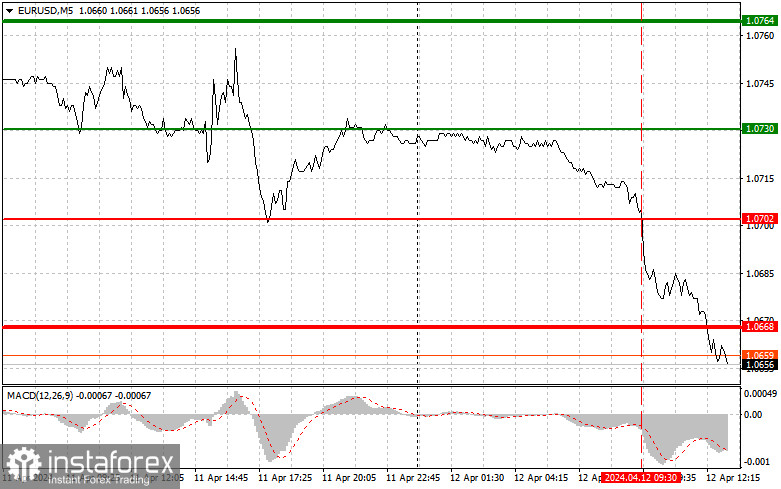

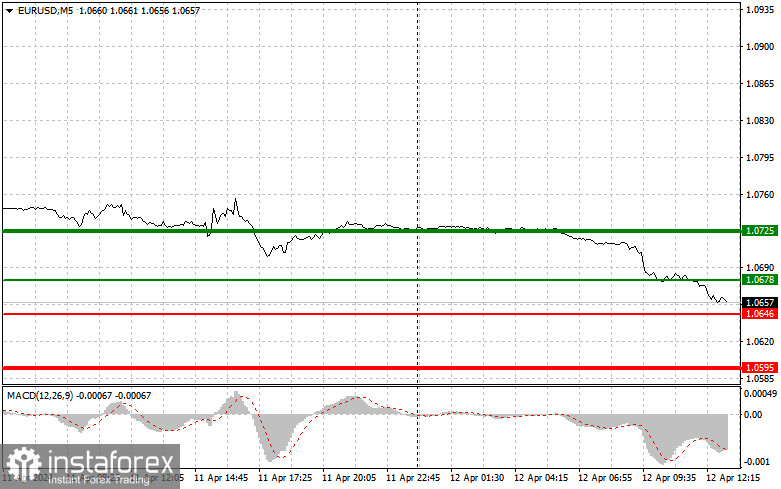

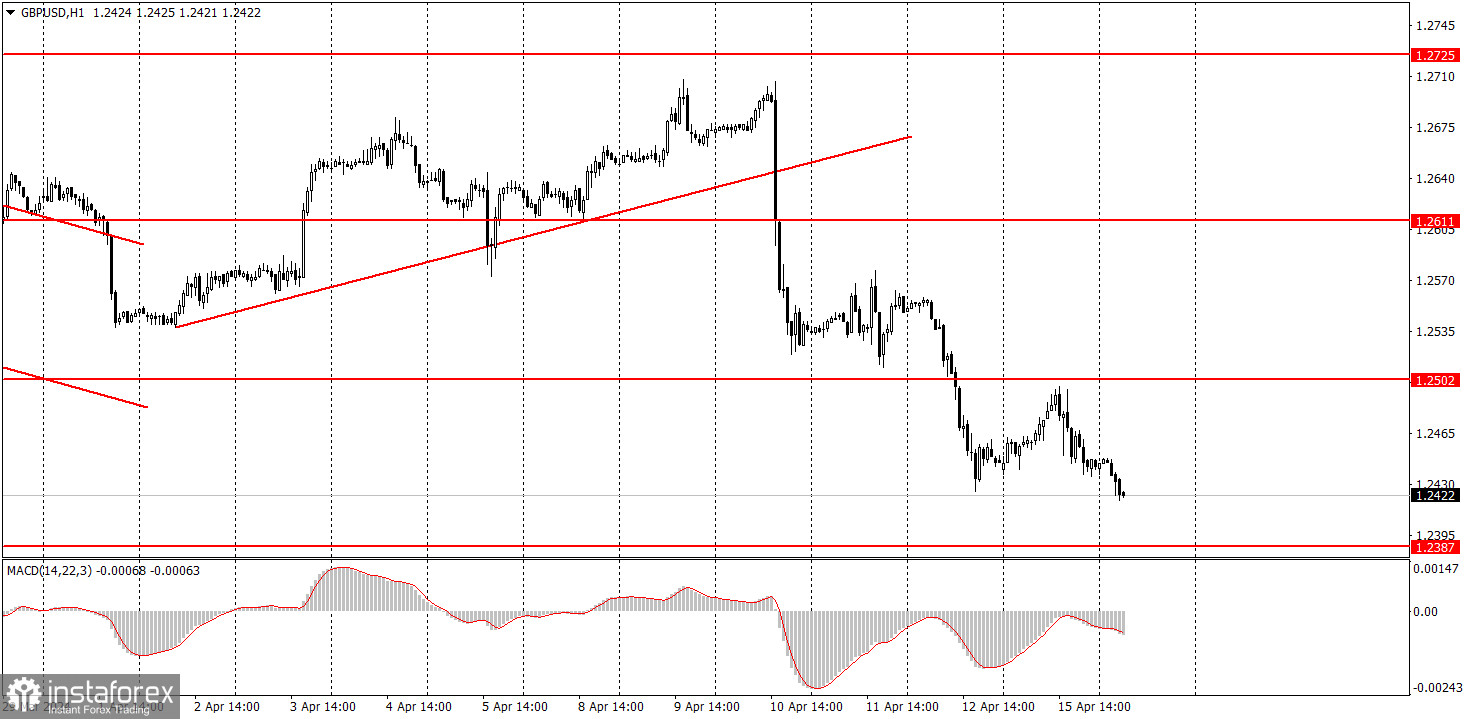

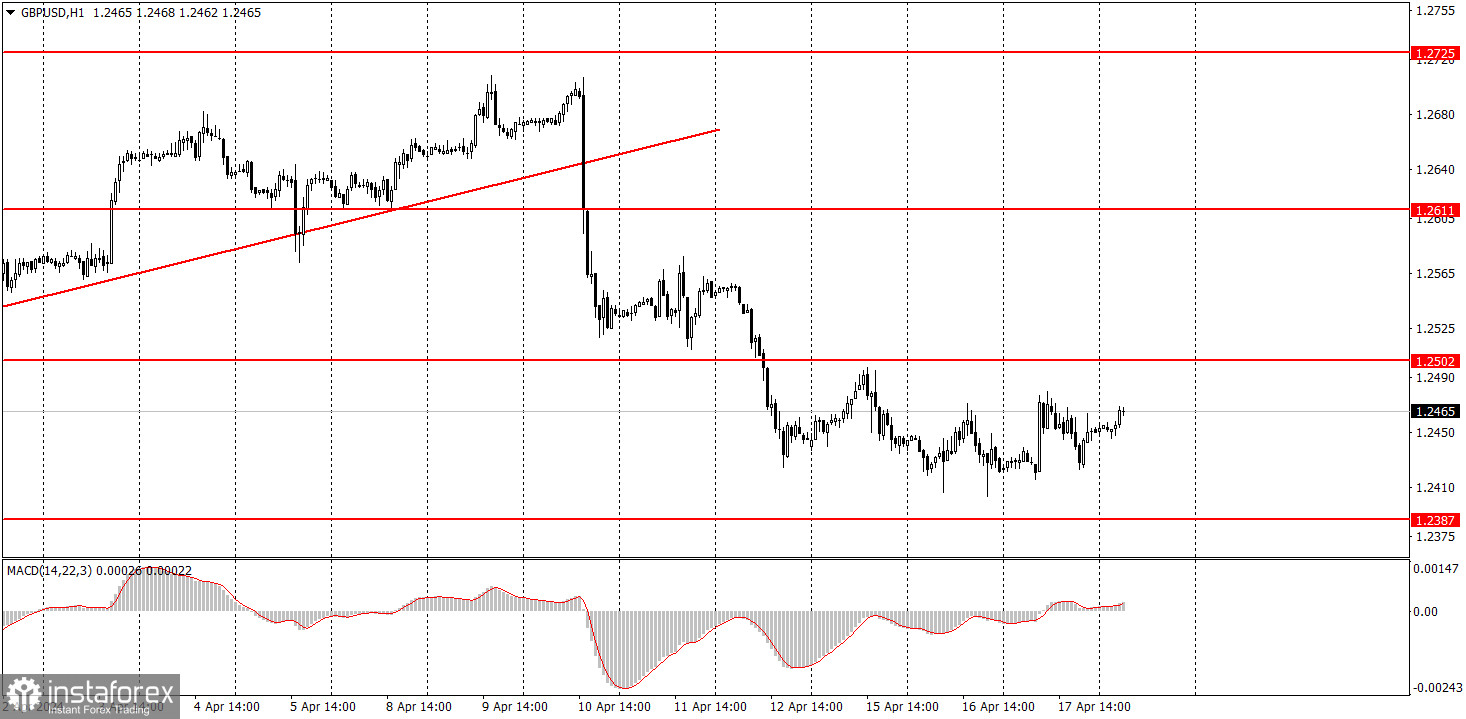

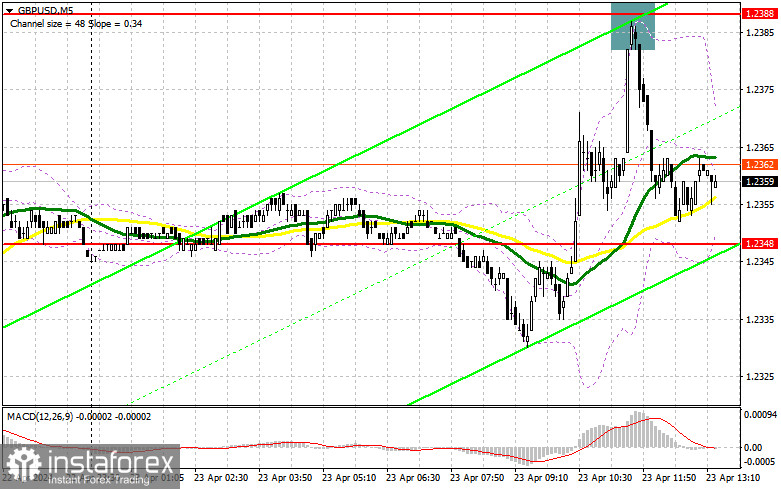

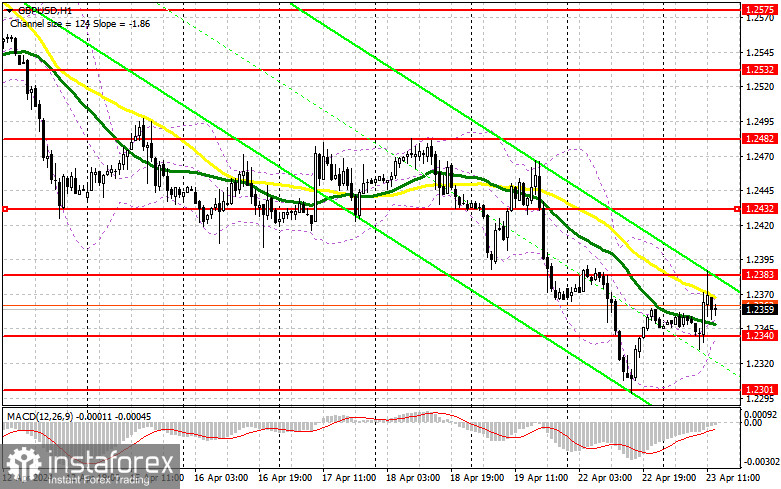

Hi, dear traders! On the 1-hour chart, the GBP/USD pair rose to the resistance zone of 1.2705–1.2715 and rebounded from it on Tuesday. The instrument made a reversal in favor of the US dollar. This allows us to expect some decline in the direction of the support zon

