Daily Technical Analysis 17th March 2014

Daily Technical Analysis

17th March 2014

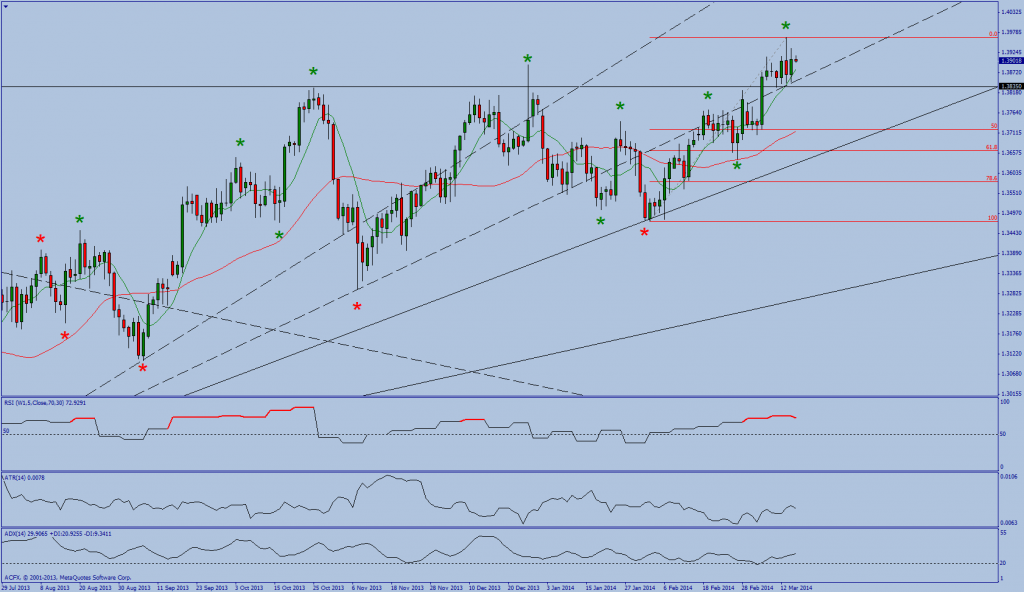

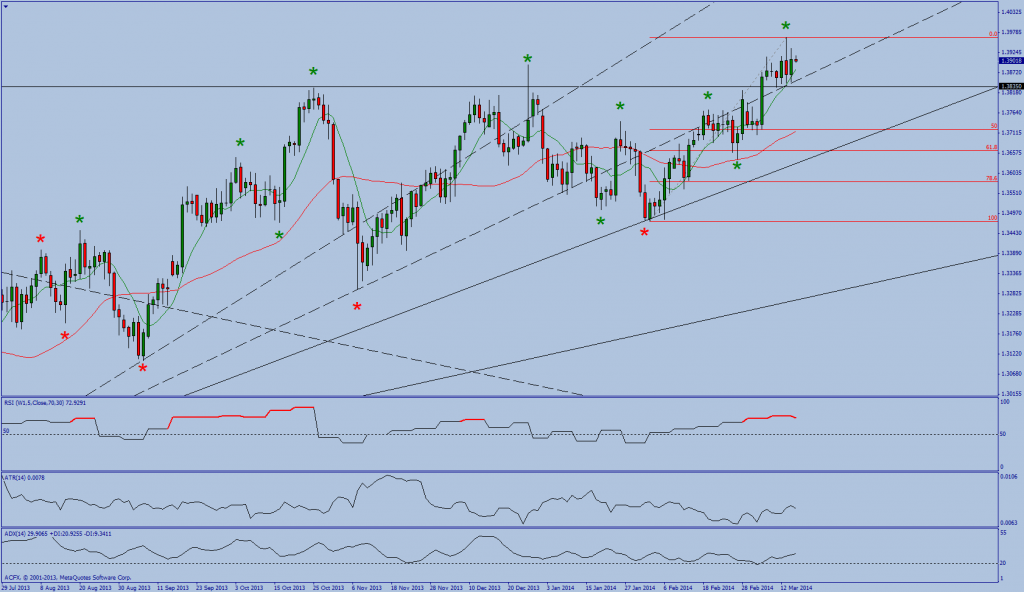

EURUSD

Summary

Friday EURUSD found support at the 8 period moving averages from where it traded and closed higher.

Market overview

EURUSD continues to trade in a daily uptrend following the breach of the 1.3741 level being the 24th January swing. This price action has put the daily time frame in gear with the positive weekly trend.

Focus on today

This morning EURUSD has opened quietly as it trades at the highs of the previous days range and just above the 1.3982 price level which corresponds to the 27th December isolated high.

I am this morning monitoring the price action for a potential for a test of the 1.4000 level.

Alternatively if EURUSD fails to resume its upward momentum there is a possibility the price action test support and trades back up to the 8 period moving averages.

GBPUSD

Summary

Friday GBPUSD traded throuhout the day between the 8 and 34 period moving averages.

Market overview

GBPUSD has traded above the 1.6668 being the prior isolated pivot high. This price activity has effectively changed the daily trend to up and puts it in line with the bullish weekly outlook. However the breach the 1.6639 level being the recent daily pivot low has added a question to the overall health of the uptrend.

Focus on today

This morning GBPUSD has opened quietly as the price action trades between both moving average support areas.

I am today monitoring the price action for a possible test of the 8 period moving averages.

Alternatively if GBPUSD cannot sustain higher prices could see the price action once again test the 34 period moving averages.

