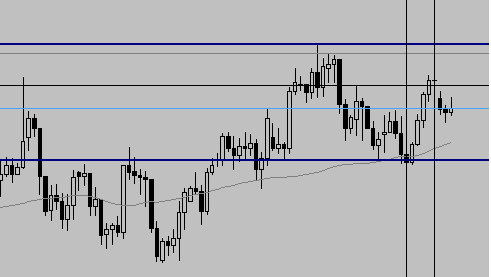

jcpfx wrote:My question is: the evolution of the thread has hovered towards larger pullback plays in line with the bias, and this method has given me an edge in 2014. However, there are moments, like today, where price is honouring the bias and is in consolidation mode..and on the micro frames makes a move right to/slightly below a momentum level, consolidates or pulls back without violating the prior swing (like EurUsd 15Min today) and then break in line with the bias and go on a stop rampage.

What & where is the momentum level you're alluding to in today’s EURUSD pair?

If, in your opinion, price is honouring a bias & breaks out in the direction of that bias, then surely it's a valid set up no matter what yeah?

The stop rampage bit is also confusing me.

I don't see price going on any kind of stop rampage this morning on that pair.

All I see is see is a pretty common lift through a quiet Tokyo session as Europe opens for business with price printing a higher low on the 5 & 15minute charts with subsequent follow through.

There won't be any real substantial stops on that pair until 1.39

Limit orders & offers will be tiered into & out the other side of that round number + buy stops beyond 1.3920 toward the current years highs.

Bids will be tiered into the approach to 1.38 & 3780 with sell stops underneath there back towards 1.3740 & the current months lows.

jcpfx wrote:Do you have any comments/suggestions as to:

1) whether anyone still plays momentum moves?

I still play momentum set ups, sure.

jcpfx wrote:2) what the background looks like before a momentum move is high probability?

As you should know, the background conditions will be very much dictated by what's influencing & driving the current price action & that criteria changes constantly.

Your trade expectations (including entry/% risk & profit expectations/trade management) will always need to reflect the current price drivers.

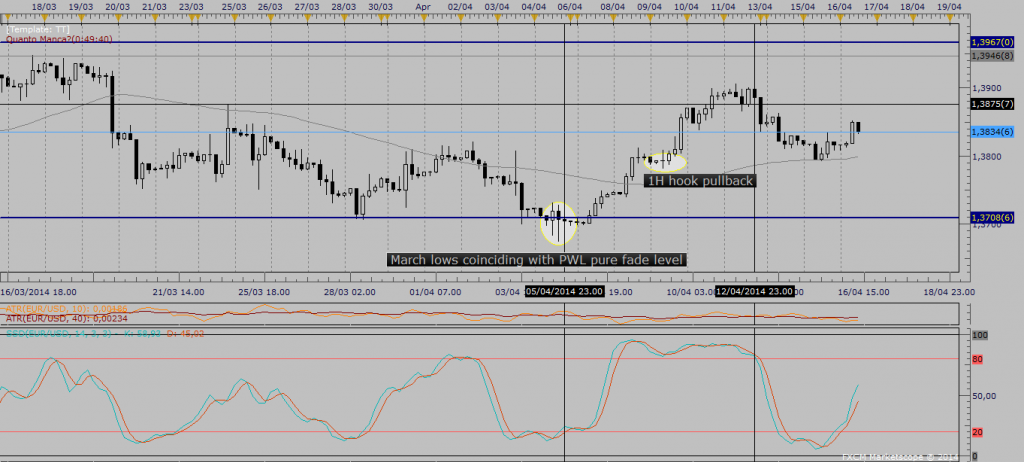

If you keep an eye on your ADR data you'll know that ranges have contracted again this year by as much as 20% on some of the majors, reflecting & further confirming the current choppy scenario. In those types of conditions it's generally prudent to lower potential profit runs & keep a sharper eye on exit & trailing stop parameters.

jcpfx wrote:3) any trigger considerations?

Triggers are personal Justin.

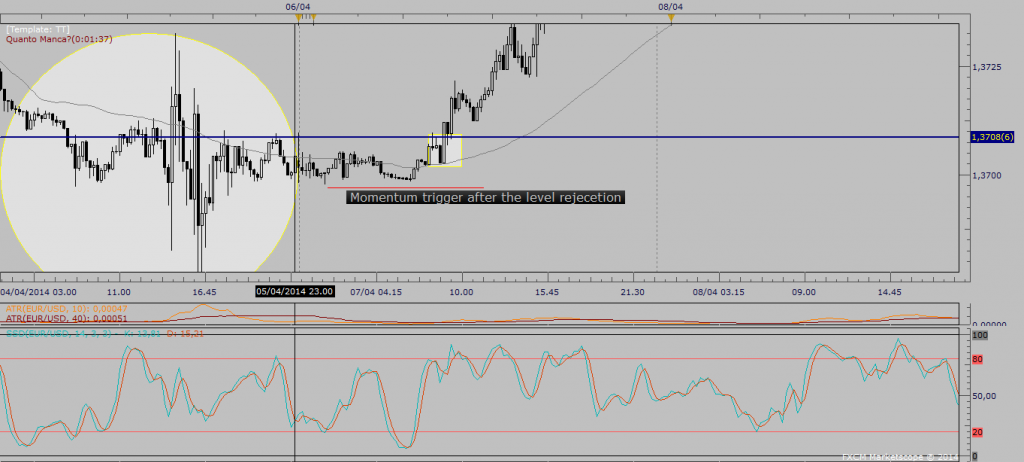

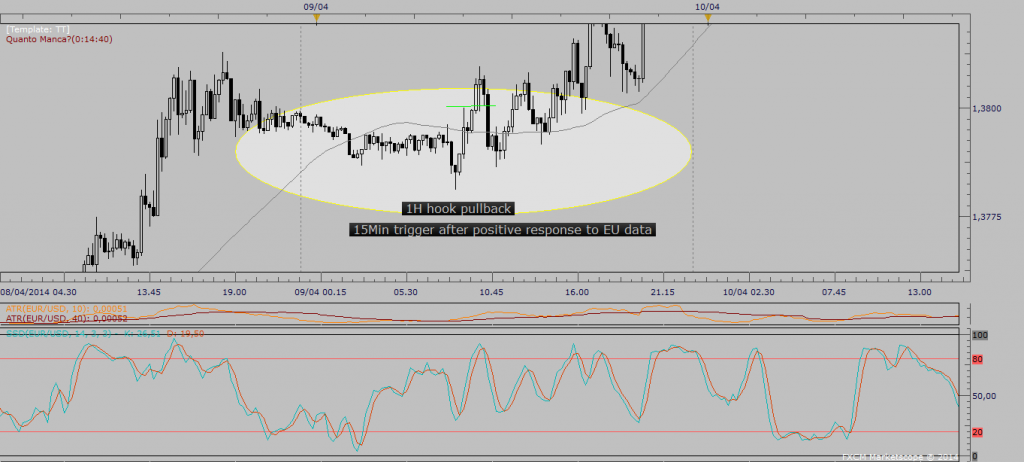

I still predominantly use the simple, effective ones (hook on the sub hourly timeframes in tandem with oscillator divergence when appropriate) that have been presented throughout the thread.

They certainly haven't let me down yet.