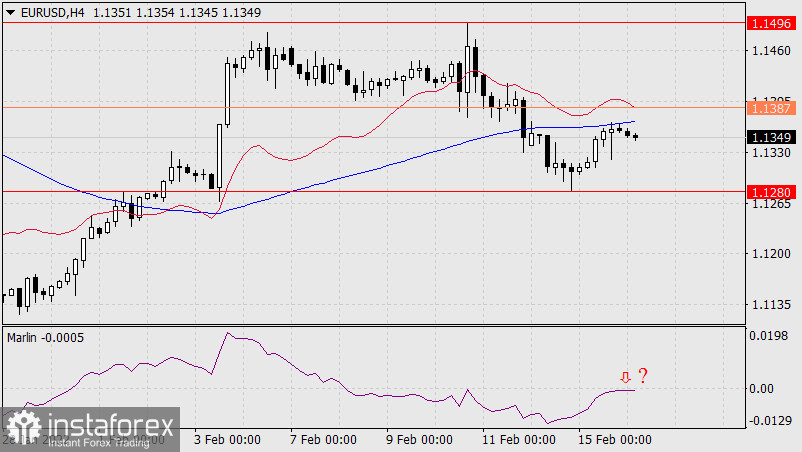

Yesterday, the euro rose by 53 points as a correction from the support of the MACD line. At the moment, the signal line of the Marlin Oscillator is turning down from the zero line, which creates a sign of the completion of this correction, followed by a repeated attack on the MACD line. The 1.1300 target level is being modified to the 1.1280 level – Monday's low. Consolidation below the level opens the way for further decline to the target level of 1.1060. The exit of the price above the December 31 high at 1.1387, as above the upper limit of the consolidation of December 2021, may extend the euro's growth to the level of 1.1496, and overcoming it opens the way to the target range of 1.1700/22.

The price is turning down from the MACD line on the four-hour chart. At the same time, the signal line of the Marlin Oscillator is also turning down from the zero neutral line. Here we see a simultaneous (expected) Marlin reversal from the zero line on both scales, which strengthens the signal. The main scenario remains down.

Analysis are provided by InstaForex.