Forex Analysis & Reviews: The Price of Progress: How AI Spending and Recession Are Squeezing Tech Giants

August Slump: Tech Giants Lose Billions Big tech companies saw their market value fall in August as rising AI infrastructure costs and recession concerns grew. These factors made the companies' shares particularly vulnerable amid the market correction. Alphabet Inc.: Ad Revenue Takes a Hit and AI Competition Alphabet Inc. (GOOGL.O) lost 4.7% of its market cap in August. One of the reasons for this decline was a slowdown in YouTube advertising revenue growth, which increased investor concerns about the stability of the company's earnings. The company's shares were also negatively affected by a US court ruling that Google violated antitrust laws. An additional blow was the emergence of a new strong competitor - OpenAI, a company working on creating a search engine based on artificial intelligence. Amazon.com Inc.: A lull in online sales Amazon.com Inc.'s (AMZN.O) market value fell by 4.5% in August. The main reason was a slowdown in online sales growth, which caused concern among investors and put pressure on the company's shares. Tesla: Tariffs and weak financials Tesla (TSLA.O), the world's largest automaker by market value, lost 7.7% of its market capitalization over the past month. This was influenced by lower-than-expected second-quarter earnings, as well as news of Canada's plans to impose a 100% tariff on electric vehicles made in China. Tesla began exporting cars made at its Shanghai plant to Canada last year, and the new tariffs could hurt export profits. Of particular concern is that the more expensive U.S. manufacturing base could prove less competitive. Risks are mounting The decline in the market value of giants such as Alphabet, Amazon and Tesla highlights the growing economic risks associated with the development of new technologies and the possibility of a recession. Investors are looking to the future with trepidation, fearing further escalation. Nvidia: Investor expectations were not met In the last days of August, the market value of Nvidia (NVDA.O) fell by 7.7%, falling to $2.92 trillion. The drop came after the company provided a third-quarter gross profit forecast that was below market expectations. In addition, the announced revenues were only in line with forecasts, which disappointed investors who had hoped for more impressive results. As the largest player in the AI chip market, controlling more than 80% of this segment, Nvidia is in a unique position. However, even this dominant role could not protect the company from market volatility. Eli Lilly: Growth Leader Amidst Successes in Medicine Amid a downturn in the tech sector, American pharmaceutical company Eli Lilly (LLY.N) demonstrated impressive growth. Its market value increased by almost 20%, which made it the leader in growth in the market. The main factors for its success were strong sales and the launch of a new weight loss drug. This drug not only helps in the fight against obesity, but also significantly reduces the risk of type 2 diabetes in adults, which caused a positive reaction among investors. Berkshire Hathaway: Buffett is back on top In late August, the market value of conglomerate Berkshire Hathaway (BRKa.N) surpassed $1 trillion for the first time. This historic moment reflects investors' confidence in the long-term strategy that Warren Buffett has been developing for nearly six decades. Berkshire Hathaway, as a barometer of the American economy, remains a reliable reference point for many market participants. Trust in digital advertising offsets AI costs The market value of Meta (an organization recognized as extremist and banned in Russia) also showed significant growth, increasing by almost 10%. This happened after the company beat market expectations for its second-quarter revenue and provided an optimistic forecast for the third quarter, covering the period from July to September. Meta's success shows that despite significant investments in the development of artificial intelligence technologies, high revenues from digital advertising on the company's platforms are able to offset these costs and support growth. Volatility and New Leaders August was a month of contrasts across market sectors. While tech giants struggled and stocks fell, pharmaceutical companies and stable conglomerates like Berkshire Hathaway posted strong gains. These developments highlight the importance of diversification and point to a shift in investor priorities. Bonds Gain Strength: Investors Await New Data Bond yields rose sharply on Tuesday, while Asian currencies and stock markets stabilized. Investors are eagerly awaiting fresh data to gauge how deeply the U.S. may cut interest rates in the near future.

News are provided by InstaForex.

Read more: https://ifxpr.com/4geSvjZ

Instaforex Analysis

Re: Instaforex Analysis

Forex Analysis & Reviews: Forecast for EUR/USD on September 5, 2024

Despite yesterday's increase in volatility and the expansion of the sideways range, the euro maintained the boundaries of safe wandering, closing the day at the upper boundary of this range—at the resistance level of 1.1085. The Marlin oscillator continued to develop within a narrow range along the zero neutral line.

