Global market indices rose, and the dollar halted its upward trajectory following the Federal Reserve's announcement of plans for three significant rate cuts this year, despite expectations of a slower decrease in inflation.

Jerome Powell, the Federal Reserve Chair, noted that despite recent high inflation figures, the main trend of easing price pressure remains unchanged. However, he emphasized that fresh economic data did not add confidence in conquering inflation. Shareholders positively received the Federal Reserve's decision to stay the course on planned interest rate cuts.

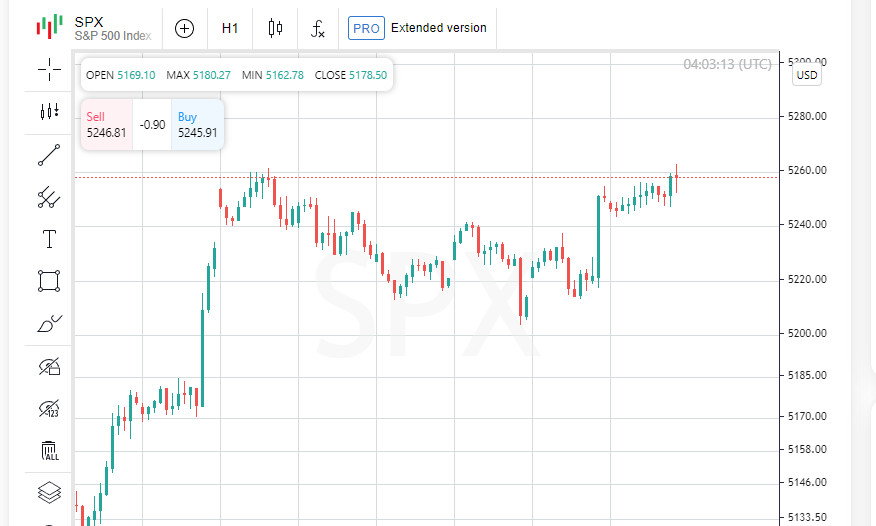

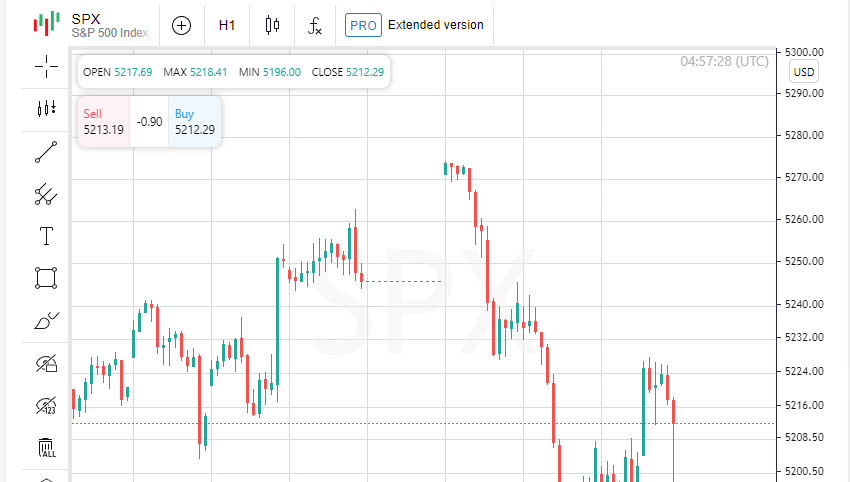

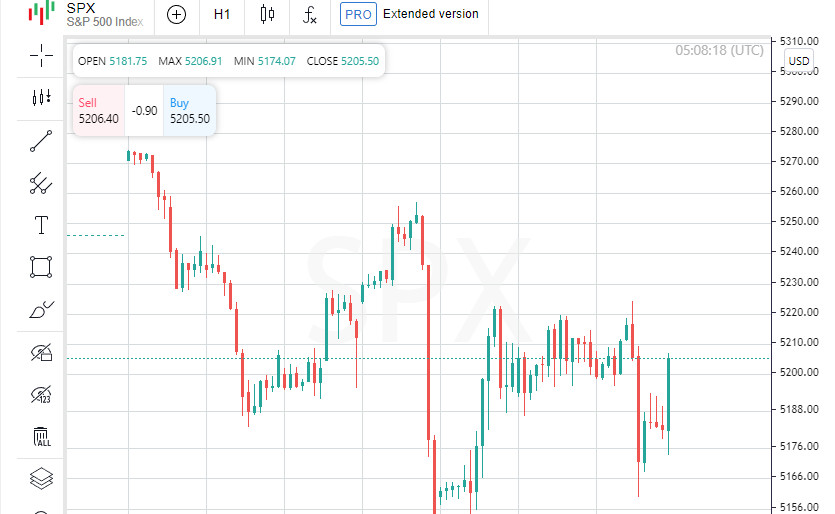

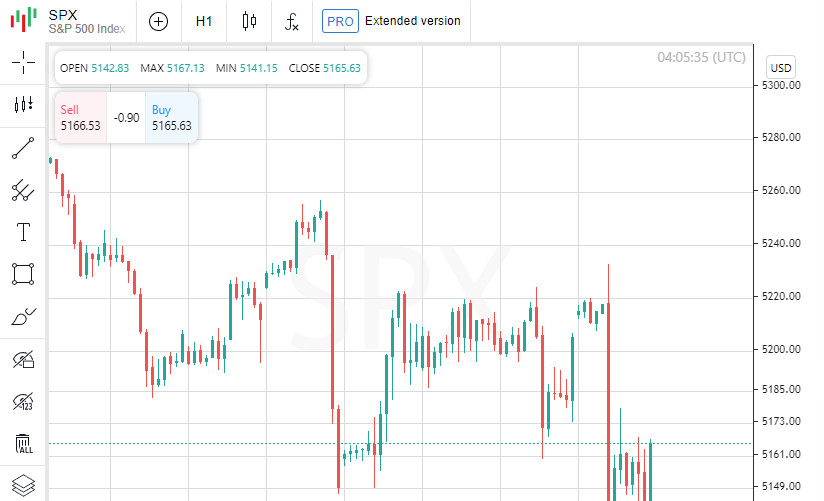

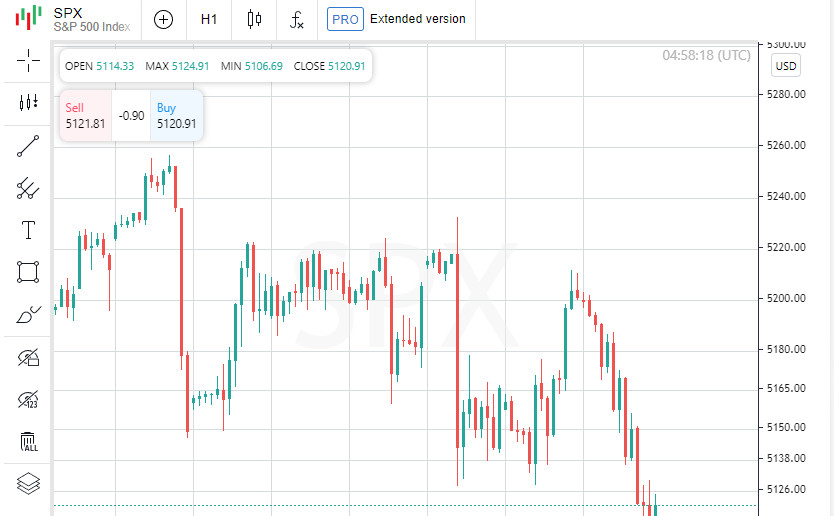

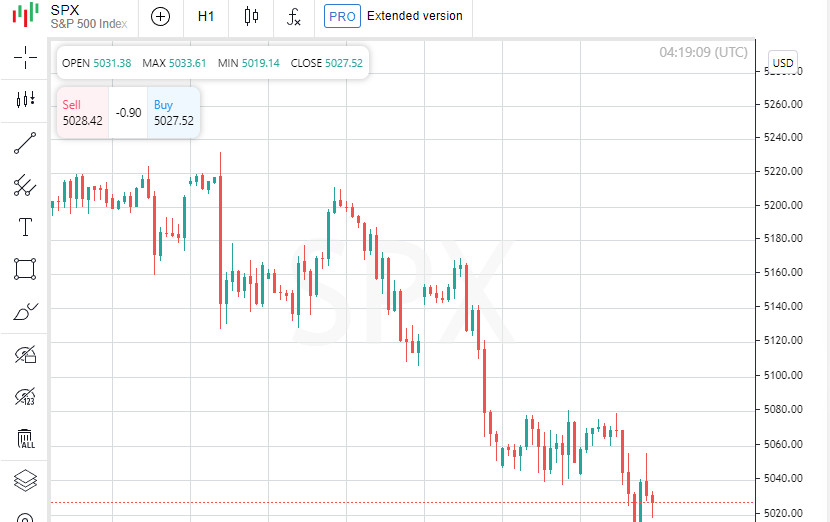

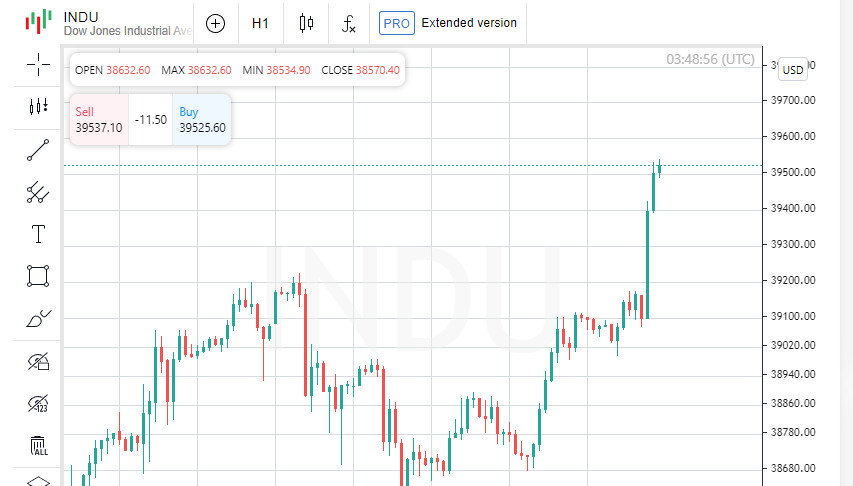

The global MSCI stock index reached a historic high, rising by 0.61%, thanks to the steady growth of stocks on Wall Street following the Fed's announcement. The Dow Jones Industrial Average increased by 1.03%, the broad-market S&P 500 index rose by 0.89%, and the Nasdaq Composite Index showed a growth of 1.25%. Irene Tunkel, a leading strategist for U.S. stocks at BCA Research based in Florida, noted,

"The market feels relieved, seeing that the Fed still plans three rate cuts this year." Expectations for rate cuts led to a decrease in the yield of government bonds. The yield on two-year Treasury notes decreased by 7.9 basis points to 4.6129%, while the yield on ten-year bonds fell by 1.5 basis points, reaching 4.281%. "It is particularly noteworthy that the Federal Reserve has significantly revised its GDP forecasts upwards not only for 2024, which was expected in light of the latest data, but also for 2025 and 2026," comments Ellen Heizen, the chief market strategist at F.L. Putnam Investment Management, located in Massachusetts.

