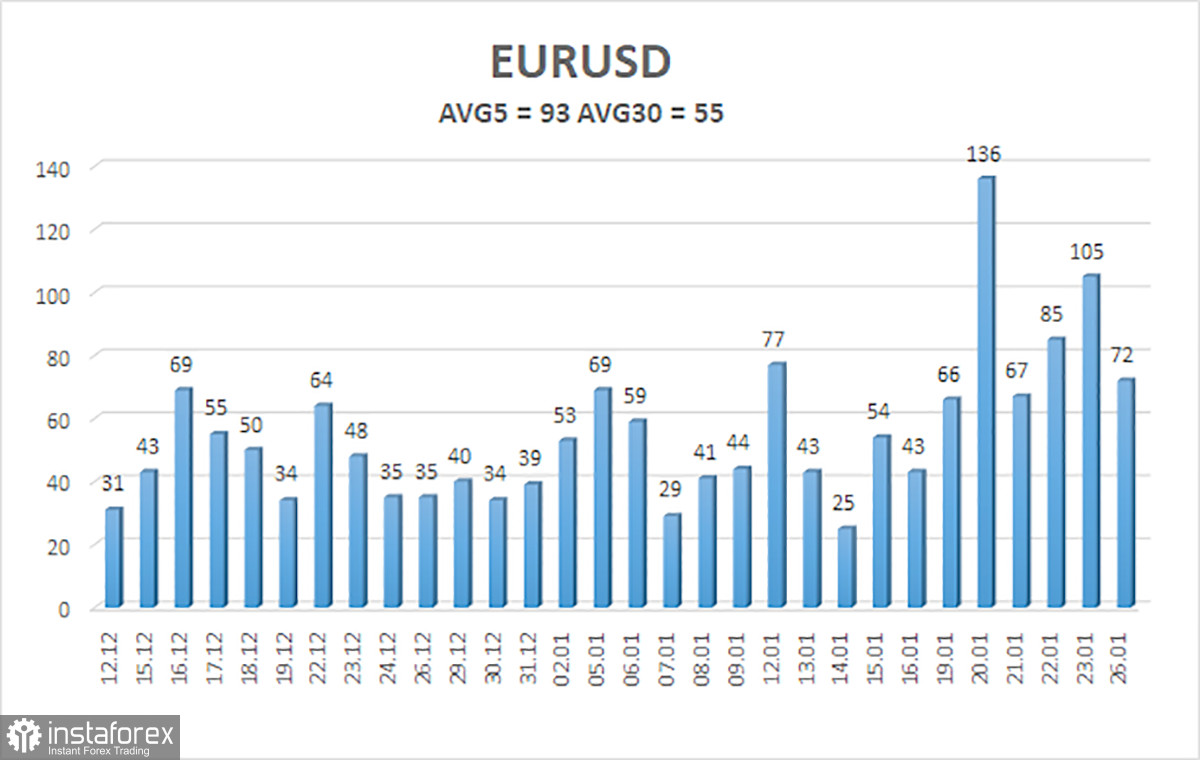

The average volatility of the EUR/USD currency pair over the last five trading days as of January 27 is 93 pips, which is considered "average." We expect the pair to trade between 1.1794 and 1.1980 on Tuesday. The upper linear regression channel points upward, indicating further growth for the euro. The CCI indicator entered overbought territory last week, signaling a downward correction, which has already completed. Nearest Support Levels: S1 – 1.1841 S2 – 1.1780 S3 – 1.1719 Nearest Resistance Levels: R1 – 1.1902 R2 – 1.1963 R3 – 1.2024 Trading Recommendations: The EUR/USD pair continues its upward movement, which has recently accelerated. The global fundamental backdrop remains crucial for the market and remains highly negative for the dollar. The pair spent seven months in a sideways channel, and it is time to resume that trend. There is no fundamental basis for the dollar's long-term growth. Below the moving average, small shorts can be considered with targets at 1.1719 and 1.1658 based purely on technical grounds. Above the moving average line, long positions remain relevant with targets of 1.1963 and 1.1980. Explanations for the Illustrations: Linear regression channels help determine the current trend. If both are directed in one way, the trend is currently strong; The moving average line (settings 20,0, smoothed) defines the short-term trend and the direction in which trading should currently be conducted; Murray levels are target levels for movements and corrections; Volatility levels (red lines) indicate the probable price channel in which the pair will operate for the next day, based on current volatility indicators; The CCI indicator entering the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3O5F78c