Today, the euro will likely decline as we await tomorrow's US employment data. The data is expected to be strong, and the primary scenario for the euro remains bearish. An attack on the support level of 1.1010 is likely. In the 4-hour chart, the price convergence with the Marlin oscillator has been processed.

The price was raised by 67 pips from the day's low. At the resistance level of 1.1065, the price also met the balance indicator line. A downward price reversal from this line tells us that yesterday's rise was a standard correction. A breakdown of the downward movement is possible if the price consolidates above the level of 1.1140, which is marked as a key MACD line.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3XxoyEL

Despite yesterday's increase in volatility and the expansion of the sideways range, the euro maintained the boundaries of safe wandering, closing the day at the upper boundary of this range—at the resistance level of 1.1085. The Marlin oscillator continued to develop within a narrow range along the zero neutral line.

Today, the euro will likely decline as we await tomorrow's US employment data. The data is expected to be strong, and the primary scenario for the euro remains bearish. An attack on the support level of 1.1010 is likely. In the 4-hour chart, the price convergence with the Marlin oscillator has been processed.

The price was raised by 67 pips from the day's low. At the resistance level of 1.1065, the price also met the balance indicator line. A downward price reversal from this line tells us that yesterday's rise was a standard correction. A breakdown of the downward movement is possible if the price consolidates above the level of 1.1140, which is marked as a key MACD line.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3XxoyEL

- IFX Bella

- Posts: 438

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Nvidia Loses $279 Billion, Tesla Disappoints Investors, Boeing Suffers From Analysts

US Stocks Under Attack Again: September Lives Up to Its Reputation US stocks plunged on Tuesday, kicking off one of the worst months in stock trading history as investors anxiously await more economic data that could impact the Federal Reserve's interest rate cut decisions. Massive Index Drop Major stock indexes such as the S&P 500, Nasdaq Composite and Dow Jones Industrial Average posted their biggest daily losses since early August. Of the 11 sectors in the S&P 500, nine were in the red, with technology, energy, communications services and raw materials feeling the brunt. Sluggish Manufacturing Growth Weighs on the Market Market optimism was dampened by the release of data from the Institute for Supply Management, which confirmed that the US manufacturing sector continues to struggle. Despite a slight improvement in August compared to July, when production hit an eight-month low, the situation remains far from stable. Historically Weak September: Seasonality in Action September is traditionally a tough month for stock markets. According to data collected since the 1950s, this month often brings significant losses. Jason Brown, president of Montgomery, Texas-based Alexis Investment Partners, emphasized that seasonality plays a key role in the current market swings. "Today's weak ISM report reinforces that point, but seasonality remains a key factor, especially given the strong performance of the market in recent months," Brown said. Self-Fulfilling Prophecy "Many market participants believe that September is a particularly tough time for stocks, and this belief often fuels negative sentiment," he added. Such pessimism can intensify with each new report, leading to the market's fears becoming reality. With uncertainty growing, market participants will be closely monitoring future economic data and the actions of the Federal Reserve to predict what measures will be taken to stabilize the situation. Shares of the largest tech companies, part of the so-called "Magnificent Seven," have experienced a sharp decline. These companies, which had led the market growth throughout the year, are now under intense pressure. Nvidia suffered particularly heavy losses, with its shares falling almost 10%, wiping out a record $279 billion in market capitalization. This left the company's market value at $2.65 trillion, the biggest one-day drop for a US company.

News are provided by InstaForex.

Read more: https://ifxpr.com/4cY7c8e

US Stocks Under Attack Again: September Lives Up to Its Reputation US stocks plunged on Tuesday, kicking off one of the worst months in stock trading history as investors anxiously await more economic data that could impact the Federal Reserve's interest rate cut decisions. Massive Index Drop Major stock indexes such as the S&P 500, Nasdaq Composite and Dow Jones Industrial Average posted their biggest daily losses since early August. Of the 11 sectors in the S&P 500, nine were in the red, with technology, energy, communications services and raw materials feeling the brunt. Sluggish Manufacturing Growth Weighs on the Market Market optimism was dampened by the release of data from the Institute for Supply Management, which confirmed that the US manufacturing sector continues to struggle. Despite a slight improvement in August compared to July, when production hit an eight-month low, the situation remains far from stable. Historically Weak September: Seasonality in Action September is traditionally a tough month for stock markets. According to data collected since the 1950s, this month often brings significant losses. Jason Brown, president of Montgomery, Texas-based Alexis Investment Partners, emphasized that seasonality plays a key role in the current market swings. "Today's weak ISM report reinforces that point, but seasonality remains a key factor, especially given the strong performance of the market in recent months," Brown said. Self-Fulfilling Prophecy "Many market participants believe that September is a particularly tough time for stocks, and this belief often fuels negative sentiment," he added. Such pessimism can intensify with each new report, leading to the market's fears becoming reality. With uncertainty growing, market participants will be closely monitoring future economic data and the actions of the Federal Reserve to predict what measures will be taken to stabilize the situation. Shares of the largest tech companies, part of the so-called "Magnificent Seven," have experienced a sharp decline. These companies, which had led the market growth throughout the year, are now under intense pressure. Nvidia suffered particularly heavy losses, with its shares falling almost 10%, wiping out a record $279 billion in market capitalization. This left the company's market value at $2.65 trillion, the biggest one-day drop for a US company.

