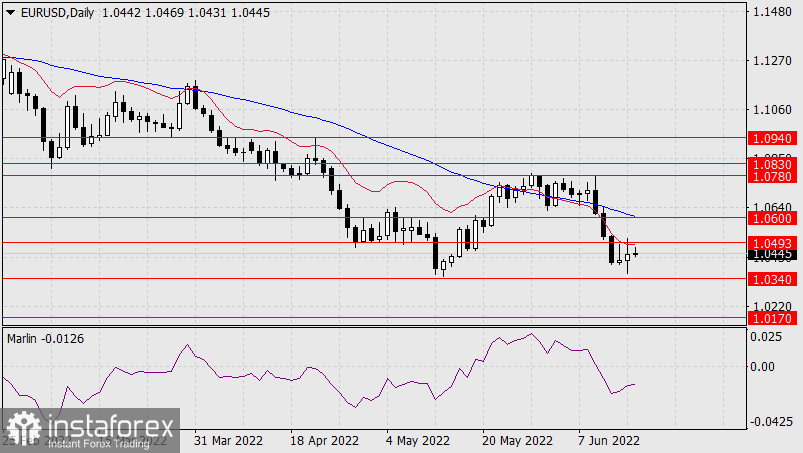

The euro is slowly declining according to the main scenario - moving towards the target level of 1.0493. Since the decline is not fast, the MACD indicator line managed to adapt to it and slightly decrease, thereby lowering the signal level to 1.0667. Now, in order to confidently hit the nearest target at 1.0600, it is necessary to go under 1.0667, otherwise the risk of a jump to 1.0780 will remain. The Marlin Oscillator is declining steadily, the main downside scenario is in force.

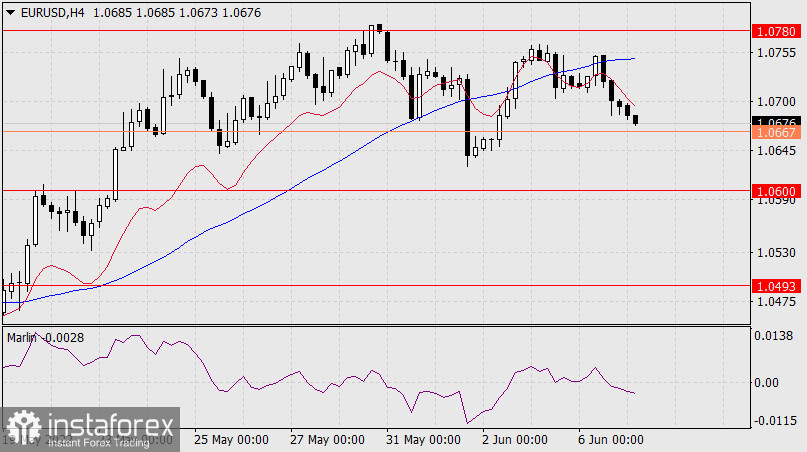

On the 4-hour chart, the Marlin Oscillator has entered negative territory. It, of course, helps the price to go under the signal level of 1.0667. Actually, the price develops under both indicator lines - under the balance line (red) and MACD(blue). The trend is downward.

Analysis are provided byInstaForex.

https://ifxpr.com/3GTDbIm