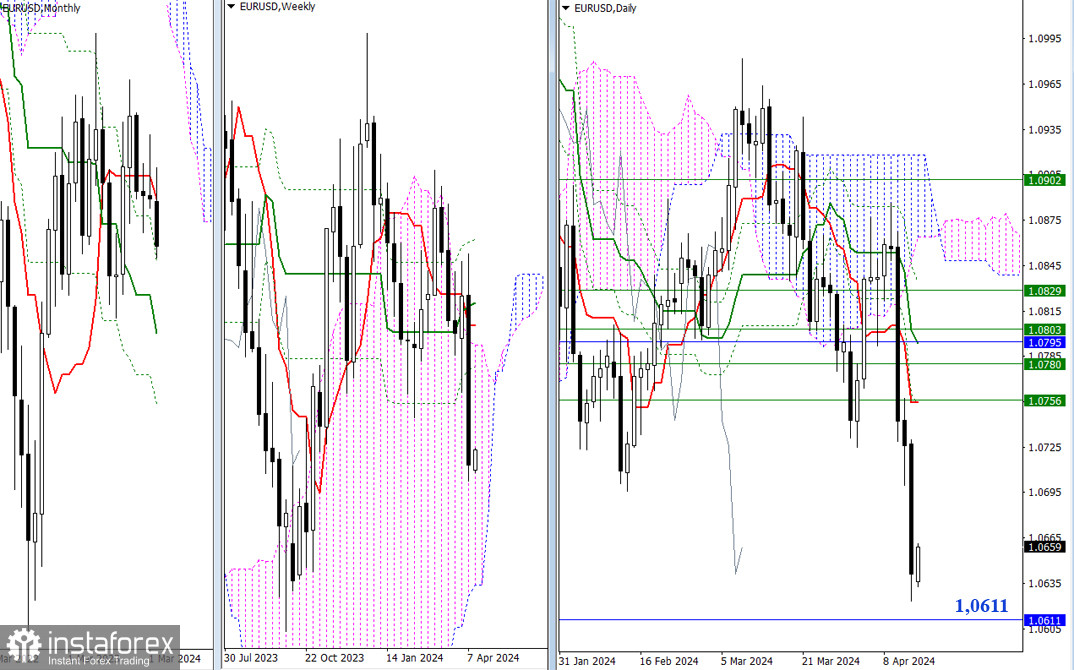

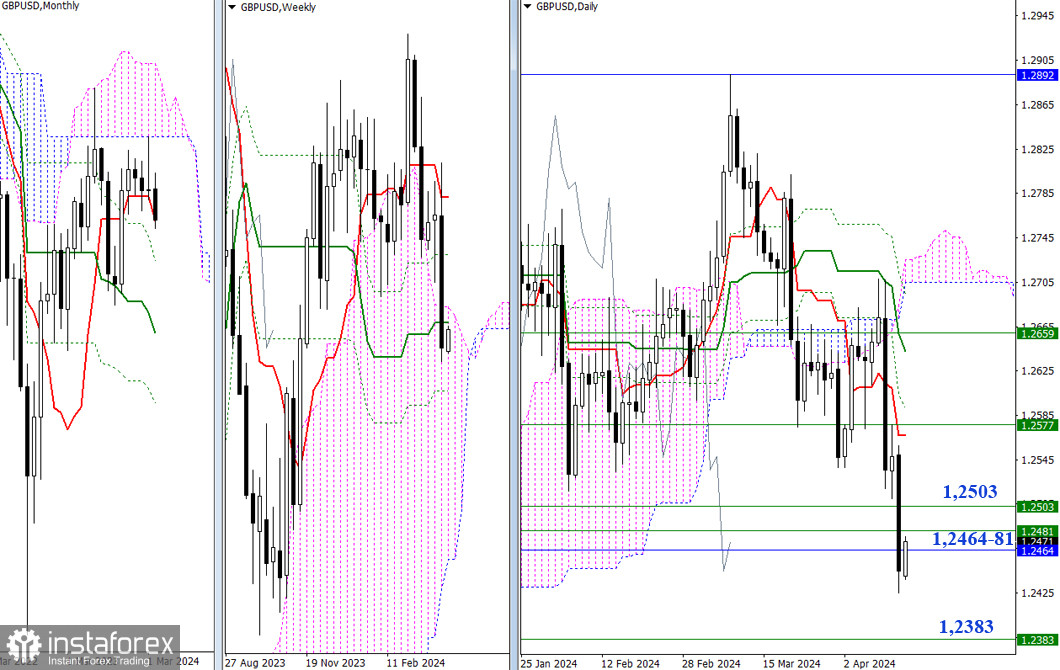

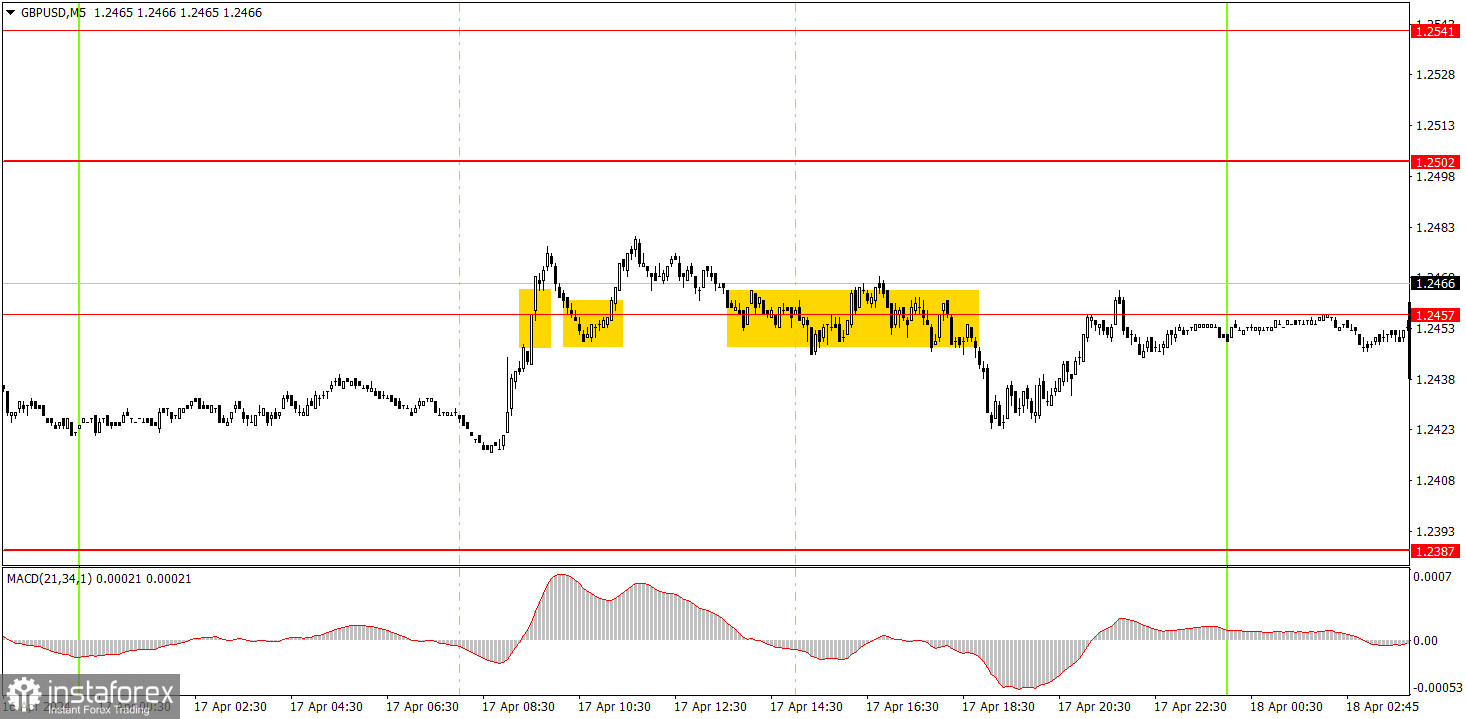

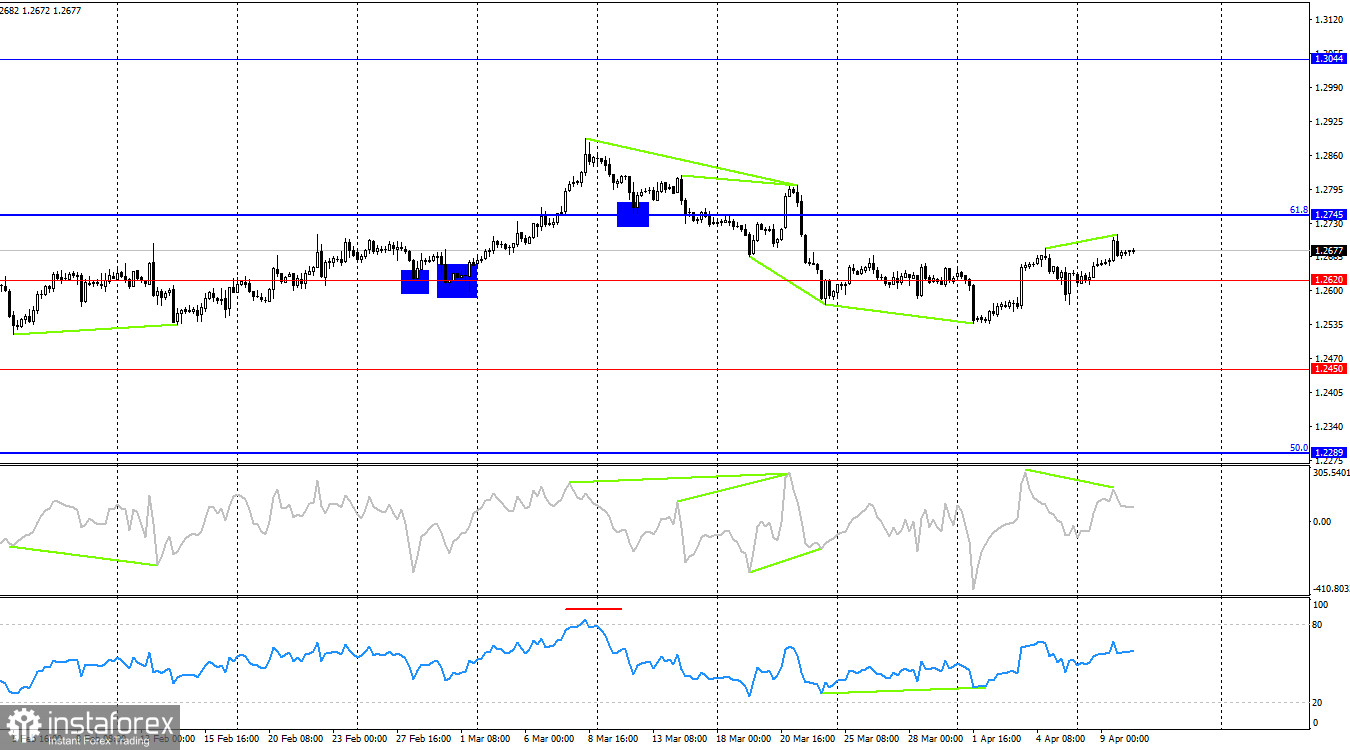

The situation with waves recently has not raised any questions. The last completed bearish wave easily broke the last low (from March 19), and the new bullish wave is not yet strong enough to break through the last high from March 21. Thus, the trend for the GBP/USD pair is bearish, and there are no signs of its end. The first sign of the bulls going on the offensive could be a breakout of the high from March 21. But to reach the 1.2788-1.2801 zone, the bulls need to cover a distance of about 140 pips, which is unlikely to happen in the coming days. If a new downward wave does not break the low of April 1, this will also be a sign of a change in the trend to bullish, but this wave has not even begun yet. There was no important news for the pound sterling and the US dollar on Tuesday. However, today a crucial report on inflation will be released in the US, which is already causing conflicting sentiment. On the one hand, inflation may accelerate again, which will arouse another wave of hawkish comments from FOMC policymakers. Any increase in hawkish expectations provides support to the US dollar, which has been going through hard times in recent months. On the other hand, the greenback did not grow in response to the US nonfarm payrolls released last week. Besides, the US dollar ignores the fact that the number of potential rate cuts in 2024 has been steadily declining. Last but not least, the US currency do

