Forex Analysis & Reviews: USD/JPY. March 25th. Bulls fear the new tightening of the Bank of Japan's policy

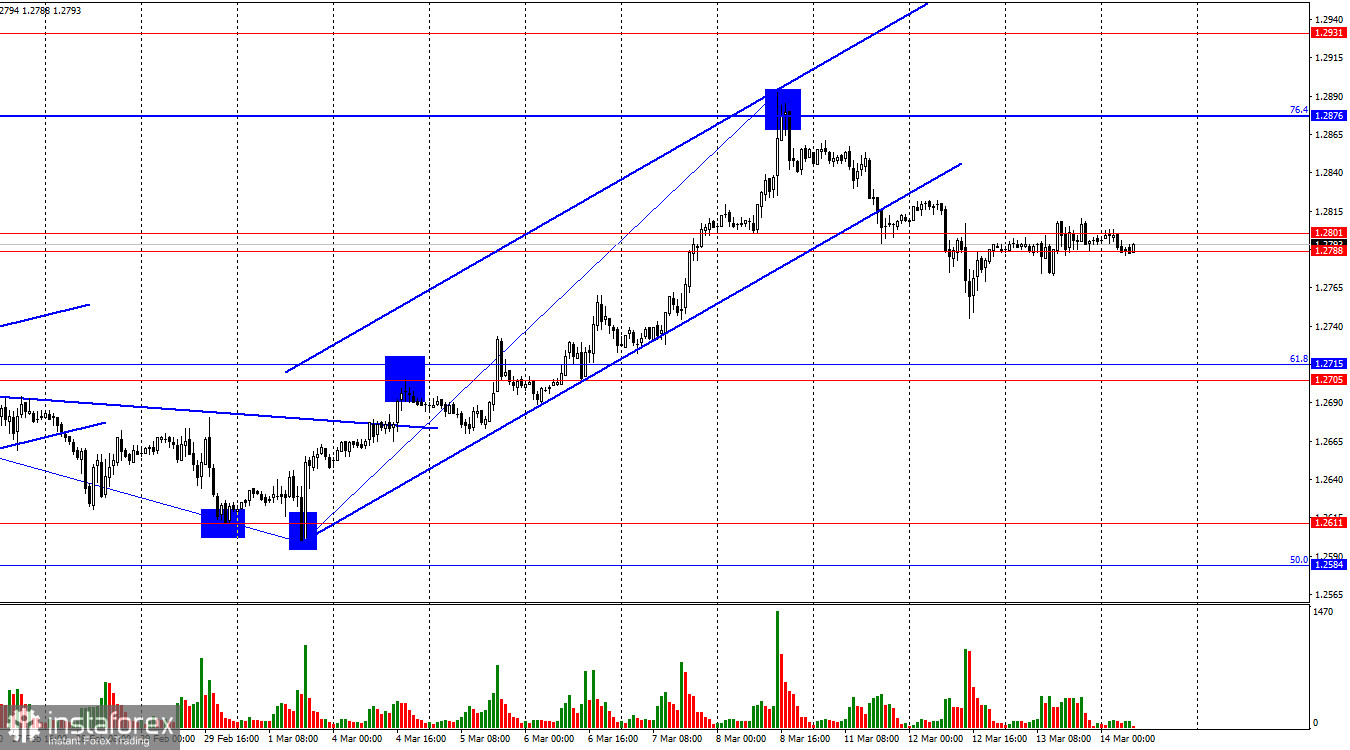

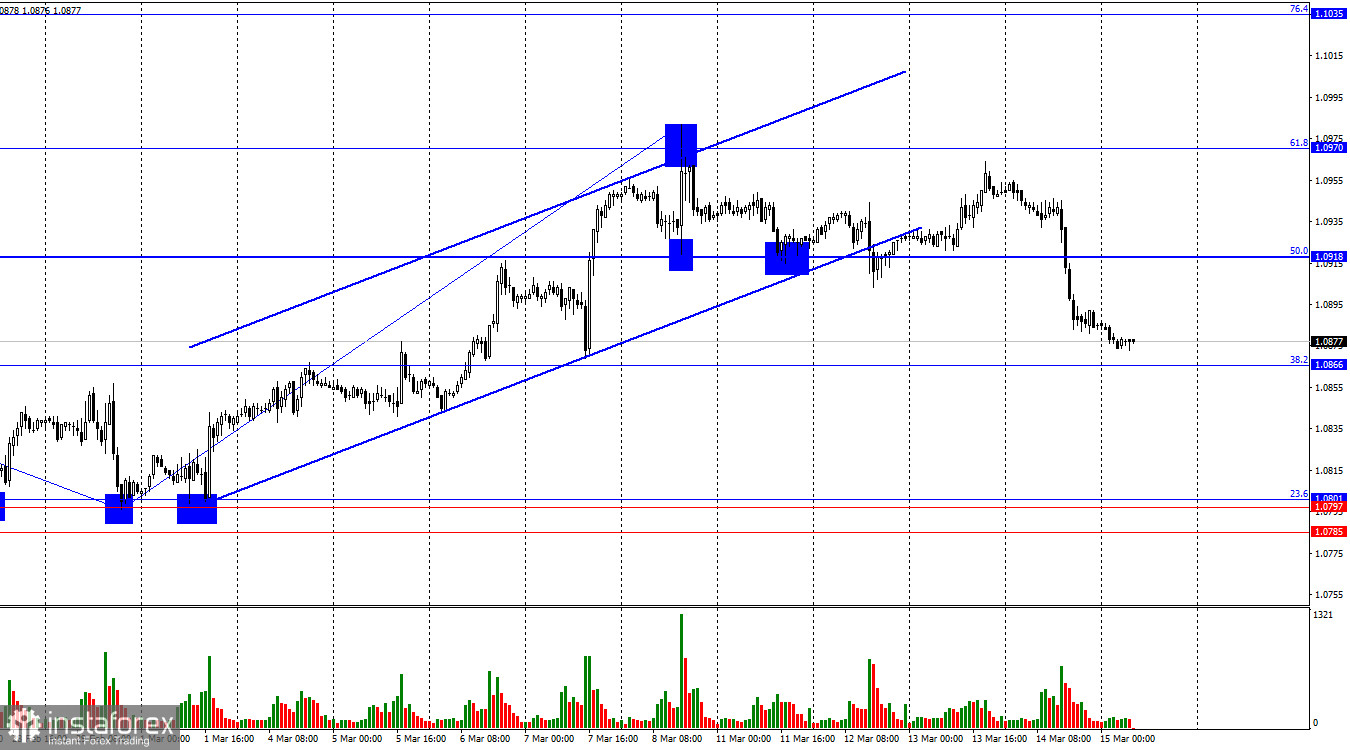

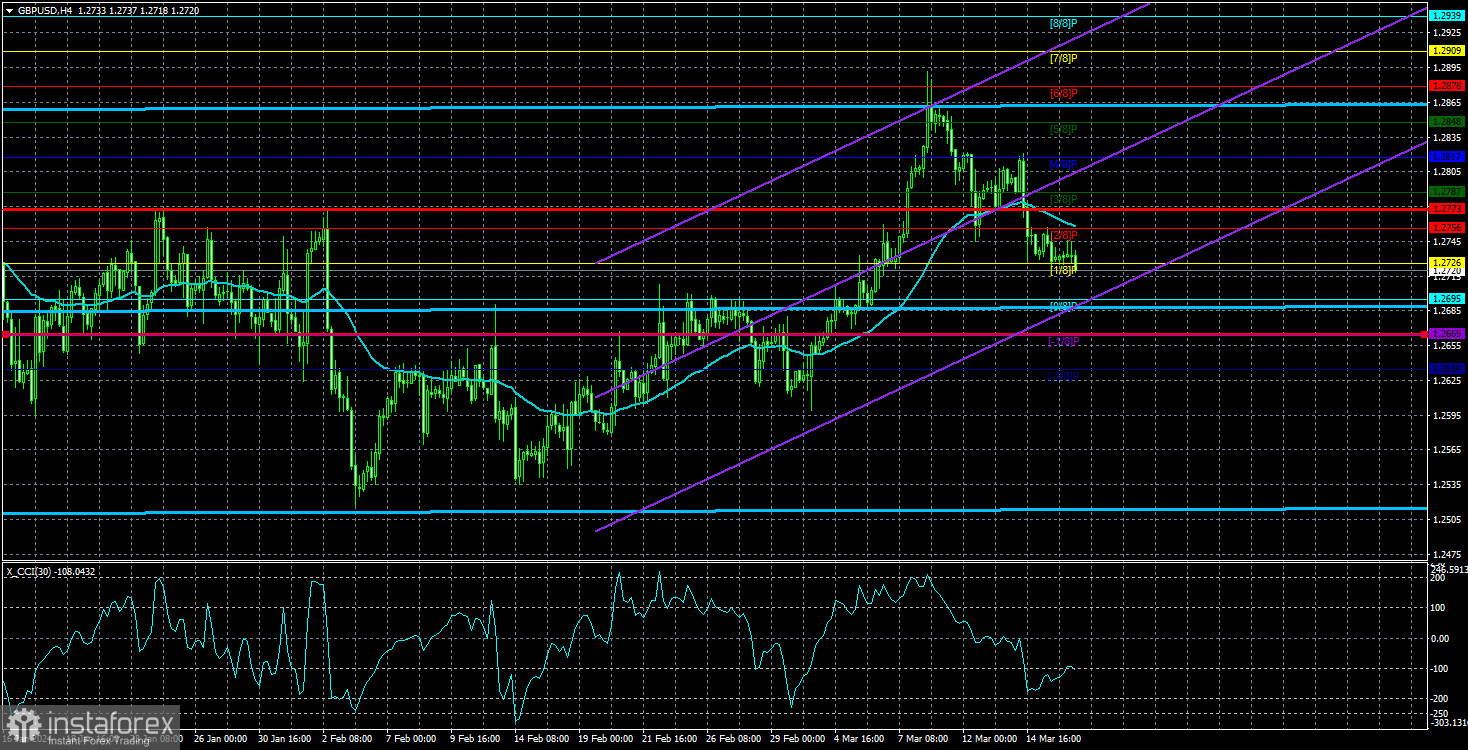

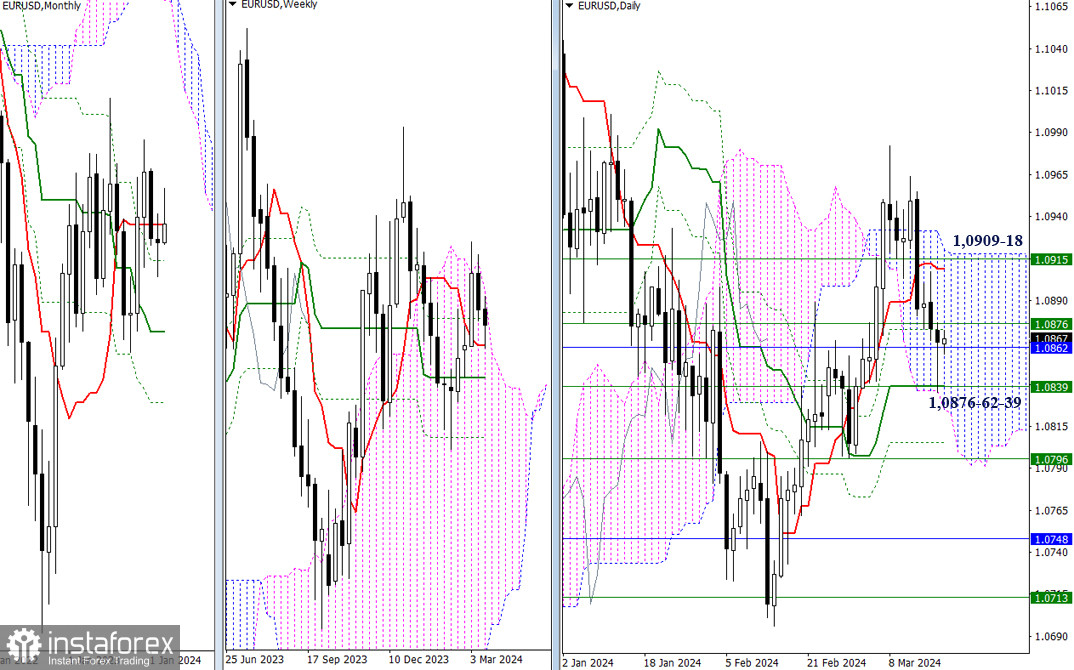

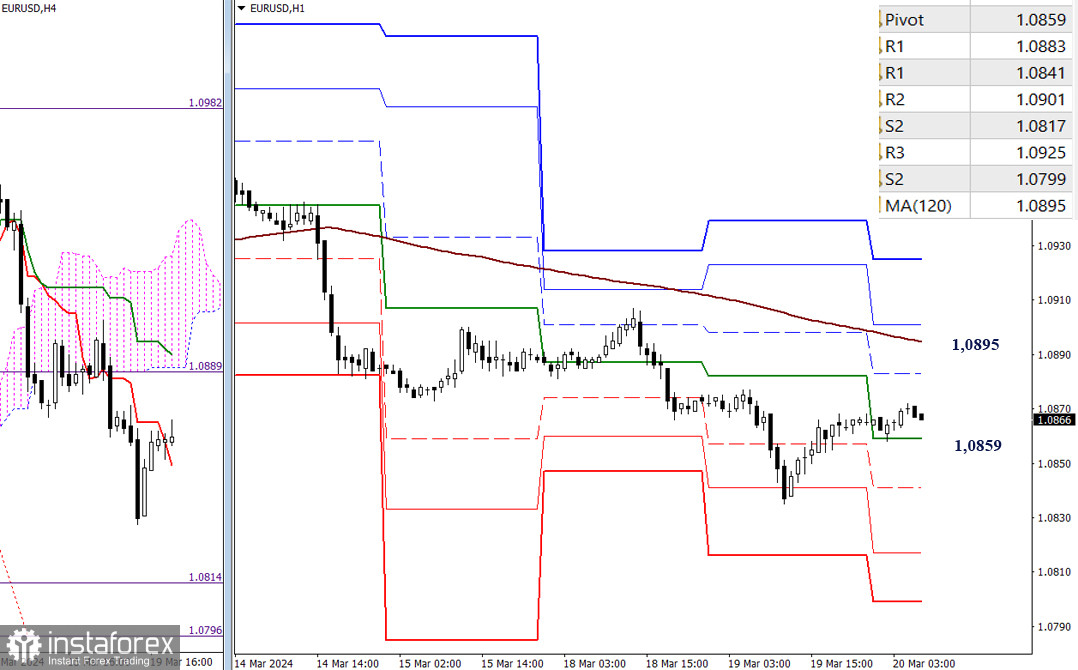

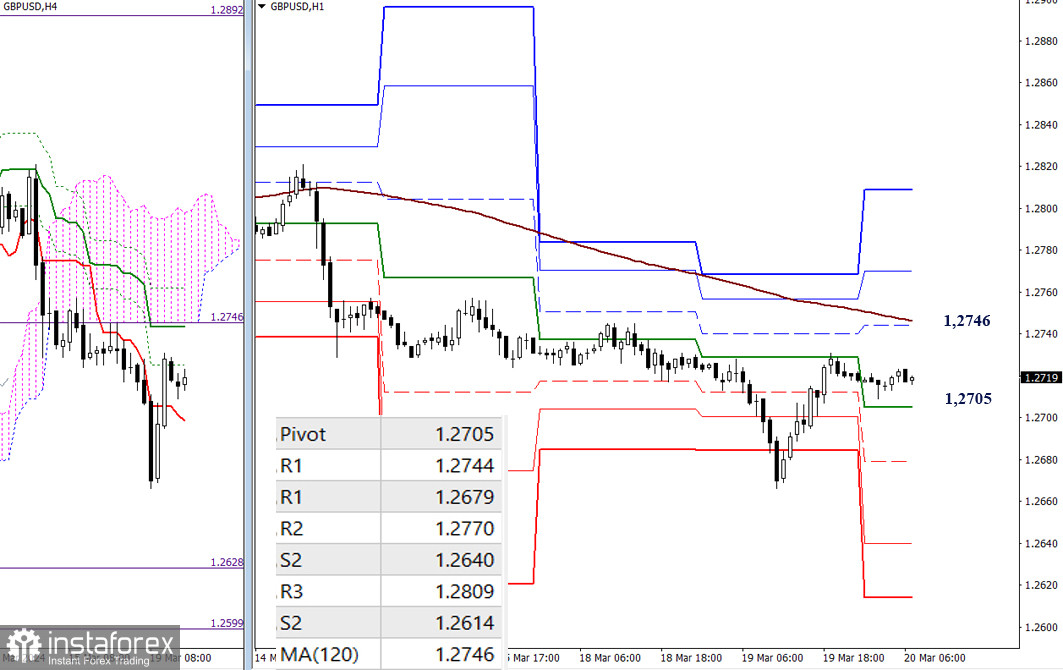

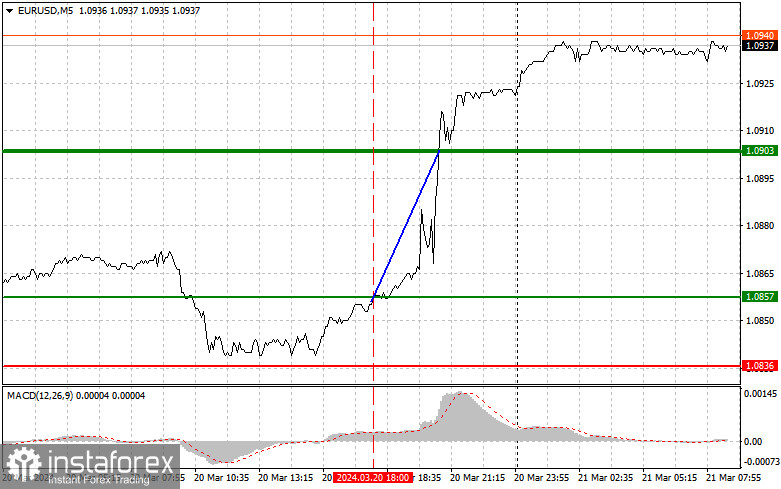

