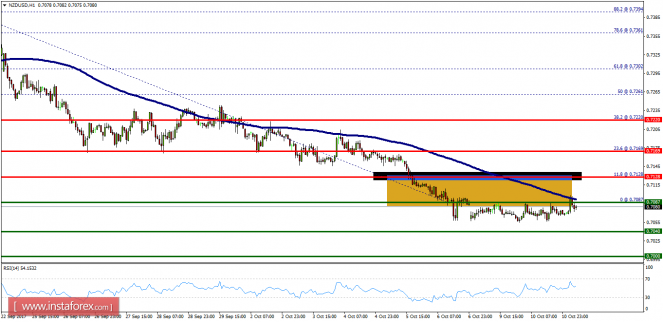

Wave summary:

We continue to look for more upside pressure towards 1.6875, but we need a break above minor resistance at 1.6410 to get the next "GO" higher. As long as the minor resistance at 1.6410 is able to cap the upside, we should look for a minor dip to 1.6311 before turning up again.

R3: 1.6451

R2: 1.6410

R1: 1.6340

Pivot: 1.6300

S1: 1.6278

S2: 1.6222

S3: 1.6200

Trading recommendation:

We will buy EUR again at 1.6300 or upon a break above 1.6365.

Analysis are provided byInstaForex.