Following the Federal Reserve's meeting, the dollar lost ground. The dollar index decreased by 0.433%, which contributed to a partial recovery of the Japanese yen. Its rate fell by 0.30% against the dollar, reaching 151.29 per dollar compared to the four-month low of 151.82, recorded earlier that same day.

Most sectors in the S&P 500 index showed growth, with nine out of the eleven main industries demonstrating an increase in stock value. Particularly, consumer sector stocks stood out, where growth was 1.5%, taking the lead in gains. The healthcare sector proved to be the least effective, showing a decline of 0.23%. In healthcare, notable decreases were observed in the U.S.-registered shares of BioNTech, which fell by 4.4% after announcing a decrease in revenue and profit for 2023 due to a focus on the development of cancer drugs.

Additionally, shares of COVID-19 vaccine manufacturers experienced a downturn: Moderna lost 1.9% in value, while Novavax dropped by 2.2%. A rise in the consumer goods sector was led by shares of Amazon.com, which increased by 1.3%. Furthermore, Tesla shares grew by 2.5% following news of a price increase for Model Y cars produced in China by 5,000 yuan ($694.55) starting April 1.

In addition to successes in the consumer sector, shares of Chipotle Mexican Grill rose by 3.5% after the board of directors announced a decision to conduct a 50-for-1 stock split. Shares of Equinix lost 2.3% in value following a report by research firm Hindenburg Research that it had taken a short position on this data center operator's stock.

The Japanese yen faced challenges following the Bank of Japan's decision to raise interest rates for the first time in 17 years. Analysts believe this move contributes to maintaining a significant yield differential between U.S. Treasury bonds and Japanese government bonds, putting pressure on the yen. The European STOXX 600 index remained unchanged throughout the day, while shares of Kering, the owner of the luxury brand Gucci, experienced a decline following announcements of potential profit reductions.