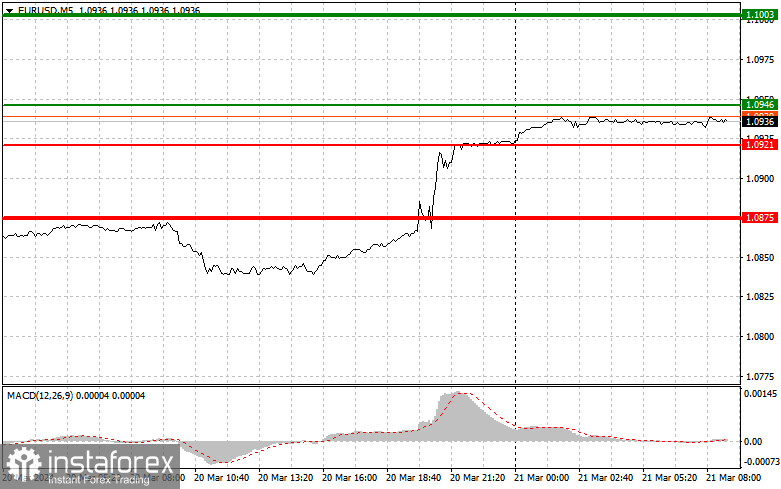

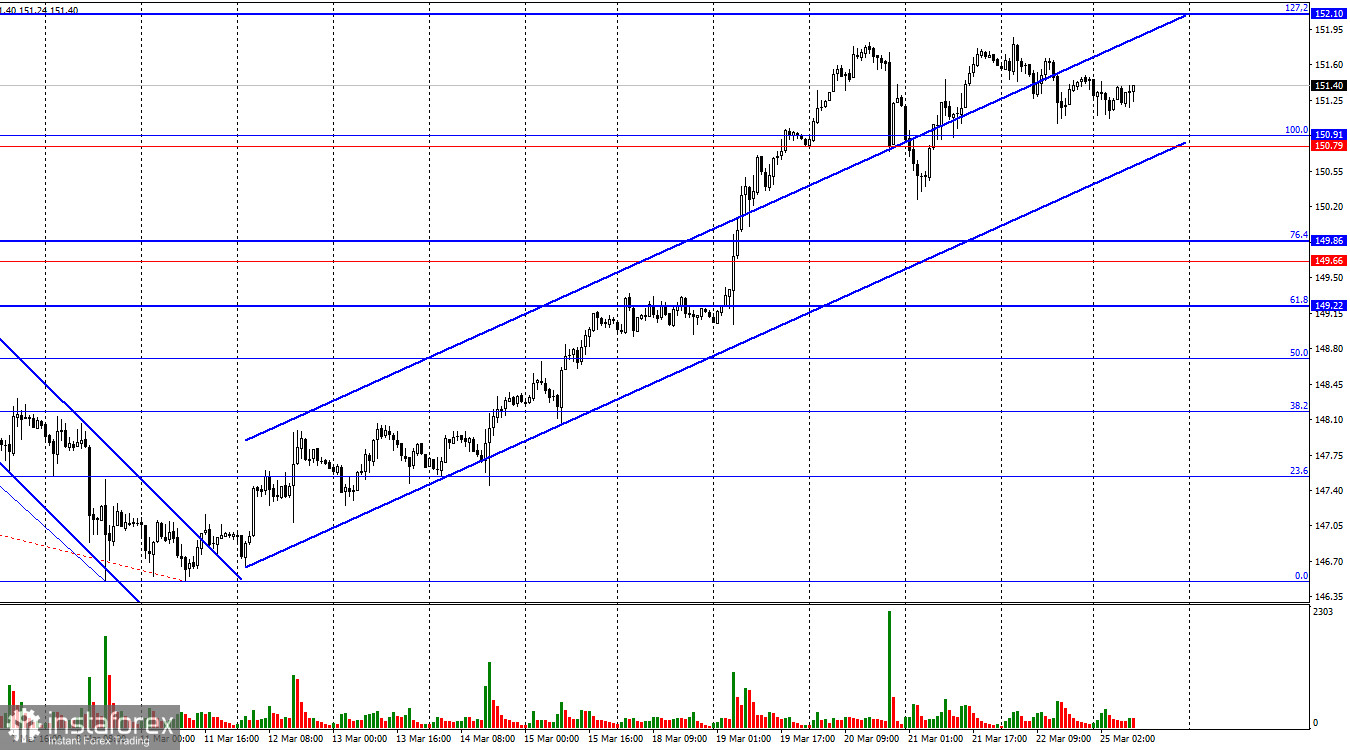

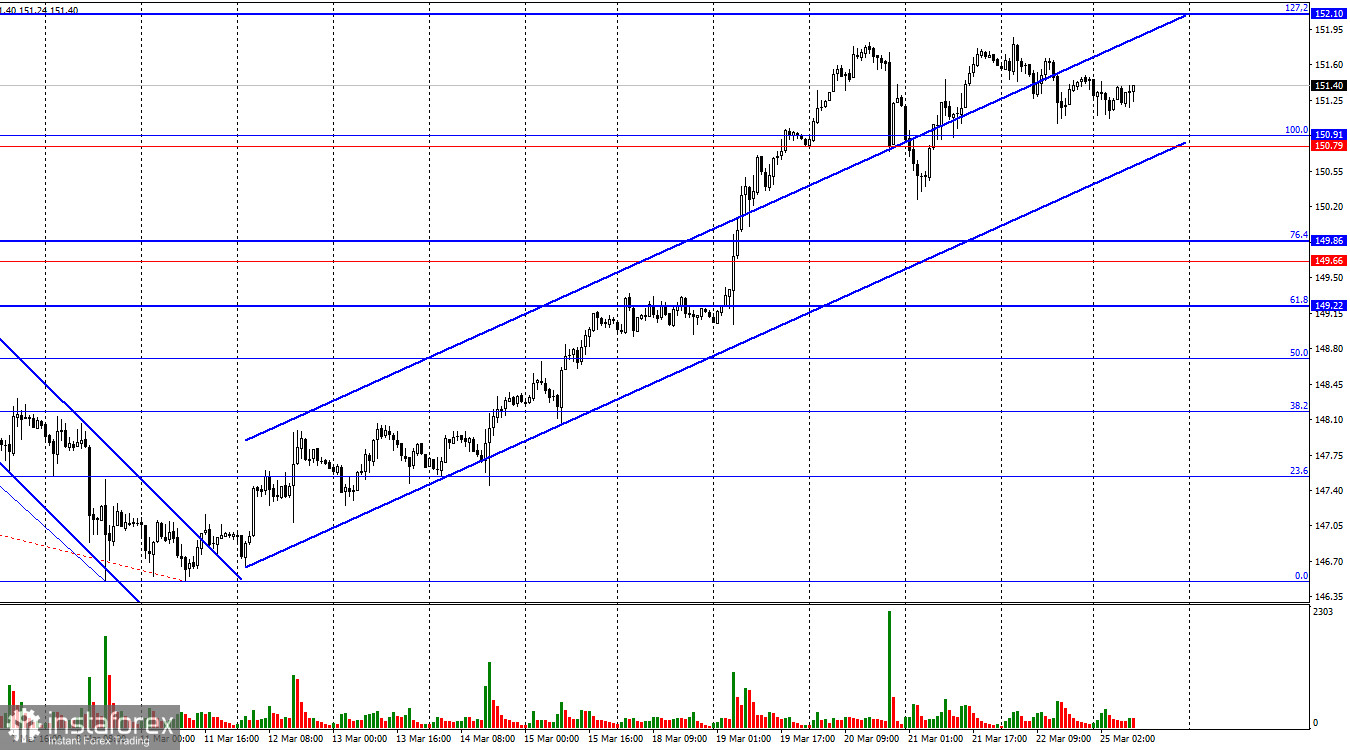

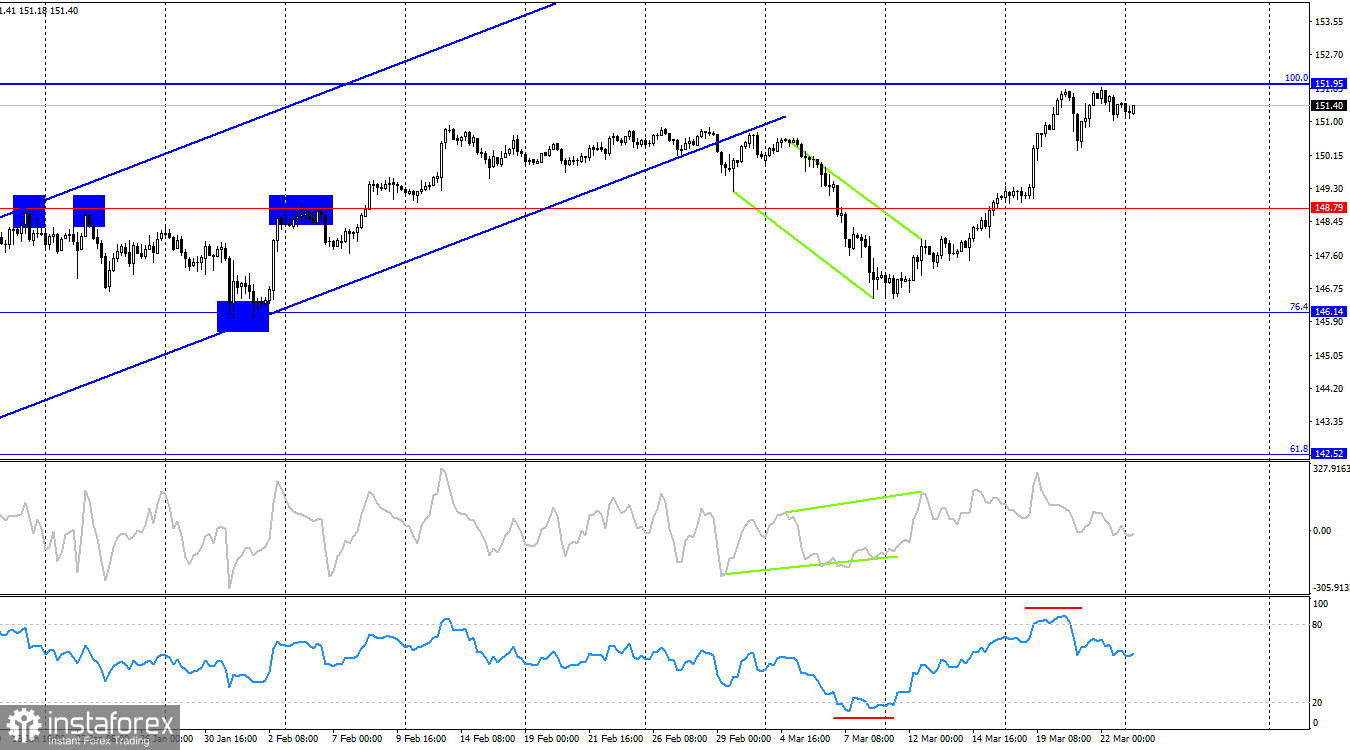

On the hourly chart, the USD/JPY pair on Friday failed to continue its upward trend towards the corrective level of 127.2%152.10. However, traders also failed to return to the support zone of 150.79150.91. Today, a rebound from the zone of 150.79150.91 will allow for a new upward movement towards 152.10, while consolidation below the ascending trend channel will favor the Japanese currency and lead to some decline towards the Fibonacci level of 76.4%149.86.

The wave situation recently fully supports the bulls. Exactly three waves were formed downwards (one being corrective), so a new "bullish" trend is forming. The new upward wave easily broke the peak of the previous wave. Thus, I have no reason to speak of the end of the "bullish" trend. For signs of its completion to appear, a new downward wave is required to break the low from March 11. Alternatively, the next upward wave should not break the last peak, which has yet to form, as the current wave still needs to be completed. On Friday, there was virtually no news in Japan or the USA, which explained the low activity of traders. However, over the weekend, it became known that the Bank of Japan may continue to tighten its monetary policy at its upcoming meetings, as it is quite concerned about the current Japanese yen exchange rate. The problem lies in the significant discrepancy between the Fed and the Bank of Japan rates, but the American regulator still needs to be ready to ease its stance. Therefore, if the Japanese regulator wants to stabilize the yen exchange rate, it must raise its interest rate. The "bullish" trend persists, but bulls have recently been contemplating the prospects and are not ready to get rid of the yen recklessly.

