Current trend

Yesterday, Brent crude oil tested a level of 60.00. A compromise regarding financial assistance to Greece contributed to the growth of oil quotes. The EU's finance ministers had approved of a Greek reform plan and extended bailout terms for another 4 months. In particular, the Greek government had promised to continue selling state-owned assets, consolidate pension funds to cut expenses, take measures to fight tax dodgers and smugglers and to introduce progressive taxes.

However, Brent price failed to hold above 60.00. The tools had fallen to a level of 57.97 by the end of the day. Fundamental factors continue to hang over oil prices and oversupply still causes hydrocarbon prices to fall.

The black gold follows a positive trend trading at about 59.00 today. The developement of Chinese production activity along with FED's flexible attitude to an interest rate rise support Brent oil rates.

Support and resistance

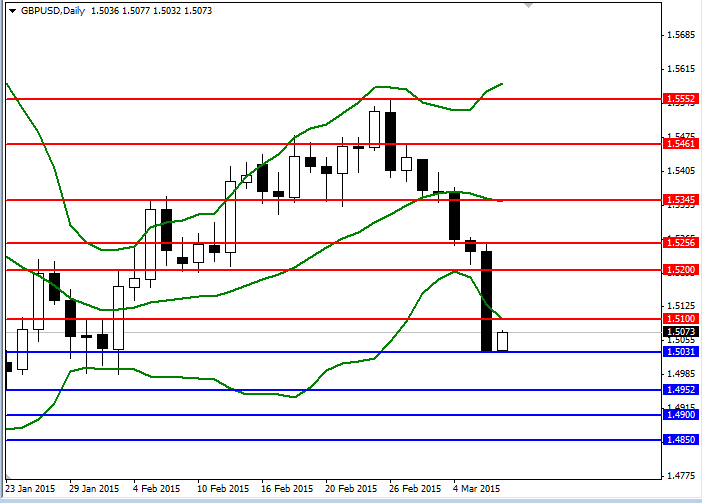

Resistance levels: 57.68 (middle line of Bollinger bands), 60.00 (important psychological level), 61.00 (20th February's maximum), 62.00 (important psychological level), 62.84 (17th February's maximum), 63.90 (upper line of Bollinger bands).

Support levels: 57.68 (middle line of Bollinger bands), 56.00 (38,2% Fibonacci retracement), 55.00 (important psychological level), 53.90 (50% Fibonacci retracement).

Trading tips

If the current trend continues, opening long positions will become relevant from a level of 60.10 with the nearest target at 61.00 and the second target at 62.80. A firm breakdown of the level 57.60 will open a way to the levels 56.00 and 53.90, from which there may resume an uptrend within the framework of technical correction.

Vadim Smarzh

Analyst of LiteForex Investments Limited