Forex Analysis & Reviews: Tesla Buzz, Nasdaq Gains, Nvidia Intrigue — Wall Street Events

Nasdaq and S&P 500 Results: Nvidia on the Horizon, Tesla Surprises The Nasdaq and S&P 500 ended Monday's trading in the "green zone," recouping some of their previous losses. Investors turned their attention to Nvidia's (NVDA.O) earnings call, while Tesla's (TSLA.O) shares rose sharply on expectations of favorable policy changes from the new Trump administration. Nvidia: AI bets continue Nvidia is set to report third-quarter financial results on Wednesday, with investors awaiting answers to a key question: whether strong demand for chips is continuing and whether the AI euphoria that has driven growth this year is sustaining the market. The company, which has accounted for about 20% of the S&P 500's earnings over the past 12 months, is expected to post 25% EPS growth in the third quarter, according to analysts at BofA Global Research. However, Nvidia shares fell 1.3% after reports of new AI chips overheating in server systems. Expert Comments: Moderate Optimism "Nvidia is the last of the Magnificent Seven to report quarterly results. While we are seeing revenue and interest pick up, the current level of expectations is not as high as it was a quarter or two ago," said Carol Schleif, chief investment officer at BMO Family Office.

News are provided by InstaForex

Read more: https://ifxpr.com/3YYEEqh

Instaforex Analysis

Re: Instaforex Analysis

Forex Analysis & Reviews: USD/JPY: Simple Trading Tips for Beginner Traders on November 21. Analysis of Yesterday's Forex Trades

