Daily Technical Analysis 24th March 2014

Daily Technical Analysis

24th March 2014

EURUSD

Summary

Friday EURUSD consolidated at the lows of the past two days downside correction and above the 34 period moving averages where we witnessed a minor bounce higher.

Market overview

EURUSD continues to trade in a daily uptrend following the breach of the 1.3741 level being the 24th January swing. This price action has put the daily time frame in gear with the positive weekly trend. However the recent correction has seen EURUSD trade back to its long average and just above the 50 to 78.6 Fibonacci support level.

Focus on today

This morning EURUSD has opened quietly as it trades within the previous two days range.

I am this morning monitoring the price action for a potential move lower and a test of 34 period moving averages.

Alternatively if EURUSD fails to sustain lower prices there is a possibility that EURUSD trades back up to the 8 period moving averages.

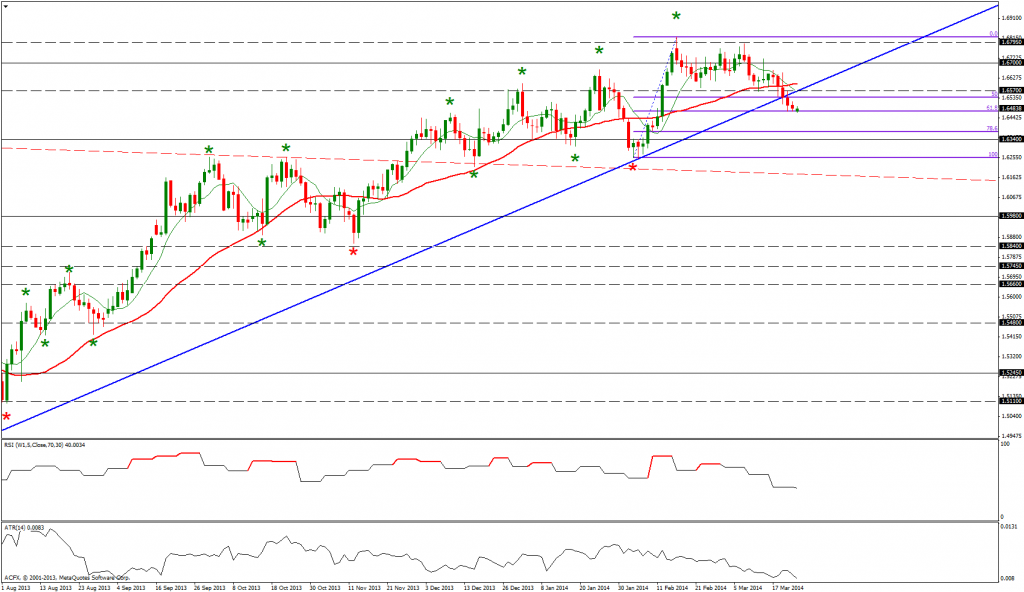

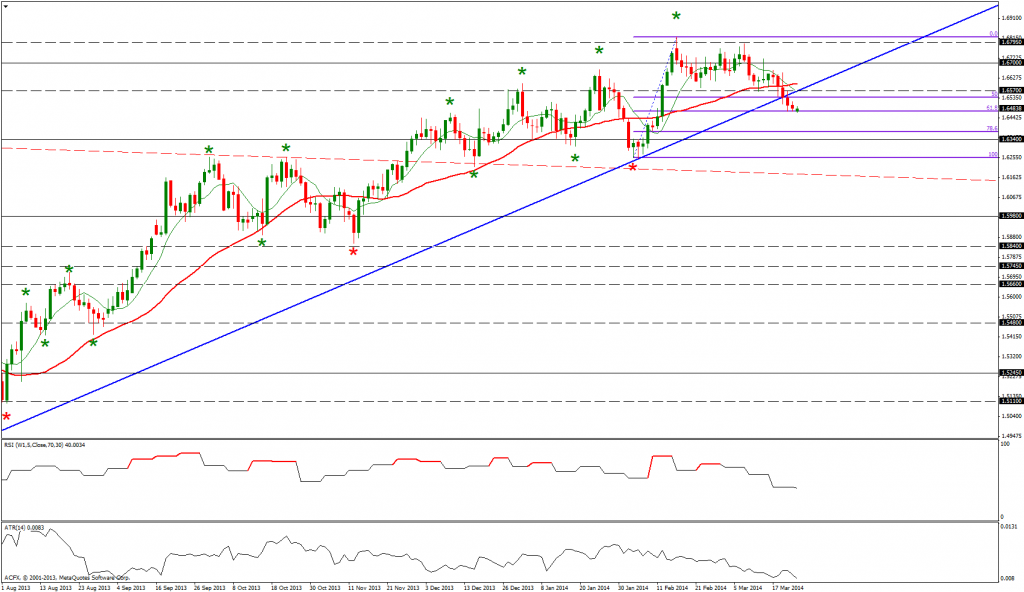

GBPUSD

Summary

Friday GBPUSD continued to traded under the 34 period moving averages, the 1.6570 support level and the upward sloping trend line.