In Tokyo, the Nikkei index remained closed due to a national holiday in Japan on Wednesday, while the broader Asia-Pacific MSCI index outside Japan showed no changes. In Seoul, the market rose by 1.3%, contributing to an overall growth of 5.6% in the Asia-Pacific region. Samsung's shares saw a significant increase following Nvidia's announcement about the start of using high-bandwidth memory (HBM) chips manufactured by the South Korean chipmaker.

Chinese stock markets slightly rose after the national central bank kept the key lending rates unchanged, aligning with analysts' expectations. The Shanghai Composite Index increased by 0.5%, while the Hong Kong Hang Seng Index went up by 0.2%. Key figures of the European Central Bank (ECB) expressed support for June as the optimal moment for initiating interest rate cuts, with some advocating for four reductions within the current year.

Christine Lagarde, President of the ECB, emphasized the importance of flexibility in decision-making at an event in Frankfurt on Wednesday: "Our actions must be based on current data and considered at each meeting. This means we cannot make any predetermined commitments regarding the specific direction of interest rates following their initial reduction."

By the close of the trading day, the euro had notably strengthened against the dollar, rising by 0.51% to reach $1.092. Meanwhile, oil prices adjusted after reaching multi-month highs, influenced by the strengthening of the dollar. The price of Brent crude oil fell by 1.95%, settling at $81.68 per barrel, while gold was valued at $2185.69 per ounce, remaining below the record monthly high of $2194.99.

News are provided by InstaForex.

Read more: https://ifxpr.com/4ai13CQ