News are provided by InstaForex.

Read more: https://ifxpr.com/4cY7c8e

- IFX Bella

- Posts: 438

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Hot forecast for EUR/USD on September 6, 2024

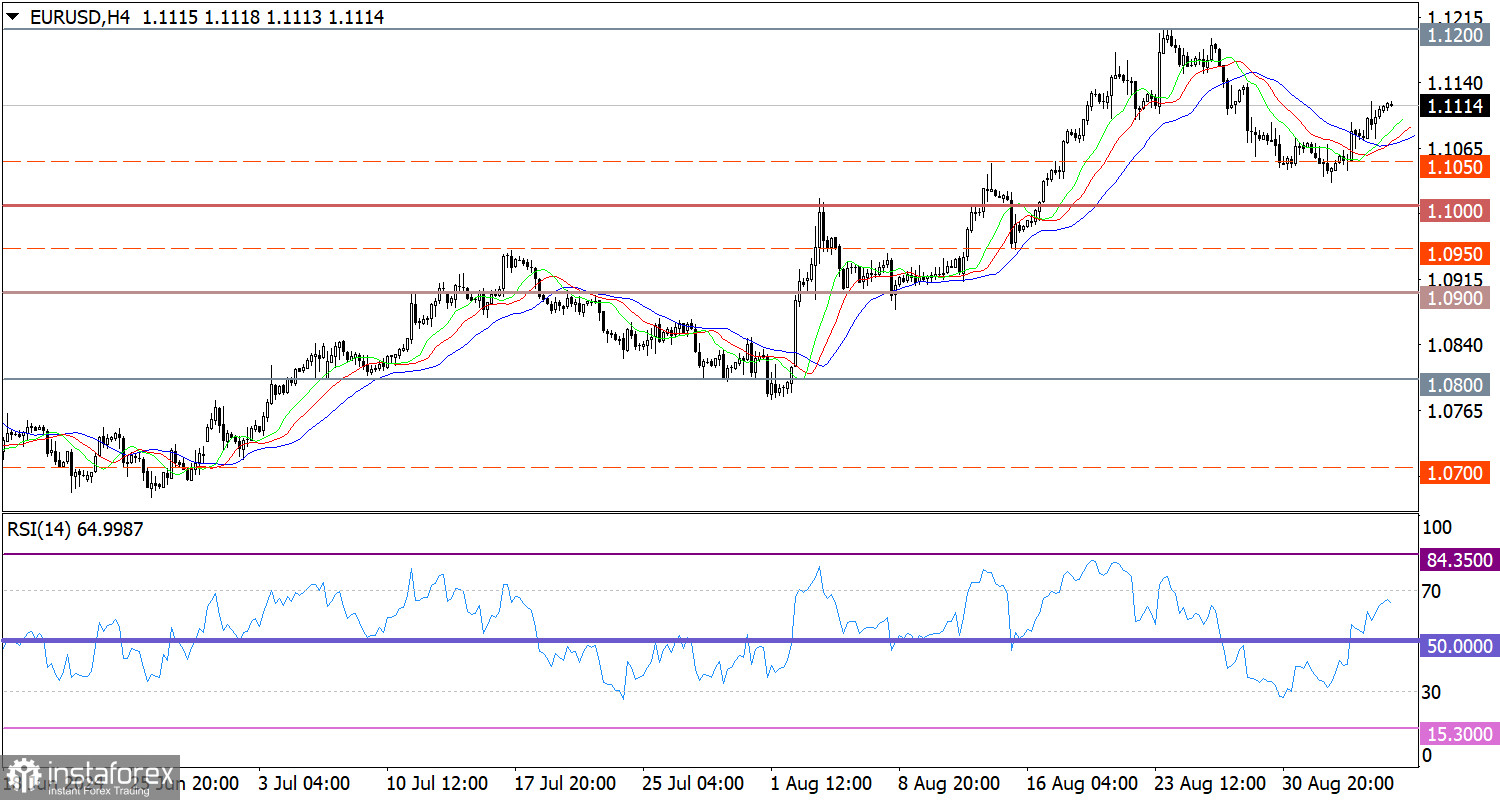

The EUR/USD pair is in a recovery phase from a recent corrective cycle. The upper deviation of the psychological level of 1.1000/1.1050 serves as a support, where an increase in the volume of long positions was observed. In the 4-hour chart, the RSI technical indicator is moving in the buyers' area of 50/70, indicating an increase in the volume of long positions for the euro. Regarding the Alligator indicator in the same time frame, the moving average lines have changed direction from downward to upward, corresponding to the end of the corrective phase. Expectations and Prospects In case of further growth, we expect the euro to recover fully, with a target at the resistance level of 1.1200. This move may indicate an extension of the medium-term upward trend. However, due to the release of the United States Department of Labor report, technical analysis takes a back seat, as speculators will primarily focus on data when making trading decisions. The complex indicator analysis points to the process of the euro's recovery in the short-term, intraday, and medium-term periods.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3MAnZU8

The EUR/USD pair is in a recovery phase from a recent corrective cycle. The upper deviation of the psychological level of 1.1000/1.1050 serves as a support, where an increase in the volume of long positions was observed. In the 4-hour chart, the RSI technical indicator is moving in the buyers' area of 50/70, indicating an increase in the volume of long positions for the euro. Regarding the Alligator indicator in the same time frame, the moving average lines have changed direction from downward to upward, corresponding to the end of the corrective phase. Expectations and Prospects In case of further growth, we expect the euro to recover fully, with a target at the resistance level of 1.1200. This move may indicate an extension of the medium-term upward trend. However, due to the release of the United States Department of Labor report, technical analysis takes a back seat, as speculators will primarily focus on data when making trading decisions. The complex indicator analysis points to the process of the euro's recovery in the short-term, intraday, and medium-term periods.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3MAnZU8

