Two sides of the market: record growth of the S&P 500 and the Tesla crisis

U.S. Economic Strength: Surpassing Expectations

The U.S. economy demonstrated remarkable growth, surpassing all forecasts in the fourth quarter. This rise was a surprise to experts, highlighting the resilience of the country's economic dynamics.

Comcast and American Airlines: Symbols of Growth

Comcast reported revenues exceeding expectations, contributing to the rise in their stocks. Meanwhile, American Airlines also pleases investors with an optimistic profit forecast, demonstrating the health of the aviation industry.

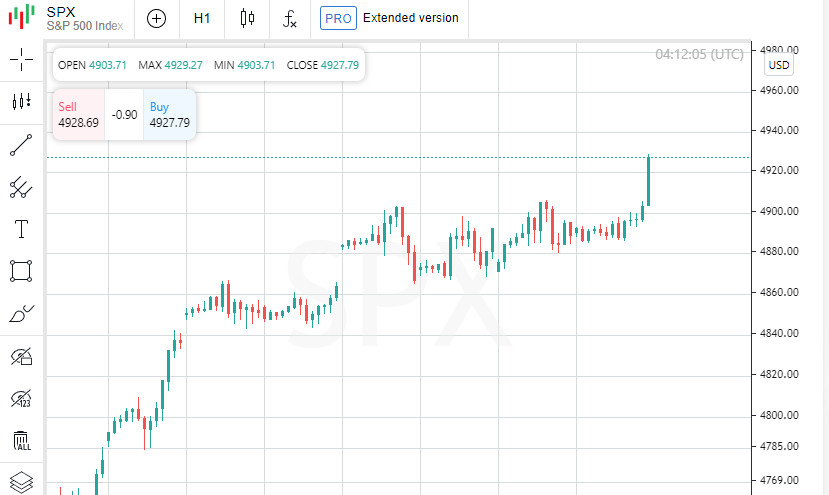

S&P 500 Index: At the Peak of Success

The S&P 500, reflecting the overall market trend, grew by 0.53%, reaching a historical high for the fifth session in a row. This record growth is backed by investors' confidence in the U.S. economic potential.

Global Market in the Rhythm of the American Economy

Global stocks rise on the wave of American economic growth. At the same time, the euro loses positions, reflecting the European Central Bank's decision to keep interest rates unchanged.

U.S. Economy: Impressive GDP Growth

The U.S. Gross Domestic Product in the fourth quarter showed an impressive 3.3% annual growth. This significantly exceeds forecasts, disproving fears of a possible recession in 2023.

Tesla: Challenges Amidst Overall Growth

In contrast to the general market optimism, Tesla faces problems. After the publication of a disappointing sales forecast, the company's stocks fell, standing out against the general market upswing.

S&P 500: New Horizons of Growth

The rally of the S&P 500 index continues, marking a new record high reached for the first time in two years. This indicates investors' optimism regarding the future of the American economy and reduced interest rates, as well as growing interest in artificial intelligence.

GDP a Pleasant Surprise for the Market

Rob Haworth from U.S. Bank Asset Management Group emphasized that the U.S. GDP growth is a pleasant surprise for the market. The absence of inflation issues and active consumer spending create a favorable environment. This circumstance strengthens confidence that companies' revenues and sales will grow in the future.

Unemployment Level: A Slight Increase in Claims

Recent data indicate a slight increase in the number of unemployment benefit claims, reaching 214,000, slightly exceeding the forecast of 200,000. This points to minor fluctuations in the labor market.

Tech Giants: Awaiting Quarterly Reports

The upcoming quarterly reports from Apple, Microsoft, Amazon, Alphabet, and Meta Platforms will provide investors valuable insight. This will help assess whether the high valuations of these companies are justified after their stock growth since the crisis on Wall Street in 2022.

Dow Jones, S&P 500, and Nasdaq: The Rise Continues

The Dow Jones Industrial Index showed significant growth, adding 242.74 points. S&P 500 and Nasdaq also increased, indicating the continuing rise in the market.

Global Market: Steady Growth

At 16:14 Eastern European Time (214 GMT), the global MSCI stock index, reflecting dynamics in 49 countries, rose by 0.32%. The European STOXX 600 index also closed with a 0.3% increase, confirming a stable positive trend in the global economy.

Electric Vehicles: Stock Fall After Tesla's Report

Following the publication of Tesla's quarterly report, shares of other electric vehicle manufacturers also suffered. Rivian Automotive and Lucid Group recorded a decrease in their shares by 2.2% and 6.7% respectively, reflecting overall concern in the sector.

Healthcare Sector: Drop in Humana's Shares

Humana's shares sharply fell by 11.7%, following the forecast of modest annual profits, which impacted the S&P 500 healthcare sector index, decreasing it by 0.2%. This reflects current challenges in the health insurance sector.

UnitedHealth and Cigna:

Falling Following Humana Following Humana, shares of other health insurers also incurred losses. UnitedHealth and Cigna showed a decrease of 3.9% and 2% respectively, highlighting instability in this market segment."

IBM and Comcast: Stock Growth Following Positive Forecasts

IBM shows impressive stock growth of 9.5%, thanks to a revenue forecast that exceeds expectations. Comcast's shares also rose by 3.4% after the company surpassed quarterly revenue forecasts.

American Airlines: Sharp Rise in Shares

Shares of American Airlines sharply increased by 10.3%, thanks to a very optimistic annual revenue forecast, which is a good sign for the aviation industry.

S&P 500: Earnings Surpass Expectations

According to the latest data, 82% of the companies in the S&P 500 index that have reported their earnings have exceeded expectations. This is significantly higher than the long-term average of 67%, indicating an overall positive sentiment in the market.

Boeing: Stock Decline Due to FAA Ban

Boeing's shares noticeably fell by 5.7%, following the decision of the U.S. Federal Aviation Administration to prohibit the company from expanding the production of 737 MAX models due to technical issues.

S&P 500 Index: Predominance of Growth Over Decline

The S&P 500 index exhibited a positive ratio of rising to falling stocks, at 4 to 1, indicating a prevailing upbeat trend in the market.

Indices Hitting New Highs and Lows

The S&P 500 recorded 50 new highs and only two new lows, while Nasdaq registered 97 new highs and 119 new lows, reflecting the current market's volatility.

Trading Volume:

Market Stability The trading volume on U.S. exchanges remained consistent, reaching 11.5 billion shares, in line with the average level of the last 20 sessions.

The U.S. Dollar Strengthens, Euro Weakens

The U.S. dollar showed an increase, signaling the Federal Reserve's reluctance to lower interest rates. Concurrently, the euro hit a six-week low against the dollar following the European Central Bank's statement about maintaining high interest rates.

Oil and Gold: Price Increase

U.S. oil prices reached their highest since late November, with futures for West Texas Intermediate and Brent crude oil rising by 3% and 2.99% respectively. Gold prices also saw an increase, with a 0.32% rise in spot prices.

News are provided by

InstaForex.Read More

https://ifxpr.com/42fEmwu