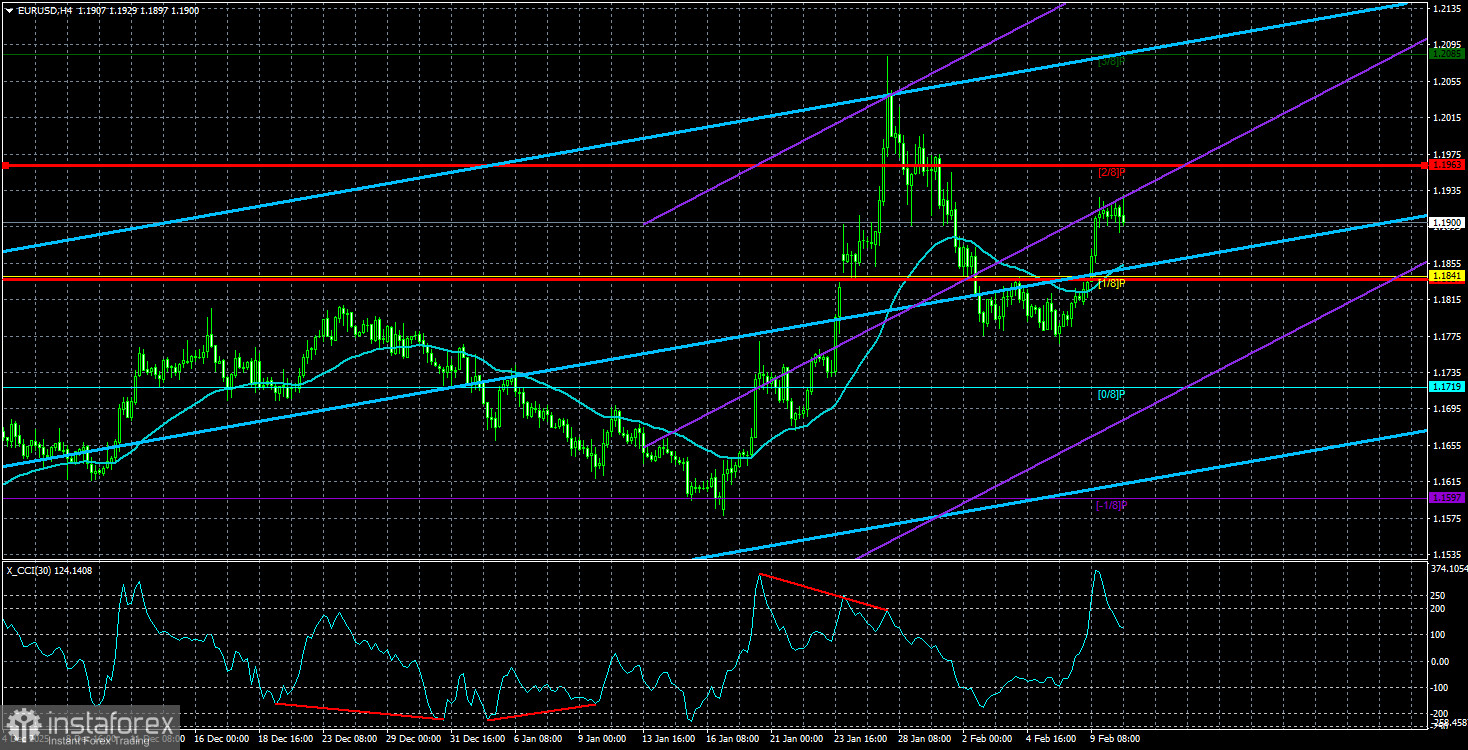

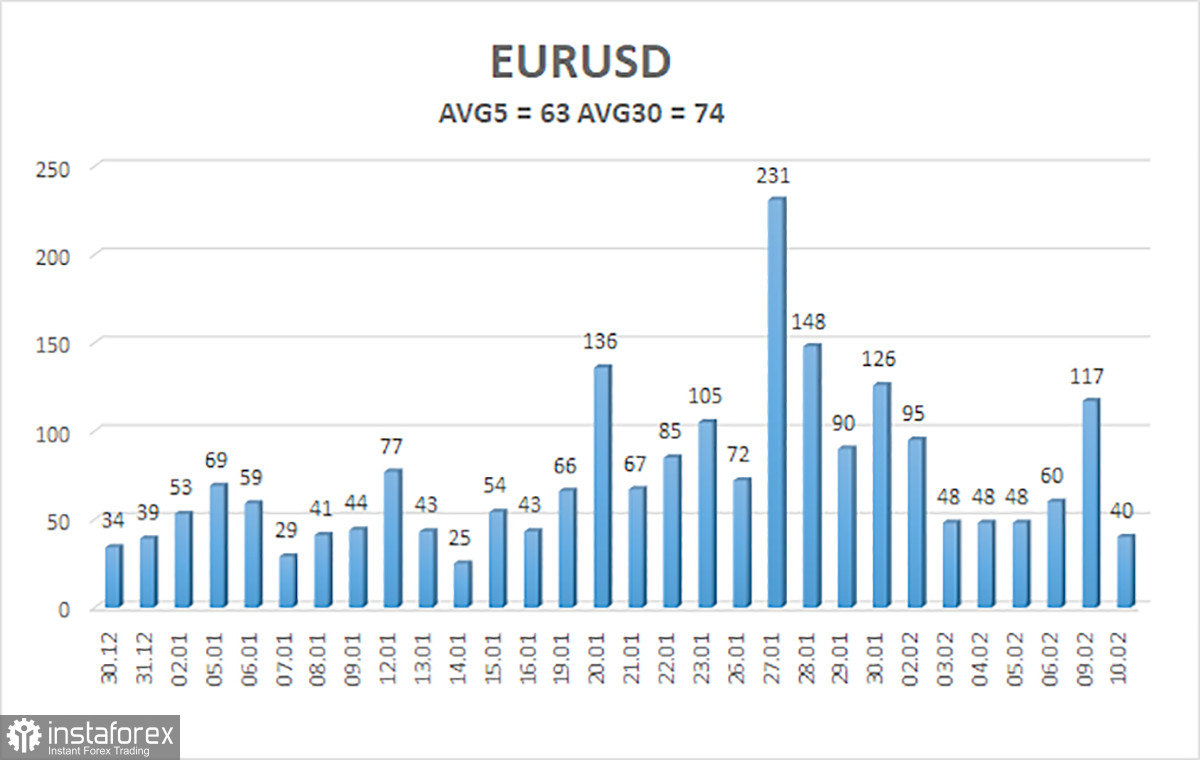

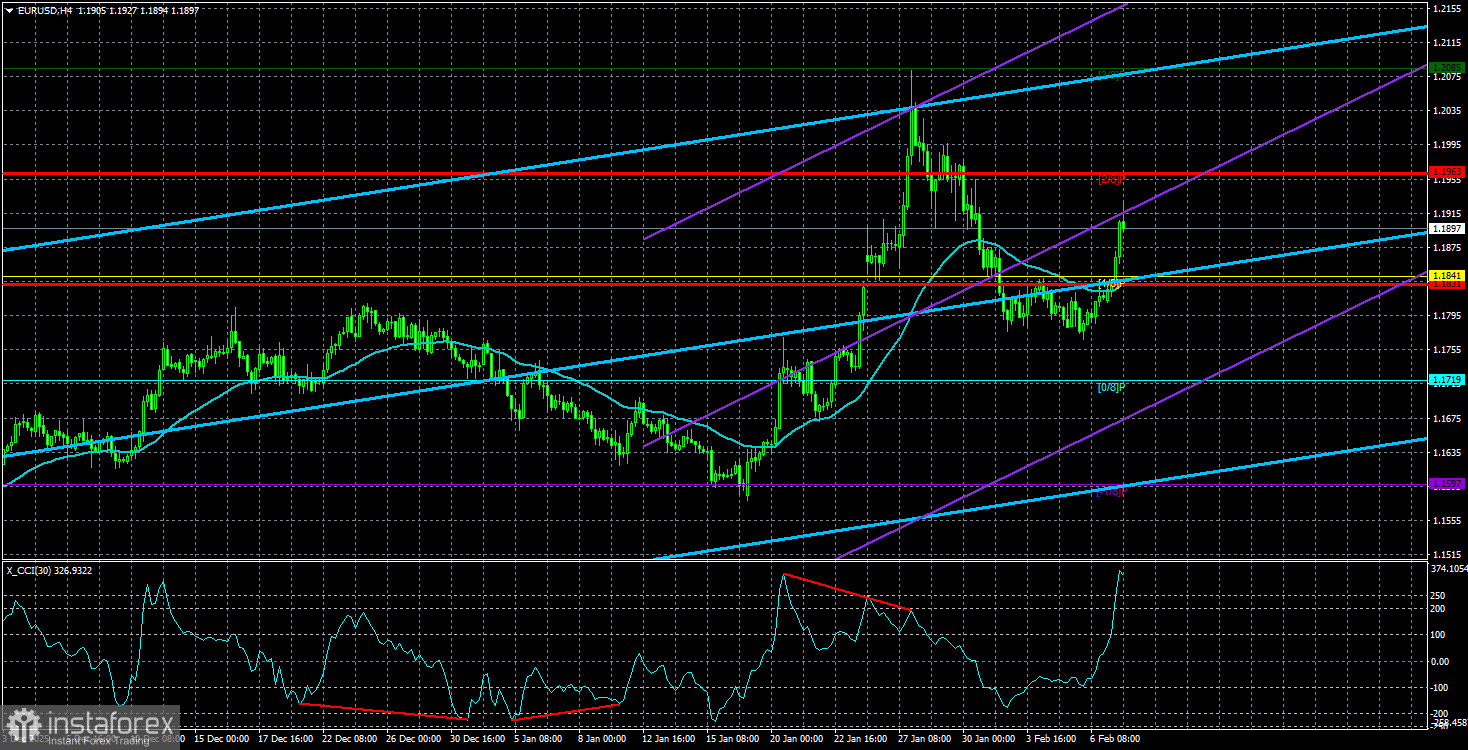

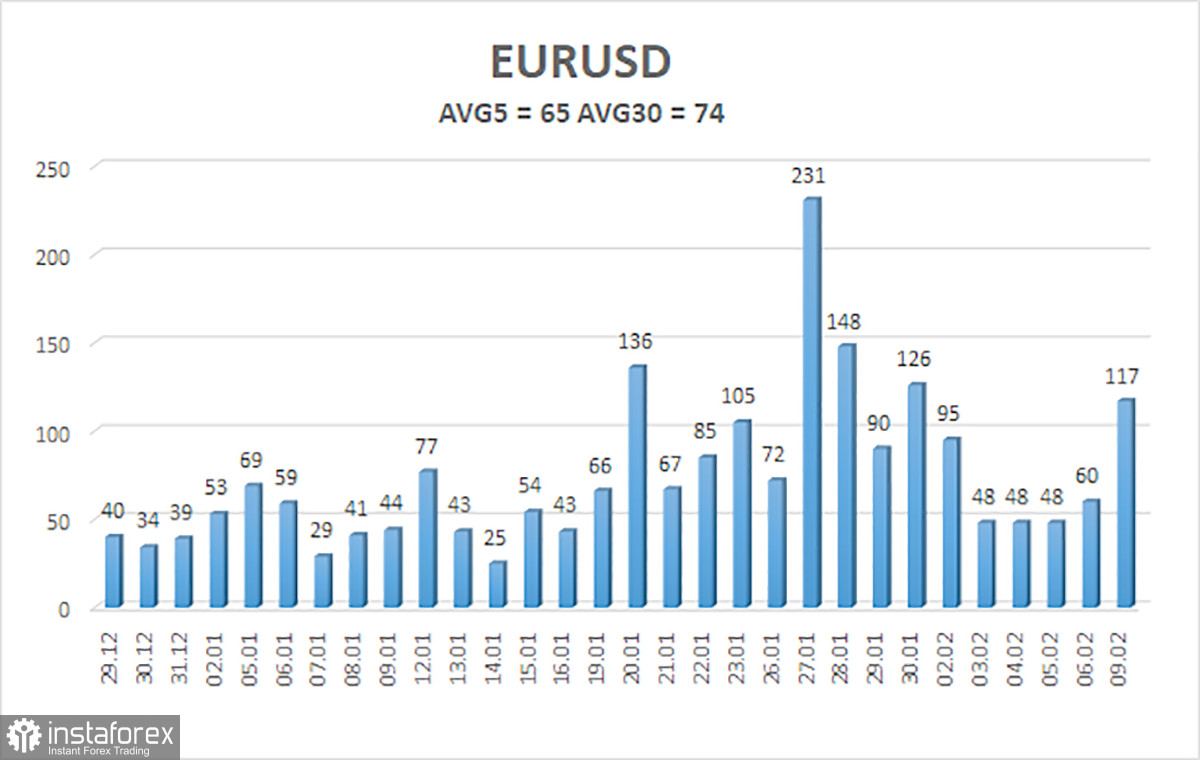

The EUR/USD currency pair unexpectedly began to rise on Monday. Although, upon closer inspection, nothing was surprising about this growth. Many traders frequently make the same mistake. They believe that market movements occur only under the influence of specific events, such as macroeconomic or fundamental factors. However, this is not the case at all. The market operates in much more complex ways. For instance, last week we saw practically no movement. Before that, there was a weekly rise in the dollar, which had little basis. However, technically, we first saw a 500-pip rise, followed by a reasonable