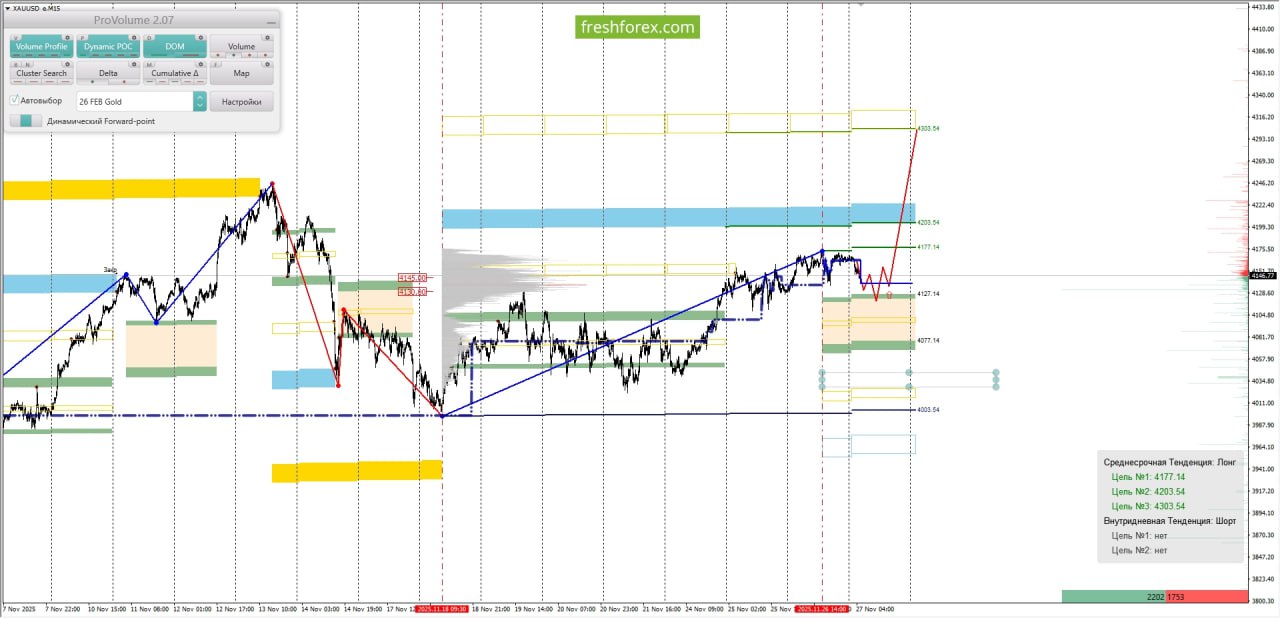

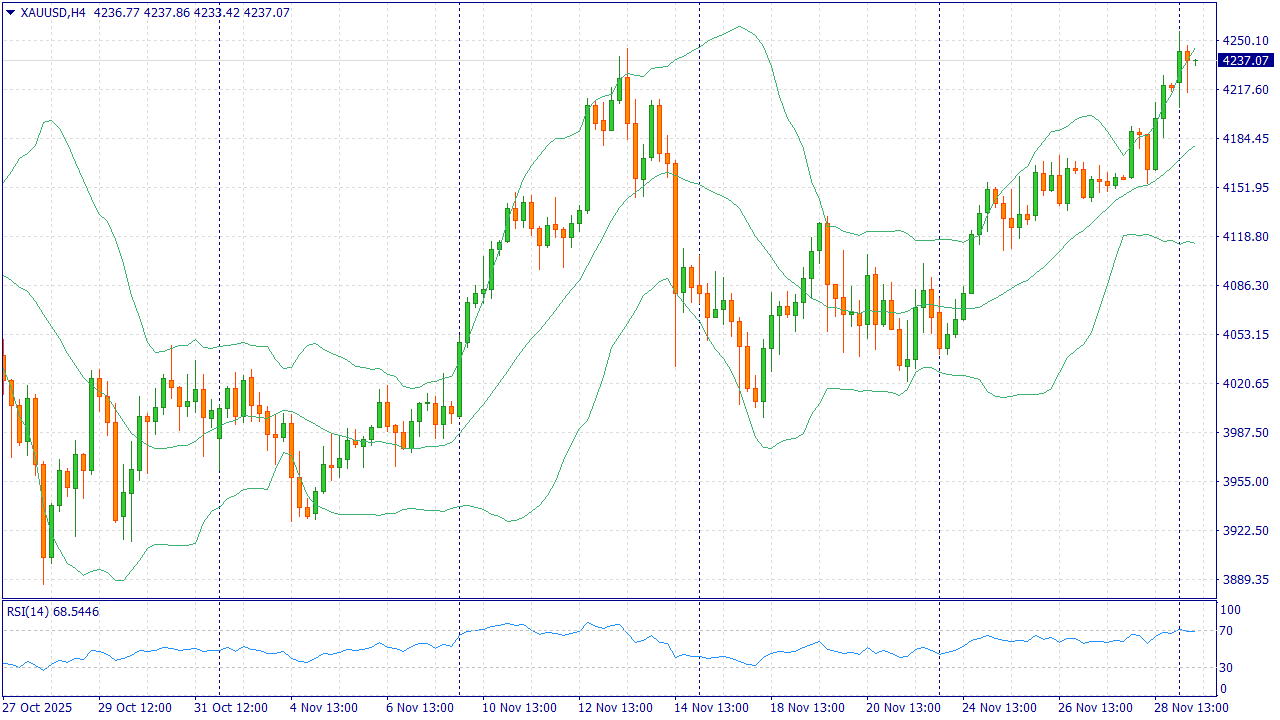

XAUUSD: BUY 4050.00, SL 4000.00, TP 4200.00

For our readers only—202% bonus on deposits from $202; mention promo code WINx2 in support and trade with TRIPLED capital; details via the link.

Gold starts the week at elevated levels: morning reports place spot near 4,054.19 per ounce. Investors keep hedging against political and geo-economic risks, while temporary gaps in US official data releases make it harder for the Fed to rely on the usual inputs, which supports demand for safe assets. Into the December meeting, markets see a meaningful probability of a rate cut, easing dollar financial conditions and backing the metal. Additional drivers include steady inflows into gold funds and continued central-bank buying through the autumn.