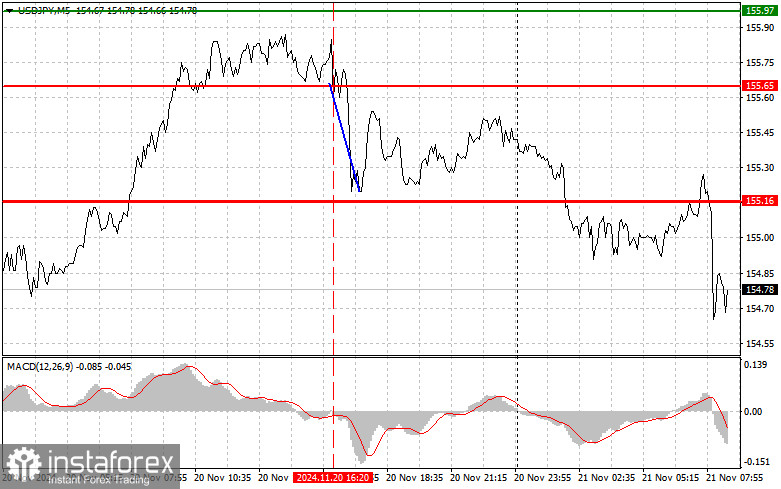

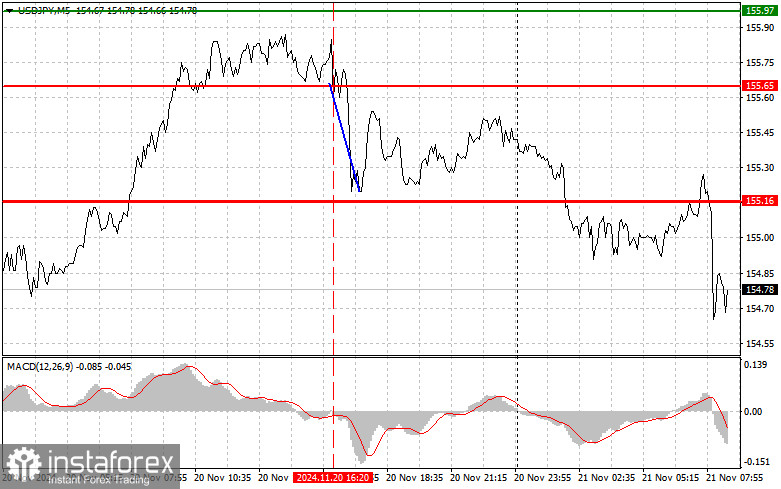

Analysis of Trades and Trading Recommendations for the Japanese Yen The test of the 155.65 price level occurred when the MACD indicator had just started moving down from the zero line, confirming a valid entry point for selling the dollar. As a result, the pair dropped to the target level of 155.16. The U.S. dollar remains in demand despite expectations of an interest rate hike in Japan. Today's speech by Bank of Japan Governor Kazuo Ueda had a noticeable impact on financial markets, leading to a slight yen strengthening. Speaking at a press conference, Ueda emphasized the need to evaluate the current economic situation further and adapt monetary policy to global changes. His comments on a potential policy shift amid inflationary pressures sparked some interest, although he provided no definitive recommendations. According to economists, short-term expectations for interest rate hikes in Japan became more justified after the governor's speech, prompting a drop in the USD/JPY pair. However, this has not affected the broader upward trend. Considering the challenges facing Japan's economy during recovery, Ueda noted that a readiness to adjust rates could bolster confidence in the yen. Still, given the global dominance of the U.S. dollar against various risk assets, caution is advised when selling the pair. For intraday strategies, I will focus on Scenario #1 and Scenario #2.

Buy Scenarios Scenario #1: I plan to buy USD/JPY today at the 155.04 entry level (green line on the chart) with a target of 155.66 (thicker green line on the chart). At 155.66, I plan to exit purchases and open sales in the opposite direction, aiming for a 30-35 pip reversal from the entry point. Growth in the pair is possible, but it is better to buy on corrections. Important! Before buying, ensure that the MACD indicator is above the zero line and beginning to rise. Scenario #2: I also plan to buy USD/JPY if the MACD indicator is in the oversold zone and the pair tests 154.55 twice consecutively. This will limit the pair's downward potential and lead to an upward market reversal. A rise to the opposite levels of 155.04 and 155.66 can be expected. Sell Scenarios Scenario #1: I plan to sell USD/JPY only after breaking below the 154.55 level (red line on the chart), which should lead to a quick decline in the pair. The key target for sellers will be 153.97, where I plan to exit sales and immediately open purchases in the opposite direction, aiming for a 20-25 pip reversal. Downward pressure on the pair may persist during the first half of the day. Important! Before selling, ensure that the MACD indicator is below the zero line and beginning to decline. Scenario #2: I also plan to sell USD/JPY if the MACD indicator is in the overbought zone and the pair tests 155.04 consecutively. This will limit the pair's upward potential and lead to a market reversal downward. A decline to the opposite levels of 154.55 and 153.97 can be expected.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4g04pgX

Analysis of Trades and Trading Recommendations for the Japanese Yen The test of the 155.65 price level occurred when the MACD indicator had just started moving down from the zero line, confirming a valid entry point for selling the dollar. As a result, the pair dropped to the target level of 155.16. The U.S. dollar remains in demand despite expectations of an interest rate hike in Japan. Today's speech by Bank of Japan Governor Kazuo Ueda had a noticeable impact on financial markets, leading to a slight yen strengthening. Speaking at a press conference, Ueda emphasized the need to evaluate the current economic situation further and adapt monetary policy to global changes. His comments on a potential policy shift amid inflationary pressures sparked some interest, although he provided no definitive recommendations. According to economists, short-term expectations for interest rate hikes in Japan became more justified after the governor's speech, prompting a drop in the USD/JPY pair. However, this has not affected the broader upward trend. Considering the challenges facing Japan's economy during recovery, Ueda noted that a readiness to adjust rates could bolster confidence in the yen. Still, given the global dominance of the U.S. dollar against various risk assets, caution is advised when selling the pair. For intraday strategies, I will focus on Scenario #1 and Scenario #2.