correction, a brief pause, and then the resumption of the primary trend, which is clearly visible on the daily timeframe. Therefore, from our perspective, the European currency is once again aiming for the 21 level. Are there grounds for this? A million. The ongoing and constantly escalating trade war, Trump's military and geopolitical ambitions, the scandal related to the "Epstein case," the persistent pressure from Trump on Jerome Powell, Lisa Cook, and the entire Federal Reserve, and the weakness of the labor market all contribute to this. The market simply cannot find reasons to buy the dollar. It has even ceased to trust macroeconomic data. Traders are no longer impressed by economic growth rates of 4.4% or strong readings in business activity indices. Trump has turned half the world against him, including many foreign investors. Protests against the president are occurring in America with alarming regularity, and his political rating has plummeted to its lowest levels. Many political experts predict that the Republican Party will lose one or both chambers of Congress by November. Naturally, the strengthening of the European currency is not related to Christine Lagarde's morning speech or the European Central Bank's policies in general. Lagarde stated just last week that the central bank does not intend to change interest rates based on inflation at 1.7%, but warned that, due to the high euro exchange rate, the consumer price index may slow further. If this happens, in which direction will the ECB be considering? Obviously, towards a "dovish" stance. Therefore, if we are destined to see a change in ECB rates in 2026, it will clearly be downward. Thus, one could say that "dovish" market expectations are slowly rising, but this is not reflected in the euro's exchange rate at all. The reason, as we have already mentioned, is one: Donald Trump and his brilliant policies. Many traders may wonder why the EUR/USD pair did not rise between August and January. However, we have answered this question many times. The market was flat for 7 months—a necessary part of any trend. We also stated that market makers would eventually finish forming their positions, that the trend would resume, and that the positions were clearly not short.

Analysis are provided by InstaForex.

Read more: hhttps://ifxpr.com/4quFwPk