EUR/USD

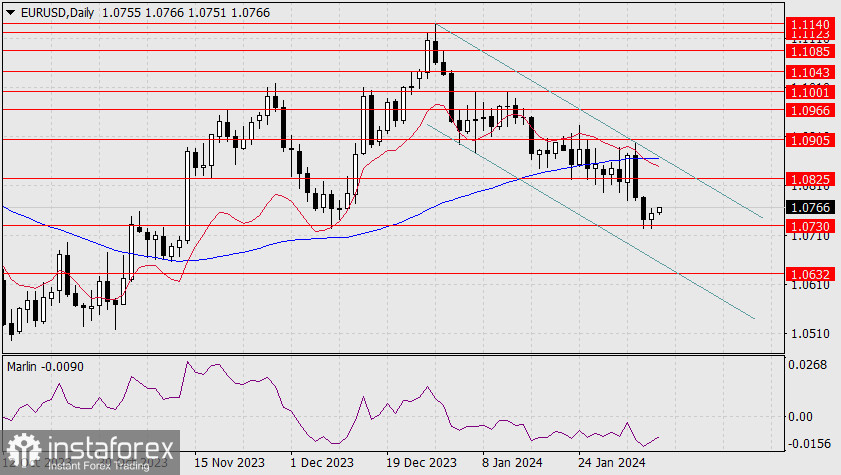

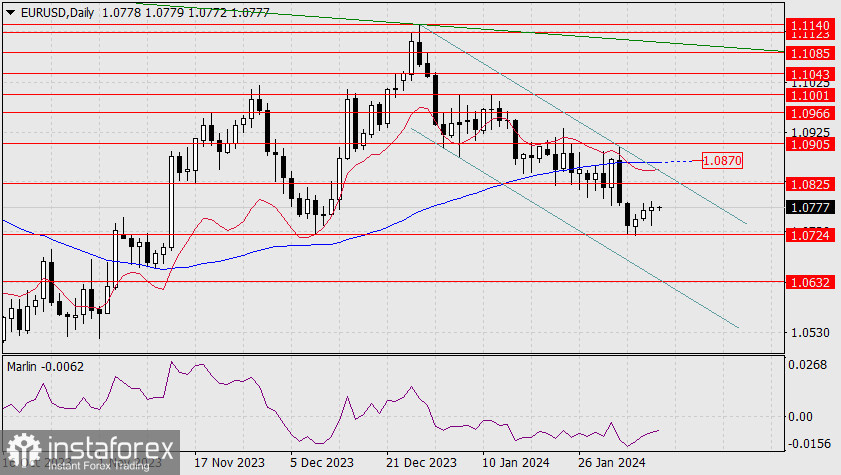

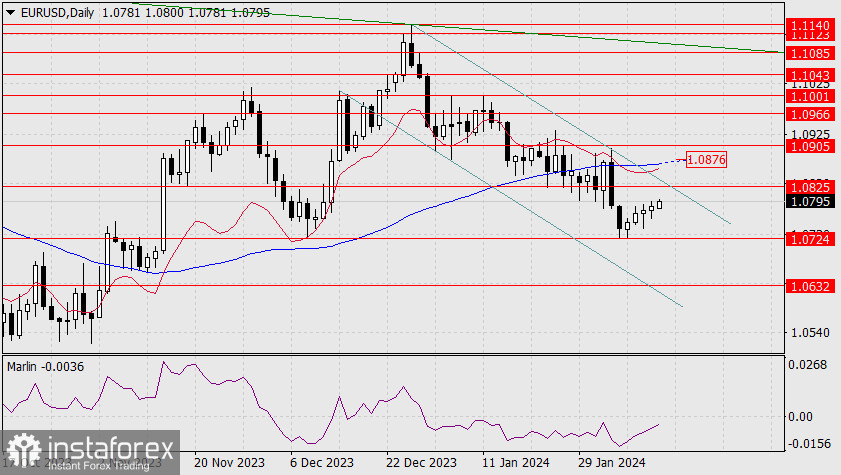

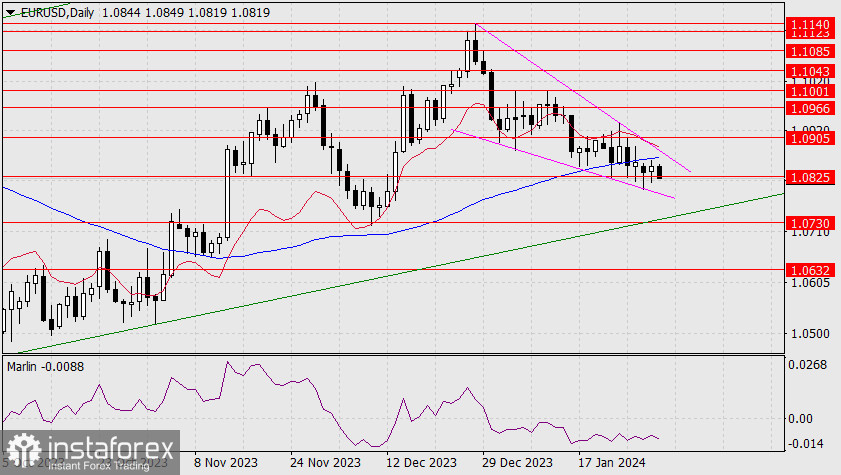

The euro completed a small task set before yesterday – it worked out the resistance of the MACD indicator line on the daily timeframe, closing the day with a white candle. Meanwhile, the Marlin oscillator strengthened its bullish momentum, which shows that the euro is ready to rise ahead of the FOMC meeting. From a technical standpoint, this will look like the price breaking out of the descending corrective wedge. This is our main scenario. The first bullish target is 1.0905, and the second is 1.0966 – the peak of November 21, 2023.

If events develop according to an alternative scenario, the price may attack the lower embedded line of the price channel with a target level of 1.0730.

On the 4-hour chart, the price pierced the price support of 1.0825 and the MACD line. The Marlin oscillator turned down from the zero line. The gap from the opening of the week was closed yesterday evening.

Earlier, we mentioned that of all the major central banks, the Federal Reserve would be the first to signal a rate cut. Assuming that the Fed will not lower the rate in March but only in May, even in this case, today is a very convenient time to send the corresponding signal. Recent statements by officials from these central banks illustrate this assumption well: Fed official James Bullard mentioned the possibility of a rate cut in March, and European Central Bank President Christine Lagarde said yesterday that we still need to wait for employment and wage data.

Analysis are provided by InstaForex.

Read More https://ifxpr.com/3HDmjqD