Buy Scenarios Scenario #1: I plan to buy USD/JPY today at the 155.04 entry level (green line on the chart) with a target of 155.66 (thicker green line on the chart). At 155.66, I plan to exit purchases and open sales in the opposite direction, aiming for a 30-35 pip reversal from the entry point. Growth in the pair is possible, but it is better to buy on corrections. Important! Before buying, ensure that the MACD indicator is above the zero line and beginning to rise. Scenario #2: I also plan to buy USD/JPY if the MACD indicator is in the oversold zone and the pair tests 154.55 twice consecutively. This will limit the pair's downward potential and lead to an upward market reversal. A rise to the opposite levels of 155.04 and 155.66 can be expected. Sell Scenarios Scenario #1: I plan to sell USD/JPY only after breaking below the 154.55 level (red line on the chart), which should lead to a quick decline in the pair. The key target for sellers will be 153.97, where I plan to exit sales and immediately open purchases in the opposite direction, aiming for a 20-25 pip reversal. Downward pressure on the pair may persist during the first half of the day. Important! Before selling, ensure that the MACD indicator is below the zero line and beginning to decline. Scenario #2: I also plan to sell USD/JPY if the MACD indicator is in the overbought zone and the pair tests 155.04 consecutively. This will limit the pair's upward potential and lead to a market reversal downward. A decline to the opposite levels of 154.55 and 153.97 can be expected.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/4g04pgX

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Market at crossroads amid tensions: How investors are saving themselves in an era of uncertainty

Nasdaq slows down as investors ponder The tech-heavy Nasdaq ended Wednesday in the red, breaking the day's upward move. The reason was the growing geopolitical tensions between Russia and Ukraine, as well as weak financial results from Target. Investors were anxiously awaiting the release of Nvidia's quarterly results, which, however, fell short of inflated expectations. Dow in the green, S&P 500 is flat The Dow Jones managed to finish the session higher, while the S&P 500 remained virtually unchanged. Meanwhile, morning trading began with a general decline - the news of Ukraine using British Storm Shadow missiles on Russian territory stirred up the markets. This happened immediately after the announcement of the launch of American ATACMS missiles, which prompted Russia to announce a reduction in the nuclear threshold. "Fear scale" at a maximum since 2020 The Wall Street VIX volatility index, known as the "fear scale", rose to 18.79, which was a record since November 2020, and then fell to 17.24. Despite the pullback, anxiety in the markets remains high. "After yesterday's strong rally in the tech sector, today the market switched to a more defensive mode," said James Regan, head of research at D.A. Davidson. Nvidia: High Expectations Disappointed The quarterly earnings report from AI chipmaker Nvidia was the highlight of the evening. The company's shares were down 0.76% during the session and fell further after the close. Despite a fourth-quarter revenue forecast that beat analysts' average estimates, investors were expecting more. The market, which has seen a strong rally, is once again faced with a choice between risk and caution as global events add uncertainty. Tech Under Pressure: Nasdaq Slightly Down The information technology sector was under pressure, ending the session down 0.23%, which affected overall investor sentiment. The tech-heavy Nasdaq lost 0.11%, showing that confidence in the segment has weakened somewhat.

News are provided by InstaForex

Read more: https://ifxpr.com/3V13DYS

Nasdaq slows down as investors ponder The tech-heavy Nasdaq ended Wednesday in the red, breaking the day's upward move. The reason was the growing geopolitical tensions between Russia and Ukraine, as well as weak financial results from Target. Investors were anxiously awaiting the release of Nvidia's quarterly results, which, however, fell short of inflated expectations. Dow in the green, S&P 500 is flat The Dow Jones managed to finish the session higher, while the S&P 500 remained virtually unchanged. Meanwhile, morning trading began with a general decline - the news of Ukraine using British Storm Shadow missiles on Russian territory stirred up the markets. This happened immediately after the announcement of the launch of American ATACMS missiles, which prompted Russia to announce a reduction in the nuclear threshold. "Fear scale" at a maximum since 2020 The Wall Street VIX volatility index, known as the "fear scale", rose to 18.79, which was a record since November 2020, and then fell to 17.24. Despite the pullback, anxiety in the markets remains high. "After yesterday's strong rally in the tech sector, today the market switched to a more defensive mode," said James Regan, head of research at D.A. Davidson. Nvidia: High Expectations Disappointed The quarterly earnings report from AI chipmaker Nvidia was the highlight of the evening. The company's shares were down 0.76% during the session and fell further after the close. Despite a fourth-quarter revenue forecast that beat analysts' average estimates, investors were expecting more. The market, which has seen a strong rally, is once again faced with a choice between risk and caution as global events add uncertainty. Tech Under Pressure: Nasdaq Slightly Down The information technology sector was under pressure, ending the session down 0.23%, which affected overall investor sentiment. The tech-heavy Nasdaq lost 0.11%, showing that confidence in the segment has weakened somewhat.