- IFX Bella

- Posts: 438

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Indexes Seek Balance: Tesla, JetBlue Gain vs. Frontier and Dow Slip

Brief Gains Turn to Slump The S&P 500 and Dow ended lower Thursday, showing choppiness amid volatile market sentiment. An initial rally fueled by a string of economic reports quickly faded, with investors turning their attention to key employment data due Friday. The Nasdaq, despite broader market wobbles, closed slightly higher. Waiting for data: Preparing for rate cuts Market sentiment remained tense ahead of the release of comprehensive nonfarm payrolls data that could shape the Federal Reserve's monetary policy. The data is expected to be a key signal for a possible rate cut later this month. Earlier, gains: reports give markets hope Earlier in the session, the major indexes showed gains. At the time, investors took note of data that helped ease concerns about the health of the labor market. A survey by the Institute for Supply Management showed that activity in the services sector increased in August, and data from the Labor Department showed that jobless claims fell last week. Sectors under pressure: Health care, industrials fall Eight of the 11 sectors in the S&P 500 ended the day in the red. Health care and industrials were the biggest losers. However, the consumer staples sector showed gains, thanks in large part to Tesla's gains. Expert Commentary: Markets on a Roller Coaster "Markets are on a roller coaster ride, from risk to rejection and back again, following the economic data. The Federal Reserve has made it clear, 'We're going to watch the data,'" said Wasif Latif, president and chief investment officer of Sarmaya Partners in Princeton, New Jersey. The development highlights the key role that upcoming employment data will play in shaping the Fed's next moves and sentiment on Wall Street. The Dilemma: Soft Landing or Recession? The stock market is awaiting data that will help better understand whether the economic landing will be soft or hard. Investors are trying to guess which scenario is most likely and what it will mean for the Federal Reserve's future moves on interest rates.

News are provided by InstaForex.

