EUR/USD

Yesterday there was a strong shift away from risk; the S&P 500 -1.37%, copper -0.52%, but bond yields increased, and oil prices rose. On the one hand, this divergence fully corresponds to investors' expectations of a slowdown in the pace of Federal Reserve rate cuts due to yesterday's US inflation data – the core index held at 3.9% YoY against expectations of a decrease to 3.7% YoY, the US CPI decreased from 3.4% YoY to 3.1% YoY against expectations of 2.9% YoY, and investors' expectations for a rate cut shifted from May to June. On the other hand, earlier in the day, before the data was released, European stock markets and futures on the US stock market were falling, only accelerating with the release of the news. Perhaps the market will not return to the record high that was set by the S&P 500 on Monday, for a long time at that, and this is the beginning of a global crisis. Traditionally, we're waiting for a major company to announce bankruptcy to officially start the crisis. Last year, there were several major bankruptcies, but amid unbridled optimism, they went unnoticed. Now, markets are more attentive.

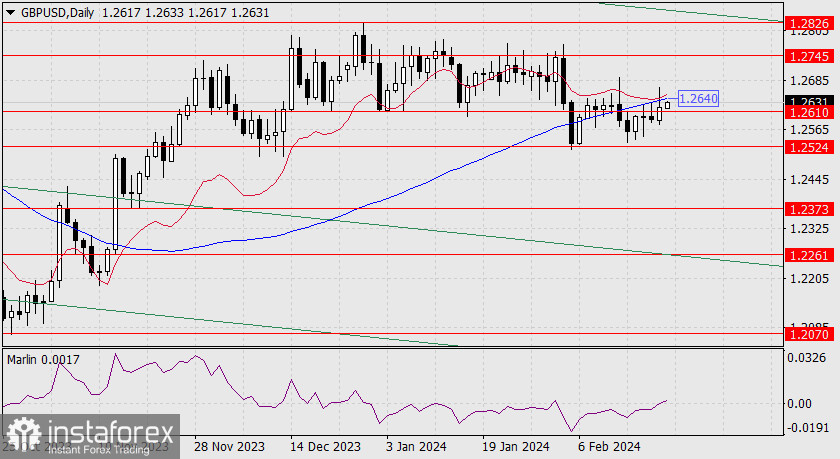

On the daily chart, the euro has crossed the midline of the descending price channel. The price has breached the support at 1.0724, so now it can aim for 1.0632. Surpassing this target would reveal a significantly lower one at 1.0450, the October 2023 low.

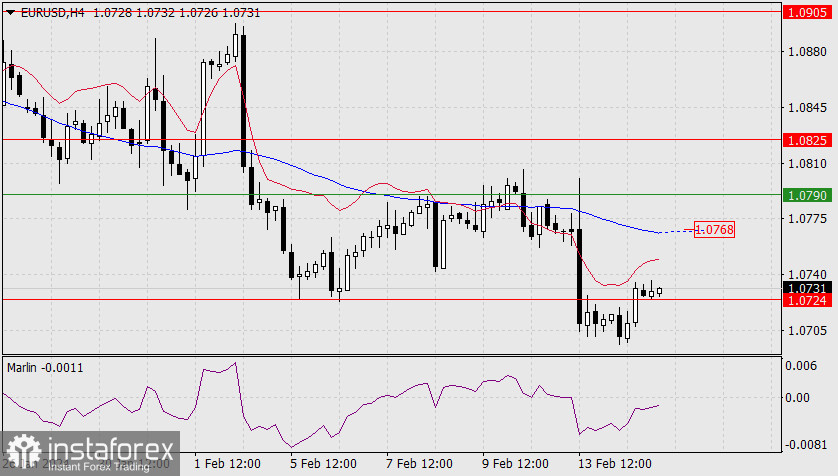

On the 4-hour chart, the price has settled below the target level of 1.0724. The Marlin oscillator has firmly settled in the downtrend territory. It is noteworthy that the decline occurred after a double false breakout above the MACD line (marked by ovals). This is a sign of the medium-term downward movement.

Analysis are provided by InstaForex.

Read More https://ifxpr.com/49qQWLW