News are provided by InstaForex

Read more: https://ifxpr.com/3V13DYS

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Forecast for GBP/USD on November 22, 2024

The British pound broke below the 1.2612 support level yesterday, but the Marlin oscillator did not confirm the move. Instead, it reversed and formed a weak convergence with the price.

If the price consolidates above 1.2612, the recent dip below support will be interpreted as a false breakout, serving as an additional signal for a potential upward reversal. The first target for a corrective rise is 1.2708. If the price moves to test the 1.2510 support, the reversal may be delayed for several days.

The price is moving below the balance and MACD lines on the four-hour chart. It has settled below the 1.2612 level, and the Marlin oscillator remains in negative territory. However, if the price consolidates above 1.2612, this scenario will become more plausible as the Marlin oscillator already shows signs of an intention to return to positive territory. Afterward, the price may attempt to overcome the MACD line at 1.2675. The probability of a reversal into a corrective movement is estimated at 65%.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3CQHsOH

The British pound broke below the 1.2612 support level yesterday, but the Marlin oscillator did not confirm the move. Instead, it reversed and formed a weak convergence with the price.

If the price consolidates above 1.2612, the recent dip below support will be interpreted as a false breakout, serving as an additional signal for a potential upward reversal. The first target for a corrective rise is 1.2708. If the price moves to test the 1.2510 support, the reversal may be delayed for several days.

The price is moving below the balance and MACD lines on the four-hour chart. It has settled below the 1.2612 level, and the Marlin oscillator remains in negative territory. However, if the price consolidates above 1.2612, this scenario will become more plausible as the Marlin oscillator already shows signs of an intention to return to positive territory. Afterward, the price may attempt to overcome the MACD line at 1.2675. The probability of a reversal into a corrective movement is estimated at 65%.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3CQHsOH

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Riding the Crest of a Wave: Nvidia Boosts Wall Street, Bitcoin Challenges $100K, Dollar High

Stock Markets Recover After Unsettled Trading World stock indexes rose on Thursday despite mixed sentiment among investors. The main topic of trading was Nvidia's forecasts, which, while still positive, fell short of market expectations. At the same time, Bitcoin continued its confident movement, approaching the psychological mark of $100,000. Nvidia: records and disappointment Shares of Nvidia (NVDA.O), a company whose technologies are shaping the future of artificial intelligence, started the session with an impressive takeoff, reaching a historical maximum. However, their dynamics later slowed down, and by the end of the day, growth was only 0.53%. Investors were concerned about the company's forecasts: the expected revenue growth was the most modest in the last seven quarters. "Nvidia's results are still impressive, but the lack of brighter prospects for the fourth quarter may have cooled the market's enthusiasm a little," commented Garrett Melson, portfolio strategist at Natixis Investment Managers. Wall Street: growth despite losses of giants On American exchanges, the session ended on a positive note. Major indexes rose, led by gains in utilities, financials, consumer discretionary and industrials. However, communications services remained in the red, led by significant losses in Alphabet (GOOGL.O), which fell 6%. Alphabet faces a new challenge as US authorities demand Google abandon its Chrome browser to eliminate its dominance in internet search. The lawsuit has left investors nervous and the tech giant's shares tumbling. More challenges ahead for the market Despite the upbeat close, investors continue to closely monitor corporate forecasts and the macroeconomic situation. Bitcoin expectations and the future performance of the largest tech companies remain the main themes for the market. Dow triumphs, Nasdaq moderately gains US stock indexes ended the session with varying degrees of growth. The Dow Jones Industrial Average added 1.06% to 43,870.35, posting a solid gain. The broad-based S&P 500 rose 0.53% to 5,948.71. The Nasdaq Composite, however, was relatively flat, up a modest 0.03% to 18,972.42. Europe: Tech, Energy Lead Gains The MSCI Global Index, which tracks stocks around the world, also showed positive momentum, adding 0.38% to 851.05. However, the day was choppy as uncertainty swept the markets. European stocks, as represented by the STOXX (.STOXX), rose 0.41%, led by a rally in the tech and energy sectors. "There's a bit of a news vacuum in the market right now, which makes it hard to pinpoint a clear direction," said Garrett Melson, portfolio strategist at Natixis Investment Managers.