Market overview

GBPUSD has traded above the 1.6668 being the prior isolated pivot high. This price activity has effectively changed the daily trend to up and puts it in line with the bullish weekly outlook. However the breach the 1.6639 level being the recent daily pivot low has added a question mark to the overall health of the uptrend. Furthermore breaches of moving average, horizontal and trend line support is adding to the downside pressure. However GBPUSD is now entering an area of Fibonacci support which could stall further downside price action.

Focus on today

This morning GBPUSD has opened quietly as the price action trades at the lows of this recent downside correction.

I am today monitoring the price action for a bounce off Fibonacci support and test of the 1.6570 level.

Alternatively if GBPUSD cannot sustain higher prices could see the price action test the 78.6 Fibonacci level.

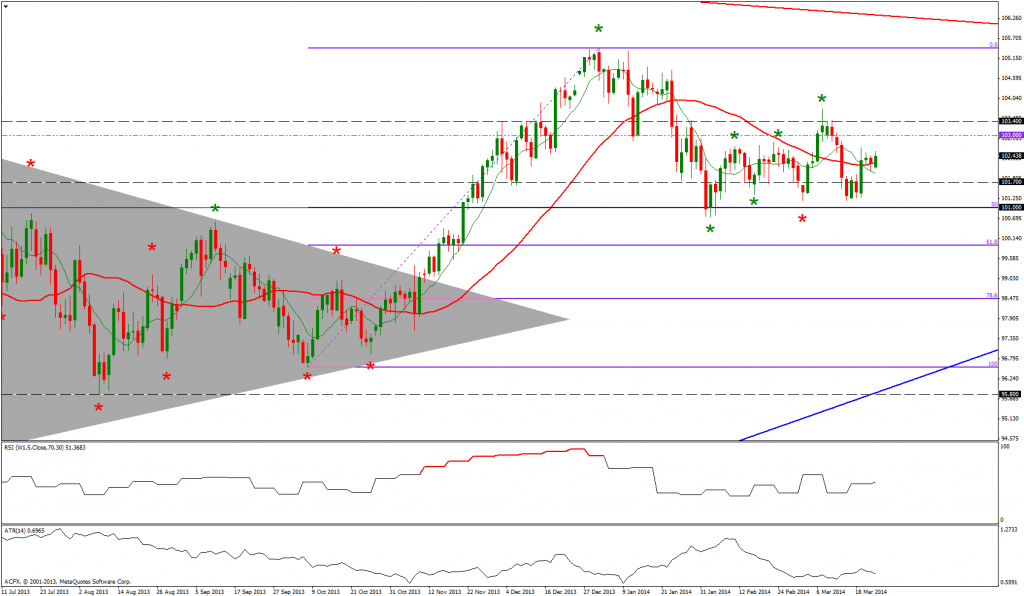

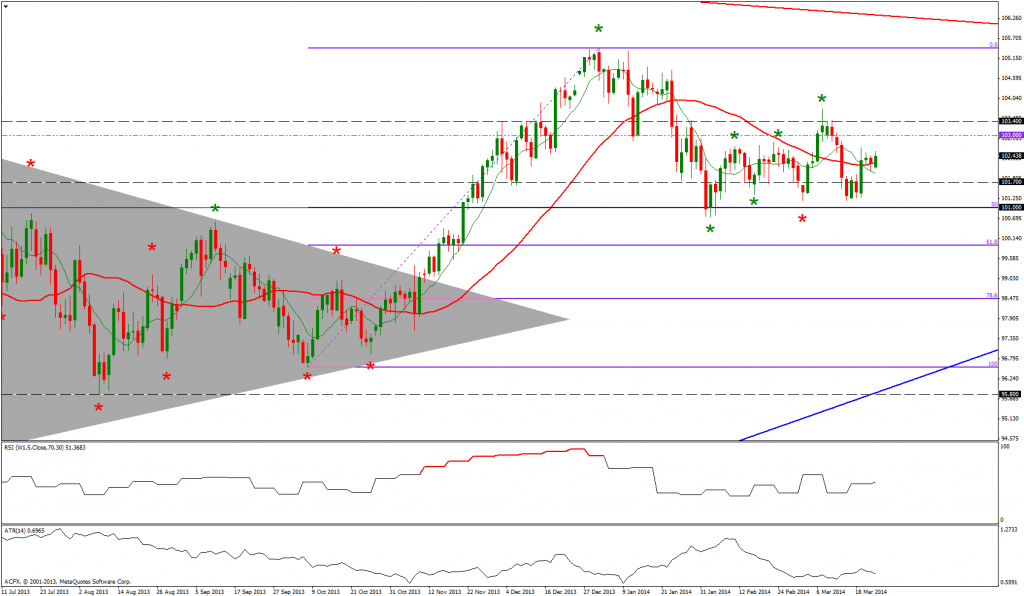

USDJPY

Summary

Friday USDJPY experienced a small range day as it traded at the highs to the recent up spike in prices.

Market overview

The breach of the 102.83 level being the swing high of the 21st February has effectively changed the daily trend to up and therefore putting this time frame into gear with the bullish weekly time frame. However a breach of the 101.19 level being the 4th March swing low would technically change the daily trend to down. The recent price action is now indicating that the 101.00 support level is likely to hold.

Focus on today

This morning USDJPY has opened positively as the price action trades above both averages.

Today I am monitoring a potential test of the 103.00 level.

Alternatively a failure to sustain higher prices could see USDJPY test the 101.70 level.