Read more: https://ifxpr.com/4dRHNhU

Brief Gains Turn to Slump The S&P 500 and Dow ended lower Thursday, showing choppiness amid volatile market sentiment. An initial rally fueled by a string of economic reports quickly faded, with investors turning their attention to key employment data due Friday. The Nasdaq, despite broader market wobbles, closed slightly higher. Waiting for data: Preparing for rate cuts Market sentiment remained tense ahead of the release of comprehensive nonfarm payrolls data that could shape the Federal Reserve's monetary policy. The data is expected to be a key signal for a possible rate cut later this month. Earlier, gains: reports give markets hope Earlier in the session, the major indexes showed gains. At the time, investors took note of data that helped ease concerns about the health of the labor market. A survey by the Institute for Supply Management showed that activity in the services sector increased in August, and data from the Labor Department showed that jobless claims fell last week. Sectors under pressure: Health care, industrials fall Eight of the 11 sectors in the S&P 500 ended the day in the red. Health care and industrials were the biggest losers. However, the consumer staples sector showed gains, thanks in large part to Tesla's gains. Expert Commentary: Markets on a Roller Coaster "Markets are on a roller coaster ride, from risk to rejection and back again, following the economic data. The Federal Reserve has made it clear, 'We're going to watch the data,'" said Wasif Latif, president and chief investment officer of Sarmaya Partners in Princeton, New Jersey. The development highlights the key role that upcoming employment data will play in shaping the Fed's next moves and sentiment on Wall Street. The Dilemma: Soft Landing or Recession? The stock market is awaiting data that will help better understand whether the economic landing will be soft or hard. Investors are trying to guess which scenario is most likely and what it will mean for the Federal Reserve's future moves on interest rates.

News are provided by InstaForex.

Read more: https://ifxpr.com/4dRHNhU

- IFX Bella

- Posts: 438

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Forecast for EUR/USD on September 9, 2024

