Forex Analysis & Reviews: Forecast for EUR/USD on January 23, 2025

Yesterday, the euro peaked at 1.0458. We previously identified a target level of 1.0461, based on the low from December 2; however, this can now be adjusted to the December 13 low, which sets the new target at 1.0454. The euro surpassed this by 4 pips. Ultimately, the price reached the resistance level but failed to consolidate above the balance line, closing the day with a 21-pip decline and did not consolidate above the MACD line.

This morning, the price continues to press against the MACD line, while the Marlin oscillator has turned downward. If the support level at 1.0350 is breached, the next target will be 1.0135. A weak double divergence has formed on the H4 chart. The signal line of the Marlin oscillator is nearing negative territory.

We expect the price to test the 1.0350 support level soon. This level is reinforced and its significance is heightened by the MACD line, which is approaching the support level. A consolidation below 1.0350 could trigger a sharp price decline.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4aviKAn

Instaforex Analysis

Re: Instaforex Analysis

Forex Analysis & Reviews: Forecast for EUR/USD on January 27, 2025

On Friday, the euro closed the day up 77 pips, with the upper shadow reaching the April 2015 low, while also covering the November 2015 low. Although this resistance appears strong, the price managed to close above the MACD line, which creates the potential risk for further growth toward 1.0598.

Conversely, the Marlin oscillator has entered the growth territory significantly, outpacing the price movement. This suggests that even if the price consolidates above the indicator line, it could eventually prove to be a false breakout. Today, Germany's IFO Business Climate Index for January is forecasted to rise from 84.7 to 84.9, while new home sales in the U.S. for December are expected to increase from 664K y/y to 669K y/y. As a result, the price may remain within the range of 1.0458 to 1.0520 throughout the day.

On the H4 chart, a small gap is visible at the market's opening. Additionally, a divergence has formed, and the Marlin oscillator is moving toward negative territory. However, for a successful downward push, the gap must be closed. This adds to the likelihood of sideways price movement. Another contributing factor is the anticipation of the Federal Reserve's interest rate decision on Wednesday, January 29.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4jpxVPw

On Friday, the euro closed the day up 77 pips, with the upper shadow reaching the April 2015 low, while also covering the November 2015 low. Although this resistance appears strong, the price managed to close above the MACD line, which creates the potential risk for further growth toward 1.0598.

Conversely, the Marlin oscillator has entered the growth territory significantly, outpacing the price movement. This suggests that even if the price consolidates above the indicator line, it could eventually prove to be a false breakout. Today, Germany's IFO Business Climate Index for January is forecasted to rise from 84.7 to 84.9, while new home sales in the U.S. for December are expected to increase from 664K y/y to 669K y/y. As a result, the price may remain within the range of 1.0458 to 1.0520 throughout the day.

On the H4 chart, a small gap is visible at the market's opening. Additionally, a divergence has formed, and the Marlin oscillator is moving toward negative territory. However, for a successful downward push, the gap must be closed. This adds to the likelihood of sideways price movement. Another contributing factor is the anticipation of the Federal Reserve's interest rate decision on Wednesday, January 29.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4jpxVPw

- IFX Bella

- Posts: 437

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Forecast for EUR/USD on January 28, 2025

The main event on Monday was the launch of an open-source AI model by the Chinese startup DeepSeek. According to the developers, they achieved this at significantly lower costs compared to OpenAI, Microsoft, Google, and certainly Nvidia. As a result, by the end of the day, the tech-heavy Nasdaq dropped by 3.07%, the S&P 500 fell by 1.46%, and the Dollar Index rose by 0.08%.

The EUR/USD pair managed to stay within the 1.0458–1.0520 range on Monday, but today it began to decline, already falling below the lower boundary of this range. The Marlin oscillator is showing signs of a stronger downward reversal. A battle is likely at the 1.0350 level, as support is bolstered by the MACD line. If the price reaches this level, it will indicate the strength and determination of the bears. Ultimately, the pair is expected to target the support of 1.0135.