USDJPY

Summary

Friday USDJPY continued to trade lower as the price action tested the 101 support area.

Market overview

The breach of the 102.83 level being the swing high of the 21st February has effectively changed the daily trend to up and therefore putting this time frame into gear with the bullish weekly time frame.

Focus on today

This morning USDJPY has opened positively as the price action away from the 101.00 level.

Today I am monitoring a potential move to the 34 period moving averages.

Alternatively a failure to sustain higher prices could see USDJPY test the 101.00 level.

USDCHF

Summary

Friday USDCHF traded throughout the day within Thursday’s range.

Market overview

USDCHF continues to trade in a negative daily and weekly swing bias.

Focus on today

This morning USDCHF has opened positively as the price action trades within a two day range.

Today I am monitoring the price action for a test of the 8 period moving averages.

Alternatively a failure to sustain higher prices could see USDCHF test the 0.8875 level.

Gold

Summary

Friday Gold traded and closed higher as the price action succesfullty tested the downward sloping trendline.

Market overview

Gold continues to trade in a daily uptrend following the breach of the 1267.99 level being the swing high of the 10th December. The weekly time frame continues to point down however we have witnessed a large multi month double bottom forming which could indicate a large upside trend reversal is a possibility. The break above the large downward sloping trend line adds impetus to the current positive bias.

Focus on today

This morning Gold has opened positively as the price trades above Friday’s range.

Today I am monitoring the price action for a continuation of the move higher and into the direction of the 1433.70 level the 28th August high.

Alternatively a failure to sustain higher prices could see Gold trade back up to the 8 period moving averages.

Oil

Summary

Friday Oil bounce higher as the price action makes an attempt to retrace to the 8 period moving averages.

Market overview

Oil continues to trade in a daily uptrend following the breach of the 100.72 level being the swing high of the 24th December. The daily and weekly times both have a positive bias.

Focus on today

This morning Oil has opened quietly as the price action trades at the highs of Friday’s range.

Today I am monitoring the price action for a continuation of the move to the 8 period moving averages.

Alternatively a failure to sustain higher prices could see Oil trade back down to the 97.53 level being last week’s low.

17th March 2014

EURUSD

Summary

Friday EURUSD found support at the 8 period moving averages from where it traded and closed higher.

Market overview

EURUSD continues to trade in a daily uptrend following the breach of the 1.3741 level being the 24th January swing. This price action has put the daily time frame in gear with the positive weekly trend.

Focus on today

This morning EURUSD has opened quietly as it trades at the highs of the previous days range and just above the 1.3982 price level which corresponds to the 27th December isolated high.

I am this morning monitoring the price action for a potential for a test of the 1.4000 level.

Alternatively if EURUSD fails to resume its upward momentum there is a possibility the price action test support and trades back up to the 8 period moving averages.

GBPUSD

Summary

Friday GBPUSD traded throuhout the day between the 8 and 34 period moving averages.

Market overview

GBPUSD has traded above the 1.6668 being the prior isolated pivot high. This price activity has effectively changed the daily trend to up and puts it in line with the bullish weekly outlook. However the breach the 1.6639 level being the recent daily pivot low has added a question to the overall health of the uptrend.

Focus on today

This morning GBPUSD has opened quietly as the price action trades between both moving average support areas.

I am today monitoring the price action for a possible test of the 8 period moving averages.

Alternatively if GBPUSD cannot sustain higher prices could see the price action once again test the 34 period moving averages.

USDJPY

Summary

Friday USDJPY continued to trade lower as the price action tested the 101 support area.

Market overview

The breach of the 102.83 level being the swing high of the 21st February has effectively changed the daily trend to up and therefore putting this time frame into gear with the bullish weekly time frame.

Focus on today

This morning USDJPY has opened positively as the price action away from the 101.00 level.

Today I am monitoring a potential move to the 34 period moving averages.

Alternatively a failure to sustain higher prices could see USDJPY test the 101.00 level.

USDCHF

Summary

Friday USDCHF traded throughout the day within Thursday’s range.

Market overview

USDCHF continues to trade in a negative daily and weekly swing bias.

Focus on today

This morning USDCHF has opened positively as the price action trades within a two day range.

Today I am monitoring the price action for a test of the 8 period moving averages.

Alternatively a failure to sustain higher prices could see USDCHF test the 0.8875 level.

Gold

Summary

Friday Gold traded and closed higher as the price action succesfullty tested the downward sloping trendline.

Market overview

Gold continues to trade in a daily uptrend following the breach of the 1267.99 level being the swing high of the 10th December. The weekly time frame continues to point down however we have witnessed a large multi month double bottom forming which could indicate a large upside trend reversal is a possibility. The break above the large downward sloping trend line adds impetus to the current positive bias.

Focus on today

This morning Gold has opened positively as the price trades above Friday’s range.

Today I am monitoring the price action for a continuation of the move higher and into the direction of the 1433.70 level the 28th August high.

Alternatively a failure to sustain higher prices could see Gold trade back up to the 8 period moving averages.

Oil

Summary

Friday Oil bounce higher as the price action makes an attempt to retrace to the 8 period moving averages.

Market overview

Oil continues to trade in a daily uptrend following the breach of the 100.72 level being the swing high of the 24th December. The daily and weekly times both have a positive bias.

Focus on today

This morning Oil has opened quietly as the price action trades at the highs of Friday’s range.

Today I am monitoring the price action for a continuation of the move to the 8 period moving averages.

Alternatively a failure to sustain higher prices could see Oil trade back down to the 97.53 level being last week’s low.