i think the lesson of this week is "dont forget that FX isn't the only thing that exists". I got some gold this week, with the last position opened this morning. There might be uncertainty regarding various market influences (ukraine, draghi's comments, taper theme) but the bias rarely lies. Gold has been in a position of strength lately compared to the currency pairs that have been sleepy for the first part of this week and last week.

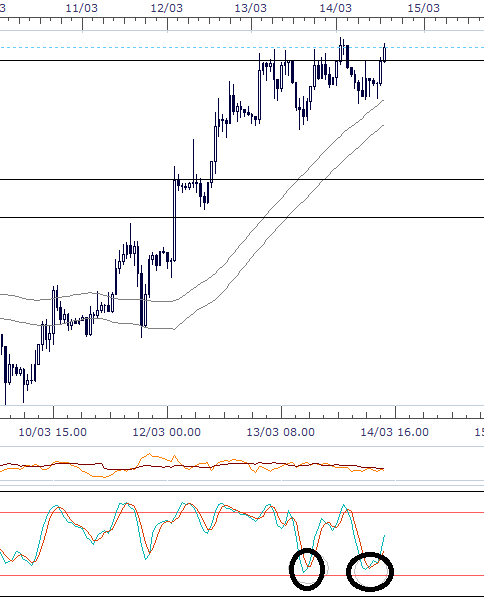

1H chart

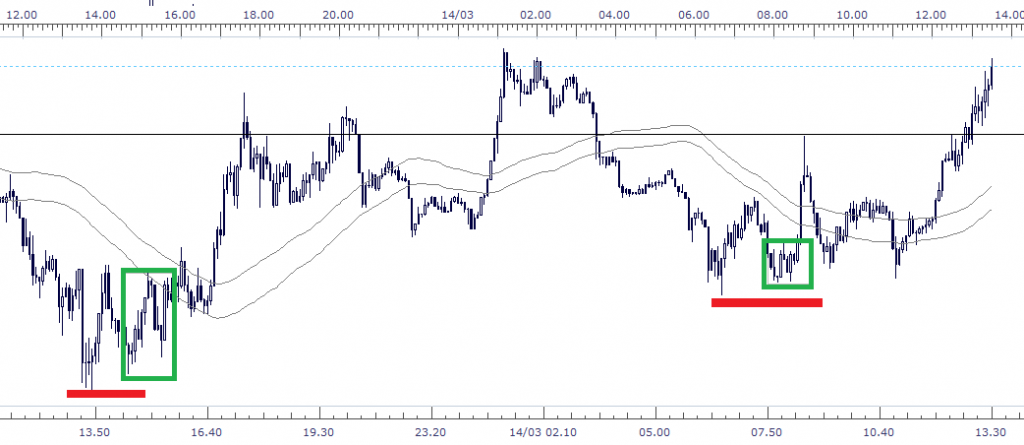

5MIn chart

I can bet there were a whole lot of people trying to sell the Euro today...and the lesson thus far is that as long as the bias is up, you don't fight it unless you've got an excellent reason, and far away from potential re-ingagement zones. The euro has a clear 4H hook in evidence today, and held up at yesterday's low print close to the current week's low. I did not engage the Euro, because there is conflicting evidence surrounding the euro pairs today, and there were clearer opportunities...but today's price action thus far has proven the bias right