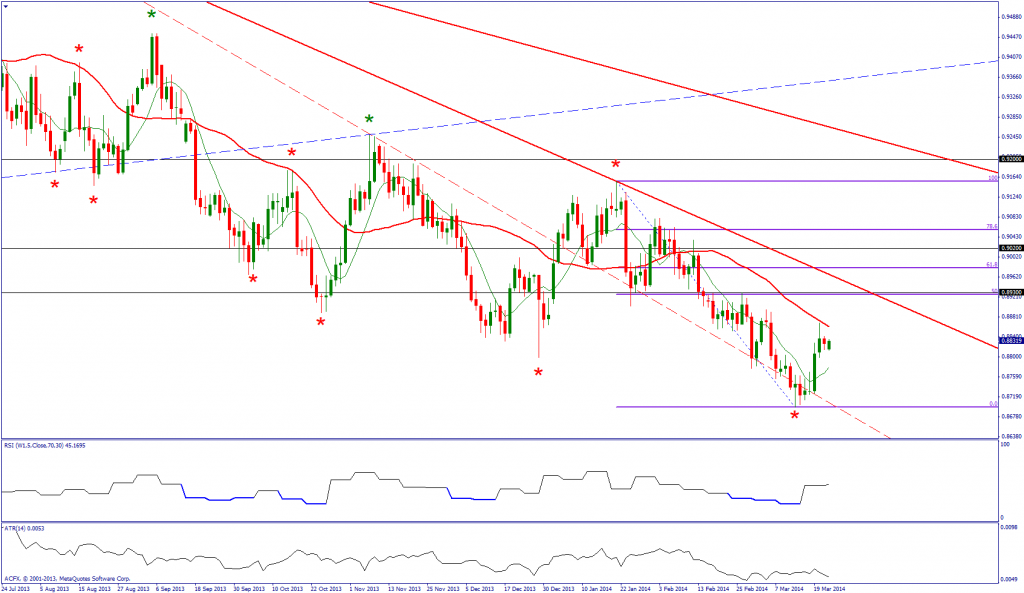

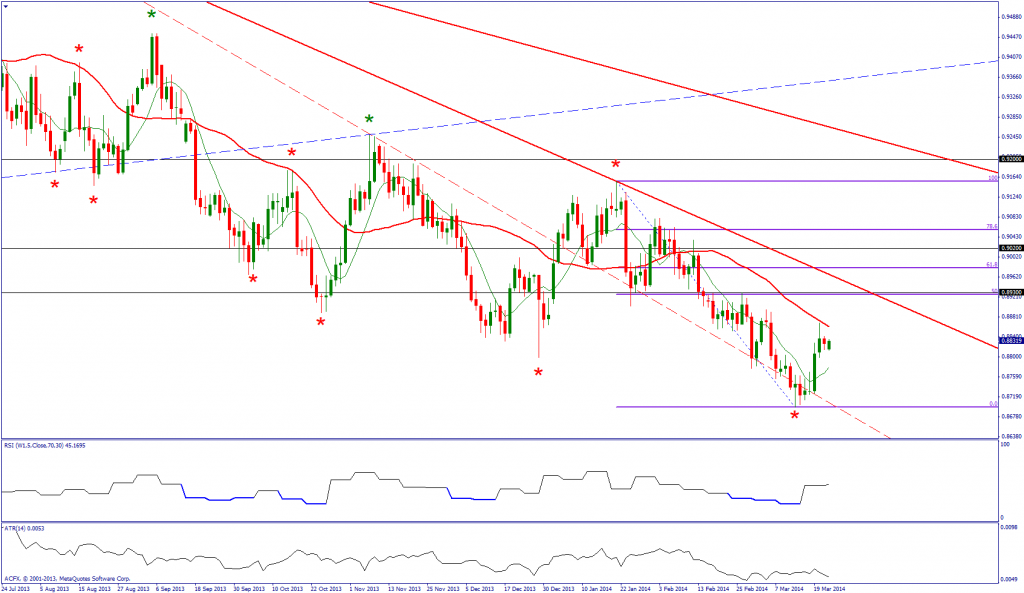

USDCHF

Summary

Friday USDCHF consolidated at the highs of the recent upside correction as the price action tests the 34 period moving averages.

Market overview

USDCHF continues to trade in a negative daily and weekly swing bias but the recent price action is beginning to take on a bullish feel to it. I am therefore monitoring signs for a base to built that will allow for further upside at least to the downward sloping trend line. However the bias does continue to be fixed to the downside therefore shorting rallies is still probably the most logical strategy to adopt.

Focus on today

This morning USDCHF has opened positively as the price action trades within the previous two day’s range.

Today I am monitoring the price action for a retest of the 34 period moving averages.

Alternatively a failure to sustain higher prices could see USDCHF trade back to the 8 period moving averages.

Gold

Summary

Friday Gold continued to consolidate above the 34 period moving averages and upward sloping trendline.

Market overview

Gold continues to trade in a daily uptrend following the breach of the 1267.99 level being the swing high of the 10th December. The break above the large downward sloping trend line adds impetus to the current positive swing bias. Furthermore we have witnessed a large multi month double bottom forming which could indicate a large upside trend reversal is a possibility.

However the weekly time frame continues to point down. That the recent rejection of higher prices has come off a bounce from a downward sloping trend line and Fibonacci resistance level could indicate that the recent rally in Gold is part of a bigger cycle correction that ultimately sends Gold lower.

Focus on today

This morning Gold has opened bearishly as the price action test support.

Today I am monitoring the price action for a potential bounce off the upward sloping trend line.

Alternatively a failure to sustain higher prices could see Gold test the upward trend line and move to the area of 1310 being a prior daily minor swing low.

