10th March 2014

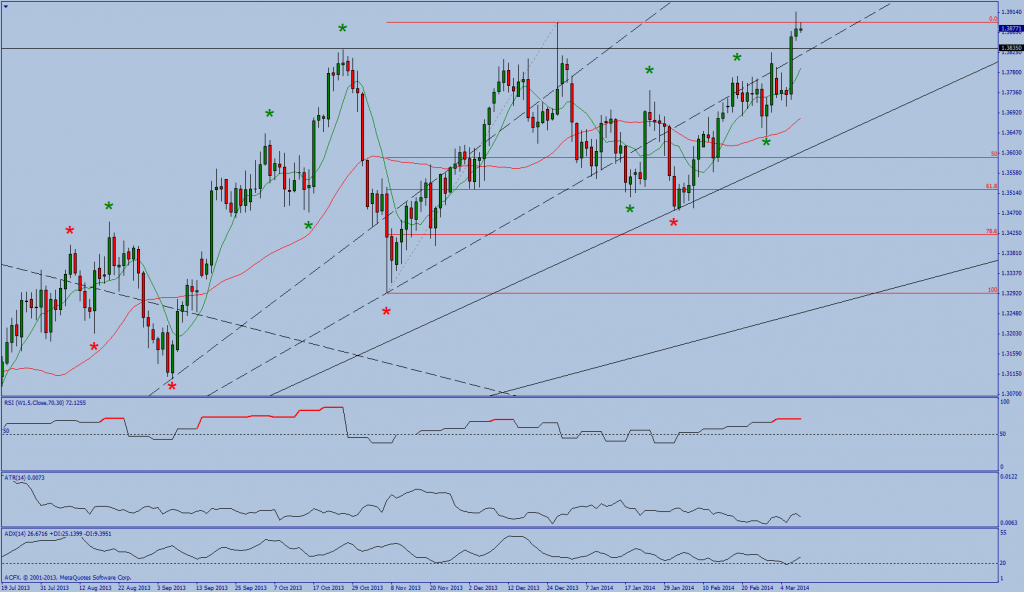

EURUSD

Friday summary

Friday traded a volatile session. This was mainly due to the US jobs report. However the price action did test and breach for a brief time the the high of the 27th December candle at 1.3893.

Market overview

EURUSD continues to trade in a daily uptrend following the breach of the 1.3741 level being the 24th January swing high has effectively changed the daily trend to up. This price action has put the daily time frame in gear with the positive weekly trend.

Focus on today

This morning EURUSD has opened quietly and trading within the previous days range.

I am this morning monitoring the price action for a potential retest of the 1.3893 level

Alternatively if EURUSD fails to sustain a move higher there is a possibility the price action trades back up to the 8 period moving averages.

GBPUSD

Friday summary

Friday trading saw GBPUSD continue to find support at the 8 period moving averages.

Market overview

GBPUSD has traded above the 1.6668 being the prior isolated pivot high. This price activity has effectively changed the daily trend to up and puts it in line with the bullish weekly outlook.

Focus on today

This morning GBPUSD has opened quietly as the price action trades within the range of the previous day’s candle.

I am today monitoring the price action for a possible breach of 1.6822 levels being last week’s high.

Alternatively if GBPUSD cannot sustain higher prices could see the price action potentially move back to the 34 period moving averages.

USDJPY

Friday summary

Friday USDJPY continued to trade higher before being turned back at the 103.74 resistance level.

Market overview

The breach of the 102.83 level being the swing high of the 21st February has effectively changed the daily trend to up and therefore putting this time frame into gear with the bullish weekly time frame.

Focus on today

This morning USDJPY is trading at the lows of the previous day’s range.

Today I am monitoring USDJPY for a possible retest of the 103.74 level.

Alternatively a failure to sustain higher prices could see USDJPY trade back to the averages.

USDCHF

Friday summary

Friday USDCHF continued to trade lower as it traded down to the a previously broken down trend line.

Market overview

USDCHF continues to trade in a negative daily and weekly swing bias.

Focus on today

This morning USDCHF has opened negatively as the price action trades within Friday range.

Today I am monitoring the price action for a sustained move beneath the 0.8776 level being the 28th February low.

Alternatively as the price action is now extended from its averages and with USDCHF trading at a previous broken trend line there is a possibility that we see a corrective bounce.