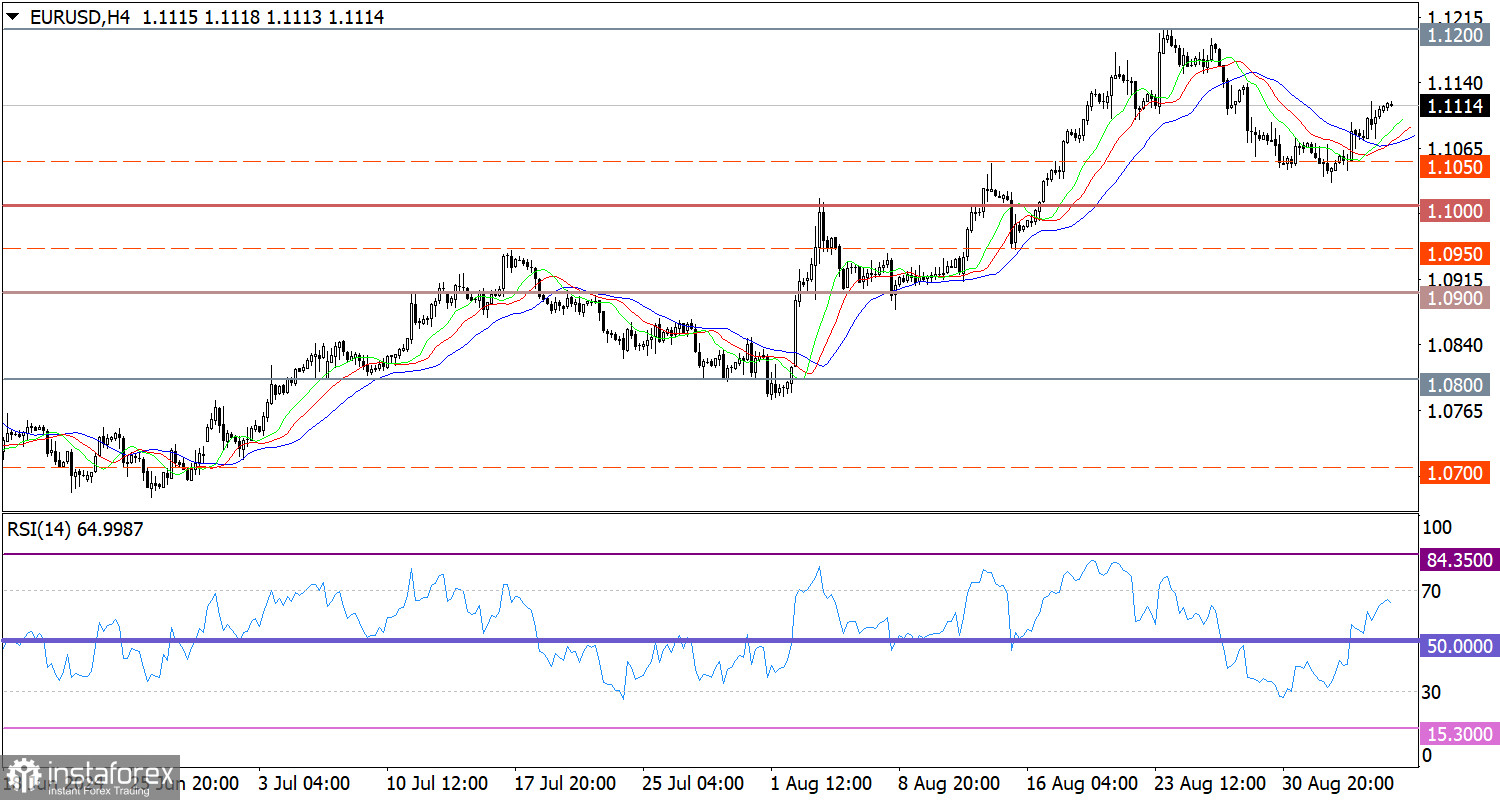

The currency market's reaction to Friday's US employment data was surprisingly muted – the dollar index changed by 0.07%, gold dropped by 0.73%, and oil by 2.14%. The stock market reacted strongly, with a decline of 1.73%. In the non-farm sector, 142,000 new jobs were created in August against a forecast of 162,000, with July's figures revised downward by 25,000. Unemployment decreased from 4.3% to 4.2%. The broader U6 unemployment rate increased from 7.8% to 7.9%. However, hourly earnings increased by 0.4% for the month. Overall, our expectations for good data were met. But we don't see the authorities' desire to manipulate the market here; the data came out at the forecast level and maintained a slight intrigue regarding the September rate cut. We believe the rate will be lowered by 0.25%, but some players are still pricing in a 30% probability of a 0.50% rate cut in September and a 41% probability of a 0.50% cut at the December meeting. Hence, the main movement of the dollar strengthening will start from September 18.

On Thursday, September 12, the European Central Bank will lower the rate by 0.25%. Market participants fully anticipate such a decrease, but it has not yet been priced in. We believe that market participants will wait until the Federal Reserve's decision and then start actively buying dollars. Currently, on the daily chart, the euro is in a balanced state—at the support level of 1.1085—and this equilibrium is confirmed by the Marlin oscillator, which is on the zero line. According to the main scenario, the euro needs to consolidate below the support level, and then an attempt can be made to target 1.1010. Generally, we expect the euro to be in the range of 1.0888-1.0905.

In the 4-hour chart, the price is above the balance line, with Marlin in the positive area. Price growth is possible, but it is limited by the MACD line around 1.1113. In general, the sideways movement of the euro is likely today and tomorrow.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3MCLCLR

The currency market's reaction to Friday's US employment data was surprisingly muted – the dollar index changed by 0.07%, gold dropped by 0.73%, and oil by 2.14%. The stock market reacted strongly, with a decline of 1.73%. In the non-farm sector, 142,000 new jobs were created in August against a forecast of 162,000, with July's figures revised downward by 25,000. Unemployment decreased from 4.3% to 4.2%. The broader U6 unemployment rate increased from 7.8% to 7.9%. However, hourly earnings increased by 0.4% for the month. Overall, our expectations for good data were met. But we don't see the authorities' desire to manipulate the market here; the data came out at the forecast level and maintained a slight intrigue regarding the September rate cut. We believe the rate will be lowered by 0.25%, but some players are still pricing in a 30% probability of a 0.50% rate cut in September and a 41% probability of a 0.50% cut at the December meeting. Hence, the main movement of the dollar strengthening will start from September 18.

On Thursday, September 12, the European Central Bank will lower the rate by 0.25%. Market participants fully anticipate such a decrease, but it has not yet been priced in. We believe that market participants will wait until the Federal Reserve's decision and then start actively buying dollars. Currently, on the daily chart, the euro is in a balanced state—at the support level of 1.1085—and this equilibrium is confirmed by the Marlin oscillator, which is on the zero line. According to the main scenario, the euro needs to consolidate below the support level, and then an attempt can be made to target 1.1010. Generally, we expect the euro to be in the range of 1.0888-1.0905.