On the four-hour chart, the Marlin oscillator has consolidated below the zero line, and the price is attempting to settle below the 1.0458 level. If this consolidation is successful, there is a high likelihood that the price will break through the MACD line at 1.0412. With the FOMC meeting scheduled for tomorrow, where no rate cuts are expected, market participants may begin to show increased activity as early as today.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/42xIw5c

The main event on Monday was the launch of an open-source AI model by the Chinese startup DeepSeek. According to the developers, they achieved this at significantly lower costs compared to OpenAI, Microsoft, Google, and certainly Nvidia. As a result, by the end of the day, the tech-heavy Nasdaq dropped by 3.07%, the S&P 500 fell by 1.46%, and the Dollar Index rose by 0.08%.

The EUR/USD pair managed to stay within the 1.0458–1.0520 range on Monday, but today it began to decline, already falling below the lower boundary of this range. The Marlin oscillator is showing signs of a stronger downward reversal. A battle is likely at the 1.0350 level, as support is bolstered by the MACD line. If the price reaches this level, it will indicate the strength and determination of the bears. Ultimately, the pair is expected to target the support of 1.0135.

On the four-hour chart, the Marlin oscillator has consolidated below the zero line, and the price is attempting to settle below the 1.0458 level. If this consolidation is successful, there is a high likelihood that the price will break through the MACD line at 1.0412. With the FOMC meeting scheduled for tomorrow, where no rate cuts are expected, market participants may begin to show increased activity as early as today.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/42xIw5c

- IFX Bella

- Posts: 437

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Forecast for EUR/USD on January 30, 2025

After the Federal Reserve meeting, which was notably neutral, the euro demonstrated a clear reluctance to lose ground, similar to other major markets. Overall, the day unfolded quietly. The lower shadow of the daily candle extended the euro's trading range to between 1.0350 and 1.0458. Since the lower boundary of this range is strengthened by the MACD line, the primary bearish scenario targeting 1.0135 is becoming increasingly challenging.

Today, however, we have the European Central Bank meeting. The market generally expects a 0.25% decrease in the main rates. Before the ECB's announcement, data on employment and GDP for the Eurozone will be released. Unemployment for December is anticipated to remain at November's level of 6.3%, while GDP growth is expected to be only 0.1%, down from 0.4% in Q3. Additionally, German GDP for Q4 may show a decline of 0.1%. Collectively, these events could potentially push the euro below the support level of 1.0350. A price consolidation below this level would open the target of 1.0135.

On the 4-hour chart, there is additional resistance at 1.0433, indicated by the MACD line. Considering both time frames cumulatively, the euro's position appears weaker than it was yesterday. We are awaiting the ECB's decision on monetary policy.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/40yAW7H

After the Federal Reserve meeting, which was notably neutral, the euro demonstrated a clear reluctance to lose ground, similar to other major markets. Overall, the day unfolded quietly. The lower shadow of the daily candle extended the euro's trading range to between 1.0350 and 1.0458. Since the lower boundary of this range is strengthened by the MACD line, the primary bearish scenario targeting 1.0135 is becoming increasingly challenging.

Today, however, we have the European Central Bank meeting. The market generally expects a 0.25% decrease in the main rates. Before the ECB's announcement, data on employment and GDP for the Eurozone will be released. Unemployment for December is anticipated to remain at November's level of 6.3%, while GDP growth is expected to be only 0.1%, down from 0.4% in Q3. Additionally, German GDP for Q4 may show a decline of 0.1%. Collectively, these events could potentially push the euro below the support level of 1.0350. A price consolidation below this level would open the target of 1.0135.

On the 4-hour chart, there is additional resistance at 1.0433, indicated by the MACD line. Considering both time frames cumulatively, the euro's position appears weaker than it was yesterday. We are awaiting the ECB's decision on monetary policy.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/40yAW7H

- IFX Bella

- Posts: 437

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: EUR/USD Forecast for February 3, 2025

February began tumultuously. On the 1st, U.S. President Trump imposed a 10% tariff on goods from China and a 25% tariff on goods from Mexico and Canada, excluding energy products. As a result, the markets opened with a decent gap.

On the weekly chart, the euro reached the embedded line of the descending turquoise price channel. While market participants assess the implications of Trump's decision, the euro may close the gap that has formed. Once the gap is closed, we anticipate the euro will continue its decline towards the support level of 1.0135 and potentially into the range of 0.9988–1.0030. The strategic target is 0.9885, which aligns with the embedded line of the red price channel.