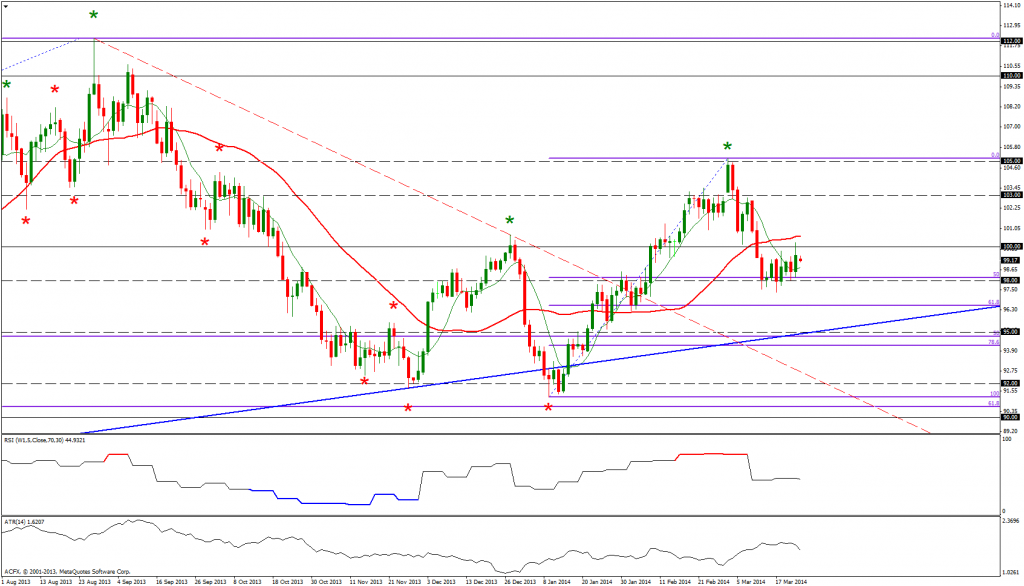

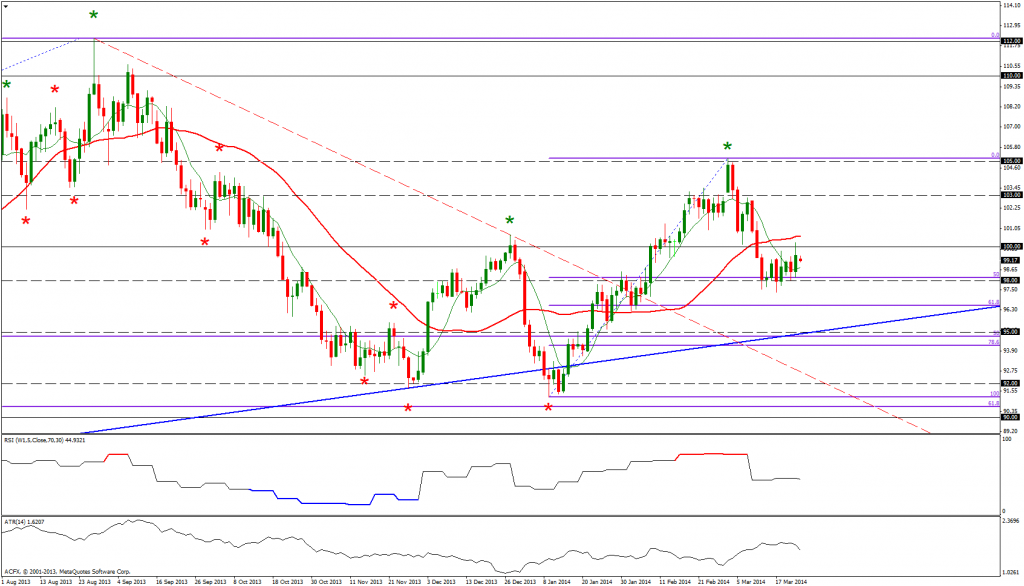

Oil

Summary

Friday Oil breifly spiked above the 100 level and ended the day fairly strongly but still closed between the 98 and 100 range as the price action continued to consolidated above Fibonacci support.

Market overview

Oil continues to trade in a daily uptrend following the breach of the 100.72 level being the swing high of the 24th December. The daily and weekly times both have a positive bias. The recent price activity has seen Oil trade down to an area of Fibonacci support which could potentially offer a buying opportunities.

Focus on today

This morning Oil has opened negatively with the price action trading within the previous day’s range.

Today I am monitoring the price action for a breach of the 100 level.

Alternatively a failure to sustain higher prices could see Oil test 98 level.

AUDUSD

Summary

Friday AUDUSD closed strong with the price action ending the day above both averages.

Market overview

AUDUSD has been trading in a daily uptrend following the breach of the 0.9080 level being the swing high of the 18th February. However the weekly chart continues to trade in a weekly down trend.

Focus on today

This morning AUDUSD has opened with much activity as the price action initially put in a new high but them collapsed back to the 8 period moving averages where support held and buyers came into the market.

I am this morning monitoring the price action for a potential test of the 0.9137 level being last week’s high.

Alternatively if AUDUSD fails to sustain higher prices there is a possibility that AUDUSD tests the 34 period moving averages.

24th March 2014

EURUSD

Summary

Friday EURUSD consolidated at the lows of the past two days downside correction and above the 34 period moving averages where we witnessed a minor bounce higher.

Market overview

EURUSD continues to trade in a daily uptrend following the breach of the 1.3741 level being the 24th January swing. This price action has put the daily time frame in gear with the positive weekly trend. However the recent correction has seen EURUSD trade back to its long average and just above the 50 to 78.6 Fibonacci support level.

Focus on today

This morning EURUSD has opened quietly as it trades within the previous two days range.

I am this morning monitoring the price action for a potential move lower and a test of 34 period moving averages.

Alternatively if EURUSD fails to sustain lower prices there is a possibility that EURUSD trades back up to the 8 period moving averages.