In the 4-hour chart, the price is above the balance line, with Marlin in the positive area. Price growth is possible, but it is limited by the MACD line around 1.1113. In general, the sideways movement of the euro is likely today and tomorrow.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3MCLCLR

- IFX Bella

- Posts: 438

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Forecast for EUR/USD on September 10, 2024

At the end of yesterday, the euro fell by 51 pips. This is probably a continuation of the reaction to Friday's US employment data. The euro can no longer hold back the obvious (reasons) — the imminent European Central Bank rate cut and the restrained pace of the Federal Reserve's rate cut on a locally overbought euro. Germany's CPI for August will be released today, expected to fall from 2.3% y/y to 1.9% y/y. In the UK, July's unemployment rate is expected to fall from 4.2% to 4.1%. The euro may continue its downward slide.

The euro is still within the consolidation range of 1.1030/85 theoretically, but on the daily time frame, the price is already pushing through the nearest embedded line of the descending green price channel. The movement's target is the level of 1.1010. From there, an assault on 1.0950 will begin, reinforced by the MACD line. If the price is not contained, we expect strong movement directly from the moment the ECB cuts rates on September 12th.

In the 4-hour chart, the price consolidated below both indicator lines, with Marlin declining in the negative area. The prevailing short-term trend is downward.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3Ziqge7

At the end of yesterday, the euro fell by 51 pips. This is probably a continuation of the reaction to Friday's US employment data. The euro can no longer hold back the obvious (reasons) — the imminent European Central Bank rate cut and the restrained pace of the Federal Reserve's rate cut on a locally overbought euro. Germany's CPI for August will be released today, expected to fall from 2.3% y/y to 1.9% y/y. In the UK, July's unemployment rate is expected to fall from 4.2% to 4.1%. The euro may continue its downward slide.

The euro is still within the consolidation range of 1.1030/85 theoretically, but on the daily time frame, the price is already pushing through the nearest embedded line of the descending green price channel. The movement's target is the level of 1.1010. From there, an assault on 1.0950 will begin, reinforced by the MACD line. If the price is not contained, we expect strong movement directly from the moment the ECB cuts rates on September 12th.

In the 4-hour chart, the price consolidated below both indicator lines, with Marlin declining in the negative area. The prevailing short-term trend is downward.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3Ziqge7

- IFX Bella

- Posts: 438

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Apple Slows Down, Boeing Takes Off: How Are Trends Changing?

Wall Street Gains After Selloff The key U.S. stock indexes posted solid gains of more than 1% on Monday as market participants looked for bargains after last week's big selloff. Investors' expectations were also focused on upcoming inflation data and Federal Reserve decisions to be announced in the coming days. Last Week's Slide and Why It Mattered It was a tough week for investors, with Friday's reports showing weaker-than-expected employment data for August. This followed disappointing manufacturing data released on Tuesday, which sent the Nasdaq Composite (.IXIC) to its biggest weekly loss since January 2022, while the S&P 500 (.SPX) posted its biggest decline since March 2023. Awaiting key data and decisions Amid uncertainty and new economic data, market participants continue to brace for potential volatility from the release of fresh inflation data and the Federal Reserve's monetary policy decision, which could significantly impact the future direction of markets.

News are provided by InstaForex.

Read more: https://ifxpr.com/4eiJcha

Wall Street Gains After Selloff The key U.S. stock indexes posted solid gains of more than 1% on Monday as market participants looked for bargains after last week's big selloff. Investors' expectations were also focused on upcoming inflation data and Federal Reserve decisions to be announced in the coming days. Last Week's Slide and Why It Mattered It was a tough week for investors, with Friday's reports showing weaker-than-expected employment data for August. This followed disappointing manufacturing data released on Tuesday, which sent the Nasdaq Composite (.IXIC) to its biggest weekly loss since January 2022, while the S&P 500 (.SPX) posted its biggest decline since March 2023. Awaiting key data and decisions Amid uncertainty and new economic data, market participants continue to brace for potential volatility from the release of fresh inflation data and the Federal Reserve's monetary policy decision, which could significantly impact the future direction of markets.

News are provided by InstaForex.

Read more: https://ifxpr.com/4eiJcha

- IFX Bella

- Posts: 438

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Hot Forecast for EUR/USD on September 11, 2024

If the debate between Donald Trump and Joseph Biden was a real disaster, yesterday's debate with Kamala Harris was much smoother and didn't cause any panic. So, the markets were able to ignore them. Investors can now calmly focus solely on U.S. inflation, especially since the rate of consumer price growth is expected to slow from 2.9% to 2.6%. This would likely convince the markets of a 50-basis-point cut in the Federal Reserve's interest rate. Thus, there is a high likelihood of a significant weakening of the U.S. dollar.

