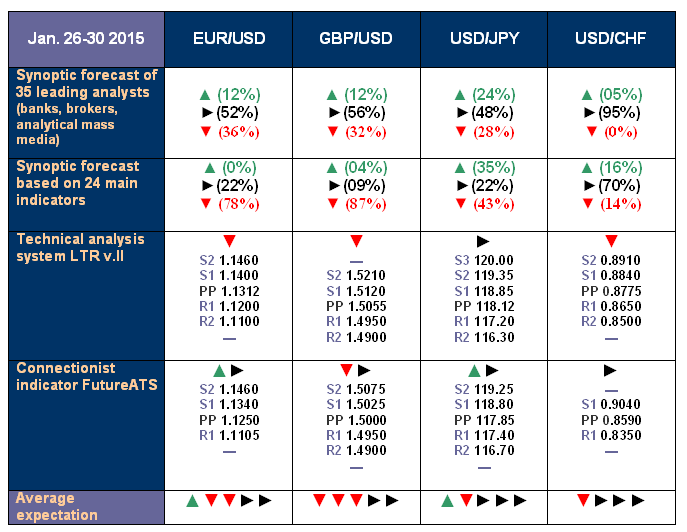

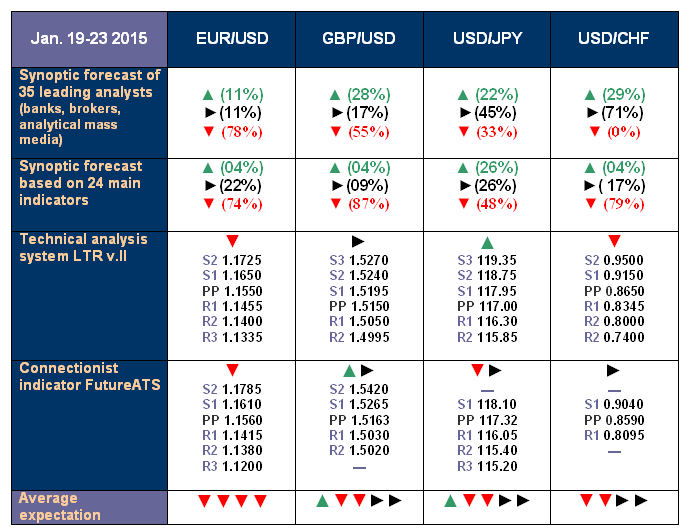

After summing up the opinions of 35 analysts from world leading banks and broker companies and forecasts based on different methods of technical and graphical analysis, it’s become clear that many experts are at a loss,and the graphical analysis providescontradictory readings. However :

- EUR/USD is an exception. The overwhelming assessment of its future is thatthe pair will continueto fallto the level of1.1400 and in case of breaking it even furtherto 1.1200. After that, EUR/USD may actually bounce upto1.1785-1.800;

- despite bearish pressure, GBP/USD will stayin the sideways trend. The most probablefluctuation range is 1.5020-1.5250;

- USD/JPY is also in the sideways trend under bearish pressure. It’s predicted to go down to 115.20-116.00, with a possible rise just to 118.75. The graphical analysis shows that by the end of this week or next week the pair may return to an upward trend moving to the previous target of 121.75;

- it is difficult to make any forecast for USD/CHF at this time – the market is at a loss, although for the most part the pair is expected to go down

This milestone event could not but affect other currencies. For example, the forecast for EUR/USD was that it would fall to 1.1650by the end of the week. In fact, another 200 points have to be added to this, thanks to the Bank of Switzerland. As a result, on Friday the pair crashed below the level of 1.1460.

The GBP/USD pair, however, demonstrated impressive resistance to stress. We predicted a sideways trend for it, which was confirmed 100%. The pair finished trading at the same level as at the beginning of the week

Roman Butko, NordFX