The Dow Jones Rises to Monthly Highs! Is Gold Retracing Or Correcting?

* The Dow Jones rises to a monthly high despite higher inflation data for February 2024.

* The Dow Jones’s best performing stock on Tuesday was 3M Co (+4.97), Intl Business Machines Corp (+3.16%) and Microsoft (+2.66%).

* US inflation rises from 3.1% to 3.2% and the Monthly Core CPI remains at recent highs for a second consecutive month.

* Gold forms its first bearish candlestick in March on the daily chart, but Dollar struggles to hold onto gains.

USA30 – Higher Inflation Fails To Keep the Dow Jones Down!

The USA30 did not see the highest gains and lags behind the SNP500 and NASDAQ which both rose more than 1.00%. However, the USA30 (Dow Jones), was the only US index which broke through resistance levels and rose to its highest level for March. The USA30 is now witnessing bullish signals from trend-lines, regression channels and oscillators. The price is trading above the 75-Bar EMA, above 60.00 on the RSI and above the VWAP. These factors indicate the asset has potential to further rise.

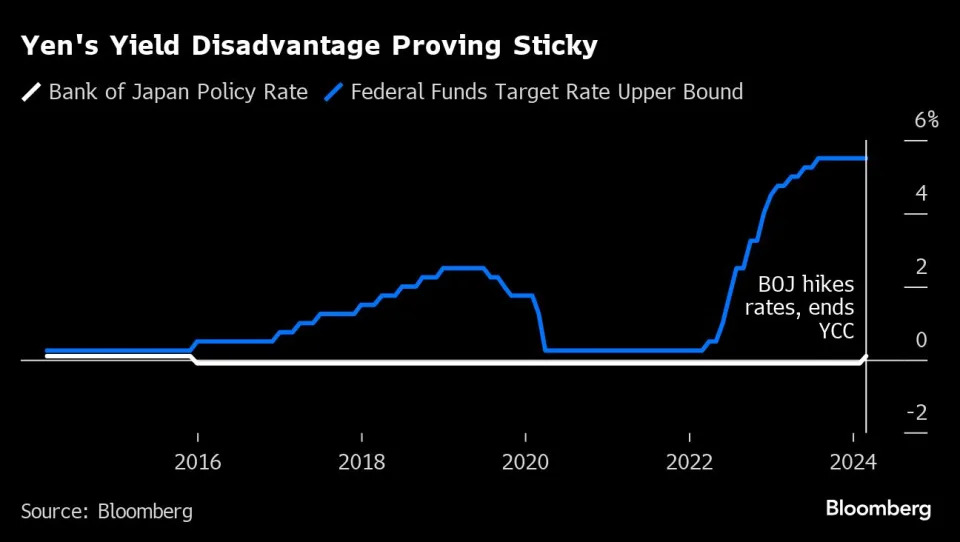

The only concern for technical analysts is entering too high and at a previous resistance level from February. Though fundamental analysts are more concerned about the higher-than-expected inflation data. The higher inflation data did not cause a decline in the price, as it normally would. However, it continues to be a concern for investors as it puts off a possible interest rate cut in May-June 2024. The US inflation rate rose from 3.1% to 3.2% and Core Inflation fell at a lower pace compared to previous predictions.

If we look at the top 15 influential stocks within the USA30, 8 of those stocks are declining. Also, the most volatile stocks in the pre-market hours are Travelers Cos Inc stocks which are declining more than 2%. This currently indicates a sideways price movement, but investors will need to continue monitoring as we come closer to the US Open. Other global indices are trading lower including the Nikkei225, DAX and CAC. However, US bond yields are trading 0.012% lower which is positive for the US stock market.

XAUUSD – Gold Forms Its First Retracement

Gold has formed its first retracement after the higher-than-expected inflation data. This ends a nine-day bullish trend where the commodity rose consecutively. However, traders should note the price is so far only forming a retracement and is yet to indicate a downward trend. Therefore, the price can potentially still be within a bullish trend. The retracement can provide investors the opportunity to enter at a more competitive entry level.

If the price breaks above the $2,161.53 mark, buy signals are likely to again materialize. The commodity formed a triple top at this level but is not showing any downward momentum. Therefore, above this level, investor sentiment can again rise. The Fibonacci levels indicate that a buy trade can potentially aim for levels between $2,169 and $2,175 in the short term.

The 30-Year Bond Yield Auction can influence the price movement of Gold as both are known as haven assets. However, tomorrow’s Producer Inflation and Retail Sales is likely to create higher volatility. Investors will also be keen to hear from members of the FOMC, but none are scheduled to speak throughout the day. Economists are now pricing in at least three 25 basis point interest rate cuts, the first of which could come in June. Previously investors were pricing in four cuts.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Michalis Efthymiou

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.