The weekly balance looks constructive: swings in US Treasury yields remain contained, while official purchases and investment inflows provide a demand cushion. Risks to the bullish case include a stronger dollar alongside rising real yields and more restrictive remarks from some Fed officials, which could delay policy easing. Even so, the combination of scarce safe-haven alternatives and ongoing investment demand argues for support on pullbacks.

Trading recommendation: BUY 4050.00, SL 4000.00, TP 4200.00

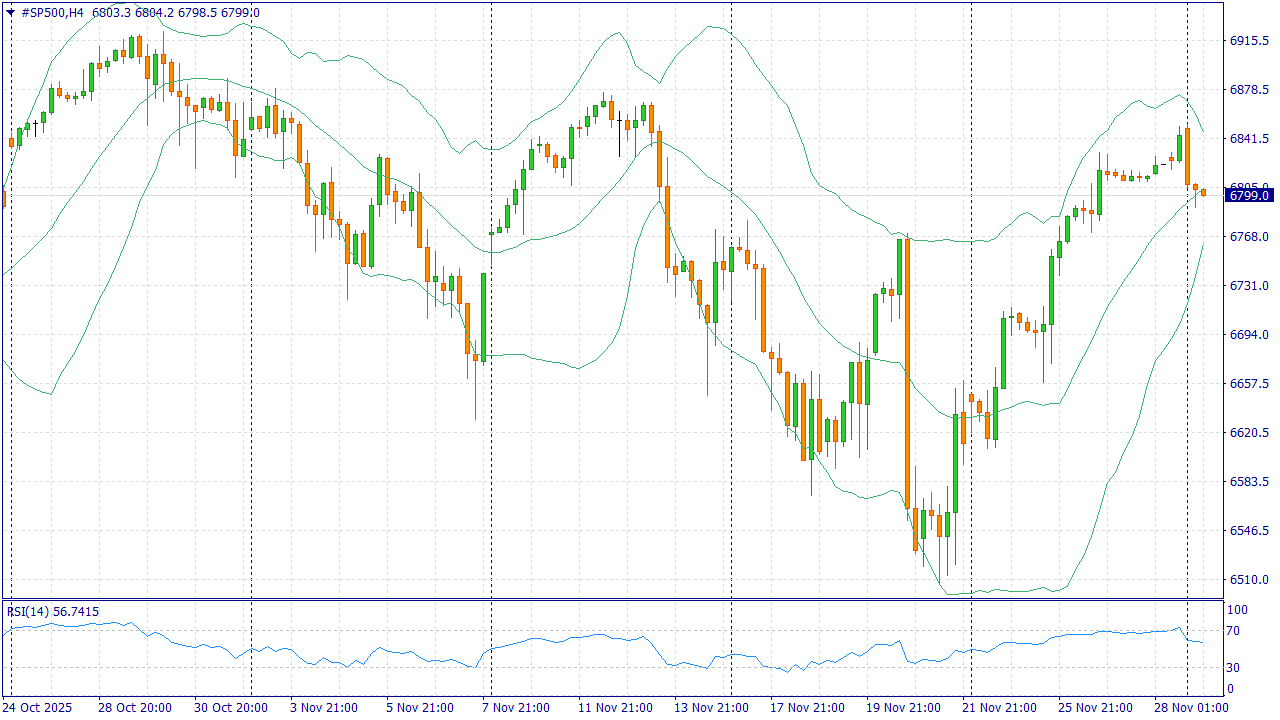

#SP500: BUY 6600, SL 6500, TP 6900

Last week ended with a pullback in the major US indices, but the new week begins on a calmer footing: S&P 500 futures are firmer in early trade, and the debate around the December Fed decision is tilting toward some easing. In aggregate, that reduces borrowing-cost pressure and underpins expectations for future earnings. Through November, strong corporate results helped: realized S&P 500 earnings growth clearly outpaced estimates from the start of the quarter, softening the drag from lofty valuations.

