Market Fundamental Analysis for January 23, 2026 EURUSDEvent to pay attention to today:11:00 EET. EUR - Business Activity Index in the Services Sector

16:45 EET. USD - PMI Index for the Services Sector

EURUSD:150% Winter Forex bonus on deposits from $250. Enter the promo code ICE150 in your Personal Account and take part! Terms apply

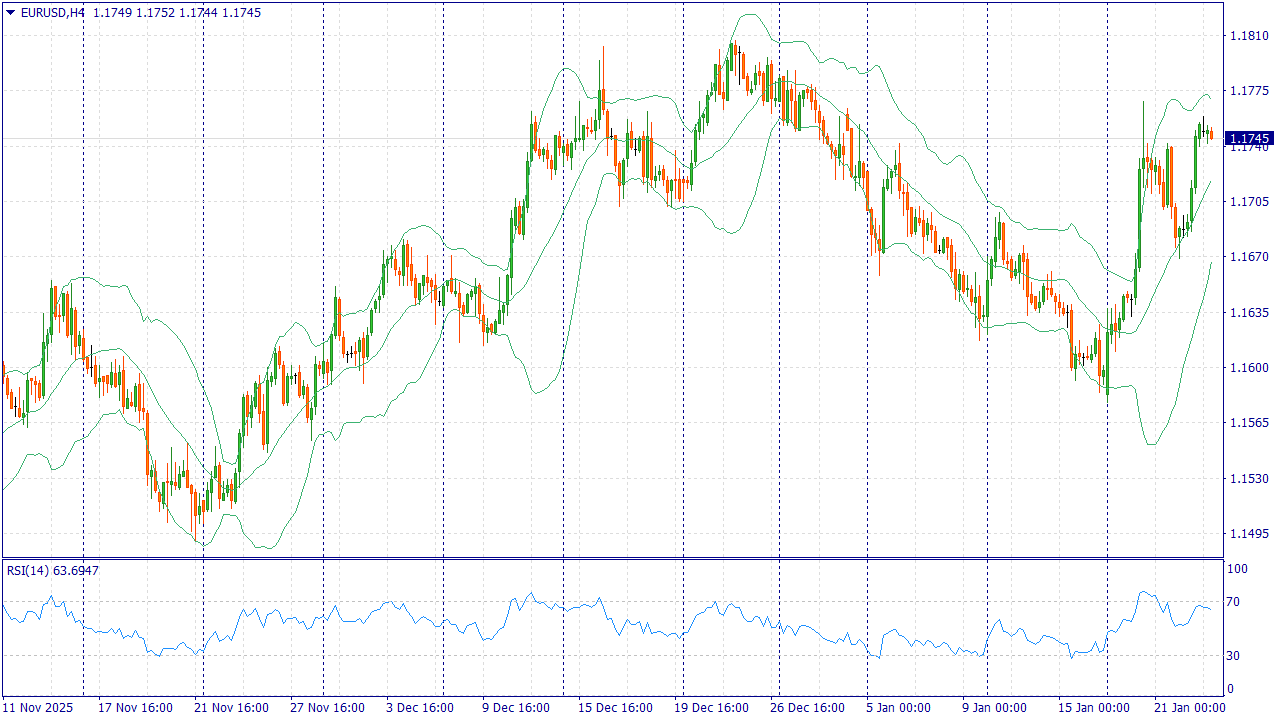

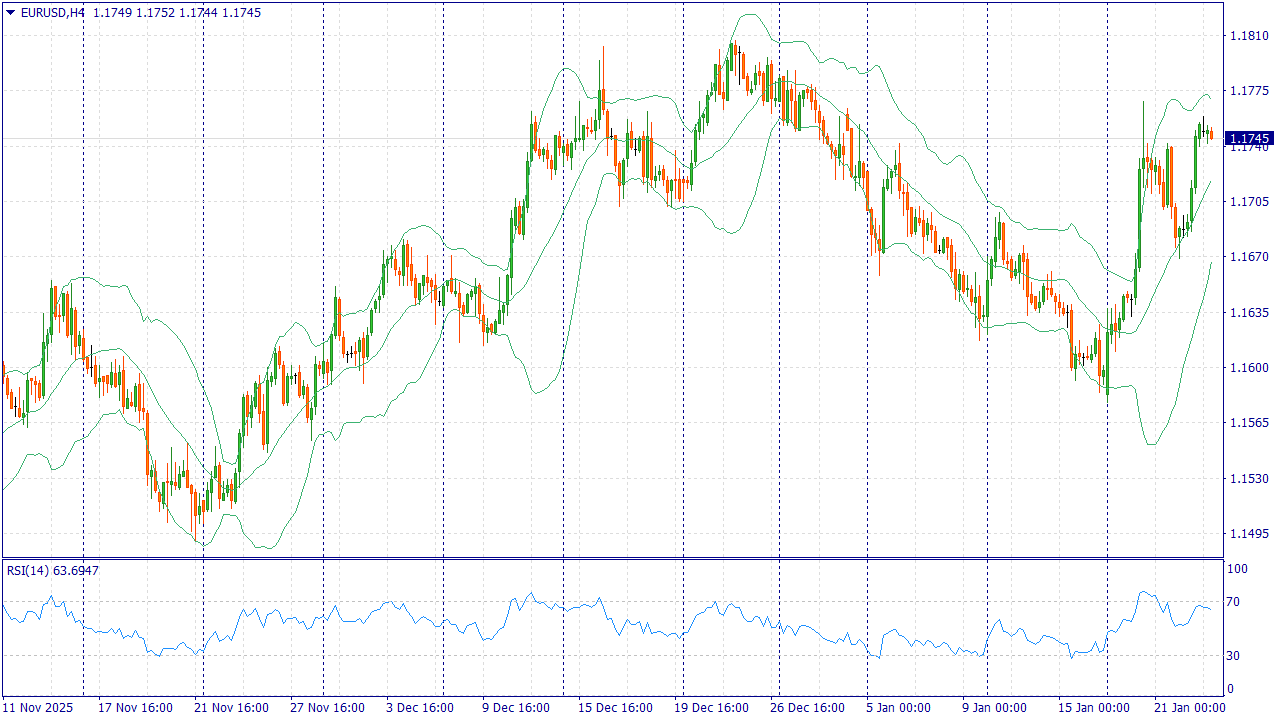

The EURUSD pair shows moderate strengthening of the euro against the US dollar, reflecting the weakness of the American currency amid expectations of key macroeconomic data from the United States. Investors remain cautious while assessing growth prospects and inflation dynamics, which reduces demand for the dollar as a safe-haven asset. Additional support for the euro comes from relative stability in the eurozone’s economic indicators and the absence of new negative signals from European regulators.

Fundamental pressure on the US dollar is increasing due to expectations of possible monetary policy easing in the United States in the medium term. Market participants are pricing in a slowdown in economic activity, which limits the potential for dollar appreciation. Against this backdrop, the euro appears more resilient, especially given that the European Central Bank has recently shown no urgency to adjust its policy stance.

At the same time, the pair remains sensitive to incoming US economic data. Stronger-than-expected indicators of economic activity or inflation could temporarily support the dollar and trigger a correction in EURUSD. In the base scenario, the balance of risks remains tilted in favor of the euro, allowing for further upward movement of the pair within the current fundamental environment.

Trading recommendation: BUY 1.1750, SL 1.1710, TP 1.1830Our company provides an opportunity to earn income not only from your trading. By attracting clients within the

affiliate program, you can get up to $30 per lot!

You can find more analytical information on our website.