S&P 500: Slow gains amid expectations of interest rate changes

Tuesday brought modest gains in the S&P 500, where investors were scrupulously analyzing mixed reports from U.S. giants and evaluating statements from Fed officials looking at hints of an upcoming interest rate cut.

Minneapolis FRB head Neel Kashkari emphasized that the fight against inflation is not over, but noted its accelerating decline, pointing to data that has been largely in line with the Fed's 2% target over the past three and six months.

FRB Cleveland Chairman Loretta Mester expressed the view that a rate cut is possible under favorable developments, although she did not go into details of possible policy easing due to uncertainty around inflation.

Dynamics of shares and sectoral changes of the market

Equity dynamics were erratic throughout the day but recorded gains towards the close.

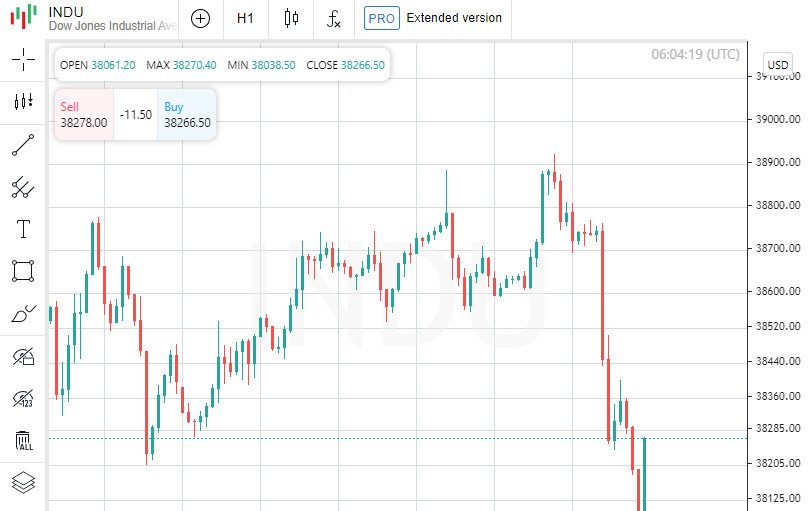

The Dow Jones Index (.DJI) jumped 141.24 points, or 0.37%, to 38,521.36. The S&P 500 (.SPX) strengthened 11.42 points, or 0.23%, to 4,954.23, while the Nasdaq Composite (.IXIC) rose 11.32 points, or 0.07%, to close at 15,609.00.

On Tuesday, U.S. Treasury Secretary Janet Yellen expressed concern about tensions in the banking sector and among commercial real estate owners, but emphasized that with the help of regulators, the situation remains under control.

The KBW Regional Banks Index (.KRX) ended the day down 1.4%, marking a 12.6% decline over the past six trading sessions. Shares of New York Community Bancorp (NYCB.N) collapsed 22.2% after the bank reported an unexpected quarterly loss due to real estate debt forgiveness for some customers, losing about 60% of its value for the week.

Meanwhile, airline stocks pushed the Dow Jones Transportation Average (.DJT) index up 2.1%, pointing to the demand for air travel. Frontier Group Holdings (ULCC.O) delighted the market by jumping 20.8% thanks to reporting reaching breakeven.

According to LSEG, more than half of the companies in the S&P 500 have already reported earnings that beat expectations 81.2% of the time. Total S&P 500 fourth-quarter earnings are projected to be up 8.1% from a year ago.

GE HealthCare Technologies (GEHC.O) rose 11.6% after posting quarterly earnings that beat expectations, fueling record gains in the healthcare sector of the S&P 500 Index (.SPXHC).

The materials sector (.SPLRCM) posted the best performance of any S&P 500 sector.

The MSCI Global Index (.MIWD00000PUS), which reflects stocks in 49 countries, rose 0.51%.

Shares of chemical giant DuPont de Nemours (DD.N) jumped 1.7%, up 7.4% after the company beat quarterly profit forecasts and also announced a $1 billion share repurchase program and a dividend hike.

Palantir Technologies (PLTR.N) soared 30.8% in anticipation of an upbeat full-year earnings forecast.

Meanwhile, shares of Eli Lilly (LLY.N) are down 0.2% despite a 2024 earnings forecast that exceeds expectations.

Shares in the semiconductor segment added to the tension on the Nasdaq Technology Market, with the Philadelphia SE Semiconductor index (.SOX) down 1%. Rambus Inc (RMBS.O) was at the epicenter of the decline, losing 19.2% after posting quarterly results.

On NYSE actively growing stocks outperformed falling ones, demonstrating a ratio of 2.6 to 1. There were 190 new highs versus 64 new lows on this floor.

The Nasdaq showed 2,721 stocks went up and 1,476 went down, with rising issues outnumbering falling ones by a ratio of 1.8 to 1. The S&P 500 marked 27 new 52-week highs versus 8 new lows, while the Nasdaq recorded 110 new highs and 122 new lows.

Total trading volume on U.S. exchanges reached 11.21 billion shares, compared with the usual average of 11.54 billion over the past 20 sessions.

Strengthening Chinese stocks and the international market

In China, authorities have taken to strengthening its stock market, leading Chinese blue chip stocks (.CSI300) to climb more than 3%. In New York, the iShares China Large-Cap ETF (FXI.P) rose 5.7% and the Golden Dragon China Index (.HXC) jumped 5.9%.

A series of statements from China's financial markets regulator and President Xi Jinping's upcoming meeting with regulators indicated Beijing's determination to combat losses in the domestic market.

State-owned investment fund Central Huijin Investment announced it is expanding its investment in ETFs.

China's blue chips hit a five-year low last week amid a slowing economy, prompting state investors, known as the "national team," to step up purchases of ETFs tracking shares of leading companies to support the market.

News are provided by

InstaForex.

Read More https://ifxpr.com/3Uw6JEX