From a technical perspective, the price correction could be influenced by the Marlin oscillator's signal line reversing from the support level marked by the lows of December 18 and January 10 (indicated by check marks). On the four-hour chart, both the oscillator and the price declined after the Marlin oscillator reversed twice from the boundary of the growth area (marked by arrows).

The Marlin oscillator has now entered the oversold zone. A correction of the oscillator back to the zero line is likely (as shown on the daily chart), which, along with the price closing the gap, would lead to a further decline. There is ample time for this movement before the U.S. employment data is released on Friday.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3EmZx85

February began tumultuously. On the 1st, U.S. President Trump imposed a 10% tariff on goods from China and a 25% tariff on goods from Mexico and Canada, excluding energy products. As a result, the markets opened with a decent gap.

On the weekly chart, the euro reached the embedded line of the descending turquoise price channel. While market participants assess the implications of Trump's decision, the euro may close the gap that has formed. Once the gap is closed, we anticipate the euro will continue its decline towards the support level of 1.0135 and potentially into the range of 0.9988–1.0030. The strategic target is 0.9885, which aligns with the embedded line of the red price channel.

From a technical perspective, the price correction could be influenced by the Marlin oscillator's signal line reversing from the support level marked by the lows of December 18 and January 10 (indicated by check marks). On the four-hour chart, both the oscillator and the price declined after the Marlin oscillator reversed twice from the boundary of the growth area (marked by arrows).

The Marlin oscillator has now entered the oversold zone. A correction of the oscillator back to the zero line is likely (as shown on the daily chart), which, along with the price closing the gap, would lead to a further decline. There is ample time for this movement before the U.S. employment data is released on Friday.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3EmZx85

- IFX Bella

- Posts: 437

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Forecast for EUR/USD on February 5, 2025

