According to the latest data, economic growth in the United States for the fourth quarter of last year was revised slightly downwards, suggesting a possible weakening of economic momentum. This downturn could have long-term implications for overall economic stability and may influence policymakers' decisions regarding monetary policy.

During this period, Applied Materials, a leading supplier of equipment for semiconductor production, faced a decline in its stock value after receiving a subpoena from the Securities and Exchange Commission (SEC) of the USA. This highlights increased regulatory pressure on the technology sector, which could restrain investment potential and growth in this area.

Also noteworthy is the drop in shares of UnitedHealth, one of the largest providers of healthcare services in the U.S., following the announcement of an antitrust investigation. This event underscores growing concerns about market power concentration and its impact on consumers and pricing in key economic sectors.

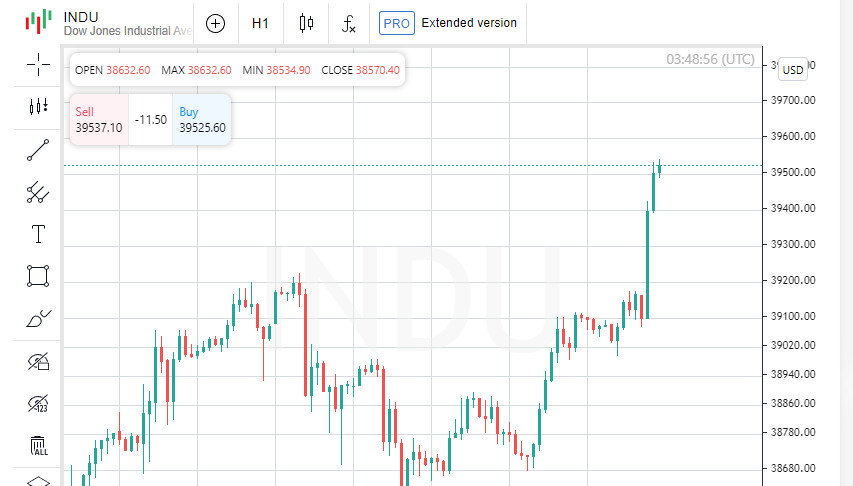

Stock indices such as the Dow, S&P 500, and Nasdaq showed a decline, reflecting overall investor caution. This caution is intensified in anticipation of the release of key inflation data, which could significantly affect the future actions of the U.S. Federal Reserve System in regulating interest rates.

The Personal Consumption Expenditures (PCE) index, which is the preferred inflation indicator for the Federal Reserve, is expected to show an increase in prices, confirming the continuation of inflationary pressure in the economy. This, in turn, could lead to a reassessment of expectations regarding the pace and timing of changes in the Fed's key interest rate.

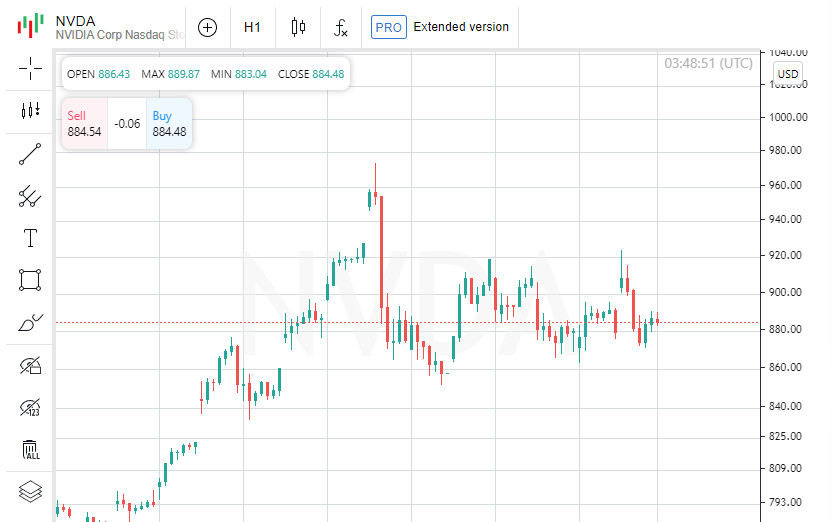

Stocks in the market have struggled to maintain an upward trend following a series of data publications, leading to a moderate decline after a prolonged period of growth based on optimism around the potential of artificial intelligence and outstanding quarterly performance by Nvidia. This period of growth was abruptly interrupted when data confirming the persistence of inflation began to emerge, causing investor concern and leading to a reassessment of their expectations regarding the future monetary policy of the Federal Reserve System.

Evidence of sustained inflation in recent reports on consumer and producer prices, along with statements from Federal Reserve officials, has led investors to contemplate the possibility of delaying the first rate cut to a later date, possibly until June instead of the previously expected March.

Keith Buchanan, a senior portfolio manager at GLOBALT Investments, expressed the opinion that the market may face a period of uncertainty as investors will need to closely monitor inflation trends and adjust to the Federal Reserve System's long-term policy and rhetoric. He emphasized that any signs of inflation resurgence would be met with particular caution by the market and could cause significant fluctuations in financial markets.

Against this backdrop, the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite demonstrated a decline, reflecting the general sentiment of uncertainty among investors. These data indicate that despite confident growth in the previous quarter, the beginning of 2024 may be marked by a slowdown in economic activity.

In addition to PCE data, this week is also expected to see other important economic reports, including weekly data on unemployment claims and manufacturing activity indices. These reports will provide a more complete picture of the economy's state and help assess further interest rate dynamics.

Statements by the president of the Federal Reserve Bank of Boston, Susan Collins, and the president of the Federal Reserve Bank of New York, John Williams, indicate the Federal Reserve System's cautious approach to changing monetary policy. Both leaders highlighted the importance of careful analysis of economic data before making decisions that could affect the goals of maximum employment and price stability.

In summary, global stocks have shown a decline, the yield on treasury bonds has fallen, and the dollar has strengthened its positions ahead of the publication of key inflation data, which could significantly impact the future policy of the Federal Reserve System. These events highlight the complexity of the economic landscape and the importance of careful monitoring by investors and policymakers to adapt to changing conditions.

News are provided by

InstaForex.

Read More https://ifxpr.com/42WDihi