NFP day could witness a surprise 'jobs' number

Friday sees Japan's leading indicators published, France's trade balance is expected in at €-5.1bn, Germany's factory orders are expected to fall by -0.4%. Canada's unemployment number is expected to rise to 7.0%. Non-farm jobs created are expected in at circa 184K, with the USA unemployment expected in at 7.2%. Personal spending in the USA is expected in up 0.4%, whilst the preliminary university of Michigan survey of consumer sentiment expected in at 76.2. Later on Friday sees FOMC member Evans hold court, with the BOJ governor Kuroda holding court later in the evening. Late Friday evening-early Saturday morning China's trade balance is published. The euro advanced 0.6 percent to $1.3671 late in New York on Thursday after rising to $1.3677, the strongest level since Oct. 31st. The single currency was little changed at 139.10 yen after weakening as much as 0.5 percent. The dollar fell 0.6 percent to 101.74 yen. The euro rose to a five-week high versus the dollar as European Central Bank President Mario Draghi refrained from introducing further monetary stimulus. Sterling slumped 0.9 percent to 83.74 pence per euro late London time Thursday, the biggest decline since March 7th. The pound dropped 0.4 percent to $1.6315 after climbing to $1.6443 on Dec. 2nd, the highest since August 2011. The DJIA equity index future is at the time of writing down 0.43%, SPX future down 0.44%, NASDAQ down 0.11%. STOXX future is down 1.24%, DAX down 0.50%, CAC down 1.21%, FTSE future down 0.34%.

http://blog.fxcc.com/market-analysis

FOREX ECONOMIC CALENDAR :

2013-12-06 13:30 GMT | USA. Nonfarm Payrolls (Nov)

2013-12-06 13:30 GMT | USA. Unemployment Rate (Nov)

2013-12-06 13:30 GMT | Canada. Unemployment Rate (Nov)

2013-12-06 13:30 GMT | Canada. Net Change in Employment (Nov)

FOREX NEWS :

2013-12-06 04:45 GMT | Yen slides on GPIF headlines

2013-12-06 04:45 GMT | EUR/USD not relenting on upside – which shows just how strong Europe is perceived to be

2013-12-06 03:38 GMT | USD/JPY continues downside correction despite good US numbers from Thursday

2013-12-06 00:12 GMT | GBP/USD pulling back after touching upside projected target at 1.6425 this week

----------------------

EURUSD :

HIGH 1.36742 LOW 1.36566 BID 1.36608 ASK 1.36611 CHANGE 0.01% TIME 08 : 37:57

OUTLOOK SUMMARY : Down

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Market sentiment has improved for the bullish oriented traders. Fresh high formed yesterday offers key resistance level at 1.3676 (R1). In case of price appreciation above it our focus would be shifted to the higher targets at 1.3692 (R2) and 1.3709 (R3). Downwards scenario: On the other hand, successful retest of our next support level at 1.3640 (S1) might provide sufficient momentum for the price acceleration towards to interim target at 1.3621 (S2). Final aim for today locates at 1.3599 (S3).

Resistance Levels: 1.3676, 1.3692, 1.3709

Support Levels: 1.3640, 1.3621, 1.3599

------------------

GBPUSD :

HIGH 1.63414 LOW 1.6319 BID 1.63243 ASK 1.63249 CHANGE 0% TIME 08 : 37:57

OUTLOOK SUMMARY : Down

TREND CONDITION : Downward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Measures of resistance might be activating when the pair approaches the 1.6340 (R1) mark. Break here would suggest next interim target at 1.6369 (R2) and If the price keeps its momentum we expect an exposure of 1.6392 (R3). Downwards scenario: On the downside our attention is shifted to the immediate support level at 1.6310 (S1). Break here is required to enable bearish forces and expose our intraday targets at 1.6289 (S2) and 1.6266 (S3).

Resistance Levels: 1.6340, 1.6369, 1.6392

Support Levels: 1.6310, 1.6289, 1.6266

----------------------

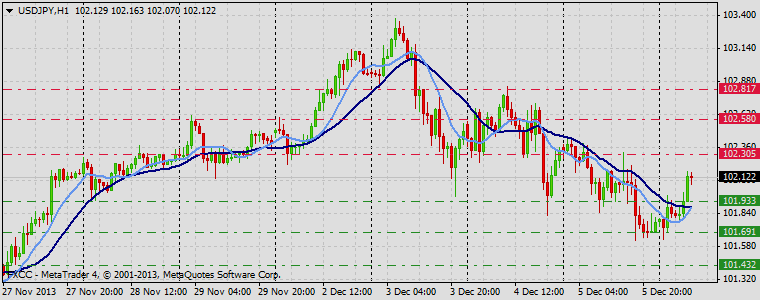

USDJPY :

HIGH 102.167 LOW 101.631 BID 102.114 ASK 102.117 CHANGE 0% TIME 08 : 37:57

OUTLOOK SUMMARY : Up

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Currently price deviates from its initial downside extension. Clearance of our next resistance level at 102.30 (R1) might trigger corrective action towards to our initial targets at 102.58 (R2) and 102.81 (R3). Downwards scenario: We do expect some pull-backs development on the downside below the support level at 101.93 (S1). Short-term momentum on the negative side might open the way towards to immediate supports at 101.69 (S2) and 101.43 (S3).

Resistance Levels: 102.30, 102.58, 102.81

Support Levels: 101.93, 101.69, 101.43

Source: FX Central Clearing Ltd,( http://www.fxcc.com )