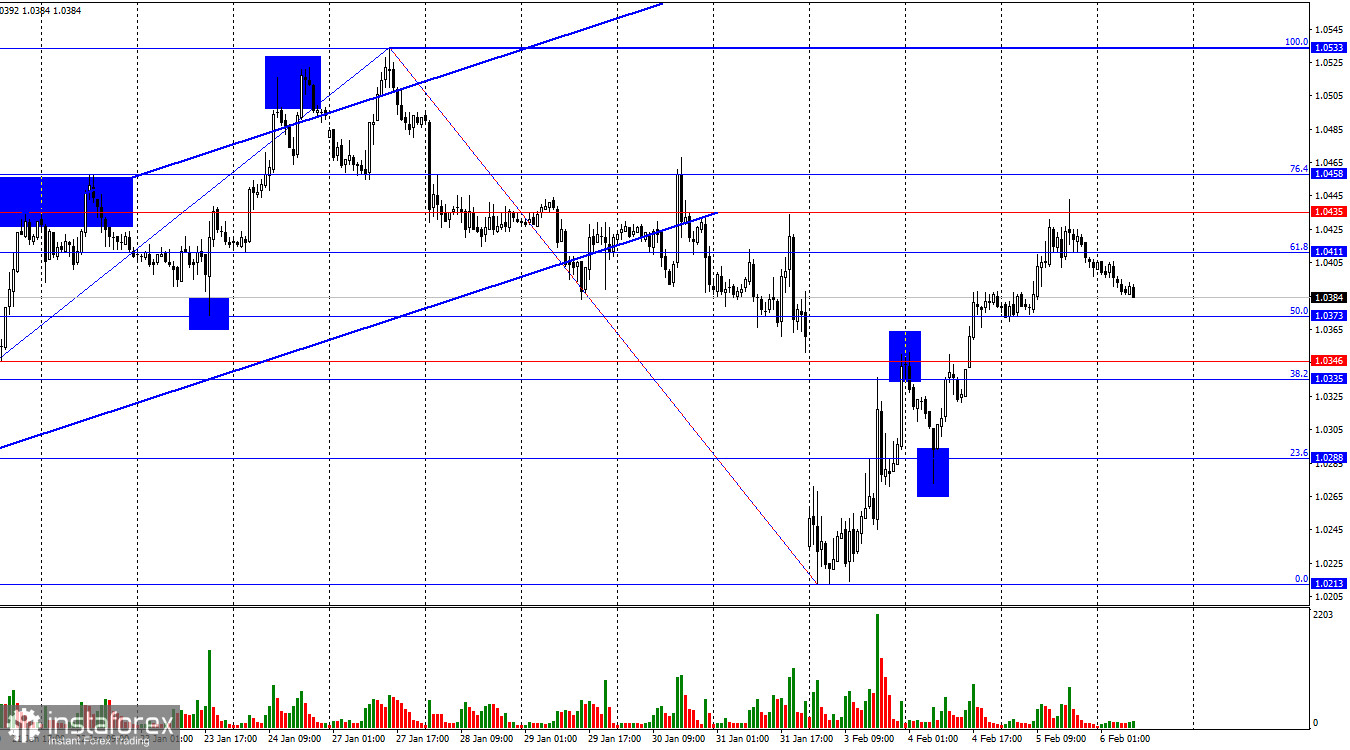

On Tuesday, the EUR/USD pair rebounded from the 23.6% retracement level, reversed in favor of the euro, and continued its upward movement. By Wednesday morning, the pair's quotes consolidated above the 50.0% Fibonacci level at 1.0373, indicating a potential continuation of growth toward the next levels at 1.0411 and 1.0435. A consolidation below 1.0373 could signal a potential decline in the euro.

The wave structure on the hourly chart has become ambiguous. The last completed upward wave broke through the previous wave's peak, while the most recent downward wave breached the lows of the two preceding waves. This suggests the trend may be shifting to a bearish phase, or we could be witnessing a complex sideways movement. The inconsistent wave sizes contribute to this uncertainty. Tuesday's economic calendar was sparse, with only one notable report that failed to support the bears. The JOLTS job openings in December totaled just 7.6 million in the U.S., significantly below the expected 8 million, forcing bears to retreat from the market. In my view, the U.S. dollar's decline is also influenced by Donald Trump's aggressive policies, targeting any country unwilling to play by America's rules. Fortunately, the conflicts are limited to trade wars for now. However, Trump has already expressed interest in the Panama Canal and Greenland. Should Panama and Denmark refuse to cede these territories, the situation could escalate. Currently, the geopolitical backdrop is unfavorable for the dollar, but from an economic standpoint, the dollar remains strong. The FOMC's monetary policy still suggests potential dollar strengthening in 2025.

On the 4-hour chart, the pair reversed in favor of the U.S. dollar after forming a bearish divergence on the CCI indicator, leading to a drop to the 161.8% retracement level at 1.0225. A rebound from this level supported the euro's recovery. A close above 1.0332 increases the likelihood of further growth toward the 127.2% Fibonacci level at 1.0436. No emerging divergences are observed on any indicators today.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4aJByfn

On Tuesday, the EUR/USD pair rebounded from the 23.6% retracement level, reversed in favor of the euro, and continued its upward movement. By Wednesday morning, the pair's quotes consolidated above the 50.0% Fibonacci level at 1.0373, indicating a potential continuation of growth toward the next levels at 1.0411 and 1.0435. A consolidation below 1.0373 could signal a potential decline in the euro.

The wave structure on the hourly chart has become ambiguous. The last completed upward wave broke through the previous wave's peak, while the most recent downward wave breached the lows of the two preceding waves. This suggests the trend may be shifting to a bearish phase, or we could be witnessing a complex sideways movement. The inconsistent wave sizes contribute to this uncertainty. Tuesday's economic calendar was sparse, with only one notable report that failed to support the bears. The JOLTS job openings in December totaled just 7.6 million in the U.S., significantly below the expected 8 million, forcing bears to retreat from the market. In my view, the U.S. dollar's decline is also influenced by Donald Trump's aggressive policies, targeting any country unwilling to play by America's rules. Fortunately, the conflicts are limited to trade wars for now. However, Trump has already expressed interest in the Panama Canal and Greenland. Should Panama and Denmark refuse to cede these territories, the situation could escalate. Currently, the geopolitical backdrop is unfavorable for the dollar, but from an economic standpoint, the dollar remains strong. The FOMC's monetary policy still suggests potential dollar strengthening in 2025.

