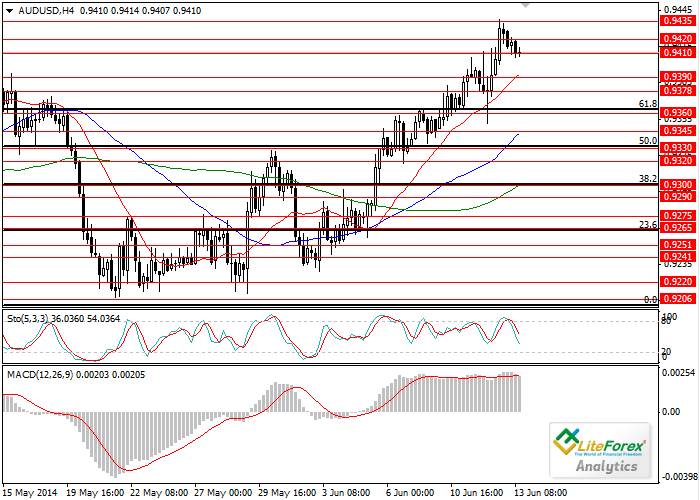

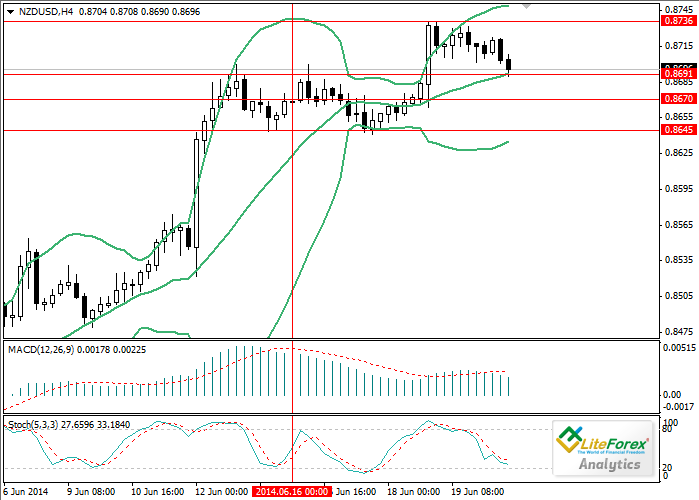

NZD/USD, H4

On the four-hour chart Tenkan-sen line is above Kijun-sen, they are both directed upwards. Chinkou Span line is above the price chart, current cloud is ascending. After small correction the pair jumped up and still growing. Tenkan-sen line is the closest support level (0.8602). One of the previous maximums of Chinkou Span line is expected to be a resistance level at 0.8685.

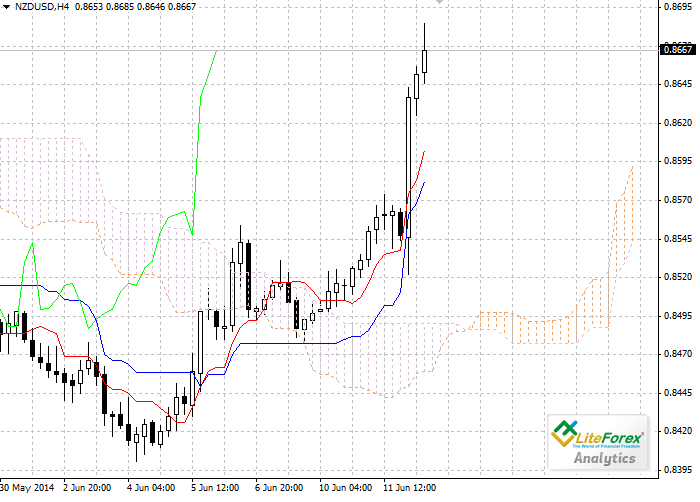

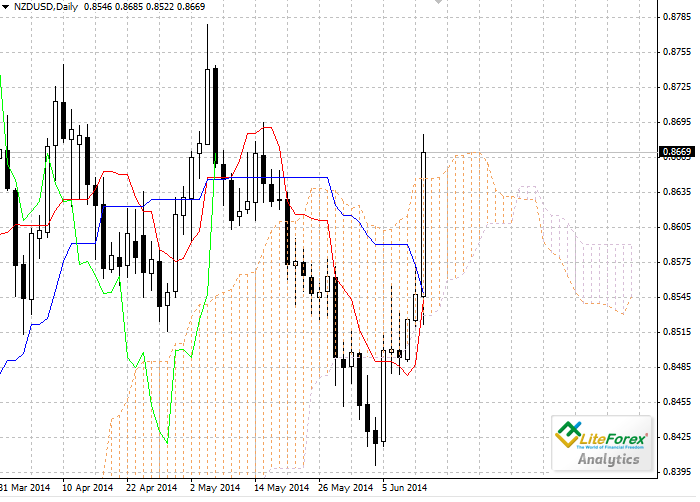

NZD/USD, D1

Let’s look at the daily chart. Tenkan-sen and Kijun-sen lines are getting closer prior to the trend reversal pattern formation. Chinkou Span line is crossing the price chart from below; current cloud is descending. The pair has broken through the cloud, giving a strong signal to buy. Upper border of the cloud becomes a support level at 0.8647.One of the previous maximums of Chinkou Span line is expected to be a resistance level at 0.8740.

Key levels

Support levels: 0.8647, 0.8602.

Resistance levels: 0.8685, 0.8740.

Trading tips

On the four-hour chart the pair continues to grow, on the daily chart we’ve got a strong signal to buy. Targets for the long positions are 0.8685 and 0.8740.

Anastasiya Glushkova

Analyst of LiteForex Investments Limited