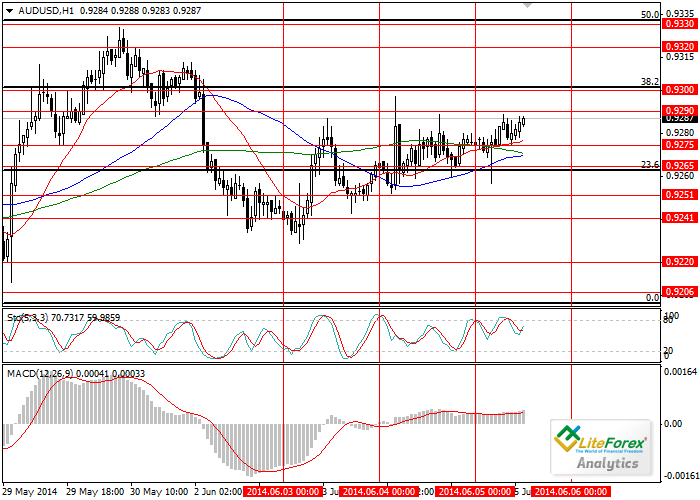

Current trend

Yesterday, Australian GDP for Q1 was released, which was above the forecast. GDP rose due to the increase in exports of iron ore and minerals. However, despite positive indices it is unlikely that RBA will change monetary policy, as the bank has confirmed this week that interest rates will remain unchanged. Due to positive fundamental news the pair managed to reach the level of 0.9300, but failed to maintain at this level, dropping back to the level of 0.9250 in the afternoon.

Tomorrow, US data on the number of jobs outside agricultural sector will become known. This indicator will obviously have impact on the currency pair AUD/USD. In case of poor data the pair may go above the level of 0.9300, which coincides with Fibonacci level of 38.2%. Today, outcome of the ECB meeting will become known and the decisions made on interest rate and monetary policy, which will affect movement in the most currency pairs.

Support and resistance

The nearest support levels: 0.9275, 0.9265, 0.9250 and 0.9240. The main target of the “bears” is the level of 0.9200. Resistance levels: 0.9290, 0.9300 and 0.9330. Key level of the “bulls” is 0.9360.

Trading tips

It is likely that volatility will be high in the next two days. Long positions are advisable above the level of 0.9300; short positions can be opened below the level of 0.9265 with the target of 0.9200. Limited sell positions can be placed at the level of 0.9200.

Ilya Lashenko

Analyst of LiteForex Investments Limited