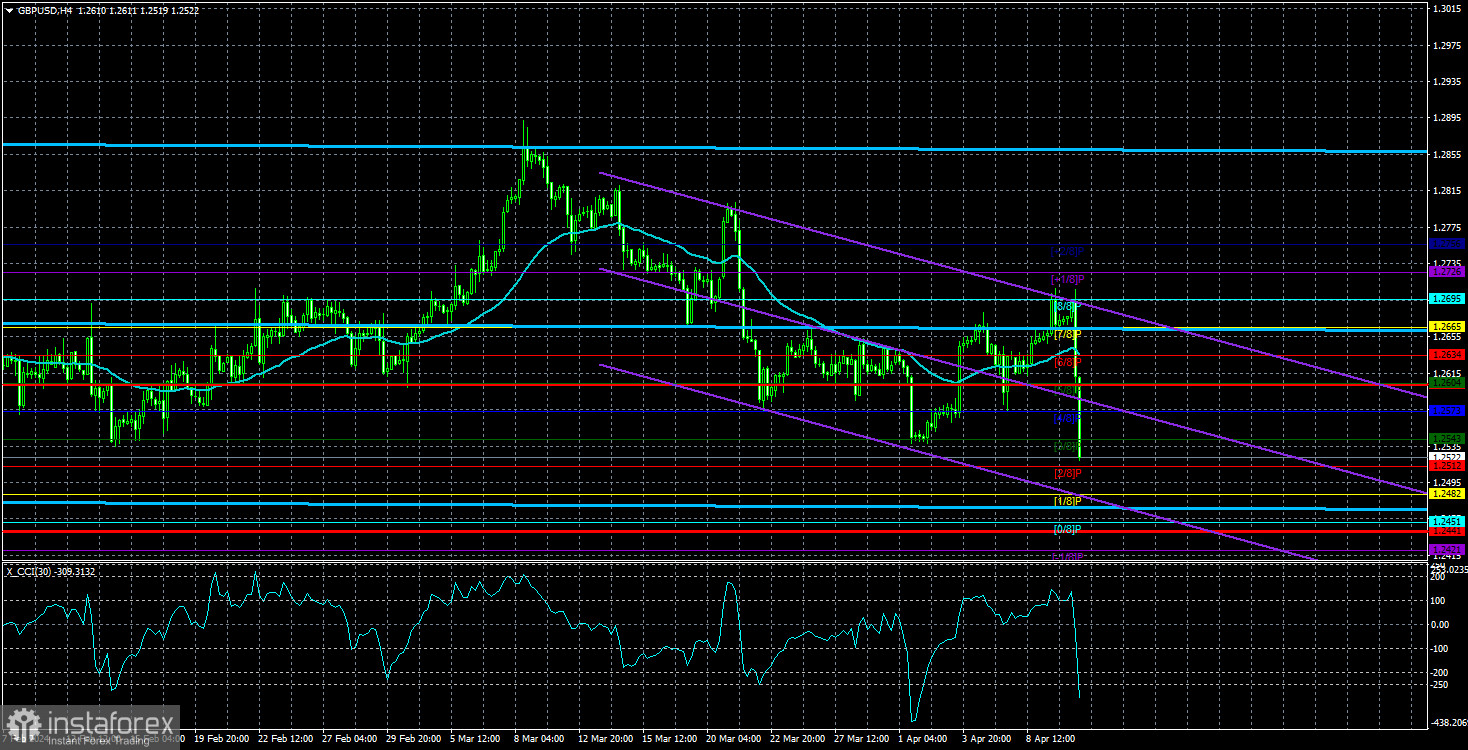

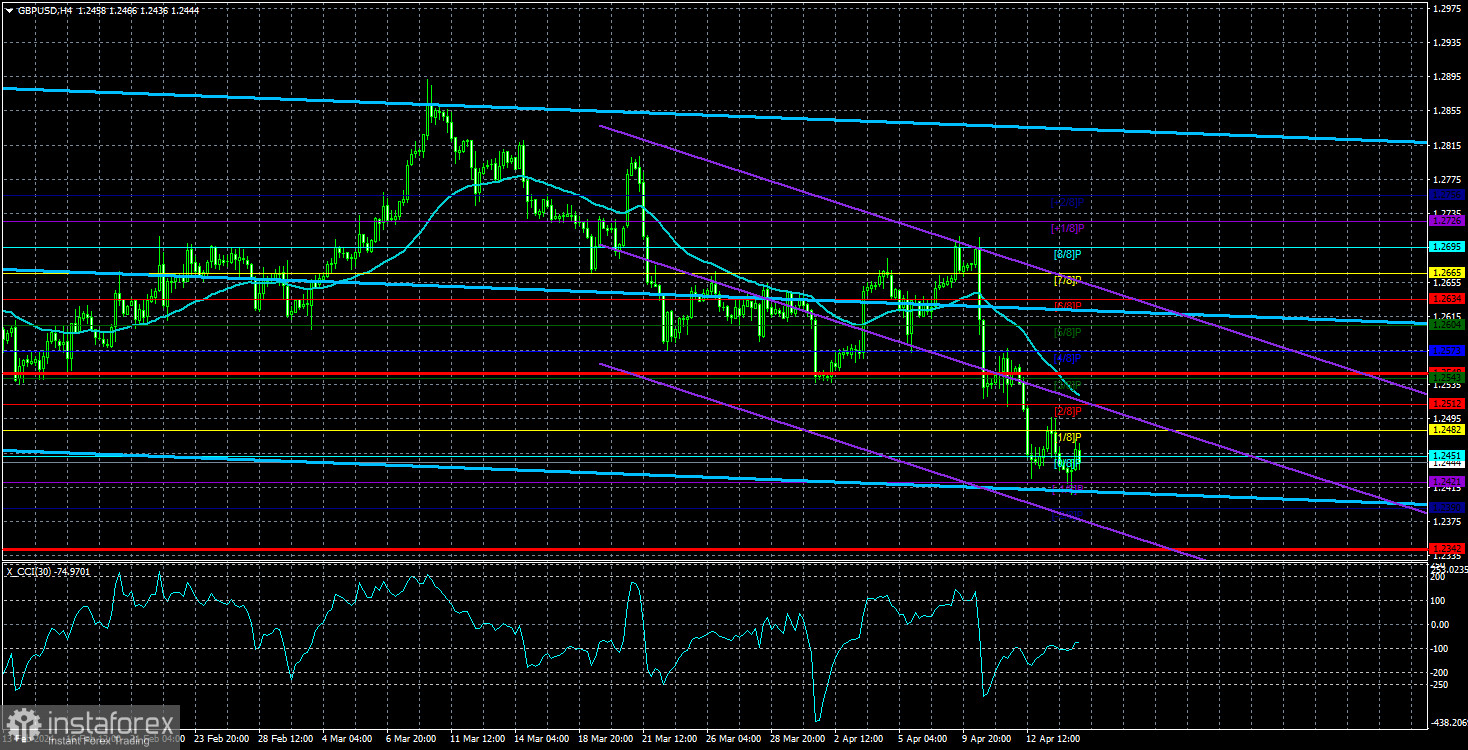

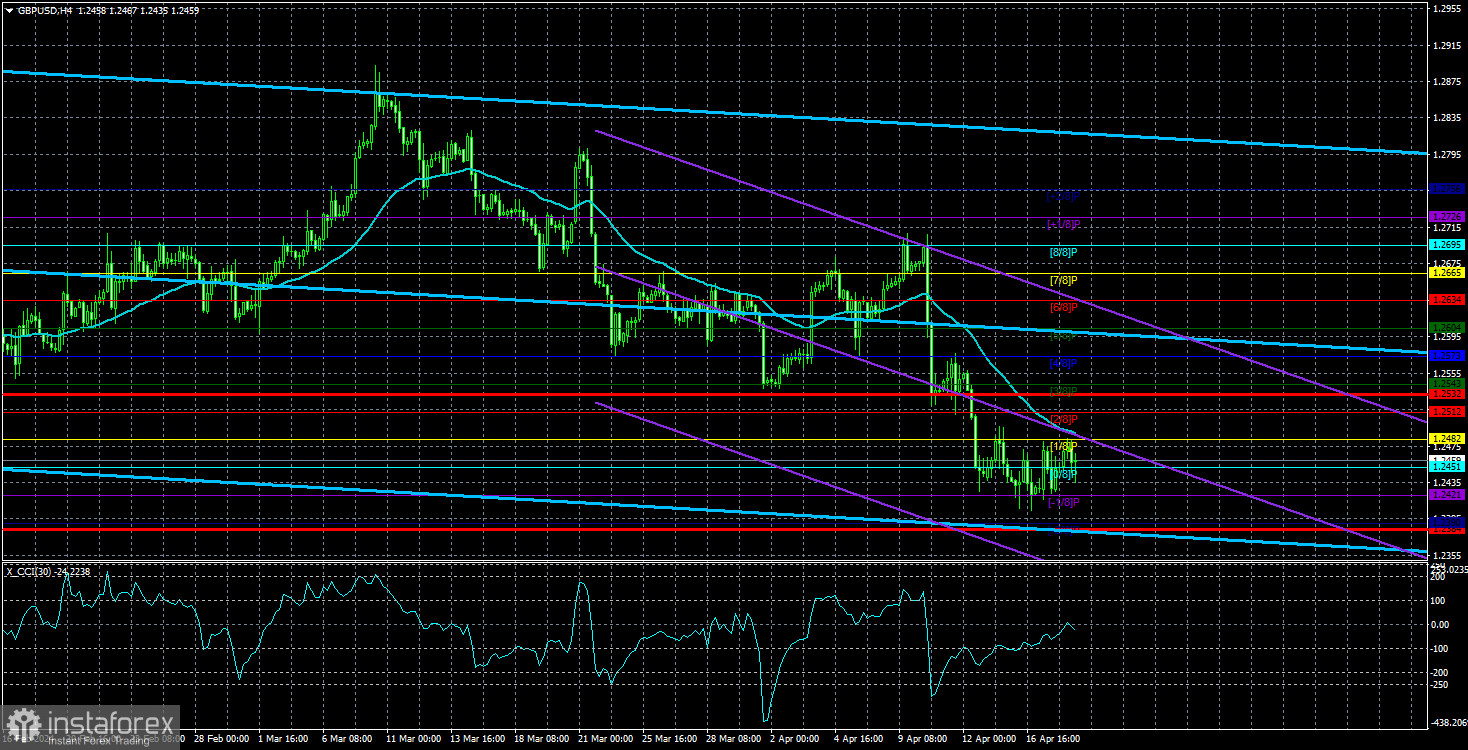

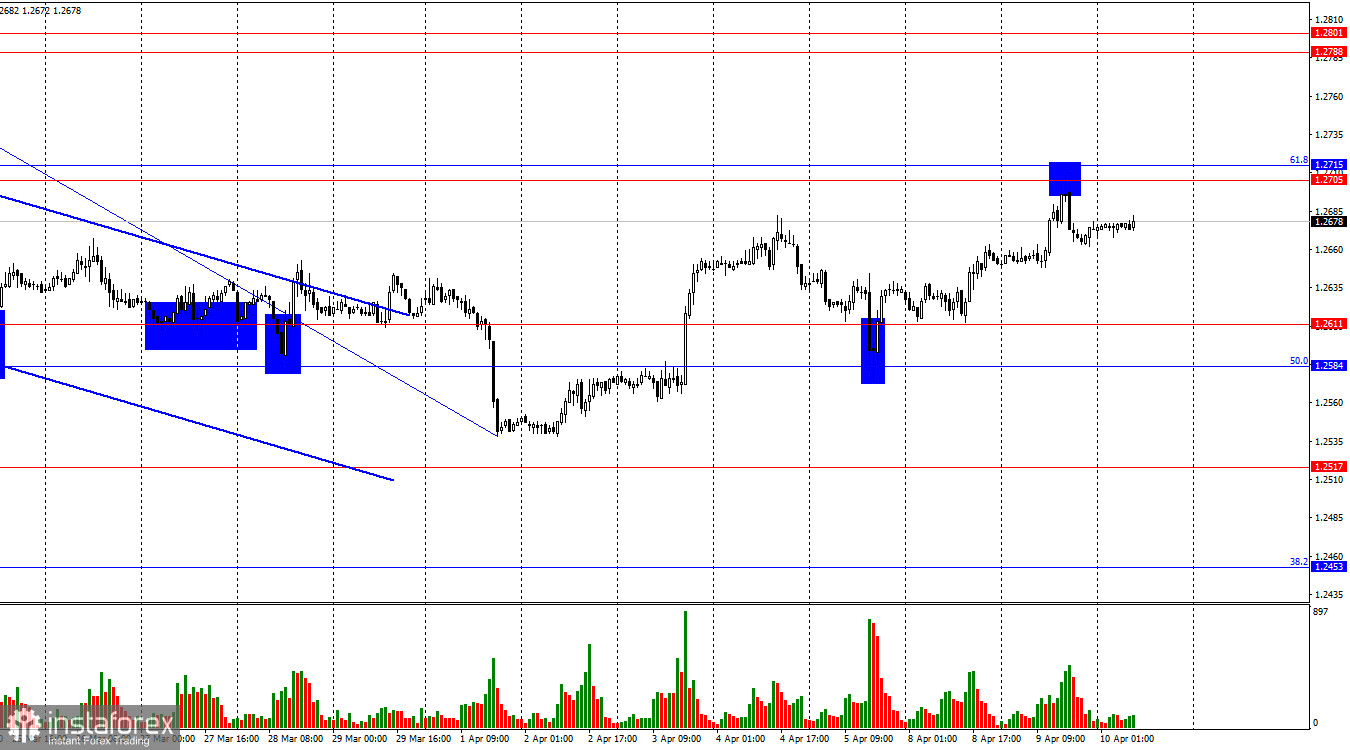

On the 4-hour chart, GBP/USD reversed in favor of the British pound after forming a bullish divergence at the RSI indicator and consolidation above the level of 1.2620. However, the bearish divergence of the CCI indicator enables us to expect a reversal in favor of the US dollar and some fall in the instrument. In my opinion, it will be short-lived. The bearish trend remains on the 1-hour chart, but on the 4-hour chart, the horizontal movement is going on.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/3vAWPb6