News are provided by InstaForex

Read more: https://ifxpr.com/3CQHsOH

Stock Markets Recover After Unsettled Trading World stock indexes rose on Thursday despite mixed sentiment among investors. The main topic of trading was Nvidia's forecasts, which, while still positive, fell short of market expectations. At the same time, Bitcoin continued its confident movement, approaching the psychological mark of $100,000. Nvidia: records and disappointment Shares of Nvidia (NVDA.O), a company whose technologies are shaping the future of artificial intelligence, started the session with an impressive takeoff, reaching a historical maximum. However, their dynamics later slowed down, and by the end of the day, growth was only 0.53%. Investors were concerned about the company's forecasts: the expected revenue growth was the most modest in the last seven quarters. "Nvidia's results are still impressive, but the lack of brighter prospects for the fourth quarter may have cooled the market's enthusiasm a little," commented Garrett Melson, portfolio strategist at Natixis Investment Managers. Wall Street: growth despite losses of giants On American exchanges, the session ended on a positive note. Major indexes rose, led by gains in utilities, financials, consumer discretionary and industrials. However, communications services remained in the red, led by significant losses in Alphabet (GOOGL.O), which fell 6%. Alphabet faces a new challenge as US authorities demand Google abandon its Chrome browser to eliminate its dominance in internet search. The lawsuit has left investors nervous and the tech giant's shares tumbling. More challenges ahead for the market Despite the upbeat close, investors continue to closely monitor corporate forecasts and the macroeconomic situation. Bitcoin expectations and the future performance of the largest tech companies remain the main themes for the market. Dow triumphs, Nasdaq moderately gains US stock indexes ended the session with varying degrees of growth. The Dow Jones Industrial Average added 1.06% to 43,870.35, posting a solid gain. The broad-based S&P 500 rose 0.53% to 5,948.71. The Nasdaq Composite, however, was relatively flat, up a modest 0.03% to 18,972.42. Europe: Tech, Energy Lead Gains The MSCI Global Index, which tracks stocks around the world, also showed positive momentum, adding 0.38% to 851.05. However, the day was choppy as uncertainty swept the markets. European stocks, as represented by the STOXX (.STOXX), rose 0.41%, led by a rally in the tech and energy sectors. "There's a bit of a news vacuum in the market right now, which makes it hard to pinpoint a clear direction," said Garrett Melson, portfolio strategist at Natixis Investment Managers.

News are provided by InstaForex

Read more: https://ifxpr.com/3CQHsOH

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Forecast for EUR/USD on November 25, 2024

On Friday, the euro made a decisive move downward, testing the linear supports on the weekly chart. The Marlin oscillator on the weekly timeframe reached significant support at -0.0450, signaling a potential rebound into a correction.

The target level of 1.0350 was reached on the daily chart, indicated by a long lower shadow suggesting a potential reversal. The price may return to the target range of 1.0590–1.0636. Notably, the levels 1.0777 and 1.0882 align with the 50.0% and 61.8% retracement levels, further reinforcing their importance as potential points of attraction.

However, the expected recovery may not come easily. The opening gap adds complexity to this rise. If this gap is not closed today or tomorrow, the rally will unlikely extend beyond the first target range of 1.0590–1.0636.