After testing the previous week's local low, the EUR/USD pair has resumed its corrective cycle. However, this movement didn't lead to any radical changes; the price merely returned to the upper deviation area of the psychological level of 1.1000/1.1050. In the 4-hour chart, the RSI technical indicator is moving in the lower 30/50 range, indicating bearish sentiment among market participants. Regarding the Alligator indicator in the same time frame, the moving average lines point downwards, which coincides with the direction of the price movement. Expectations and Prospects Stabilizing the price below the 1.1000 mark is necessary for the next phase of the decline. However, this would only shift the local support level to the lower region of the psychological range. Until that happens, traders are considering a price rebound as the main scenario on the market. The complex indicator analysis suggests a price rebound in the short term, while indicators point to a downward cycle in the intraday period.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3ToxY2Q

If the debate between Donald Trump and Joseph Biden was a real disaster, yesterday's debate with Kamala Harris was much smoother and didn't cause any panic. So, the markets were able to ignore them. Investors can now calmly focus solely on U.S. inflation, especially since the rate of consumer price growth is expected to slow from 2.9% to 2.6%. This would likely convince the markets of a 50-basis-point cut in the Federal Reserve's interest rate. Thus, there is a high likelihood of a significant weakening of the U.S. dollar.

After testing the previous week's local low, the EUR/USD pair has resumed its corrective cycle. However, this movement didn't lead to any radical changes; the price merely returned to the upper deviation area of the psychological level of 1.1000/1.1050. In the 4-hour chart, the RSI technical indicator is moving in the lower 30/50 range, indicating bearish sentiment among market participants. Regarding the Alligator indicator in the same time frame, the moving average lines point downwards, which coincides with the direction of the price movement. Expectations and Prospects Stabilizing the price below the 1.1000 mark is necessary for the next phase of the decline. However, this would only shift the local support level to the lower region of the psychological range. Until that happens, traders are considering a price rebound as the main scenario on the market. The complex indicator analysis suggests a price rebound in the short term, while indicators point to a downward cycle in the intraday period.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3ToxY2Q

- IFX Bella

- Posts: 438

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Hot Forecast for EUR/USD on September 12, 2024

The slowdown in inflation in the United States turned out to be more significant than even the most optimistic forecasts, yet the situation in the currency market remained unchanged. Almost immediately after it was revealed that the consumer price growth rate had slowed from 2.9% to 2.5%, major media outlets began focusing on core inflation, particularly in its monthly measure rather than the annual one. Core inflation increased by 0.3%. Although the U.S. central bank never mentions this indicator and is thus largely insignificant, the media started claiming that the Federal Reserve will slowly lower interest rates because of core inflation. As a result, the media frenzy somewhat balanced out the actual data, leaving the market in its previous position. Today, all eyes are on the European Central Bank's board meeting. The market has long been prepared for the refinancing rate to be lowered from 4.25% to 4.00%, so this fact will not affect investor sentiment. Everything will depend on the statements ECB President Christine Lagarde may make during the subsequent press conference, particularly regarding the central bank's future actions. The market is concerned only with the pace of monetary policy easing at least until the end of this year. If the head of the ECB announces even one more rate cut, it will substantially boost the U.S. dollar, allowing it to continue strengthening its position.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4d2bATF

The slowdown in inflation in the United States turned out to be more significant than even the most optimistic forecasts, yet the situation in the currency market remained unchanged. Almost immediately after it was revealed that the consumer price growth rate had slowed from 2.9% to 2.5%, major media outlets began focusing on core inflation, particularly in its monthly measure rather than the annual one. Core inflation increased by 0.3%. Although the U.S. central bank never mentions this indicator and is thus largely insignificant, the media started claiming that the Federal Reserve will slowly lower interest rates because of core inflation. As a result, the media frenzy somewhat balanced out the actual data, leaving the market in its previous position. Today, all eyes are on the European Central Bank's board meeting. The market has long been prepared for the refinancing rate to be lowered from 4.25% to 4.00%, so this fact will not affect investor sentiment. Everything will depend on the statements ECB President Christine Lagarde may make during the subsequent press conference, particularly regarding the central bank's future actions. The market is concerned only with the pace of monetary policy easing at least until the end of this year. If the head of the ECB announces even one more rate cut, it will substantially boost the U.S. dollar, allowing it to continue strengthening its position.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4d2bATF

- IFX Bella

- Posts: 438

- Joined: Sat Dec 08, 2012 12:39 am