On the 4-hour chart, the pair reversed in favor of the U.S. dollar after forming a bearish divergence on the CCI indicator, leading to a drop to the 161.8% retracement level at 1.0225. A rebound from this level supported the euro's recovery. A close above 1.0332 increases the likelihood of further growth toward the 127.2% Fibonacci level at 1.0436. No emerging divergences are observed on any indicators today.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4aJByfn

- IFX Bella

- Posts: 437

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Forecast for EUR/USD on February 6, 2025

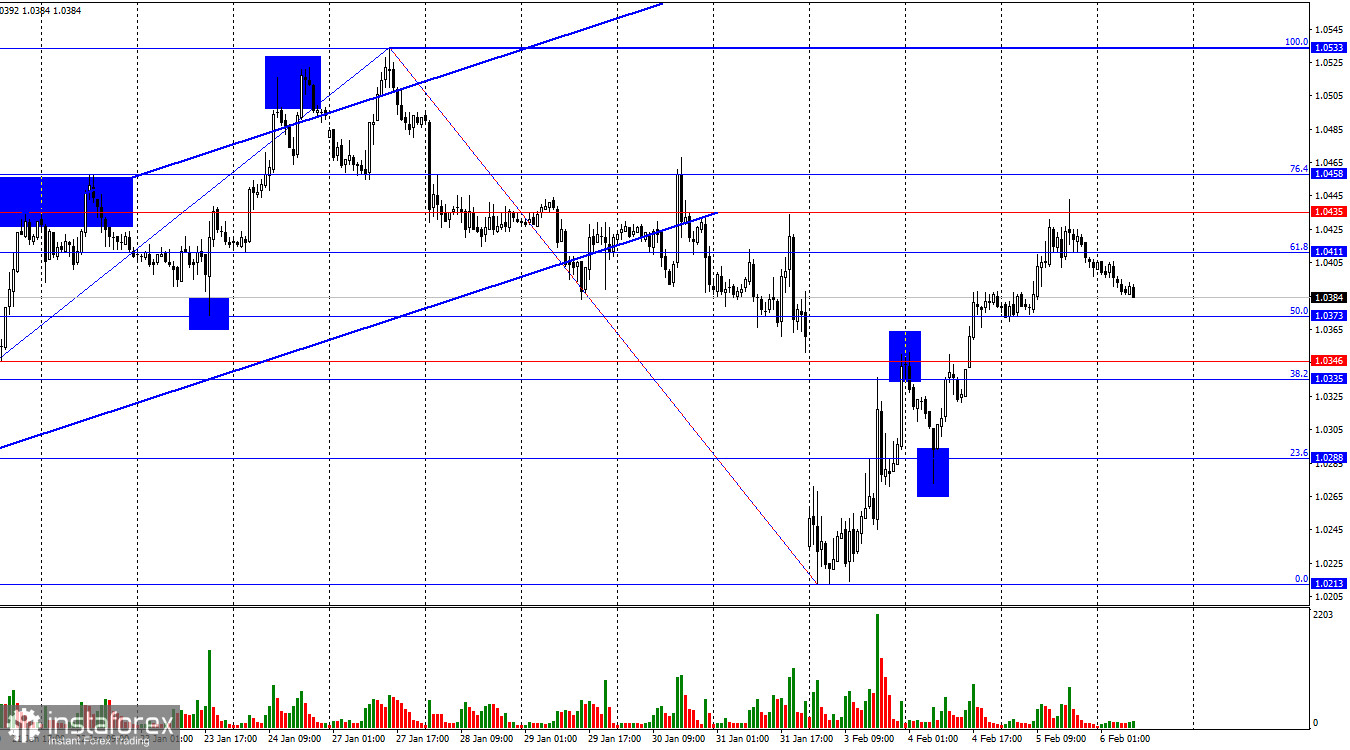

On Wednesday, the EUR/USD pair rose to the 1.0435 level before bouncing off and reversing in favor of the U.S. dollar. A downward move has begun towards the 50.0% and 38.2% Fibonacci retracement levels. With multiple key levels within the current range, traders should closely monitor potential rebounds and breakouts. On the 4-hour chart, the movement has been mostly sideways for the past month and a half.