On the 4-hour chart, the price is consolidating within the range of 1.0449–1.0483, waiting for stronger signals. Since the price failed to break through this range on the first attempt, stopping at the balance line resistance (red moving average), the gap may close according to the usual pattern—on the same day it was formed. From there, the euro will need renewed momentum to overcome the resistance range of 1.0449–1.0483 and the MACD line, which is rapidly approaching this zone.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3Oqsq4M

On Friday, the euro made a decisive move downward, testing the linear supports on the weekly chart. The Marlin oscillator on the weekly timeframe reached significant support at -0.0450, signaling a potential rebound into a correction.

The target level of 1.0350 was reached on the daily chart, indicated by a long lower shadow suggesting a potential reversal. The price may return to the target range of 1.0590–1.0636. Notably, the levels 1.0777 and 1.0882 align with the 50.0% and 61.8% retracement levels, further reinforcing their importance as potential points of attraction.

However, the expected recovery may not come easily. The opening gap adds complexity to this rise. If this gap is not closed today or tomorrow, the rally will unlikely extend beyond the first target range of 1.0590–1.0636.

On the 4-hour chart, the price is consolidating within the range of 1.0449–1.0483, waiting for stronger signals. Since the price failed to break through this range on the first attempt, stopping at the balance line resistance (red moving average), the gap may close according to the usual pattern—on the same day it was formed. From there, the euro will need renewed momentum to overcome the resistance range of 1.0449–1.0483 and the MACD line, which is rapidly approaching this zone.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3Oqsq4M

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Bessent changes the game: Nikkei soars, dollar falls as indexes rise

Wall Street ends week on the rise: key growth drivers On Friday, Wall Street's key indexes ended the trading session with solid gains, securing a positive weekly result. Investors were pleased with economic indicators that signal stable activity in the world's largest economy. New peak in business activity November brought a 31-month high in the business activity indicator. The main driver of optimism is the expectation of monetary easing and possible tax breaks. These prospects are associated with the upcoming change in political course, which Donald Trump promises to implement after taking office next year. Leaders among indices Amid confidence in the growth of the domestic market, the Russell 2000 index (.RUT), which focuses on small company stocks, became a bright leader. On Friday, it added 1.8%, and over the week, its growth amounted to an impressive 4.3%. As a result, the index reached its maximum in recent weeks. Corporate failures: Alphabet and Nvidia However, not all companies were able to please their shareholders. Thus, Alphabet (GOOGL.O) shares continued to fall, losing another 1.7% after a 4% decline on Thursday. The reason is the statement of the US Department of Justice, accusing the tech giant of monopolizing the online search market. AI leader Nvidia (NVDA.O) also fell 3.2% after choppy trading. The volatility came after investors released a mixed quarterly guidance. A Value Shift Amid the S&P 500's gains, the value index (.IVX) rose 0.78%, reflecting a shift in investor sentiment. Companies that focus on long-term stability have begun to attract more attention than traditional growth stocks (.IGX).

News are provided by InstaForex

Read more: https://ifxpr.com/4fHvqpF

Wall Street ends week on the rise: key growth drivers On Friday, Wall Street's key indexes ended the trading session with solid gains, securing a positive weekly result. Investors were pleased with economic indicators that signal stable activity in the world's largest economy. New peak in business activity November brought a 31-month high in the business activity indicator. The main driver of optimism is the expectation of monetary easing and possible tax breaks. These prospects are associated with the upcoming change in political course, which Donald Trump promises to implement after taking office next year. Leaders among indices Amid confidence in the growth of the domestic market, the Russell 2000 index (.RUT), which focuses on small company stocks, became a bright leader. On Friday, it added 1.8%, and over the week, its growth amounted to an impressive 4.3%. As a result, the index reached its maximum in recent weeks. Corporate failures: Alphabet and Nvidia However, not all companies were able to please their shareholders. Thus, Alphabet (GOOGL.O) shares continued to fall, losing another 1.7% after a 4% decline on Thursday. The reason is the statement of the US Department of Justice, accusing the tech giant of monopolizing the online search market. AI leader Nvidia (NVDA.O) also fell 3.2% after choppy trading. The volatility came after investors released a mixed quarterly guidance. A Value Shift Amid the S&P 500's gains, the value index (.IVX) rose 0.78%, reflecting a shift in investor sentiment. Companies that focus on long-term stability have begun to attract more attention than traditional growth stocks (.IGX).

