Forex Analysis & Reviews: Forecast for EUR/USD on January 26, 2024EUR/USD

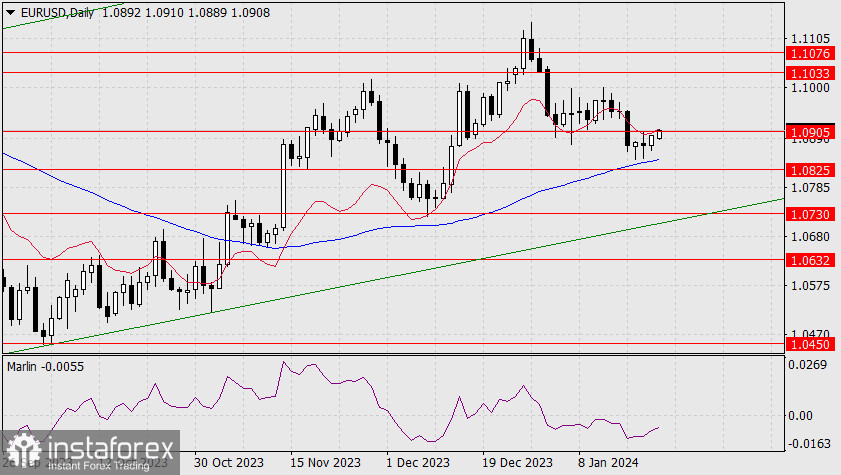

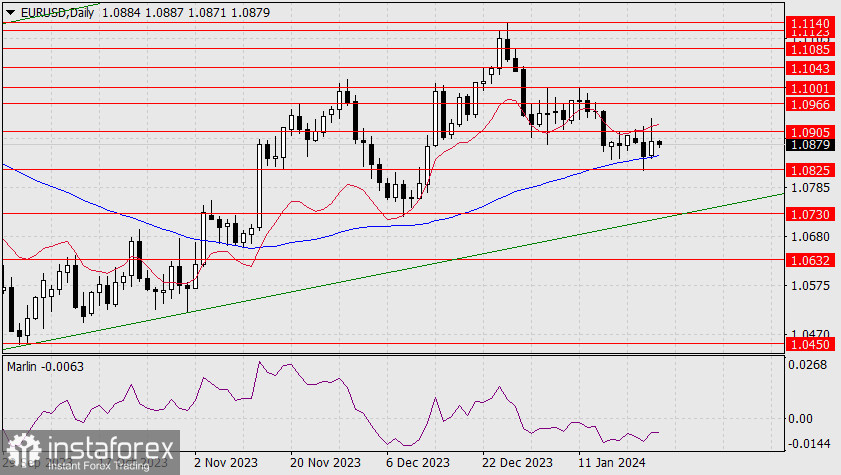

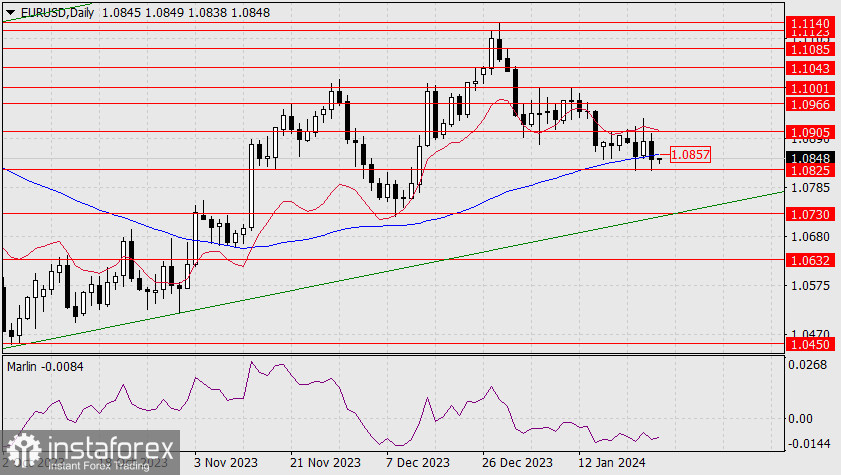

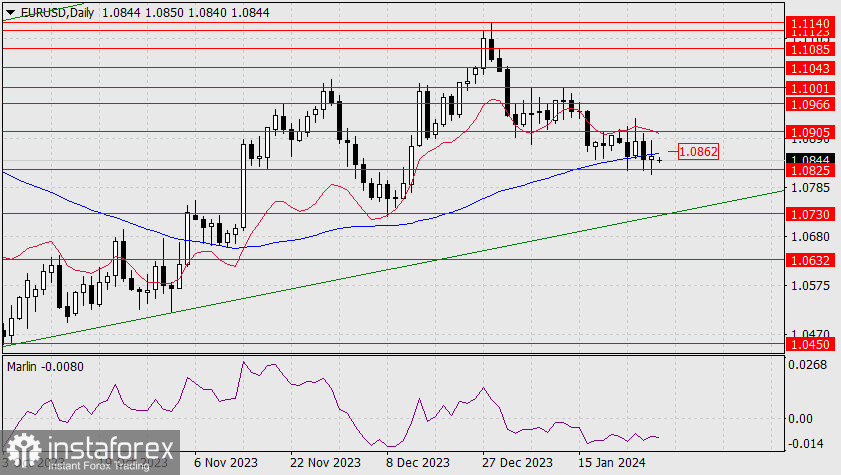

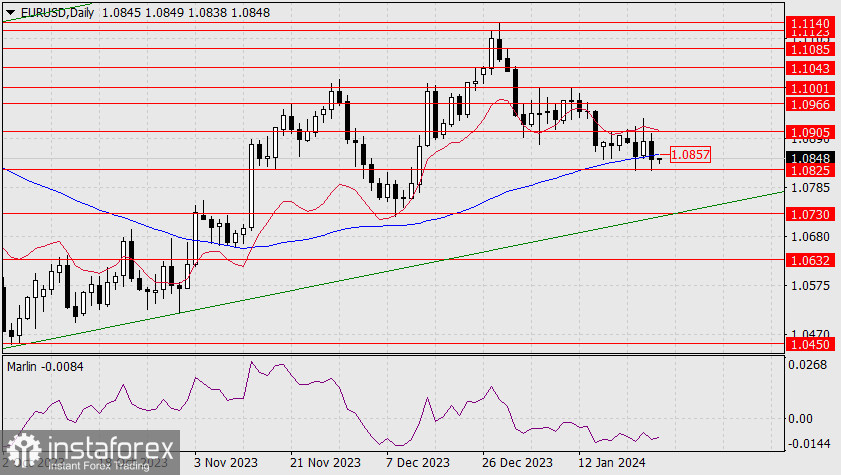

Yesterday, the price repeated Tuesday's scenario – the daily candle tested the boundaries of the range between 1.0825 and 1.0905 with candles, and the day closed with a long black body. However, the price closed the day below the MACD indicator line, and it opened today below this line. The European Central Bank meeting and ECB President Christine Lagarde's subsequent speech were neutral.

There are currently more technical prerequisites for breaking through support, but overall, market interest in risk has increased significantly – almost all financial market instruments rose yesterday, from stock markets to bonds and gold. This increase in risk appetite was driven by strong US GDP data – 3.3% growth in the fourth quarter, exceeding the forecast of 2.0%.

Investors may be expecting a dovish tone from the Federal Reserve at its January 31 meeting. Now, any of the euro's movements could turn out to be a false move. We are waiting for the key event of the upcoming week. We believe that the Federal Reserve will be the first to start the rate-cut cycle, so the Fed may also start to show verbal signals.

Today, the US will release data on income and spending for December, with expectations being positive, and they could strengthen the rise of riskier assets, including the euro.

On the 4-hour chart, the price and oscillator have formed a semblance of a double or even triple convergence. We can confirm this once the price settles above the MACD line (1.0855). Take note that the MACD line coincides in price level with the daily MACD line (1.0857), and overcoming such significant resistance could push the euro upward.

Analysis are provided by InstaForex.Read More

https://ifxpr.com/4b5OAUl