Will Fed Speeches Halt the Dollar Rally?

Based on the sell-off in global equities and rise in bond yields around the world, deleveraging in the financial markets intensified. However in the forex market, the U.S. dollar appears to have stabilized. Early losses for many major currencies against the dollar were recovered by the end of the day. In fact, the AUD/USD even ended the North American trading session in positive territory. Does this mean that the dollar rally has peaked? No. There were no fundamental drivers behind the reversal in the greenback outside of exhaustion. U.S. stocks continued to decline, extending losses that began at the end of May. While the S&P 500 is still up more than 11% year to date, it lost 6% of its value since setting a record high of 1,669.16 on May 21st. With 1,500 in sight more losses are likely for the S&P 500 and additional weakness in equities is a reflection of risk aversion, which could lead to further strength for the greenback.

https://support.fxcc.com/email/technical/25062013/

FOREX ECONOMIC CALENDAR :

2013-06-25 08:30 GMT | UK. BBA Mortgage Approvals (May)

2013-06-25 12:30 GMT | USA. Durable Goods Orders (May)

2013-06-25 13:00 GMT | USA. Housing Price Index (MoM) (May)

2013-06-25 14:00 GMT | USA. New Home Sales (MoM) (May)

FOREX NEWS :

2013-06-25 02:02 GMT | USD/JPY retesting 98.00 as Nikkei jumps 1%

2013-06-25 01:13 GMT | AUD/USD well supported by 0.9250, 1h EMA

2013-06-25 01:01 GMT | GBP/JPY struggling around the 151.00 handle

2013-06-25 00:21 GMT | EUR/JPY structurally bearish, above 128.40 sees relief

EURUSD :

HIGH 1.31356 LOW 1.31105 BID 1.31152 ASK 1.31158 CHANGE -0.03% TIME 08:19:56

OUTLOOK SUMMARY : Down

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: A buying interest might push the pair to attack next resistive measure at 1.3144 (R1). Clearance here is required to resume upside formation, targeting marks at 1.3162 (R2) and 1.3180 (R3) later on today. Downwards scenario: On the other hand, further downtrend formation might commence below the support level at 1.3104 (S1). Break here is required to validate our targets at 1.3087 (S2) and 1.3069 (S3) in potential.

Resistance Levels: 1.3144, 1.3162, 1.3180

Support Levels: 1.3104, 1.3087, 1.3069

-----------------------

GBPUSD :

HIGH 1.5455 LOW 1.5425 BID 1.54402 ASK 1.54410 CHANGE 0.06% TIME 08:19:57

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: Upwards penetration is limited to the psychological resistance level at 1.5466 (R1). Clearance here might open a route towards to our initial target at 1.5486 (R2) and then further price appreciation would be targeting resistance at 1.5506 (R3). Downwards scenario: Break of the support at 1.5426 (S1) is required to determine negative intraday bias and enable lower target at 1.5405 (S2). Clearance of this target would open a path towards to final support for today at 1.5385 (S3).

Resistance Levels: 1.5466, 1.5486, 1.5506

Support Levels: 1.5426, 1.5405, 1.5385

-------------------------

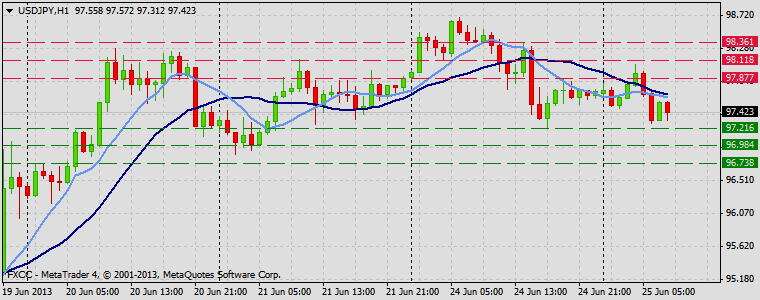

USDJPY :

HIGH 98.065 LOW 97.275 BID 97.436 ASK 97.441 CHANGE -0.28% TIME 08:19:57

OUTLOOK SUMMARY : Neutral

TREND CONDITION : Sideway

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : Low

Upwards scenario: Neutral channel formation remains favored pattern on the hourly chart frame. Possible clearance of our next resistive barrier at 97.87 (R1) would suggest next intraday targets at 98.11 (R2) and 98.36 (R3) in potential. Downwards scenario: On the other hand, loss of our support level at 97.21 (S1) would open road for a market decline towards to our next target at 96.98 (S2). Any further price weakening would then be limited to final support for today at 96.73 (S3).

Resistance Levels: 97.87, 98.11, 98.36

Support Levels: 97.21, 96.98, 96.73

Source: FX Central Clearing Ltd,( ECN Broker Account | Best Forex Trading Platform | Forex Blog | FXCC )