News are provided by InstaForex

Read more: https://ifxpr.com/4fHvqpF

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Hot Forecast for EUR/USD on November 26, 2024

Despite some fluctuations, the market is essentially at a standstill. This pattern may persist until the FOMC meeting minutes are published this evening. A significant reaction is only likely if the minutes contain something new. However, this is highly improbable, as representatives of the U.S. Federal Reserve have repeatedly stated that the Federal Reserve System will pause further monetary policy easing. As such, the stagnation is expected to continue.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3VxDuBp

Despite some fluctuations, the market is essentially at a standstill. This pattern may persist until the FOMC meeting minutes are published this evening. A significant reaction is only likely if the minutes contain something new. However, this is highly improbable, as representatives of the U.S. Federal Reserve have repeatedly stated that the Federal Reserve System will pause further monetary policy easing. As such, the stagnation is expected to continue.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3VxDuBp

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

POUND RISES AGAINST MAJORS

The British pound strengthened against other major currencies in the European session on Tuesday. The pound rose to a 4-day high of 191.82 against the yen, from an early low of 190.83. Against the Swiss franc, the U.S. dollar and the euro, the pound edged up to 1.1286, 1.2389 and 0.8622 from early lows of 1.1252, 1.2330 and 0.8645, respectively. If the pound extends its uptrend, it is likely to find resistance around 194.00 against the yen, 1.15 against the franc, 1.27 against the greenback and 0.84 against the euro.

News are provided by InstaForex

Read more: https://ifxpr.com/4g14JvN

The British pound strengthened against other major currencies in the European session on Tuesday. The pound rose to a 4-day high of 191.82 against the yen, from an early low of 190.83. Against the Swiss franc, the U.S. dollar and the euro, the pound edged up to 1.1286, 1.2389 and 0.8622 from early lows of 1.1252, 1.2330 and 0.8645, respectively. If the pound extends its uptrend, it is likely to find resistance around 194.00 against the yen, 1.15 against the franc, 1.27 against the greenback and 0.84 against the euro.

News are provided by InstaForex

Read more: https://ifxpr.com/4g14JvN

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am

Re: Instaforex Analysis

Forex Analysis & Reviews: Forecast for EUR/USD on November 27, 2024

Yesterday, the euro closed above 1.0483, with the opening and closing candles positioned higher. The Marlin oscillator supported the price's upward movement with its growth. This opens the way for the price to target the 1.0590-1.0636 range. If this range is surpassed, further growth into the 1.0724/77 range becomes possible.

The prolonged decline in gold and oil raises concerns, as these trends could pull the euro lower without allowing for a significant correction. The U.S. stock market is also nearing a technical turning point. If these risks materialize—resulting in a drop in market valuations—the euro could fall below 1.0350 without even testing the nearest resistance range.

On the H4 chart, the price is tangled between indicator lines and the 1.0449/83 range. The Marlin oscillator's signal line has formed a small triangle that could break in either direction. The euro is awaiting new data to determine its next move.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3B1I97q

Yesterday, the euro closed above 1.0483, with the opening and closing candles positioned higher. The Marlin oscillator supported the price's upward movement with its growth. This opens the way for the price to target the 1.0590-1.0636 range. If this range is surpassed, further growth into the 1.0724/77 range becomes possible.

The prolonged decline in gold and oil raises concerns, as these trends could pull the euro lower without allowing for a significant correction. The U.S. stock market is also nearing a technical turning point. If these risks materialize—resulting in a drop in market valuations—the euro could fall below 1.0350 without even testing the nearest resistance range.

On the H4 chart, the price is tangled between indicator lines and the 1.0449/83 range. The Marlin oscillator's signal line has formed a small triangle that could break in either direction. The euro is awaiting new data to determine its next move.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3B1I97q

- IFX Bella

- Posts: 585

- Joined: Sat Dec 08, 2012 12:39 am