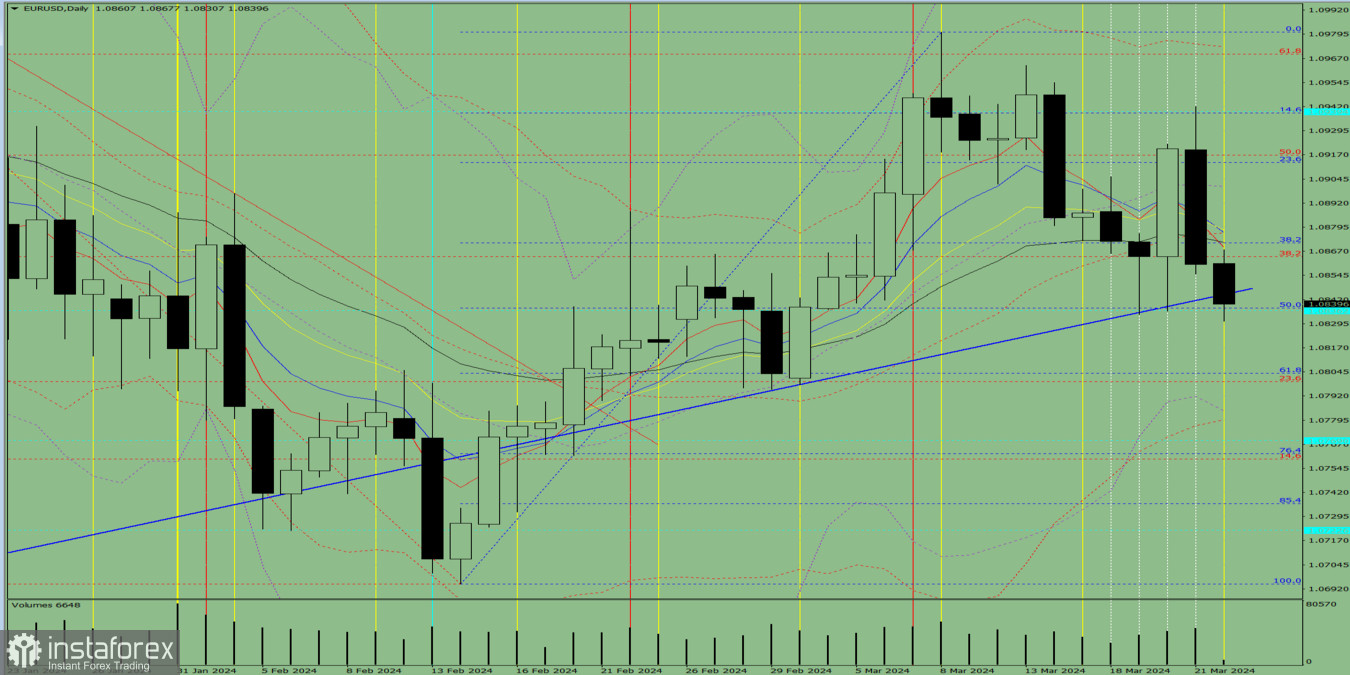

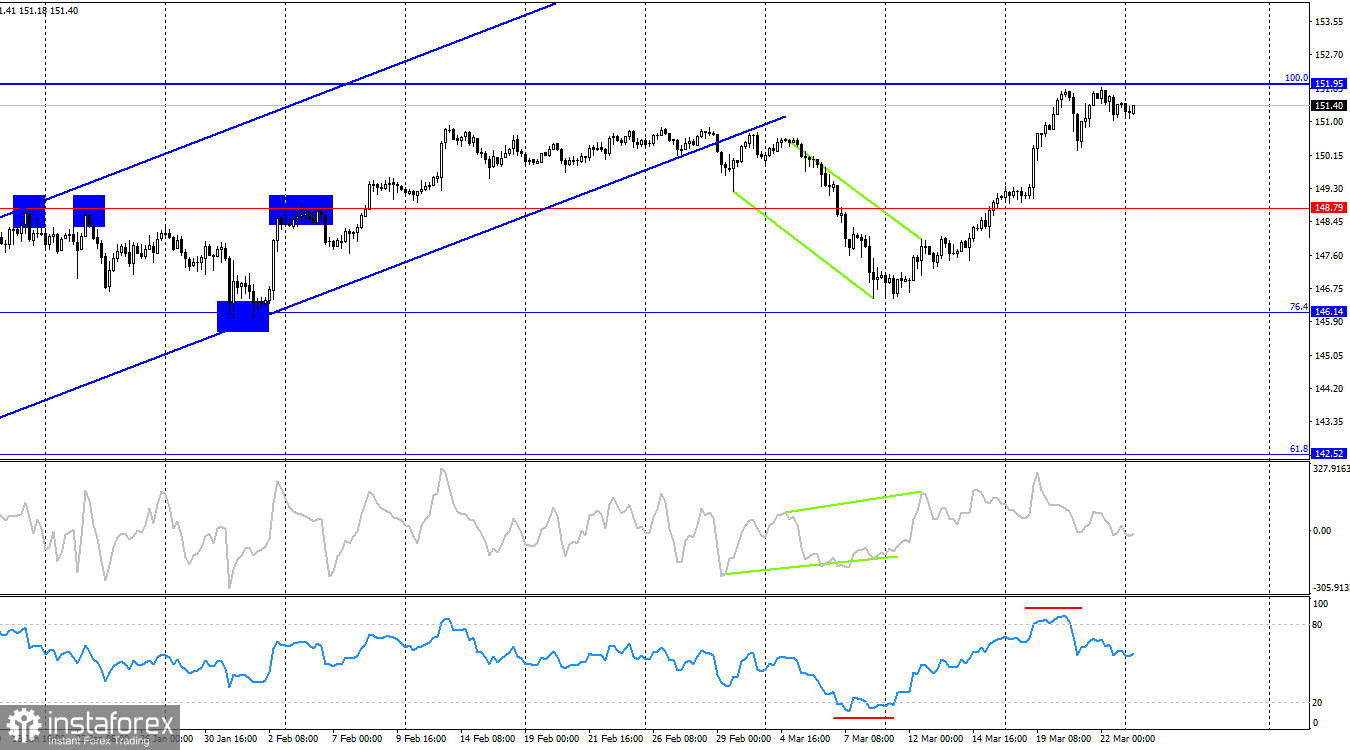

On the 4-hour chart, the pair continues toward the corrective level of 100.0%-151.95. After consolidating below the ascending trend corridor, bears were in a more advantageous position for a couple of days, but on the hourly chart, bulls are now in the lead. Consolidation of the pair's rate above the level of 151.95 will increase the likelihood of further growth towards the next Fibonacci level of 127.2%158.66. Commitments of Traders (COT) report: The sentiment of the "non-commercial" trader category became even more "bearish" during the last reporting week. The number of long contracts held by speculators increased by 11,351 units, while the number of short contracts increased by 25,041. The overall sentiment of major players remains "bearish," and the advantage of sellers is huge. There is almost a threefold gap between the number of long and short contracts: 66,000 versus 182,000. The yen still has excellent prospects for further decline. Still, the significant gap between long and short contracts may also indicate the proximity of the end of the "bearish" trend for the Japanese currency. In other words, bullish speculators may start to retreat from the market. On the 4-hour chart, we already see a significant break in the "bullish" trend, but the dollar may continue to rise in the short term.

Analysis are provided by InstaForex.

Read more:

https://ifxpr.com/3vu9wUT