Wave analysis on the hourly chart has become increasingly uncertain. The last completed upward wave broke the previous peak, while the most recent downward wave broke the lows of the two preceding waves. This suggests that the trend may be shifting to a bearish one, or we are witnessing complex horizontal movement. The inconsistent size of recent waves adds to the uncertainty. On Wednesday, economic data had little impact on traders' sentiment despite the presence of several significant reports. Initially, the bulls maintained control, but later in the day, bears took over—possibly in anticipation of a dovish decision from the Bank of England. The German Services PMI increased as expected to 52.5. The Eurozone Services PMI declined from 51.6 to 51.3. The ADP employment report in the U.S. showed 183K new jobs, beating the forecast of 150K. The ISM Services PMI in the U.S. dropped from 54.0 to 52.8. Despite the large number of critical reports, they did not provide a clear direction for EUR/USD trading. Following a strong upward move, a bearish correction seems likely. However, today's Bank of England meeting is the only major scheduled event, which could influence sentiment among euro traders. Currently, neither bulls nor bears have a decisive advantage.

On the 4-hour chart, the pair reached the 127.2% Fibonacci retracement level at 1.0436 before pulling back. This suggests a potential reversal in favor of the U.S. dollar, with a real chance of a return to the 161.8% level at 1.0225. Bulls would need strong fundamental catalysts to break above 1.0436. No divergence signals are currently visible on any indicator.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3XdE3Bd

On Wednesday, the EUR/USD pair rose to the 1.0435 level before bouncing off and reversing in favor of the U.S. dollar. A downward move has begun towards the 50.0% and 38.2% Fibonacci retracement levels. With multiple key levels within the current range, traders should closely monitor potential rebounds and breakouts. On the 4-hour chart, the movement has been mostly sideways for the past month and a half.

Wave analysis on the hourly chart has become increasingly uncertain. The last completed upward wave broke the previous peak, while the most recent downward wave broke the lows of the two preceding waves. This suggests that the trend may be shifting to a bearish one, or we are witnessing complex horizontal movement. The inconsistent size of recent waves adds to the uncertainty. On Wednesday, economic data had little impact on traders' sentiment despite the presence of several significant reports. Initially, the bulls maintained control, but later in the day, bears took over—possibly in anticipation of a dovish decision from the Bank of England. The German Services PMI increased as expected to 52.5. The Eurozone Services PMI declined from 51.6 to 51.3. The ADP employment report in the U.S. showed 183K new jobs, beating the forecast of 150K. The ISM Services PMI in the U.S. dropped from 54.0 to 52.8. Despite the large number of critical reports, they did not provide a clear direction for EUR/USD trading. Following a strong upward move, a bearish correction seems likely. However, today's Bank of England meeting is the only major scheduled event, which could influence sentiment among euro traders. Currently, neither bulls nor bears have a decisive advantage.

On the 4-hour chart, the pair reached the 127.2% Fibonacci retracement level at 1.0436 before pulling back. This suggests a potential reversal in favor of the U.S. dollar, with a real chance of a return to the 161.8% level at 1.0225. Bulls would need strong fundamental catalysts to break above 1.0436. No divergence signals are currently visible on any indicator.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3XdE3Bd

- IFX Bella

- Posts: 437

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: EUR/USD Forecast for February 7, 2025

Since Tuesday, the euro has remained within the 1.0350 to 1.0458 range, as investors await today's release of U.S. employment data for January. During this period, the price has stayed above the MACD line, and the Marlin oscillator has been developing in positive territory, reflecting optimistic investor sentiment toward the euro. The forecast for Nonfarm Payrolls stands at 169,000, compared to 256,000 in December, while the unemployment rate is expected to remain steady at 4.1%.

We believe that the actual Nonfarm Payrolls data may slightly underperform expectations, as recent reports on jobless claims, job openings, and layoffs have worsened, often missing forecasts. There is also a possibility that the unemployment rate could rise to 4.2%. Notably, the Federal Reserve itself projects an average unemployment rate of 4.3% for the current year, indicating that, in its assessment, the labor market is nearing saturation. As a result, we anticipate a breakout above 1.0458, with the euro potentially targeting the 1.0534 to 1.0575 range, which corresponds to the support zone from February to March 2023.