GBPUSD

Summary

Friday GBPUSD continued to traded under the 34 period moving averages, the 1.6570 support level and the upward sloping trend line.

Market overview

GBPUSD has traded above the 1.6668 being the prior isolated pivot high. This price activity has effectively changed the daily trend to up and puts it in line with the bullish weekly outlook. However the breach the 1.6639 level being the recent daily pivot low has added a question mark to the overall health of the uptrend. Furthermore breaches of moving average, horizontal and trend line support is adding to the downside pressure. However GBPUSD is now entering an area of Fibonacci support which could stall further downside price action.

Focus on today

This morning GBPUSD has opened quietly as the price action trades at the lows of this recent downside correction.

I am today monitoring the price action for a bounce off Fibonacci support and test of the 1.6570 level.

Alternatively if GBPUSD cannot sustain higher prices could see the price action test the 78.6 Fibonacci level.

USDJPY

Summary

Friday USDJPY experienced a small range day as it traded at the highs to the recent up spike in prices.

Market overview

The breach of the 102.83 level being the swing high of the 21st February has effectively changed the daily trend to up and therefore putting this time frame into gear with the bullish weekly time frame. However a breach of the 101.19 level being the 4th March swing low would technically change the daily trend to down. The recent price action is now indicating that the 101.00 support level is likely to hold.

Focus on today

This morning USDJPY has opened positively as the price action trades above both averages.

Today I am monitoring a potential test of the 103.00 level.

Alternatively a failure to sustain higher prices could see USDJPY test the 101.70 level.

USDCHF

Summary

Friday USDCHF consolidated at the highs of the recent upside correction as the price action tests the 34 period moving averages.

Market overview

USDCHF continues to trade in a negative daily and weekly swing bias but the recent price action is beginning to take on a bullish feel to it. I am therefore monitoring signs for a base to built that will allow for further upside at least to the downward sloping trend line. However the bias does continue to be fixed to the downside therefore shorting rallies is still probably the most logical strategy to adopt.

Focus on today

This morning USDCHF has opened positively as the price action trades within the previous two day’s range.

Today I am monitoring the price action for a retest of the 34 period moving averages.

Alternatively a failure to sustain higher prices could see USDCHF trade back to the 8 period moving averages.

Gold

Summary

Friday Gold continued to consolidate above the 34 period moving averages and upward sloping trendline.

Market overview

Gold continues to trade in a daily uptrend following the breach of the 1267.99 level being the swing high of the 10th December. The break above the large downward sloping trend line adds impetus to the current positive swing bias. Furthermore we have witnessed a large multi month double bottom forming which could indicate a large upside trend reversal is a possibility.

However the weekly time frame continues to point down. That the recent rejection of higher prices has come off a bounce from a downward sloping trend line and Fibonacci resistance level could indicate that the recent rally in Gold is part of a bigger cycle correction that ultimately sends Gold lower.

Focus on today

This morning Gold has opened bearishly as the price action test support.

Today I am monitoring the price action for a potential bounce off the upward sloping trend line.

Alternatively a failure to sustain higher prices could see Gold test the upward trend line and move to the area of 1310 being a prior daily minor swing low.

Oil

Summary

Friday Oil breifly spiked above the 100 level and ended the day fairly strongly but still closed between the 98 and 100 range as the price action continued to consolidated above Fibonacci support.

Market overview

Oil continues to trade in a daily uptrend following the breach of the 100.72 level being the swing high of the 24th December. The daily and weekly times both have a positive bias. The recent price activity has seen Oil trade down to an area of Fibonacci support which could potentially offer a buying opportunities.

Focus on today

This morning Oil has opened negatively with the price action trading within the previous day’s range.

Today I am monitoring the price action for a breach of the 100 level.

Alternatively a failure to sustain higher prices could see Oil test 98 level.

AUDUSD

Summary

Friday AUDUSD closed strong with the price action ending the day above both averages.

Market overview

AUDUSD has been trading in a daily uptrend following the breach of the 0.9080 level being the swing high of the 18th February. However the weekly chart continues to trade in a weekly down trend.

Focus on today

This morning AUDUSD has opened with much activity as the price action initially put in a new high but them collapsed back to the 8 period moving averages where support held and buyers came into the market.

I am this morning monitoring the price action for a potential test of the 0.9137 level being last week’s high.

Alternatively if AUDUSD fails to sustain higher prices there is a possibility that AUDUSD tests the 34 period moving averages.