Over the week ahead the setup is mixed but mildly positive: the prospect of easier Fed policy, 10-year yields stabilizing near 4%, and softer oil prices improve cost and margin expectations for several sectors. Headwinds include elevated volatility among tech leaders and uncertainty about the timing of subsequent policy steps. In this backdrop, a modest upside for the benchmark looks like the base case unless inflation risks re-accelerate unexpectedly.

Trading recommendation: BUY 6600, SL 6500, TP 6900

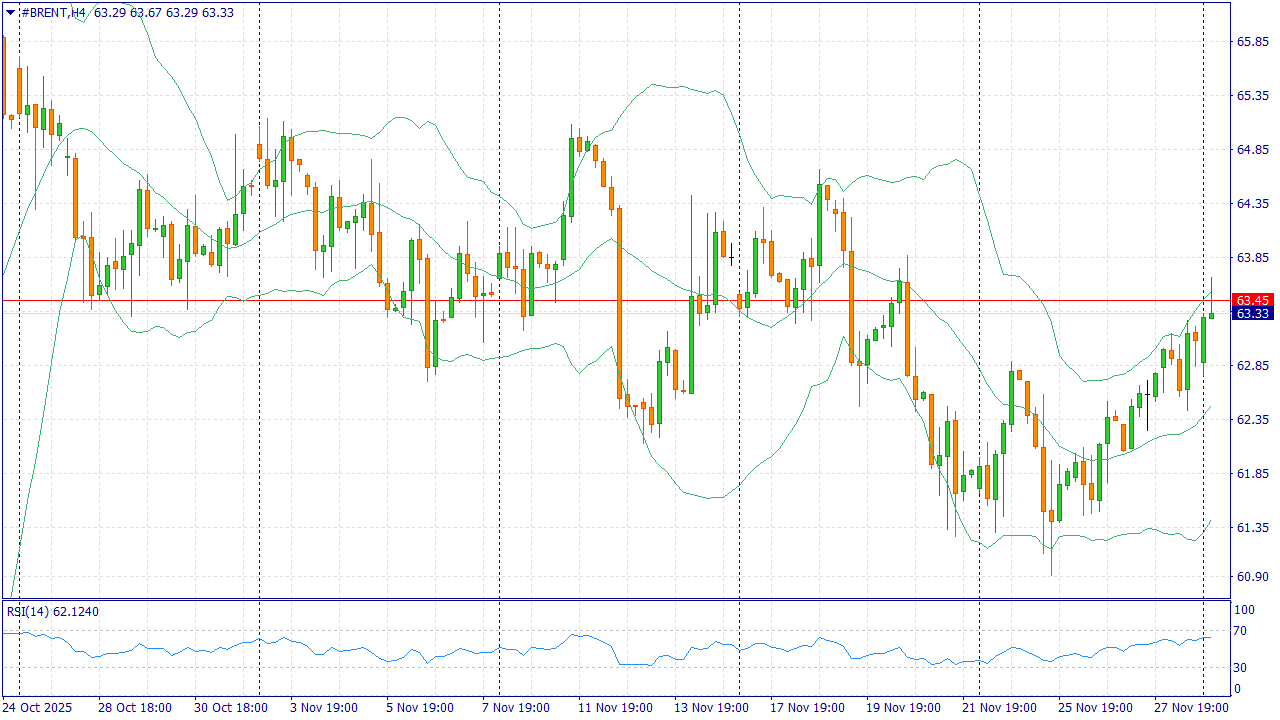

#BRENT: SELL 62.50, SL 65.00, TP 55.00

Oil opened the week under pressure: morning reports show Brent around 62.46 per barrel. The market is digesting headlines that trim the geopolitical premium and imply a possible gradual expansion of supply over the medium term. At the same time, US commercial inventories continue to trend higher, and recent projections point to stock builds in Q4, which also weighs on prices.

On the supply side, OPEC+ decisions for year-end and the working configuration for early next year do not remove oversupply concerns: growth from producers outside the alliance together with the recovery in certain exports continues to pressure the futures curve. A firmer dollar also caps prices by raising the cost of imported crude for consumers. Net-net, the base case for the week is a continuation of the downward drift, with occasional bounces on sanction or disruption headlines.

Trading recommendation: SELL 62.50, SL 65.00, TP 55.00

Up to $20 for each lot in real money - get a guaranteed income by connecting Cashback promotion!

You can find more analytical information on our website