On the four-hour chart, the price is fluctuating between the 1.0350 support level and the MACD line at 1.0420. The Marlin oscillator is near the threshold of a downtrend zone. A breakout above the MACD line would pave the way to attack 1.0458. However, a move below 1.0350 would not immediately signal a further decline, as additional support comes from the daily MACD line at 1.0325. Bears would need to consolidate below this level.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4aMBYBH

Since Tuesday, the euro has remained within the 1.0350 to 1.0458 range, as investors await today's release of U.S. employment data for January. During this period, the price has stayed above the MACD line, and the Marlin oscillator has been developing in positive territory, reflecting optimistic investor sentiment toward the euro. The forecast for Nonfarm Payrolls stands at 169,000, compared to 256,000 in December, while the unemployment rate is expected to remain steady at 4.1%.

We believe that the actual Nonfarm Payrolls data may slightly underperform expectations, as recent reports on jobless claims, job openings, and layoffs have worsened, often missing forecasts. There is also a possibility that the unemployment rate could rise to 4.2%. Notably, the Federal Reserve itself projects an average unemployment rate of 4.3% for the current year, indicating that, in its assessment, the labor market is nearing saturation. As a result, we anticipate a breakout above 1.0458, with the euro potentially targeting the 1.0534 to 1.0575 range, which corresponds to the support zone from February to March 2023.

On the four-hour chart, the price is fluctuating between the 1.0350 support level and the MACD line at 1.0420. The Marlin oscillator is near the threshold of a downtrend zone. A breakout above the MACD line would pave the way to attack 1.0458. However, a move below 1.0350 would not immediately signal a further decline, as additional support comes from the daily MACD line at 1.0325. Bears would need to consolidate below this level.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4aMBYBH

- IFX Bella

- Posts: 437

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: EUR/USD Forecast for February 10, 2025

By the end of last week, the euro failed to consolidate above the trend lines of price channels, retreating back under the red descending channel line on the weekly chart.

This price movement suggests that after closing the opening gap, if the price fails to rise above the red line, it may attempt to break below the azure channel line. This would open the path to the key target at 0.9885, aligning with the red channel line.

The new daily candle opened below the MACD indicator line, reinforcing bearish sentiment. The Marlin oscillator remains in negative territory, supporting the potential for further declines. After closing the gap, we expect the price to move towards the support level at 1.0135.

On Friday, the price reversed downward from the MACD indicator line on the 4-hour chart. The price has also secured itself below the balance

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/42KQzM1

By the end of last week, the euro failed to consolidate above the trend lines of price channels, retreating back under the red descending channel line on the weekly chart.

This price movement suggests that after closing the opening gap, if the price fails to rise above the red line, it may attempt to break below the azure channel line. This would open the path to the key target at 0.9885, aligning with the red channel line.

The new daily candle opened below the MACD indicator line, reinforcing bearish sentiment. The Marlin oscillator remains in negative territory, supporting the potential for further declines. After closing the gap, we expect the price to move towards the support level at 1.0135.

On Friday, the price reversed downward from the MACD indicator line on the 4-hour chart. The price has also secured itself below the balance

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/42KQzM1

- IFX Bella

- Posts: 437

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: GBP/USD Forecast for February 13, 2025

Yesterday, the British pound traded in a range of over 100 pips, closing the day nearly at its opening level. The MACD line on the daily timeframe acted as support, from which the price rebounded, successfully closing above both indicator lines.

The Marlin oscillator is moving sideways but remains in the positive zone. The first target for growth is set at 1.2500, and a consolidation above this level will pave the way to the second target at 1.2616.

On the four-hour chart, the price is still struggling to break through the MACD line, although it is making progress. The balance line, above which the price is currently developing, along with the Marlin oscillator in the positive area, supports this. A break above yesterday's high at 1.2482 will signify an attempt to surpass the first resistance level.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3EOuCS0

Yesterday, the British pound traded in a range of over 100 pips, closing the day nearly at its opening level. The MACD line on the daily timeframe acted as support, from which the price rebounded, successfully closing above both indicator lines.

The Marlin oscillator is moving sideways but remains in the positive zone. The first target for growth is set at 1.2500, and a consolidation above this level will pave the way to the second target at 1.2616.

On the four-hour chart, the price is still struggling to break through the MACD line, although it is making progress. The balance line, above which the price is currently developing, along with the Marlin oscillator in the positive area, supports this. A break above yesterday's high at 1.2482 will signify an attempt to surpass the first resistance level.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3EOuCS0

- IFX Bella

- Posts: 437

- Joined: Sat Dec 08, 2012 12:39 am